By Lukas I. Alpert

Alphabet Inc.'s Google and Facebook Inc. are making concessions

long sought by news publishers whose business has been hurt by the

platforms' dominance, moves that some in the media industry see as

an effort to pre-empt potential regulatory backlash.

Google last week announced changes to how it ranks stories on

its news page to better promote original content, addressing

publishers' long-running complaints that their scoops were often

overshadowed by quick rewrites by other outlets.

Facebook, meanwhile, is negotiating with media outlets to pay

them for the rights to publish their stories in a special news feed

on the social media platform, and will rely on humans to determine

which stories to feature, The Wall Street Journal reported last

month.

"The platforms are finally recognizing the massive role they

play in our ecosystem and that pretending that they are neutral

distribution channels just doesn't wash with regulators or with the

public either," said Lydia Polgreen, editor in chief of

HuffPost.

Top state law-enforcement officials from across the country last

week launched antitrust investigations into Facebook and Google,

further pressuring tech giants already under federal scrutiny over

whether their online dominance stifles competition.

Congress has opened an antitrust probe into Google, Facebook,

Apple Inc. and Amazon.com Inc. Over the summer, the Federal Trade

Commission imposed a $5 billion fine and oversight conditions on

Facebook for privacy violations.

While the probes haven't focused directly on the platforms'

relationships with news publishers, the media industry has seen its

business model severely disrupted by tech giants, particularly in

online advertising. Together, Facebook and Google controlled 60% of

the U.S. digital advertising market last year, according to

eMarketer.

Google executives said the prospect of regulation didn't

influence their effort to better promote original news, adding that

technological advances had finally allowed the company to address a

longstanding concern among publishers.

"The challenge of identifying and precisely ranking original

reporting has taken years to address and has proven extremely

difficult," said Richard Gingras, Google's vice president for news.

"What has changed is that we now have a lot more technical

capabilities than we had 10 years ago."

Facebook has expressed a commitment to improving its

partnerships with news outlets, particularly those that publish

legitimate, high-quality reporting.

"We understand the critical importance of rewarding publishers

that put their resources into original reporting, which is why it's

been one of our guiding principles for the news tab since we

decided to develop the product earlier this year," said Campbell

Brown, Facebook's vice president for global news partnerships.

"It's important to get this right."

The outlets Facebook pitched on its news tab include the

Journal's publisher, Dow Jones, people familiar with the matter

said.

While many in the news industry welcomed Google's algorithm

tweak to help original reporting rank higher on Google News,

several said they would reserve judgment until they could ascertain

whether the change was making an impact.

"With all of these things, you don't know what it means until

you see it in practice," said David Chavern, president and chief

executive of the News Media Alliance, a trade coalition

representing some 2,000 news organizations in the U.S. and Canada,

including Dow Jones.

Mr. Gingras wrote in a blog post last week that Google had made

changes to keep stories containing significant original reporting

higher in search rankings for longer. It also had changed

guidelines for some 10,000 human raters charged with checking the

algorithms' work, to give greater prominence to news sites with

reputations for producing high-quality journalism and with records

of industry awards, such as the Pulitzer Prize.

"We have long argued that provenance must be a priority and so

applaud any change that actually highlights the qualitative

difference in journalism and ends the crass commodification of

content," News Corp Chief Executive Robert Thomson said in a

statement. "We will closely monitor these alterations to the

algorithm and trust that the promised reforms do indeed

eventuate."

News Corp, the Journal's parent company, has been developing a

news-aggregation service called Knewz.com that is designed, in

part, to promote original reporting over quick rehashes of existing

articles.

Google's rating-guideline change raised concern among

conservative publishers who have long claimed big platforms have a

liberal bias that leads them to unfairly downgrade right-leaning

articles.

"I'm happy about this if they implement it fairly," said Neil

Patel, co-founder and publisher of the Daily Caller. "But with

Google, there has always been a lot of opacity about how they run

their algorithms, and the worry is there will be a similar lack of

transparency about how they define who they think is a respected

publisher."

Facebook has been offering news outlets as much as $3 million a

year in licensing fees to use headlines and article previews in a

special news section it aims to launch later this year, the Journal

reported last month. The social-media platform has been offering

some smaller, regional publishers fees in the range of $500,000

annually, a person familiar with the matter said.

News Corp Executive Chairman Rupert Murdoch and BuzzFeed Chief

Executive Jonah Peretti have both called on Facebook and Google to

pay organizations that provide quality news.

"Those of us who do a lot of original reporting are thrilled

Google is fixing this frustrating bug, but we're still waiting for

Google and some other platforms to follow Facebook's lead in

recognizing the real value they extract from our original

journalism," said Ben Smith, BuzzFeed's editor in chief.

Earlier this year, Apple announced a partnership with more than

300 magazines and several digital media outlets and newspapers,

including the Journal, for a $9.99 a month subscription news bundle

called Apple News+. As part of the deal, publishers would split 50%

of the revenue based on readership of their stories.

Write to Lukas I. Alpert at lukas.alpert@wsj.com

(END) Dow Jones Newswires

September 18, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

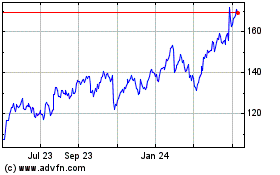

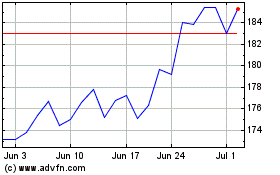

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024