Google Inc.'s (GOOG) carefully structured stock split keeps

insider control of the company at the same level but dilutes other

shareholders' influence and raises the prospect of current owners

having lifelong control of the company, experts said Friday.

Thursday, the Mountain View, Calif., company said it would

create a new class of stock, which would be listed on the Nasdaq

Stock Market and be distributed to shareholders via a tax-free

dividend. Each holder will get a new Class C share for each Class A

and Class B share, producing an effective two-for-one split.

The twist is that the new shares will be a nonvoting class of

stock. The distribution preserves the level of control for Chief

Executive Larry Page, co-founder Sergey Brin and Executive Chairman

Eric Schmidt, who collectively hold about 66% of the company's

voting power.

As a result of the split, shareholders will have twice as many

shares but no additional influence, an issue that can intensify as

more Class C shares get added over time, said MKM Partners

event-driven strategist Keith Moore.

"Shareholders are generally aggravated their voting power will

be diluted," he said.

Google's Class A shares closed down 4.1% at $624.60 Friday.

"From a shareholder perspective, this should be very troubling,"

said Charles M. Elson, head of the Weinberg Center for Corporate

Governance at University of Delaware's business school. If

something is going wrong at the company, he said, shareholders have

very little they can do to influence the company's direction.

"That lack of accountability ultimately leads to poor management

decision-making," Elson said.

The structure will make it harder for shareholders to challenge

Page, Brin and Schmidt, as activists have done at other tech

companies. For example, the founders of Yahoo Inc. (YHOO) and

Research In Motion Ltd. (RIMM, RIM.T) recently diminished their

respective roles in part because of shareholder complaints.

Barry Genkin, a partner at law firm Blank Rome LLP in

Philadelphia with expertise in corporate governance, said if Class

C shareholders are dissatisfied, their chief recourse simply is to

"vote with their feet and that's to sell the stock."

Google's Page said on the company's conference call Thursday

"investors and others have always taken a big bet" on himself and

Brin. "That bet will likely last longer as a result of these

changes."

Page and Brin also said in a letter they "decided that

maintaining this founder-led approach is in the best interests of

Google." A Google representative reiterated the founders' comments

in an email Friday.

The split will provide the company more flexibility in rewarding

employees and in making acquisitions, the founders said, though

Google was quick to tamp down speculation a big deal was in the

offing.

Evercore Partners analyst Ken Sena said in terms of voting

interest and economics, the split wouldn't have much of an impact

initially. But he noted the new structure raised the prospect of

giving Page, Brin and Schmidt lifetime control over Google.

Under the pre-split structure, a point may have arrived in a

10-year time span in which the owners' voting power fell below 50%,

he said, just through acquisitions and stock-option issuance to

employees.

"Now you have a currency that could be used instead where

there's no voting dilution of the three," Sena said.

Google's Class C shares likely will trade at a discount to the

Class A shares currently on the market, although the difference is

expected to be minimal. "The plan should not change a holder's

fundamental evaluation of the merits of holding [Google] shares,"

MKM's Moore said.

The price of the Class A shares is expected to be cut in half

after the split.

Other companies have dual-class stock structures. News Corp.

(NWS, NWSA, NWS.AU), which owns Dow Jones & Co., publisher of

this newswire, and The Wall Street Journal, has Class A shares with

limited voting rights as well as more powerful Class B shares. As

of Friday's close, the more narrowly held Class B shares were

priced 1.9% higher.

Investor wariness about the new stock structure contributed to

the decline Friday in Google's share price. In addition, investors

were re-evaluating the quality of Google's first-quarter earnings

increase, which was helped by a lower tax rate and slower

hiring.

Sameet Sinha, analyst at B. Riley & Co., said the shares'

move lower came as Wall Street analysts were largely raising price

targets and estimates based on Google's improving fundamentals.

"The nonfundamental issue is the stock split, and that's what

investors are working through," he said, adding some are finding

the new structure is "probably not that good a thing."

-By Joan E. Solsman, Dow Jones Newswires; 212-416-2291;

joan.solsman@dowjones.com

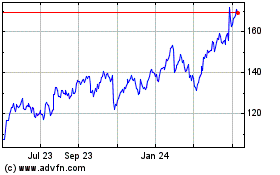

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

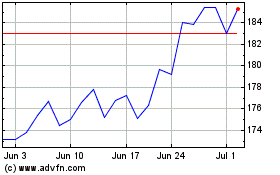

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024