As filed with the Securities and Exchange Commission on December 27, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GENPREX, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

|

2834

|

|

90-0772347

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

1601 Trinity Street, Bldg B, Suite 3.322

Austin, TX 78712

(512) 537-7997

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

J. Rodney Varner

Chief Executive Officer

1601 Trinity Street, Bldg B, Suite 3.322

Austin, TX 78712

(512) 537-7997

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Richard A. Friedman, Esq.

Nazia Khan, Esq.

Sheppard, Mullin, Richter & Hampton LLP

30 Rockefeller Plaza

New York, NY 10112

Telephone: (212) 653-8700

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

|

Smaller reporting company

|

☒

|

|

|

|

|

Emerging growth company

|

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

Proposed

|

|

|

Proposed

|

|

|

|

|

|

|

|

|

|

|

Maximum

|

|

|

Maximum

|

|

|

|

|

|

|

|

Amount

|

|

|

Offering

|

|

|

Aggregate

|

|

|

Amount of

|

|

|

Title of Each Class of Securities to be Registered (1)

|

|

to be

Registered

|

|

|

Price Per

Share (2)

|

|

|

Offering

Price (2)

|

|

|

Registration

Fee

|

|

|

Common Stock, par value $0.001 per share (3)

|

|

|

3,611,504

|

|

|

$

|

0.25

|

|

|

$

|

902,876

|

|

|

$

|

117.19

|

|

|

Total

|

|

|

3,611,504

|

|

|

|

|

|

|

$

|

902,876

|

|

|

$

|

117.19

|

|

|

(1)

|

The shares of our common stock being registered hereunder are being registered for sale by the selling security holders named in the prospectus. Under Rule 416 of the Securities Act of 1933, as amended, the shares being registered include such indeterminate number of shares of common stock as may be issuable with respect to the shares being registered in this registration statement as a result of any stock splits, stock dividends or other similar event.

|

|

(2)

|

The proposed maximum offering price per share and the proposed maximum aggregate offering price have been estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended, using the average of the high and low prices as reported on The Nasdaq Capital Market on December 20, 2019.

|

|

(3)

|

Represents shares of common stock issuable upon exercise of outstanding warrants to purchase shares of common stock offered by the selling stockholders.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities under this prospectus until the registration statement of which it is a part and filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED DECEMBER 27, 2019

GENPREX, INC.

3,611,504 Shares of Common Stock

This prospectus relates to the resale by certain selling stockholders of Genprex, Inc. ("Genprex," the “Company,” "we," "our," or "us") identified in this prospectus of up to 3,611,504 shares (the “Resale Shares”) of common stock, par value $0.001 per share, issuable upon the exercise of outstanding warrants. All of the Resale Shares were either purchased from the Company in a private placement transaction or issued to designees of the placement agent for services rendered and are being offered for resale by the selling stockholders only.

The Resale Shares may be sold by the selling stockholders to or through underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional information regarding the methods of sale you should refer to the section entitled “Plan of Distribution” in this Prospectus.

The prices at which the selling stockholders may sell the Resale Shares will be determined by the prevailing market price for shares of the Company’s common stock or in privately negotiated transactions. We will not receive any proceeds from the sale of the Resale Shares by the selling stockholders; provided, however, we will receive the proceeds from any cash exercise of warrants.

We will bear all costs relating to the registration of the Resale Shares, other than any selling stockholder's legal or accounting costs or commissions.

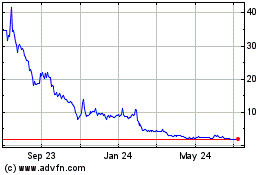

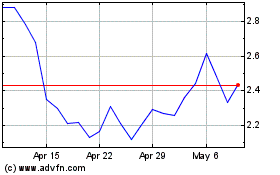

Our common stock is presently listed on The Nasdaq Capital Market under the symbol “GNPX.” The closing price of our common stock on December 26, 2019, as reported on The Nasdaq Capital Market was $0.26 per share.

Investing in our common stock involves a high degree of risk. See the section entitled “Risk Factors” on page 10 of this prospectus and elsewhere in this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is __________, 2019.

TABLE OF CONTENTS

|

|

Page

|

|

PROSPECTUS SUMMARY

|

3

|

|

RISK FACTORS

|

10

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA

|

25

|

|

USE OF PROCEEDS

|

26

|

|

DIVIDEND POLICY

|

26

|

|

SECURITY OWNERSHIP OF BENEFICIAL OWNERS AND MANAGEMENT

|

26

|

|

SELLING STOCKHOLDERS

|

28

|

|

PLAN OF DISTRIBUTION

|

31

|

|

LEGAL MATTERS

|

32

|

|

EXPERTS

|

32

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

32

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

33

|

ABOUT THIS PROSPECTUS

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give to you.

You should rely only on the information contained in this prospectus. No dealer, salesperson or other person is authorized to give information that is not contained in this prospectus. This prospectus is not an offer to sell nor is it seeking an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

PROSPECTUS SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference into this prospectus. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire prospectus carefully before making an investment decision, including the “Risk Factors” section, our historical financial statements and the notes thereto incorporated herein by reference. Unless the context provides otherwise, all references herein to “Genprex”, the “Company”, “we”, “our” and “us” refer to Genprex, Inc.

Company Overview

Genprex™ is a clinical stage gene therapy company developing a new approach to treating cancer, based upon our novel licensed technology platform, including our initial product candidate, Oncoprex™ immunogene therapy, or Oncoprex, for non-small cell lung cancer (NSCLC). Our platform technologies are designed to administer cancer fighting genes by encapsulating them into nanoscale hollow spheres called nanovesicles, which are then administered intravenously and taken up by tumor cells where they express proteins that are missing or found in low quantities. Oncoprex has a multimodal mechanism of action whereby it interrupts cell signaling pathways that cause replication and proliferation of cancer cells, re-establishes pathways for apoptosis, or programmed cell death, in cancer cells, and modulates the immune response against cancer cells. Oncoprex has also been shown to block mechanisms that create drug resistance.

We hold an exclusive worldwide license from The University of Texas MD Anderson Cancer Center, or MD Anderson, to patents covering the therapeutic use of a series of genes that have been shown in preclinical and clinical research to have cancer fighting properties.

With Oncoprex, we are initially targeting NSCLC. Researchers at MD Anderson have conducted two Phase I clinical trials and are currently conducting an ongoing Phase II clinical trial of Oncoprex plus erlotinib in NSCLC. According to the World Health Organization (“WHO”), lung cancer is the leading cause of cancer deaths worldwide in 2018, killing more people than colorectal, prostate, stomach and skin cancers, and is the second most common type of cancer. According to WHO, in 2018, there were over 2 million new lung cancer cases and over 1.7 million deaths from lung cancer worldwide, and the National Cancer Institute ("NCI") estimated that in 2019 there would be over 228,000 new cases and more than 142,000 deaths from lung cancer in the United States. According to the American Society of Clinical Oncology, NSCLC represents 84% of all lung cancers. According to NCI, the five-year survival rate for Stage IV (metastatic) NSCLC is less than 5%, and overall survival for lung cancer has not improved appreciably in the last 25 years. We believe that there is a significant unmet medical need for new treatments for NSCLC in the United States and globally, and we believe that Oncoprex may be suitable for a majority of NSCLC patients.

We believe that our platform technologies could allow delivery of a number of cancer fighting genes, alone or in combination with other cancer therapies, to combat multiple types of cancer. Our research and development pipeline, discussed in “Our Pipeline” below, demonstrates our clinical and preclinical progress to date.

Cancer results from genetic mutations. Mutations that lead to cancer are usually present in two major classes of genes: oncogenes, which are involved in functions such as signal transduction and transcription; and tumor suppressor genes, which play a role in governing cell proliferation by regulating transcription. Transduction is the process by which chemical and physical signals are transmitted through cells. Transcription is the process by which a cell’s DNA sequence is copied to make RNA molecules, which then play a role in protein expression. In normal cells, mutations in oncogenes are discovered and targeted for elimination by tumor suppressor genes. In cancer cells, the oncogene mutations may overwhelm the natural tumor suppression processes, or those tumor suppression processes may be impaired or absent. Functional alterations due to mutations in oncogenes or tumor suppressor genes may result in the abnormal and uncontrolled growth patterns characteristic of cancer. These genetic alterations facilitate such malignant growth by affecting signal transduction pathways and transcription, thus inhibiting normal growth signaling in the cell, circumventing the natural process of apoptosis, evading the immune system’s response to cancer, and inducing angiogenesis, which is the formation of new blood vessels that supply cancer cells.

The most common genetic alterations present in NSCLC are in tumor suppressor genes, against which few targeted small molecule drugs have been developed. Each of the two sets of chromosomes in the cell nucleus includes two copies of each gene, called alleles, which may be identical or may show differences. In most situations, tumor suppressor genes require both alleles of a gene to be deleted or inactivated to impair tumor suppression activity and lead to tumor growth. The replacement of just one functional allele may therefore be enough to restore the normal cellular functions of growth regulation and apoptosis.

Among the genetic conditions associated with lung cancer are the overexpression of epidermal growth factor receptors, or EGFRs, and mutations of kinases. Kinases are enzymes that play an important role in signal transduction through the modification of proteins by adding or taking away phosphate groups, a process called (de-)phosphorylation, to change the proteins’ function. When two EGFR transmembrane proteins are brought to proximity on the cell membrane surface, or dimerize, either through a ligand, or binding molecule, that binds to the extracellular receptor, or through some other process, the intracellular protein-kinase domains can autophosphorylate, and activate downstream processes, including cell signaling pathways that can lead to either cell cycle arrest or cell growth and proliferation. EGFRs and kinases can act similarly to a switch that turns “on” and “off” when phosphate groups are either added or taken away. Mutated kinases can have a malfunctioning on/off switch, causing the switch to be stuck in the “on” position or failing to turn the switch “off,” leading to the loss of cell control.

A subset of NSCLC patients (approximately 7% of NSCLC patients of North American and European descent and approximately 30% to 50% of NSCLC patients of Asian descent) carry an EGFR mutation that makes their tumors sensitive to tyrosine kinase inhibitors, or TKIs, such as erlotinib or osimertinib. However, even for these patients, tumor resistance to TKIs frequently develops within two to three years, resulting in eventual disease progression. Erlotinib or osimertinib generally do not benefit NSCLC patients who do not have this activating EGFR mutation. However, our clinical and preclinical data have shown that the combination of Oncoprex and erlotinib can increase anti-tumor activity even in cancers without the EGFR mutations, as well as in cancers that have become resistant to erlotinib. For this reason, we believe Oncoprex may be suitable for the majority of NSCLC patients.

Cancer can spread when cells’ natural cancer suppression functions are impaired. The tumor suppressor gene called Tumor Suppressor Candidate 2, or TUSC2 (which was formerly known as FUS1) has been shown to affect both cell proliferation and apoptosis. TUSC2 is a pan-kinase inhibitor, which means that it has the ability to inhibit multiple kinase receptors, such as EGFR and platelet-derived growth factor receptor, or PDGFR. TUSC2 is frequently inactivated early in the development of lung cancer, and loss of TUSC2 expression in NSCLC is associated with significantly worse overall survival compared to patients with normal TUSC2 expression. Many types of cancer cells, including approximately 80% of NSCLC cells, lack expression of TUSC2.

Cancer can also spread when the body’s natural immune functions are impaired, including by the cancer cells themselves. PD-1, or Programmed Death-1, is a receptor expressed on the surface of activated T cells, which are part of the body’s immune system. PD-L1, or Programmed Death Ligand-1, is a protein/receptor expressed on the surface of cancer and other cells. The binding of PD-1 to PD-L1 has been speculated to contribute to cancer cells’ ability to evade the body’s immune response. PD-1 and molecules like it are called immune checkpoints, because they can impede the normal immune response, for example by blocking the T cells from attacking the cancer cells. In many cancers, PD-L1 receptors are up-regulated, and substantial research is now being performed in the emerging field of immuno-oncology to discover drugs or antibodies that could block PD-L1 and similar receptors. It is believed that blocking the PD-1/PD-L1 interaction pathway and other similar checkpoints, such as cytotoxic T-lymphocyte-associated protein 4, or CTLA-4, with drugs called checkpoint inhibitors can prevent cancer cells from inactivating T cells.

Our Oncoprex immunogene therapy is designed to interrupt cell signaling pathways that cause replication and proliferation of cancer cells, and to target and kill cancer cells via receptor pathways, and also to stimulate the natural immune responses against cancer. Oncoprex combines features of gene therapy and immunotherapy in that it up-regulates TUSC2 expression in the cell, and also increases the anti-tumor immune cell population and down-regulates PD-L1 receptors, thereby potentially boosting the immune response to cancer.

Oncoprex consists of a TUSC2 gene encapsulated in a nanovesicle made from lipid molecules with a positive electrical charge. Oncoprex is injected intravenously and can specifically target cancer cells, which generally have a negative electrical charge. Once Oncoprex is taken up into a cancer cell, the TUSC2 gene is expressed into a protein that is capable of restoring certain defective functions arising in the cancer cell. Oncoprex nanovesicles are designed to deliver the functioning TUSC2 gene to cancer cells while minimizing their uptake by normal tissue. Tumor biopsy studies conducted at MD Anderson show that, in three patients, the uptake of TUSC2 in tumor cells after Oncoprex treatment was 10 to 25 times the uptake in normal cells. We believe that Oncoprex, unlike other gene therapies, which either need to be delivered directly into tumors or require cells to be removed from the body, re-engineered and then reinserted into the body, is the first systemic gene therapy to be used for cancer in humans.

Clinical data from the evaluation of 25 patients in our Phase I/II clinical trial, as well as our preclinical data, indicate that Oncoprex can be combined with the widely used anti-cancer drug erlotinib (marketed as Tarceva® by Genentech, Inc.) in humans. Erlotinib is a tyrosine kinase inhibitor, or TKI, which uses a mechanism of action similar to that of pan-kinase inhibitors to block the action of tyrosine kinases, which are a type of kinase involved in many cell functions, including cell signaling, growth and division. In addition, MD Anderson researchers have conducted preclinical studies combining Oncoprex with:

|

|

●

|

the TKI gefitinib (marketed as Iressa® by AstraZeneca Pharmaceuticals) in animals and in human NSCLC cells;

|

|

|

●

|

third generation TKIs such as osimertinib (marketed as Tagrisso® by AstraZeneca Pharmaceuticals);

|

|

|

●

|

MK2206 in animals (MK2206 is an inhibitor of AKT kinases, which affect cell signaling pathways downstream from tyrosine kinases);

|

|

|

●

|

an anti-PD-1 antibody equivalent to the checkpoint inhibitor pembrolizumab (marketed as Keytruda® by Merck & Co. ) in animals;

|

|

|

●

|

an anti-PD-1 antibody equivalent to the checkpoint inhibitor nivolumab (marketed as Opdivo® by Bristol-Myers Squibb Company) in animals; and

|

|

|

●

|

an anti-CTLA4 antibody equivalent to ipilimumab (marketed as Yervoy® by Bristol-Myers Squibb Company) in animals.

|

The manufacturers of the marketed drugs were not involved in any of our clinical or preclinical studies. In studies involving marketed drugs, the drugs were administered concurrently with Oncoprex without being modified in any way, and the antibodies used in our preclinical studies that did not use the marketed drugs were the non-humanized equivalent to marketed drugs.

Data from these clinical and preclinical studies indicate that combining Oncoprex with these other therapies yields results more favorable than either these therapies or Oncoprex alone, with minimal side effects relative to other lung cancer drugs, thereby potentially making Oncoprex a therapy complementary to these cancer treatments. In addition, based on our clinical and preclinical studies and on preclinical studies conducted by others, we believe that Oncoprex could be combined with other lung cancer drugs that have similar mechanisms of action to the drugs mentioned above, such as nivolumab (marketed as Opdivo® by Bristol-Myers Squibb Company) and atezolizumab (marketed as Tecentriq® by Genentech/Roche). We have not conducted any preclinical or clinical studies combining Oncoprex with atezolizumab.

Researchers at MD Anderson have collaborated with other researchers to identify other genes, such as those in the 3p21.3 chromosomal region, that may act as tumor suppressors or have other cancer fighting functions. We hold rights to certain of these genes under license agreements with MD Anderson. Data from preclinical studies performed by others suggest that product candidates that could be derived from our technology platform could be effective against other types of cancer, including glioblastoma, head and neck, breast, renal cell (kidney), and soft tissue sarcoma, as well as NSCLC. Therefore, our platform technologies may allow delivery of a number of cancer fighting genes, alone or in combination with other cancer therapies, to combat multiple types of cancer.

In 2012, MD Anderson researchers completed a Phase I clinical trial of Oncoprex as a monotherapy. The primary objective of this Phase I trial was to assess the toxicity of Oncoprex administered intravenously and to determine the maximum tolerated dose, or MTD and recommended Phase II dose of Oncoprex alone. Secondary objectives were to assess the expression of TUSC2 following intravenous delivery of Oncoprex in tumor biopsies and also to assess the anticancer activity of Oncoprex. This trial demonstrated that Oncoprex was well tolerated and established the MTD and the therapeutic dosage for Oncoprex at 0.06 mg/kg administered every 21 days. Although this trial was not designed to show changes in outcomes, a halt in cancer growth was observed in a number of patients, and tumor regressions occurred in primary lung tumors and metastatic cancers in the liver, pancreas, and lymph nodes. In addition, pre- and post-treatment patient biopsies demonstrated that intravenous Oncoprex selectively and preferentially targeted patients’ cancer cells, and suggested that clinical anti-cancer activity was mediated by TUSC2.

We believe that Oncoprex’ combination of pan-kinase inhibition, direct induction of apoptosis, anti-cancer immune modulation and complementary action with targeted drugs and immunotherapies is unique, and positions Oncoprex to provide treatment for patients with NSCLC and possibly other cancers, who are not benefitting from currently offered therapies.

MD Anderson researchers have completed the first phase of a Phase I/II clinical trial of Oncoprex in combination with erlotinib in patients with Stage IV (metastatic) or recurrent NSCLC that is not potentially curable by radiotherapy or surgery, whether or not they have received prior chemotherapy, and whether or not they have an activating EGFR mutation. The Phase I portion of the trial was a dose-escalating study with primary endpoints of establishing the safety and tolerability of the combination of Oncoprex and erlotinib, and establishing the MTD. The secondary endpoint of the Phase I portion of the trial was to assess the toxicity of the combination of Oncoprex with erlotinib. In the Phase I portion of the trial, which began in 2014, 18 subjects were treated, and the MTD was determined to be the highest tested dose: 0.6 mg/kg of Oncoprex administered every 21 days and 150 mg of erlotinib per day. Toxicities were found to compare favorably with those of other lung cancer drugs.

The Phase II portion of the trial was designed to include subjects treated with the combination of Oncoprex and erlotinib at the MTD with the primary goal of measuring the response rate, and secondary endpoints of stable disease, time to progression and overall survival. The response rate for cancer therapies is defined under the Response Evaluation Criteria in Solid Tumors, or RECIST, as Complete Response (CR) + Partial Response (PR); disease control rate is defined under the RECIST criteria as Complete Response (CR) + Partial Response (PR) + Stable Disease (SD)>8weeks.

Enrollment criteria for the second phase of the Phase I/II clinical trial are identical to those in the first phase. The Phase II portion of the trial began in June 2015 and is ongoing at MD Anderson. Of the 39 patients allowed in the protocol for the Phase II portion of the trial, ten have been enrolled and nine are evaluable for response under the trial protocol, because they have received two or more cycles of treatment. Interim results show that four of the patients had tumor regression and one patient had a Complete Response, or CR under the RECIST criteria. The patient with the CR had disappearance of the lung primary tumor, as well as lung, liver, and lymph node metastases. The median response duration for all patients, which is defined as the median time between when response is first noted to the time when cancer progression is observed, was three months. The response rate for the nine patients evaluated to date was 11% and the disease control rate for the nine patients was 78%.

The response rate and disease control rate to date in the Phase II portion of our Phase I/II clinical trial substantially exceeds the response rate of 7% (with no CRs) and disease control rate of 58% reported for a clinical trial of the TKI afatinib (marketed as Gilotrif® by Boehringer Ingelheim Pharmaceuticals, Inc.) in a study referred to as the LUX-Lung 1 clinical trial. A total of 585 patients were enrolled in that Phase IIB/III clinical trial, whose primary endpoint was overall survival and whose secondary endpoints were progression-free survival, RECIST response, quality of life and safety. The LUX-Lung 1 clinical trial was a randomized, double blinded Phase IIB/III clinical trial treating subjects with Stage IIIB or IV adenocarcinoma, a type of NSCLC. The Phase II portion of our Phase I/II trial is not blinded, and is designed to treat NSCLC subjects regardless of EGFR status.

Preliminary analysis of the early data from the Phase II portion of our Phase I/II trial supports our belief that Oncoprex may provide medical benefit in several subpopulations of NSCLC patients for which there is an unmet medical need, and may provide pathways for accelerated approval by the US Food and Drug Administration, or FDA. As a result of these initial findings, in April 2016, we suspended enrollment of new patients in the Phase II portion of the trial to collect additional trial data and have it analyzed in order to seek FDA guidance as to whether the protocol for this clinical trial could be modified to expand enrollment and also to divide the patients into cohorts with a view toward seeking accelerated approval in one or more of these cohort populations. We subsequently decided not to modify the trial, but to continue it as originally designed. Although this clinical trial is currently closed to new patient enrollment, it is not terminated, and is considered “ongoing” because activities such as patient follow-up and further data collection and analysis continue.

We now plan to reopen enrollment in the current version of the Phase II portion of the trial. We have encountered delays in reopening this trial at MD Anderson and will likely reopen the trial at one or more other clinical trial sites. We intend to use a portion of our available funds to add additional clinical trial sites.

Our Oncoprex immunogene therapy technology was discovered through a lung cancer research consortium from MD Anderson and The University of Texas Southwestern Medical Center along with the National Cancer Institute. The TUSC2 discovery teams included Jack A. Roth, MD, FACS, chairman of our Scientific and Medical Advisory Board. We have assembled a team of experts in clinical and translational research, including laboratory scientists, medical oncologists and biostatisticians, to pursue the development and commercialization of Oncoprex and other potential product candidates.

Our technology discoveries and research and development programs have been the subjects of numerous peer-reviewed publications and have been supported by Small Business Innovation Research grants and grants from the National Institutes of Health, the United States Department of Treasury, and the State of Texas. We hold a worldwide, exclusive license from MD Anderson to patents covering the therapeutic use of TUSC2 and other genes that have been shown to have cancer fighting properties, as well as a number of related technologies, including 33 issued patents and two pending patent applications.

Our Pipeline

We are developing Oncoprex, our lead product candidate, to be administered with erlotinib for NSCLC. We are also conducting preclinical research with the goal of developing Oncoprex to be administered with immunotherapies in NSCLC. In addition, we have conducted research into other tumor suppressor genes associated with chromosome 3p21.3. Our research and development pipeline is shown below:

Our Strategy

We intend to develop and commercialize treatments for cancer based on our proprietary gene therapy platform, alone or in combination with other cancer therapies. Key elements of our strategy include:

|

|

●

|

Conduct Ongoing and New Clinical Trials. We plan to continue clinical trials of Oncoprex immunogene therapy in combination with EGFR TKIs, such as erlotinib or osimertinib, and/or in combination with immunotherapies, such as anti-PD-1 immunotherapy, for treatment of NSCLC, while exploring pathways to accelerated FDA approval of this combination in NSCLC patients. We also may pursue clinical trials using multi-drug combinations of Oncoprex with additional targeted therapies and immunotherapies.

|

|

|

●

|

Investigate the Effectiveness of Oncoprex in Other Cancers. We may also explore the combination of Oncoprex and other therapies in other cancers such as soft tissue, kidney, head and neck, and/or breast cancer. We may also pursue development of additional proprietary genes, alone or in combination with EGFR TKIs such as erlotinib or osimertinib and/or with immunotherapies.

|

|

|

●

|

Prepare to Commercialize Oncoprex. We plan to continue to develop the manufacturing, process development and other capabilities needed to commercialize Oncoprex.

|

|

|

●

|

Pursue Strategic Partnerships. As we gather additional clinical data, we plan to pursue strategic partnerships with other developers and providers of anti-cancer drugs to investigate possible therapeutic combinations of Oncoprex with drugs manufactured by others, to accelerate the development of our current and potential product candidates through co-development and to increase the commercial opportunities for our current and potential product candidates.

|

|

|

●

|

Develop Our Platform Technology. We plan to investigate the applicability of our platform technology with additional anti-cancer drugs.

|

|

|

●

|

Acquire Additional Technologies. We are investigating other technologies for possible acquisition, and plan to add additional technologies to our pipeline should we have the opportunity to do so on acceptable financial terms.

|

November 2019 Registered Direct Offering and Private Placement

On November 20, 2019, we entered into a securities purchase agreement with certain accredited investors pursuant to which we sold an aggregate of 3,167,986 shares of our common stock in a registered direct offering. The shares were offered by us pursuant to our shelf registration statement on Form S-3 (File No. 333-233774) filed with the Securities and Exchange Commission (the "SEC") on September 16, 2019, as amended on October 4, 2019.

In a concurrent private placement, we also agreed, pursuant to the securities purchase agreement, to issue and sell to each of the purchasers a warrant to purchase one share of common stock for each share of common stock purchased by a purchaser in the registered direct offering, resulting in the issuance of warrants to purchase an aggregate of 3,167,986 shares of our common stock, all of which are being registered for resale pursuant to this prospectus. The exercise price of the warrants is $0.46 per share, subject to adjustment as provided therein, and will be exercisable beginning on May 22, 2020 through May 22, 2025.

The purchase price for one share in the registered direct offering was $0.40. No additional consideration was paid for the warrants.

In connection with the offerings, we issued designees of the placement agent warrants to purchase an aggregate of 443,518 shares of common stock, all of which are being registered for resale pursuant to this prospectus. In addition, in connection with the offerings, we reduced the exercise price of an aggregate of 2,283,740 outstanding warrants (the "Outstanding Warrants") held by the purchasers in the registered direct offering to $0.46. In connection with such adjustment, the Outstanding Warrants shall not be exercisable for six months and one day from the closing date of the offerings and the expiration date of the Outstanding Warrants will be extended by six months and one day. The Outstanding Warrants have been registered for resale pursuant to a Registration Statement on Form S-1 (File No. 333-225090) which was declared effective by the SEC on July 26, 2018.

Corporate Information

We were incorporated in Delaware in April 2009. Our principal executive offices are located at 1601 Trinity Street, Bldg. B, Suite 3.322, Austin, TX 78712, and our telephone number is (512) 537-7997. Our corporate website address is www.genprex.com. The information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our securities.

THE OFFERING

|

Common stock offered by selling stockholders:

|

|

3,611,504 shares (the “Resale Shares”) of common stock issuable upon exercise of outstanding warrants.

|

|

|

|

|

|

Offering price:

|

|

Market price or privately negotiated prices.

|

|

|

|

|

|

Common stock outstanding after the offering:

|

|

19,263,841

|

|

|

|

|

|

Use of proceeds:

|

|

We will not receive any proceeds from the sale of the Resale Shares by the selling stockholders; however, we will receive the proceeds from any cash exercise of warrants.

|

|

|

|

|

|

Risk factors:

|

|

An investment in our securities involves a high degree of risk and could result in a loss of your entire investment. Prior to making an investment decision, you should carefully consider all of the information in this prospectus and, in particular, you should evaluate the risk factors incorporated by reference under the caption “Risk Factors” on page 10.

|

|

|

|

|

|

Nasdaq Capital Market Symbol:

|

|

GNPX

|

The number of shares of common stock to be outstanding immediately after this offering is based on 19,263,841 shares of common stock outstanding as of December 18, 2019 (including 3,167,986 shares of common stock issued pursuant to our November 2019 registered direct offering) and excludes as of that date:

|

|

●

|

7,476,056 shares of common stock underlying warrants to purchase shares of our common stock at a weighted average exercise price of $1.45 per share;

|

|

|

●

|

5,905,583 shares of common stock underlying options to purchase shares of our common stock at a weighted average exercise price of $2.94 per share

|

|

|

●

|

208,050 shares of common stock reserved for issuance under our 2018 Employee Stock Purchase Plan; and

|

|

|

●

|

1,645,123 shares of common stock reserved for issuance under our 2018 Equity Incentive Plan.

|

RISK FACTORS

Any investment in our common stock involves a high degree of risk. Before deciding whether to purchase our common stock, investors should carefully consider the risk factors set forth below and described in our most recent Annual Report on Form 10-K and in our subsequent Quarterly Reports on Form 10-Q, which are incorporated herein by reference, as may be amended, supplemented or superseded from time to time by other reports we file with the SEC. Our business, financial condition, operating results and prospects are subject to the material risks set forth below and incorporated herein by reference. Additional risks and uncertainties not presently foreseeable to us may also impair our business operations. If any of the risks set forth below or incorporated by reference herein actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the trading price of our common stock could decline, and our stockholders may lose all or part of their investment in the shares of our common stock.

Risks Related to Our Financial Position and Need for Additional Capital

We will require substantial additional funding, which may not be available to us on acceptable terms, or at all, and, if not so available, may require us to delay, limit, reduce or cease our operations.

We have used, and plan to continue using the proceeds from our initial public offering, registered direct offering, and private placements of our securities to advance Oncoprex through clinical development, as well as for other purposes. Developing pharmaceutical products, including conducting preclinical studies and clinical trials, is expensive. We will require substantial additional future capital in order to complete clinical development and commercialize Oncoprex. If the FDA requires that we perform additional preclinical studies or clinical trials, our expenses will further increase beyond what we currently expect and the anticipated timing of any potential approval of Oncoprex would likely be delayed. Further, there can be no assurance that the costs we will need to incur to obtain regulatory approval of Oncoprex will not increase.

We will continue to require substantial additional capital to continue our clinical development and commercialization activities. Because successful development of our current and potential product candidates is uncertain, we are unable to estimate the actual amount of funding we will require to complete research and development and commercialize our products under development.

The amount and timing of our future funding requirements will depend on many factors, including, but not limited to:

|

|

•

|

the progress, costs, results and timing of our clinical trials for Oncoprex;

|

|

|

•

|

the outcome, costs and timing of seeking and obtaining FDA and any other regulatory approvals;

|

|

|

•

|

the ability of third parties to deliver materials and provide services for us;

|

|

|

•

|

the costs associated with securing and establishing commercialization and manufacturing capabilities;

|

|

|

•

|

market acceptance of our current and potential product candidates;

|

|

|

•

|

the costs of acquiring, licensing or investing in businesses, products, product candidates and technologies;

|

|

|

•

|

our ability to maintain, expand and enforce the scope of our intellectual property portfolio, including the amount and timing of any payments we may be required to make, or that we may receive, in connection with the licensing, filing, prosecution, defense and enforcement of any patents or other intellectual property rights;

|

|

|

•

|

our need and ability to hire additional management and scientific and medical personnel;

|

|

|

•

|

the effect of competing drug candidates and new product approvals;

|

|

|

•

|

our need to implement additional internal systems and infrastructure, including financial and reporting systems; and

|

|

|

•

|

the economic and other terms, timing of and success of our existing licensing arrangements and any collaboration, licensing or other arrangements into which we may enter in the future.

|

Some of these factors are outside of our control. We expect that our existing cash, and marketable securities will be sufficient to fund our current operations through at least the first quarter of 2020. This period could be shortened if there are any significant increases in planned spending on development programs or more rapid progress of development programs than anticipated. We believe that our existing capital will not be sufficient to enable us to complete the development and commercialization of Oncoprex. Accordingly, we expect that we will need to raise additional funds in the future.

We may seek additional funding through a combination of equity offerings, debt financings, government or other third-party funding, commercialization, marketing and distribution arrangements and other collaborations, strategic alliances and licensing arrangements. Additional funding may not be available to us on acceptable terms or at all. In addition, the terms of any financing may adversely affect the holdings or the rights of our stockholders. Any new equity securities we issue could have rights, preferences, and privileges superior to those of holders of our existing capital stock. In addition, the issuance of additional shares by us, or the possibility of such issuance, may cause the market price of our shares to decline. Any debt financing secured by us in the future could involve restrictive covenants relating to our capital-raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities.

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail one or more of our research or development programs, our ability to continue to support our business growth and to respond to business challenges could be significantly limited, and we may be required to curtail or cease operations. Accordingly, our business may fail, in which case you would lose the entire amount of your investment in our securities.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

Our financial statements as of December 31, 2018 have been prepared under the assumption that we will continue as a going concern for the next twelve months. Our independent registered public accounting firm included in its opinion for the year ended December 31, 2017 an explanatory paragraph referring to our recurring losses from operations and expressing substantial doubt in our ability to continue as a going concern without additional capital becoming available. Our ability to continue as a going concern is dependent upon our ability to obtain additional equity or debt financing, reduce expenditures and to generate significant revenue. Our financial statements as of December 31, 2018 did not include any adjustments that might result from the outcome of this uncertainty. The reaction of investors to the inclusion of a going concern statement by our auditors, and our potential inability to continue as a going concern, in future years could materially adversely affect our share price and our ability to raise new capital or enter into strategic alliances. Furthermore, we also could be required to seek funds through arrangements with collaborative partners or otherwise that may require us to relinquish rights to some of our technologies or product candidates or otherwise agree to terms unfavorable to us.

Risks Related to Development and Commercialization of Our Current and Potential Product Candidates

Our success depends greatly on the success of our development of Oncoprex for the treatment of non-small cell lung cancer, and our pipeline of product candidates beyond this lead indication is extremely early stage and limited. Oncoprex and our other product candidates are based on novel technology, which makes it difficult to predict the time and cost or the outcome of development and of subsequently obtaining regulatory approval.

At this time we are actively pursuing development of only one product candidate, Oncoprex for NSCLC. Therefore, we are dependent on the success of Oncoprex in the near term. We cannot provide you any assurance that we will be able to successfully advance Oncoprex through the development process, or that any development problems we experience in the future will not cause significant delays or unanticipated costs, or that such development problems can be solved. We may also experience delays in developing a sustainable, reproducible and scalable manufacturing process or transferring that process to commercial partners, or developing or validating product release assays in a timely manner, which may prevent us from completing our clinical trials or commercializing our products on a timely or profitable basis, if at all. Immunotherapy, gene therapy and biopharmaceutical product development are highly speculative undertakings and involve a substantial degree of uncertainty. Because Oncoprex and our other potential product candidates are based upon novel technology, it is difficult to predict whether, either as stand-alone therapies or in combination with other drugs, they will show consistently favorable results and to predict the time and cost of their development and of subsequently obtaining regulatory approval. Few gene therapy products have been approved in the United States or Europe. We have found it difficult to enroll patients in our clinical studies and may, in the future, find it difficult to enroll patients in our clinical studies, which could delay or prevent clinical studies of our current and potential product candidates. We may encounter delays in our clinical studies, or we may fail to demonstrate safety and efficacy to the satisfaction of FDA and other regulatory authorities. We may not be successful in our efforts to identify or discover additional product candidates, or to develop product candidates that we have identified.

In addition, the clinical trial requirements of FDA, the European Commission, the European Medicines Agency, or the EMA, the competent authorities of the Member States of the European Union, or EU, and other regulatory authorities and the criteria these regulators use to determine the safety and efficacy of a product candidate vary substantially according to the type, complexity, novelty and intended use and market of such product candidates. The regulatory approval process for novel product candidates such as ours can be more expensive and take longer than for other, better known or more extensively studied product candidates. Even if we are successful in developing additional product candidates, it is difficult to determine how long it will take or how much it will cost to obtain regulatory approvals for these product candidates in either the United States or the EU, or how long it will take to commercialize any other products for which we receive marketing approval. In addition, any future marketing authorization granted by the European Commission may not be indicative of what FDA may require for approval and vice versa.

Delays in the commencement, enrollment and completion of clinical trials could result in increased costs to us and delay or limit our ability to obtain regulatory approval for Oncoprex and our other potential product candidates.

Oncoprex has been tested in only one prior Phase I clinical study, involving 31 patients. In that study, Oncoprex was tested as a monotherapy. We believe that the best path for development is to develop a combination therapy of Oncoprex in combination with EGFR TKIs, such as erlotinib and osimertinib, and/or in combination with immunotherapies, such as anti-PD-1 immunotherapy, and possibly other drugs. We have an ongoing Phase I/II clinical trial testing Oncoprex in combination with erlotinib. Enrollment was completed in March 2015 for the Phase I portion of this clinical trial, in which 18 patients were enrolled. The Phase II portion of our Phase I/II clinical trial is at an early stage, with a limited number of patients enrolled, and the favorable results observed so far may not continue in the current clinical trial or be replicated in other clinical trials, especially those involving larger numbers of patients. Even if the Phase I/II trial is successful, success in early clinical studies may not be indicative of results obtained in later studies. The results from our Phase I/II trial may not demonstrate sufficient safety and efficacy to support the submission of marketing approval for Oncoprex. Before we request marketing approval, the FDA may require us to conduct additional clinical studies or evaluate subjects for an additional follow-up. Unless an accelerated approval process is allowed by the FDA, one or more Phase III studies is normally required for approval.

Delays in the commencement, enrollment and/or completion of clinical trials at any of our sites could increase our product development costs or delay or limit the regulatory approval of our current and potential product candidates. We do not know whether any future trials or studies of our other potential product candidates will begin on time or will be completed on schedule, if at all. The start or end of a clinical study is often delayed or halted due to regulatory requirements, changes in the proposed regulatory approval pathway for a drug candidate, manufacturing challenges, including delays or shortages in available drug product, required clinical trial administrative actions, slower than anticipated patient enrollment, changing standards of care, availability or prevalence of use of a comparative drug or required prior therapy, clinical outcomes or financial constraints. For instance, delays or difficulties in patient enrollment or difficulties in retaining trial participants can result in increased costs, longer development times or termination of a clinical trial. Clinical trials of a new product candidate require the enrollment of a sufficient number of patients, including patients who are suffering from the disease the product candidate is intended to treat and who meet other eligibility criteria. Rates of patient enrollment are affected by many factors, including the size of the patient population, the eligibility criteria for the clinical trial, which include the age and condition of the patients and the stage and severity of disease, the nature of the protocol, the proximity of patients to clinical sites and the availability of effective treatments and/or availability of other investigational treatment options for the relevant disease.

If we are unable to secure contract manufacturers with capabilities to produce the products that we require, we could experience further delays in reopening enrollment of the second phase of our Phase I/II clinical trial at MD Anderson.

As the second phase of a Phase I/II clinical trial, MD Anderson researchers are conducting a Phase II clinical trial evaluating Oncoprex in combination with erlotinib in NSCLC. The Phase II trial began in June 2015. We have encountered delays in reopening enrollment primarily because the GMP manufacturing facility at MD Anderson did not have the capacity to produce additional drug product, and requested that, with MD Anderson’s assistance, we transfer the portion of the process which such manufacturing facility had performed to a third party manufacturer. Although we have contracted with contract manufacturers with capabilities to produce the products that we require, no assurance can be given that such contract manufacturers will be able to, and receive all approvals to, produce product sufficient for our trials. In accordance with cGMPs, changing manufacturers may require the re-validation of manufacturing processes and procedures, and may require further preclinical studies or clinical trials to show comparability between the materials produced by different manufacturers. Changing our current or future contract manufacturers may be difficult and could be costly if we do make such a change, which could result in our inability to manufacture our clinical product candidate and a delay in the development of our clinical product candidate. Further, in order to maintain our development timelines in the event of a change in a third-party contract manufacturer, we may incur higher costs to manufacture our clinical product candidate. Furthermore, we may open enrollment at one or more other clinical trial sites prior to, or in lieu of, reopening enrollment at MD Anderson. Any additional clinical trial sites that we open will require approval of the Investigational Review Board, or IRB, and no assurance can be given the IRB will approve such sites in a timely manner, if at all.

A product candidate can unexpectedly fail at any stage of preclinical and clinical development.

The historical failure rate for product candidates is high due to scientific feasibility, safety, efficacy, changing standards of medical care and other variables. The results from preclinical testing or early clinical trials of a product candidate may not predict the results that will be obtained in later phase clinical trials of the product candidate. We, the FDA or other applicable regulatory authorities may suspend clinical trials of a product candidate at any time for various reasons, including, but not limited to, a belief that subjects participating in such trials are being exposed to unacceptable health risks or adverse side effects, or other adverse initial experiences or findings. We may not have the financial resources to continue development of, or to enter into collaborations for, a product candidate if we experience any problems or other unforeseen events that delay or prevent regulatory approval of, or our ability to commercialize, product candidates, including:

|

|

•

|

inability to obtain sufficient funds required for a clinical trial;

|

|

|

•

|

inability to reach agreements on acceptable terms with current or prospective CROs and trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites;

|

|

|

•

|

negative or inconclusive results from our clinical trials or the clinical trials of others for product candidates similar to ours, leading to a decision or requirement to conduct additional preclinical testing or clinical trials or abandon a program;

|

|

|

•

|

serious and unexpected side effects experienced by subjects in our clinical trials or by individuals using drugs similar to our current and potential product candidates;

|

|

|

•

|

conditions imposed by the FDA or comparable foreign authorities regarding the scope or design of our clinical trials;

|

|

|

•

|

delays in enrolling research subjects in clinical trials;

|

|

|

•

|

high drop-out rates and high fail rates of research subjects;

|

|

|

•

|

inadequate supply or quality of product candidate components or materials or other supplies necessary for the conduct of our clinical trials;

|

|

|

•

|

greater than anticipated clinical trial costs;

|

|

|

•

|

poor effectiveness of our current and potential product candidates during clinical trials; or

|

|

|

•

|

unfavorable FDA or other regulatory agency inspection and review of a clinical trial site or vendor.

|

We may have difficulty engaging or retaining clinical trial sites and/or enrolling patients in our clinical trials, which could delay or prevent development of our current and potential product candidates.

Identifying and qualifying patients to participate in clinical trials of our current and potential product candidates is critical to our success. The timing of our clinical trials depends on the speed at which we can engage and retain clinical trial sites and recruit patients to participate in testing our current and potential product candidates. We have experienced delays in some of our clinical trials in the past due to difficulties with enrollment and we may experience similar delays in the future. We have suspended enrollment of new patients in the Phase II portion of our Phase I/II clinical trial evaluating Oncoprex in combination with erlotinib in NSCLC, and we may experience difficulties with enrollment upon reopening enrollment for the trial under the current protocol or a modified protocol. If patients are unwilling to participate in our clinical trials because of negative publicity from adverse events in the industry or in the trials for other third-party product candidates, or for other reasons, including competitive clinical trials for similar patient populations, the timeline for engaging sites, recruiting patients, conducting studies and obtaining regulatory approval of potential products may be delayed. These delays could result in increased costs, delays in advancing our product development, delays in testing the effectiveness of our technology or termination of the clinical trials altogether.

We or our clinical trial sites may not be able to identify, recruit and enroll a sufficient number of patients, or those with the required or desired characteristics in a clinical trial, to complete our clinical trials in a timely manner. Patient enrollment is affected by factors including:

|

|

•

|

severity of the disease under investigation;

|

|

|

•

|

design of the clinical trial protocol, including the fact that certain of our clinical trials are randomized to current treatments;

|

|

|

•

|

size of the patient population;

|

|

|

•

|

eligibility criteria for the clinical trial in question;

|

|

|

•

|

perceived risks and benefits of the product candidate under study;

|

|

|

•

|

proximity and availability of clinical trial sites for prospective patients;

|

|

|

•

|

availability of competing therapies and clinical trials;

|

|

|

•

|

efforts to facilitate timely enrollment in clinical trials;

|

|

|

•

|

timely availability of the study drug;

|

|

|

•

|

patient referral practices of physicians; and

|

|

|

•

|

ability to monitor patients adequately during and after treatment.

|

We currently plan to seek initial marketing approval in the United States and subsequently in Europe. We may not be able to initiate or continue clinical trials if we cannot enroll a sufficient number of eligible patients to participate in the clinical trials required by the FDA or the EMA, or other regulatory agencies. Our ability to successfully initiate, enroll and complete a clinical trial in any foreign country is subject to numerous risks unique to conducting business in foreign countries, including:

|

|

•

|

difficulty in establishing or managing relationships with CROs and physicians;

|

|

|

•

|

different standards for the conduct of clinical trials;

|

|

|

•

|

our inability to locate qualified local consultants, physicians and partners; and

|

|

|

•

|

the potential burden of complying with a variety of foreign laws, medical standards and regulatory requirements, including the regulation of pharmaceutical and biotechnology products and treatments.

|

If we have difficulty enrolling a sufficient number of patients to conduct our clinical trials as planned, we may need to delay, limit or terminate ongoing or planned clinical trials, any of which would have an adverse effect on our business.

Any product candidate we advance through clinical trials may not have favorable results in later clinical trials or receive regulatory approval. Even if we complete the necessary clinical trials, we cannot predict when, or if, we will obtain regulatory approval to commercialize a product candidate, and the approval may be for a narrower indication than we seek.

Clinical failure can occur at any stage of our clinical development. Clinical trials may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical trials or nonclinical studies. In addition, data obtained from trials and studies are susceptible to varying interpretations, and regulators may not interpret our data as favorably as we do, which may delay, limit or prevent regulatory approval. Additionally, our partners, clients, other vendors, and/or other stakeholders may not agree with our interpretation(s) of data obtained from our clinical trials, which could potentially cause a variety of issues, including, but not limited to delays, the necessity for additional clinical studies and analyses, dependence on third-party validation, and/or other unforeseen challenges. Success in preclinical studies and early clinical trials does not ensure that subsequent clinical trials will generate the same or similar results or otherwise provide adequate data to demonstrate the efficacy and safety of a product candidate. A number of companies in the pharmaceutical industry, including those with greater resources and experience than ours, have suffered significant setbacks in clinical trials, even after seeing promising results in earlier clinical trials.

In addition, the design of a clinical trial can determine whether its results will support approval of a product and flaws in the design of a clinical trial may not become apparent until the clinical trial is well advanced. We may be unable to design and execute a clinical trial to support regulatory approval. Further, clinical trials of potential products often reveal that it is not practical or feasible to continue development efforts.

If Oncoprex is found to be unsafe or lack efficacy, we will not be able to obtain regulatory approval for it and our business would be harmed.

In some instances, there can be significant variability in safety and/or efficacy results between different trials of the same product candidate due to numerous factors, including changes in trial protocols, differences in composition of the patient populations, adherence to the dosing regimen and other trial protocols and the rate of drop out among clinical trial participants. We do not know whether any clinical trials we or any of our potential future collaborators may conduct will demonstrate the consistent or adequate efficacy and safety that would be required to obtain regulatory approval and market any products. If we are unable to bring Oncoprex to market, or to acquire other products that are on the market or can be developed, our ability to create stockholder value will be limited.

Regulatory authorities also may approve a product candidate for more limited indications than requested, or they may impose significant limitations in the form of narrow indications. These regulatory authorities may require warnings or precautions with respect to conditions of use or they may grant approval subject to the performance of costly post-marketing clinical trials. In addition, regulatory authorities may not approve the labeling claims or allow the promotional claims that are necessary or desirable for the successful commercialization of our product candidates. Any of the foregoing scenarios could materially harm the commercial prospects for our product candidates and materially and adversely affect our business, financial condition, results of operations and prospects.

Potential product liability lawsuits against us could cause us to incur substantial liabilities and could limit commercialization of Oncoprex or any other products that we may develop.

In the event Oncoprex or any of our other potential product candidates is approved for marketing by the FDA and other regulatory authorities, we may face potential product liability. If successful claims are brought against us, we may incur substantial liability and costs. If the use of our current and potential product candidates harms patients, or is perceived to harm patients even when such harm is unrelated to our current and potential product candidates, our regulatory approvals could be revoked or otherwise negatively affected, and we could be subject to costly and damaging product liability claims. Although we do not currently maintain product liability insurance coverage, we may not be able to obtain or maintain insurance coverage in the future at a reasonable cost or in an amount adequate to satisfy any liability that may arise, if at all.

Security breaches and other disruptions could compromise our information and expose us to liability, which would cause our business and reputation to suffer.

In the ordinary course of our business, we collect and store sensitive data, including intellectual property, our proprietary business information and that of our suppliers and business partners, as well as personally identifiable information of clinical trial participants and employees. Similarly, our CROs, contractors and consultants possess certain of our sensitive data. The secure maintenance of this information is critical to our operations and business strategy. Despite our security measures our information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions. Any such breach could compromise our networks and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information, including our data being breached at our our CROs, contractors and consultants, could result in legal claims or proceedings, liability under laws that protect the privacy of personal information, disrupt our operations, and damage our reputation which could adversely affect our business. Furthermore, the loss of clinical trial data from completed or future clinical trials could result in delays in our regulatory approval efforts and significantly increase our costs to recover or reproduce the data which could cause the development and commercialization of our current and potential product candidates to be delayed.

We face competition from other biotechnology and pharmaceutical companies and our operating results will suffer if we fail to compete effectively.

The biotechnology and pharmaceutical industries are intensely competitive and subject to rapid and significant technological change. We have competitors in the United States, Europe and elsewhere, including major multinational pharmaceutical companies, established biotechnology companies, specialty pharmaceutical and generic drug companies and universities and other research institutions. Many of our competitors have greater financial and other resources, such as larger research and development staff and more experienced marketing and manufacturing organizations than we do. Large pharmaceutical companies, in particular, have extensive experience in clinical testing, obtaining regulatory approvals, recruiting patients and manufacturing pharmaceutical products. These companies also have significantly greater research, sales and marketing capabilities and collaborative arrangements in our target markets with leading companies and research institutions. Established pharmaceutical companies may also invest heavily to accelerate discovery and development of novel compounds or to in-license novel compounds that could make the product candidates that we develop obsolete. As a result of these factors, our competitors may succeed in obtaining patent protection and/or FDA approval or in discovering, developing and commercializing drugs for the cancer indications that we are targeting before we do or may develop drugs that are deemed to be more effective or gain greater market acceptance than ours. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large, established companies. In addition, many universities and private and public research institutes may become active in our target disease areas. Our competitors may succeed in developing, acquiring or licensing on an exclusive basis, technologies and drug products that are more effective or less costly than any product candidates that we are currently developing or that we may develop, which could render our products obsolete or noncompetitive.

There are a number of drugs approved and under development for treatment of lung cancer. Treatments competitive with our primary product candidates generally fall into the following categories: chemotherapies such as cisplatin, carboplatin, docetaxel and pemetrexed; targeted therapies such as erlotinib, gefitinib, afatinib and osimertinib, and immunotherapies such as checkpoint inhibitors and CAR and CAR-T cells, and oncolytic virus-based technology. In addition, new drug candidates are constantly being conceived and developed. Any such competing therapy may be more effective and/or cost-effective than ours.

If our competitors market products that are more effective, safer or less expensive or that reach the market sooner than our future products, if any, we may not achieve commercial success. In addition, because of our limited resources, it may be difficult for us to stay abreast of the rapid changes in each technology. If we fail to stay at the forefront of technological change, we may be unable to compete effectively. Technological advances or products developed by our competitors may render our technologies or product candidates obsolete, less competitive or not economical.

Risks Related to Regulatory Approval and Marketing of Our Current and Potential Product Candidates and Other Legal Compliance Matters

If we obtain approval to commercialize any of our product candidates outside the United States, in particular in the EU, a variety of risks associated with international operations could materially adversely affect our business.

We expect that we will be subject to additional risks in commercializing any of our product candidates outside the United States, including the following, any one or combination of which could have a material adverse effect on our business:

|

|

•

|

different regulatory requirements for approval of drugs and biologics in foreign countries;

|

|

|

•

|

reduced protection for intellectual property rights;

|

|

|

•

|

unexpected changes in tariffs, trade barriers and regulatory requirements;

|

|

|

•

|

economic weakness, including inflation, or political instability in particular foreign economies and markets;

|

|

|

•

|

compliance with tax, employment, immigration and labor laws for employees living or traveling abroad;

|

|

|

•

|

foreign currency fluctuations, which could result in increased operating expenses and reduced revenues, and other obligations incident to doing business in another country;

|

|

|

•

|

workforce uncertainty in countries where labor unrest is more common than in the United States;

|

|

|

•

|

production shortages resulting from any events affecting raw material supply or manufacturing capabilities abroad; and

|

|

|

•

|

business interruptions resulting from geopolitical actions, including war and terrorism or natural disasters including earthquakes, typhoons, floods and fires.

|

Risks Related to Our Intellectual Property

Obtaining and maintaining our patent protection depends on compliance with various procedural, document submission, fee payment and other requirements imposed by governmental patent agencies, and our patent protection could be reduced or eliminated for non-compliance with these requirements.

Periodic maintenance fees, renewal fees, annuity fees and various other governmental fees on patents and/or applications will be due to be paid to the US PTO and various governmental patent agencies outside of the United States in several stages over the lifetime of the patents and/or applications. We employ an outside firm and rely on our outside counsel to pay these fees due to non-US patent agencies. The US PTO and various non-US governmental patent agencies require compliance with a number of procedural, documentary, fee payment and other similar provisions during the patent application process. Although an inadvertent lapse can be cured by payment of a late fee or by other means in accordance with the applicable rules, there are situations in which non-compliance can result in abandonment or lapse of the patent or patent application, resulting in partial or complete loss of patent rights in the relevant jurisdiction. In such an event, our competitors might be able to enter the market which would have a material adverse effect on our business.

We will need to expand our operations and increase the size of our company, and we may experience difficulties in managing growth.