Hennessy Capital Acquisition Corp. IV (NASDAQ: HCAC, HCACW, HCACU)

(“HCAC”) reminds stockholders to vote in favor of the previously

announced proposed business combination (the “Business

Combination”) with Canoo Holdings Ltd. (“Canoo”) and the related

proposals to be voted upon at HCAC’s special meeting in lieu of the

2020 annual meeting of stockholders (the “Special Meeting”). In

light of the COVID-19 pandemic and to support the well-being of

HCAC’s stockholders and partners, the Special Meeting will be held

virtually at the following address:

https://www.cstproxy.com/hennessycapiv/sm2020, on December 21, 2020

at 10:00 a.m., Eastern time, as described in HCAC’s definitive

proxy statement/prospectus, dated December 4, 2020 (the “Proxy

Statement”).

HCAC’s stockholders of record at the close of business on

October 27, 2020 (the “Record Date”) are entitled to vote the

shares of common stock of HCAC owned by them at the Special

Meeting. In connection with the Business Combination, HCAC filed

the Proxy Statement with the SEC on December 4, 2020, and the Proxy

Statement and proxy card were mailed shortly thereafter to HCAC’s

stockholders of record as of the Record Date. If any of HCAC's

stockholders have not received the Proxy Statement, such

stockholder should confirm their proxy's status with their broker,

or call HCAC’s proxy solicitor, Morrow Sodali LLC, at (800)

662-5200 for help (banks and brokers can call collect at (203)

658-9400).

Every stockholder's vote is important, regardless of the

number of shares the stockholder holds. As such, all

stockholders of record as of the Record Date are encouraged to

complete, sign, date and return a proxy card, if it has not already

done so, to ensure that the stockholder's shares will be

represented at the Special Meeting. Stockholders which hold shares

in street name, meaning that their shares are held of record by a

broker, bank or other nominee, should contact their broker, bank or

nominee to ensure that their shares are voted.

Stockholders of record as of the Record Date can access the

Special Meeting by visiting

https://www.cstproxy.com/hennessycapiv/sm2020, where such

stockholders will be able to listen and vote during the Special

Meeting. Additionally, stockholders can listen only to the special

meeting by dialing +1 877-770-3647 (toll-free) if within the U.S.

or Canada, or +1 312-780-0854 (standard rates apply) if outside of

the U.S. and Canada. The passcode for telephone access is

40049387#, but please note that stockholders cannot vote or ask

questions if participating telephonically. Please note that you

will only be able to access the Special Meeting by means of remote

communication at 10:00 a.m., Eastern time, on December 21,

2020.

About Hennessy Capital Acquisition Corp. IV

Hennessy Capital Acquisition Corp. IV is a special purpose

acquisition company (or SPAC) which raised $300 million in its IPO

in March 2019 and is listed on the Nasdaq Stock Market (NASDAQ:

HCAC, HCACU, HCACW). HCAC was founded by Daniel J. Hennessy to

pursue an initial business combination, with a specific focus on

businesses in the industrial, technology and infrastructure

sectors. For more information, please visit

www.hennessycapllc.com.

Additional Information About the Proposed Business

Combination and Where to Find It

In connection with the Business Combination, HCAC filed the

Registration Statement with the SEC, which includes the definitive

proxy statement to be distributed to holders of HCAC’s common stock

in connection with HCAC’s solicitation of proxies for the vote by

HCAC’s stockholders with respect to the Business Combination and

other matters as described in the Registration Statement and a

prospectus relating to the offer of the securities to be issued to

the equity holders of Canoo in connection with the Business

Combination. The Registration Statement was declared effective by

the SEC on December 4, 2020 and the definitive proxy

statement/prospectus and other relevant documents have been mailed

to HCAC’s stockholders as of the Record Date. HCAC’s stockholders

and other interested persons are advised to read the definitive

proxy statement / prospectus, in connection with HCAC’s

solicitation of proxies for the Special Meeting to be held to

approve, among other things, the Business Combination, because

these documents contain important information about HCAC, Canoo and

the Business Combination. Stockholders may also obtain a copy of

the definitive proxy statement/prospectus, as well as other

documents filed with the SEC regarding the Business Combination and

other documents filed with the SEC by HCAC, without charge, at the

SEC’s website located at www.sec.gov or by directing a request

to Nicholas A. Petruska, Executive Vice President, Chief Financial

Officer, 3415 N. Pines Way, Suite 204, Wilson, Wyoming 83014 or by

telephone at (307) 201-1903.

Participants in the Solicitation

HCAC, Canoo and certain of their respective directors, executive

officers and other members of management and employees may, under

SEC rules, be deemed to be participants in the solicitation of

proxies from HCAC’s stockholders in connection with the Business

Combination. Information regarding the persons who may, under SEC

rules, be deemed participants in the solicitation of HCAC’s

stockholders in connection with the Business Combination, including

a description of their direct and indirect interests, is set forth

in the Registration Statement filed with the SEC. You can find more

information about HCAC’s directors and executive officers in the

Registration Statement. You may obtain free copies of these

documents from the sources indicated above.

Forward-Looking Statements

The information in this press release includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words

such as “estimate,” “plan,” “project,” “forecast,” “intend,”

“will,” “expect,” “anticipate,” “believe,” “seek,” “target” or

other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These

forward-looking statements include, but are not limited to,

statements regarding estimates and forecasts of financial and

performance metrics, projections of market opportunity and market

share, expectations and timing related to commercial product

launches, ability to accelerate Canoo’s go-to-market strategy and

capitalize on commercial opportunities, potential benefits of the

transaction and the potential success of Canoo’s go-to-market

strategy, and expectations related to the terms and timing of

completing the transaction. These statements are based on various

assumptions, whether or not identified in this press release, and

on the current expectations of Canoo’s and HCAC’s management and

are not predictions of actual performance. These forward-looking

statements are provided for illustrative purposes only and are not

intended to serve as, and must not be relied on by any investor as,

a guarantee, an assurance, a prediction or a definitive statement

of fact or probability. Actual events and circumstances are

difficult or impossible to predict and will differ from

assumptions. Many actual events and circumstances are beyond the

control of Canoo and HCAC. These forward-looking statements are

subject to a number of risks and uncertainties, including changes

in domestic and foreign business, market, financial, political and

legal conditions; the inability of the parties to successfully or

timely consummate the Business Combination, including the risk that

any required regulatory approvals are not obtained, are delayed or

are subject to unanticipated conditions that could adversely affect

the combined company or the expected benefits of the Business

Combination or that the approval of the stockholders of HCAC or

Canoo is not obtained; failure to realize the anticipated benefits

of the Business Combination; risks relating to the uncertainty of

the projected financial information with respect to Canoo; risks

related to the rollout of Canoo’s business and the timing of

expected business milestones and commercial launch; risks related

to future market adoption of Canoo’s offerings; risks related to

Canoo’s go-to-market strategy and subscription business model; the

effects of competition on Canoo’s future business; the amount of

redemption requests made by HCAC’s public stockholders; the ability

of HCAC or the combined company to issue equity or equity-linked

securities in connection with the Business Combination or in the

future, and those factors discussed in HCAC’s final prospectus

filed on March 4, 2019, Annual Report on Form 10-K for the fiscal

year ended December 31, 2019, Quarterly Reports on Form 10-Q for

the quarters ended March 31, 2020, June 30, 2020 and September 30,

2020 and the Registration Statement, and the definitive proxy

statement/prospectus contained therein, in each case, under the

heading “Risk Factors,” and other documents of HCAC filed, or to be

filed, with the SEC. If any of these risks materialize or our

assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. There

may be additional risks that neither HCAC nor Canoo presently know

or that HCAC and Canoo currently believe are immaterial that could

also cause actual results to differ from those contained in the

forward-looking statements. In addition, forward-looking statements

reflect HCAC’s and Canoo’s expectations, plans or forecasts of

future events and views as of the date of this press release. HCAC

and Canoo anticipate that subsequent events and developments will

cause HCAC’s and Canoo’s assessments to change. However, while HCAC

and Canoo may elect to update these forward-looking statements at

some point in the future, HCAC and Canoo specifically disclaim any

obligation to do so. These forward-looking statements should not be

relied upon as representing HCAC’s and Canoo’s assessments as of

any date subsequent to the date of this press release. Accordingly,

undue reliance should not be placed upon the forward-looking

statements.

No Offer or Solicitation

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities, or a solicitation

of any vote or approval, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended, or an exemption therefrom.

Contacts:

Hennessy Capital Acquisition Corp. IVNicholas A. Petruska,

Executive Vice President and CFO(307)

201-1903npetruska@hennessycapllc.com

Investor RelationsMike Callahan / Tom CookCanooIR@icrinc.com

Canoo Public Relationspress@canoo.com

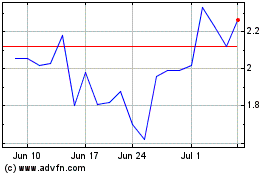

Canoo (NASDAQ:GOEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

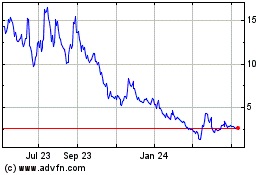

Canoo (NASDAQ:GOEV)

Historical Stock Chart

From Apr 2023 to Apr 2024