Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-252370

The

information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and

the accompanying prospectus are part of an effective registration statement filed with the Securities and Exchange Commission under the

Securities Act of 1933, as amended. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these

securities, and we are not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

SEPTEMBER 14, 2022 |

(To

the Prospectus dated February 5, 2021)

Shares

of Common Stock or Pre-Funded Warrants

Warrants

to Purchase Shares of Common Stock

ESPORTS

ENTERTAINMENT GROUP, INC.

We

are offering, on a firm commitment basis, (a) shares of our common stock (the “Common Stock”), $0.001 par value per share,

at a price of $ per share and (b) warrants to purchase up to shares of our common stock, at an exercise price of $ per share (the “Warrants”),

in this offering pursuant to this prospectus supplement and the accompanying prospectus.

We

are also offering to each purchaser that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our

outstanding common stock immediately following the consummation of this offering, the opportunity to purchase securities consisting of

one pre-funded warrant (in lieu of one share of common stock) and one Warrant. Subject to limited exceptions, a holder of pre-funded

warrants will not have the right to exercise any portion of its pre-funded warrants if the holder, together with its affiliates, would

beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the number of

common stock outstanding immediately after giving effect to such exercise. Each pre-funded warrant will be exercisable for one share

of common stock. The purchase price of each pre-funded warrant and Warrant will be equal to the price of each Common Stock and Warrant,

minus $0.01, and the remaining exercise price of each pre-funded warrant will equal $0.01 per share. The pre-funded warrants will be

immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of the pre-funded warrants

are exercised in full. For each pre-funded warrant we sell (without regard to any limitation on exercise set forth therein), the number

of shares of common stock we are offering will be decreased on a one-for-one basis. The common stock and pre-funded warrants, if any,

can each be purchased in this offering only with the accompanying Warrant (other than pursuant to the option of the representatives of

the underwriters to purchase additional common stock and/or pre-funded warrants and/or Warrants). See “Description of the Securities

that we are Offering” in this prospectus for more information.

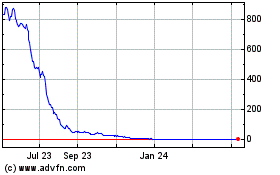

Our

Common Stock trades on the Nasdaq Capital Market under the symbol “GMBL.” On September 13, 2022, the last reported

sale price of our Common Stock was $0.4433 per share.

We

currently have two classes of Common Stock Purchase Warrants that trade on the Nasdaq Capital Market under the symbols “GMBLW”

and “GMBLZ.”

Our

Common Stock Purchase Warrants that have an exercise price of $4.25 per share and expire in April 2025 trade under the symbol GMBLW and,

on September 13, 2022, the last reported sale price of our GMBLW warrants was $0.17 per warrant.

Our

Common Stock Purchase Warrants that have an exercise price of $1.00 per share and expire in March 2027 trade under the symbol GMBLZ and,

on September 13, 2022, the last reported sale price of our GMBLZ warrants was $0.14 per warrant.

There

is no established public trading market for the Warrants or pre-funded warrants being offered in this offering and we do not expect an

active trading market to develop. We do not intend to list the Warrants or pre-funded warrants on any securities exchange or other trading

market. Without an active trading market, the liquidity of the Warrants and pre-funded warrants will be limited.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-11 of this prospectus supplement

and on page 11 of the accompanying prospectus for a discussion of information that should be considered in connection with an investment

in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per Share or Pre-Funded Warrant and Warrant | | |

Total | |

| Public offering price | |

| | | |

| | |

| Underwriting discounts and commissions (1) | |

| | | |

| | |

| Proceeds, before expenses, to us | |

| | | |

| | |

| |

(1) |

In

addition, we have agreed to reimburse the underwriters for certain expenses and to pay a non-accountable expense allowance to the

representative of the underwriters equal to one percent (1%) of the gross proceeds received at the closing of the offering (excluding

any proceeds received upon any subsequent exercise of the over-allotment option). See “Underwriting” on page S-20 of

this prospectus supplement for additional information. |

We

have granted the representatives of the underwriters an option to purchase up to an additional [●] shares of our Common Stock and/or

pre-funded warrants and/or Warrants from us at the public offering price, less the underwriting discounts and commissions, within 45

days from the date of this prospectus to cover over-allotments, if any.

The

underwriters expect to deliver the shares of Common Stock or pre-funded warrants and the Warrants to the purchasers on or about ________________.

MAXIM

GROUP LLC |

JOSEPH

GUNNAR & CO., LLC |

The

date of this prospectus supplement is _____________, 2022

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying base prospectus form part of a registration statement on Form S-3 that we filed with the Securities

and Exchange Commission, which we refer to as the SEC, using a “shelf” registration process. This document contains two parts.

The first part consists of this prospectus supplement, which provides you with specific information about this offering. The second part,

the accompanying base prospectus dated February 5, 2021, provides more general information, some of which may not apply to this offering.

Generally, when we refer only to the “prospectus,” we are referring to both parts combined. This prospectus supplement may

add, update or change information contained in the accompanying base prospectus. To the extent that any statement we make in this prospectus

supplement is inconsistent with statements made in the accompanying base prospectus or any documents incorporated by reference herein

or therein, the statements made in this prospectus supplement will be deemed to modify or supersede those made in the accompanying base

prospectus and such documents incorporated by reference herein and therein.

In

this prospectus supplement, “EEG,” the “Company,” “we,” “us,” “our” and similar

terms refer to Esports Entertainment Group, Inc., a Nevada corporation, and its consolidated subsidiaries. References to our “common

stock” refer to the common stock of Esports Entertainment Group, Inc.

All

references in this prospectus supplement to our consolidated financial statements include, unless the context indicates otherwise, the

related notes.

The

industry and market data and other statistical information contained in the documents we incorporate by reference in the prospectus are

based on management’s own estimates, independent publications, government publications, reports by market research firms or other

published independent sources, and, in each case, are believed by management to be reasonable estimates. Although we believe these sources

are reliable, we have not independently verified the information.

You

should rely only on the information contained in or incorporated by reference in this prospectus supplement, the accompanying base prospectus

and in any free writing prospectus that we have authorized for use in connection with this offering. We have not, and the underwriters

in this offering, including the representatives of the underwriters, Maxim Group LLC and Joseph Gunnar & Co., LLC, have not, authorized

any other person to provide you with any information that is different. If anyone provides you with different or inconsistent information,

you should not rely on it. You should assume that the information in this prospectus supplement, the accompanying base prospectus, the

documents incorporated by reference in the accompanying base prospectus, and in any free writing prospectus that we have authorized for

use in connection with this offering, is accurate only as of the date of those respective documents. Our business, financial condition,

results of operations and prospects may have changed since those dates. You should read this prospectus supplement, the accompanying

base prospectus, the documents incorporated by reference in the accompanying base prospectus, and any free writing prospectus that we

have authorized for use in connection with this offering, in their entirety before making an investment decision. You should also read

and consider the information in the documents to which we have referred you in the sections of the accompanying base prospectus entitled

“Where You Can Find More Information” and “Incorporation by Reference of Certain Documents.” We are offering

to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The distribution of this

prospectus supplement and the offering of the securities in certain jurisdictions may be restricted by law. Persons outside the United

States who come into possession of this prospectus supplement must inform themselves about, and observe any restrictions relating to,

the offering of our securities and the distribution of this prospectus supplement outside the United States. This prospectus supplement

does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered

by this prospectus supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

CAUTIONARY

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

The

information included or incorporated by reference into this prospectus supplement and the accompanying prospectus contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities

Exchange Act of 1934, as amended, or Exchange Act. These forward-looking statements that relate to future events or our future financial

performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity,

performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or

implied by these forward-looking statements. Words such as, but not limited to, “believe,” “expect,” “anticipate,”

“estimate,” “intend,” “plan,” “targets,” “likely,” “aim,” “will,”

“would,” “could,” and similar expressions or phrases identify forward-looking statements. We have based these

forward-looking statements largely on our current expectations and future events and financial trends that we believe may affect our

financial condition, results of operation, business strategy and financial needs. Actual results may differ materially from those expressed

or implied in such forward-looking statements as a result of various factors. We do not undertake, and we disclaim, any obligation to

update any forward-looking statements or to announce any revisions to any of the forward-looking statements, except as required by law.

Certain factors that could cause results to be materially different from those projected in the forward-looking statements include, but

are not limited to, statements about:

| |

● |

our

ability to comply with the continued listing requirements of Nasdaq Capital Market; |

| |

● |

any

statements of the plans, strategies and objectives of management for future operations; |

| |

● |

any

statements concerning proposed new products, services or developments; |

| |

● |

any

statements regarding future economic conditions or performance; |

| |

● |

our

ability to protect our intellectual property and operate our business without infringing upon the intellectual property rights of

others; |

| |

● |

our

estimates regarding the sufficiency of our cash resources and our need for additional funding; and |

| |

● |

our

intended use of the net proceeds from the offering of shares of common stock and warrants to purchase shares of common stock

under this prospectus supplement. |

We

urge you to consider these factors before investing in our securities. The forward-looking statements included in this prospectus supplement,

the accompanying prospectus and any other offering material, or in the documents incorporated by reference into this prospectus supplement,

the accompanying prospectus and any other offering material, are made only as of the date of the prospectus supplement, the accompanying

prospectus, any other offering material or the incorporated document. For more detail on these and other risks, please see “Risk

Factors” in this prospectus supplement, the accompanying prospectus, our Annual Report on Form 10-K/A and Form 10-K for our

fiscal year ended June 30, 2021 filed with the Securities and Exchange Commission, or SEC, on October 22, 2021 and October 13, 2021,

respectively, and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2022, December 31, 2021 and September 30, 2021

filed with the SEC on May 23, 2022, February 22, 2022, and November 15, 2021, respectively.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following information below is only a summary of more detailed information included elsewhere in, or incorporated by reference in, this

prospectus supplement and the accompanying prospectus, and should be read together with the information contained or incorporated by

reference in other parts of this prospectus supplement and the accompanying prospectus. This summary highlights selected information

about us and this offering. This summary may not contain all of the information that may be important to you. Before making a decision

to invest in our securities, you should read carefully all of the information contained in or incorporated by reference into this prospectus

supplement and the accompanying prospectus, including the information set forth under the caption “Risk Factors” in this

prospectus supplement and the accompanying prospectus as well as the documents incorporated herein by reference, which are described

under “Where You Can Find More Information” and “Information Incorporated by Reference” in this prospectus supplement.

About

Esports Entertainment Group, Inc.

Overview

Corporate

History

Esports

Entertainment Group, Inc. (“EEG”) was formed in the State of Nevada on July 22, 2008 under its prior name Virtual Closet,

Inc. Virtual Closet, Inc. changed its name to DK Sinopharma, Inc. on June 6, 2010. DK Sinopharma, Inc. changed its name to VGambling,

Inc. on August 12, 2014. On or about April 24, 2017, Vgambling, Inc. changed its name to Esports Entertainment Group, Inc. The Company

was engaged in a number of different enterprises up until May 20, 2013, when, pursuant to the terms of the Share Exchange Agreement,

we acquired all of the outstanding capital stock of H&H Arizona Corporation in exchange for 3,333,334 shares of its common stock.

From May 2013 until August 2018, its operations were limited to designing, developing and testing its wagering systems. We launched our

online esports wagering website (www.vie.gg) in August 2018.

Business

Overview

Esports

is the competitive playing of video games by amateur and professional teams as a spectator sport. Esports typically takes the form of

organized, multiplayer video games that include genre’s such as real-time strategy, fighting, first-person shooter and multiplayer

online battle arena games. Most major professional esports events and a wide range of amateur esports events are broadcast live via streaming

services including twitch.tv and youtube.com.

EEG

is an esports focused iGaming and entertainment company with a global footprint. EEG’s strategy is to build and acquire betting

and related platforms, and lever them into the rapidly growing esports vertical. We operate the business in two verticals, EEG iGaming

and EEG Games.

EEG

iGaming:

EEG

iGaming includes the esports betting platform with full casino and sportsbook functionality and services for iGaming customers.

iDefix, proprietary technology acquired with the Lucky Dino

acquisition is an MGA iGaming platform with PAM, payments, bonusing, loyalty, compliance and casino integrations that services all Lucky

Dino sites along with SportNation.com and Vie.bet. In addition, our other in-house gambling software platform, Phoenix, is a modern

reimagined sportsbook that caters to both millennial esports bettors as well as traditional sports bettors. Phoenix is being developed

through the assets and resources from our acquisition of FLIP Sports Limited, a software development company.

EEG’s

goal is to be a leader in the large and rapidly growing sector of esports real-money wagering, offering fans the ability to wager on

professional esports events in a licensed and secure environment. From February 2021, under the terms of our Maltese Gaming Authority

(MGA) license, we are now able to accept wagers from residents of over 180 jurisdictions including countries within the European Union,

Canada, New Zealand and South Africa, on our ‘‘Vie.bet’’ platform.

Alongside

the Vie.bet esports focused platform, EEG owns and operates:

| |

● |

Argyll

Entertainment’s flagship Sportnation.bet online sportsbook and casino brand, licensed in the UK and Ireland; |

| |

● |

Lucky

Dino’s 5 online casino brands licensed by the MGA on its in-house built iDefix casino-platform; and |

| |

● |

The

Bethard online sportsbook and casino brands, operating under MGA, Spanish, Irish and Swedish licenses. |

On

August 17, 2020, we announced entry into a multi-year partnership with Twin River Worldwide Holdings, Inc, now Bally’s Corporation,

to launch their proprietary mobile sports betting product, ‘‘Vie.gg’, in the state of New Jersey,

as a real money wagering “skin” of Bally’s Atlantic City, the holder of a New Jersey Casino License, Internet Gaming

Permit and a Sports Wagering License. We were granted our transactional waiver by the New Jersey Division of Gaming Enforcement (‘‘DGE’’)

on January 21, 2022.

We

also currently hold five Tier-1 gambling licenses (Malta,

UK, Ireland, Spain and Sweden) and are in the process of acquiring one in New Jersey. Our acquisitions of Argyll Entertainment, Lucky

Dino and Bethard provide a foothold in mature markets in Europe into which we believe we can cross-sell our esports offerings.

EEG

Games:

EEG

Games’ focus is on providing esports entertainment experiences to gamers through a combination of 1) online tournaments (through

our EGL tournament platform) and 2) player-vs-player wagering (through our yet to be released BETGROUND (previously referred to as “LanDuel”)

proprietary waging product).

Underpinning

our focus on esports and EEG Games customers, is our proprietary infrastructure software, ggCircuit. ggCircuit is the leading provider

of local area network (“LAN”) center management software and services, enabling us to seamlessly manage mission critical

functions such as game licensing and payments.

We

believe that as the size of the market and the number of esports enthusiasts continues to grow, so will the number of esports enthusiasts

who gamble on events, which would likely increase the demand for our platform.

Competitive

Advantages/Operational Strengths

The

online gambling and wagering industry is increasingly competitive. With relatively low barriers to entry, new competitors are entering

the esports wagering and video game tournament segments. In both of these segments, there currently exist several major competitors.

Most of EEG’s current competitors, including Unikrn, bet365, William Hill, Betway, and Pinnacle Sports, have far greater resources

than us.

However,

we believe the following strengths position us for sustainable growth:

Management

Team and Key Personnel Experience: EEG’s Board includes senior managers with extensive experience in online gambling, esports,

information technology, compliance, regulation, accounting and finance.

EEG’s

Officers and management include individuals with extensive experience in online gambling, esports, information technology, marketing,

business development, payment processing, compliance, regulation, accounting, finance and customer service.

Unique

Positioning within Digital Gaming: EEG was one of the first digital gaming companies with an esports-first focus and a line of

esports businesses; leading the effort to broaden legislation for betting on esports competitions. We are uniquely focused on connecting

to customers across a broad set of retail and digital businesses to achieve greater revenue, scale, and profitability, as well as shaping

esports infrastructure to facilitate omni-channel betting.

Technology

Assets:

| |

● |

EEG

has acquired businesses with state-of-the-art B2B/B2C technologies across esports competition infrastructure, for in-person and internet-based

competitions, for tournaments, esports wagering and skill-based betting. |

| |

● |

EEG Labs:

an established esports analytics provider for game publishers and esports leagues facilitates

greater monetization of esports audiences through proprietary technology, provision of customized

marketing, improvements to betting lines and greater customer retention. |

| |

● |

ggCircuit

Proprietary Platform: ggCircuit’s ggLeap cloud-based management software solution enables Gaming Centers to run games through the

stat integrated client, reward gamers for playing the games they love, as well as run their own local tournaments. ggCircuit is currently

used by over 600 LAN centers and connects with over 2 million gamers monthly. |

| |

● |

Lucky Dino’s online casino platform - iDefix,

a modern online casino platform licensed in Malta, upon which the Lucky Dino’s online casino brands operate. iDefix provides

a full technical solution for casino operations, with various management tools as well as in-depth business intelligence reporting

and analysis. The technology is built on a scalable event-driven micro-services-based architecture offering advanced automation features

including anti money laundering compliance and know your customer (“KYC”) handling, responsible gambling management and

monitoring, fraud and bonus abuse detection, as well as gamification, customer relationship management and bonus management. |

| |

● |

Argyll’s proprietary sports betting rewards and

bonus efficiency technology, provides an industry-leading customer loyalty program, driving above industry customer retention rates

and player lifetime values. The Program helped earn Argyll the Innovative Start-up of the Year award and the 2018 EGR Marketing &

Innovation Awards, and will be able to be leveraged across all of EEG’s verticals. |

| |

● |

Argyll’s technology and Lucky Dino’s full

iGaming tech stack will accelerate the development of EEG’s new Vie esports-centric platform, and generate synergies from further

digital gaming acquisitions. |

Strong

Brand Partnerships: EEG has already partnered, via “affiliate Marketing Agreements’’, with twelve leading brands

in pro sports, including football, hockey, basketball and soccer, with an aggregate fanbase of over 50 million, as well as with several

individual social media influencers.

| |

● |

Pro

sports team partnerships lever huge customer databases for esports tournament participation and betting, lowering EEG’s customer

acquisition costs. |

| |

● |

As

a “Marketing Affiliate’’, the esports team will provide their fans with a link to the online tournament platform

of EGL, where the fan can enter tournaments to win team merchandise, and subscribe to subsequent tournaments. |

Recent

Developments

Sale

of Helix Assets

On

June 10, 2022, the Company entered into and consummated the transaction contemplated by that certain asset purchase agreement by and

between the Company and SCV CAPITAL, LLC (the “Buyer”) pursuant to which the Buyer agreed to acquire from the Company the

Helix assets related to the Company’s ownership and operation of esports game centers in Foxboro, MA and North Bergen, NJ, herein

referred to as the “Helix Game Centers”. The total purchase price for the Helix Game Centers was approximately $1,200,000,

with the purchase price being primarily attributable to the Buyer’s assumption of certain liabilities related to the Helix Game

Centers, including leases and sponsorship liabilities. Our estimated

gain on sale of $1,069,262 was driven by the amounts of liabilities assumed by the Buyer.

Estimated Results for the Year Ended June 30, 2022

Based on a preliminary review

of our results for the year ended June 30, 2022, set forth below are preliminary estimates of unaudited selected financial data for the

year ended June 30, 2022. Our audited consolidated financial statements for the year June 30, 2022 are not yet available. The following

information reflects our preliminary estimates based on currently available information, is not a comprehensive statement of our financial

results, and is subject to change. We have provided ranges, rather than specific amounts, for the preliminary estimates of the unaudited

financial data described below primarily because our financial closing procedures for the year ended June 30, 2022 are not yet complete.

These estimates should not be viewed as a substitute for our full audited financial statements prepared in accordance with generally

accepted accounting principles in the United States, or GAAP. Further, our preliminary estimated results are not necessarily indicative

of the results to be expected for any future period. See the sections titled “Cautionary Statements Regarding Forward-Looking Information,”

“Special Note Regarding Forward-Looking Statements” and “Risk Factors” in this prospectus supplement, the accompanying

prospectus, and the documents incorporated by reference herein and therein for additional information regarding factors that could result

in differences between the preliminary estimated ranges of certain of our unaudited financial data presented below and the actual audited

financial data we will report for the year ended June 30, 2022.

| | |

Year

Ended June 30, 2022

Estimated (unaudited) | |

| | |

Low | | |

High | |

| Net Revenue | |

$ | 55,000,000 | | |

$ | 60,000,000 | |

| Cost of sales | |

$ | (22,000,000 | ) | |

$ | (25,000,000 | ) |

| Operating Loss, including estimated impairment* | |

$ | (84,000,000 | ) | |

$ | (100,000,000 | ) |

| Total other operating income (expense), net | |

$ | (17,000,000 | ) | |

$ | (20,000,000 | ) |

* Includes an estimated unaudited

asset impairment charge of $46.5 million for the year-ended June 30, 2022. The asset impairment charge is subject to change based on

the results of our annual goodwill impairment test and conclusion of our financial statement audit for the year ended June 30, 2022.

Potential

Sale of Spanish iGaming Operations

On

June 15, 2022, the Company signed a non-binding letter of intent to sell its Spanish iGaming operations, including its Spanish iGaming

license, as part of its strategy to focus on its core brand assets.

Regulatory

Developments

United

Kingdom

Since

the acquisition of the Argyll iGaming business on July 31, 2020, the Company has been responding to periodic requests for information

from the UK Gambling Commission in relation to information required to maintain its UK license following the change of corporate control.

The Company continues to operate in the UK market and there have been no adverse judgments imposed by the Gambling Commission against

the Company. In recent months, the Company has reduced its spending on marketing and has been focused on retaining existing customers

and reactivating past customers. We believe these efforts will have a positive effects on our results of operations.

Netherlands

On

October 1, 2021, a new licensing regime was implemented in the Netherlands for online gaming operators. This resulted in the Company

discontinuing its iGaming operations in this market in the fiscal quarter ended December 31, 2021 (Q2 of fiscal year 2022). The sole

period in which the Company had revenues from its iGaming operations in the Netherlands was in the fiscal quarter ended September 30,

2021 (Q1 of fiscal year 2022). As a result of these regulatory developments in the Netherlands, net revenues for our Bethard business

declined from approximately $5.7 million for the three months ended September 30, 2021 to approximately $3.5 million for the three months

ended December 31, 2021. Net revenues for our Bethard business represented approximately 35% and 24% of our total net revenues for, respectively,

the three months ended September 30, 2021 and three months ended December 31, 2021. The Company may re-enter the Dutch market in the

second half of fiscal year 2023.

Finland

On

January 1, 2022, amendments to the Finnish Lotteries Act came into effect, further restricting marketing opportunities and enhancing

the enforcement powers of the Finnish regulator. Prior to these amendments coming into effect, in the fiscal quarter ended December 31,

2021, the Company received a communication from the Finnish regulator requesting clarification on its marketing and gaming practices

related to its Finnish iGaming operations. The Company responded to the communication in Q3 of fiscal year 2022 and starting in the fiscal

quarter ended June 30, 2022, the Company has changed its business operations in Finland as part of its response.

Further

powers allowing the Finnish regulator to require blocking by payment service providers of overseas operators who are targeting their

marketing activities towards Finnish customers are also due to come into effect in calendar year starting January 1, 2023. The

Company believes that the changes that it has made to its business operations in Finland will allow it to avoid being adversely affected

by the Finnish regulator’s new powers.

While

there have been no adverse judgments imposed by the Finnish regulator against the Company, as a result of these Finnish regulatory developments,

we estimate that net revenues for our Lucky Dino business have declined from approximately $6.5 million for the three months ended March

31, 2022 to approximately $4.2 million for the three months ended June 30, 2022 (a preliminary estimate based on currently available

information and subject to change). Net revenues for our Lucky Dino business represented approximately 42% of our consolidated net revenues

for the three months ended March 31, 2022.

Operations

in Finland run under the MGA license on the Lucky Dino in-house built iDefix casino-platform. The Company continues to launch new brands

and offer new products on its various sites tailoring the experience towards each of its markets including new markets in Central American

and South America. We believe revenues will be generated by these new brands and new products.

Compliance

with Nasdaq Listing Requirements

On

April 11, 2022, the Company received a deficiency notification letter from the Listing Qualifications

Staff of Nasdaq Stock Market LLC (“Nasdaq”) indicating that the Company was not in compliance with Nasdaq Listing

Rule 5550(a)(2) because the bid price for the Company’s common stock had closed below $1.00 per share for the previous 30 consecutive

business days. In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has 180 calendar days from the date of such notice,

or until October 8, 2022, to regain compliance with the minimum bid price requirement. To regain compliance, the bid price for the Company’s

common stock must close at $1.00 per share or more for a minimum of 10 consecutive business days. As of September 9, 2022, we have not

yet regained compliance with the $1.00 bid price requirement.

On

June 7, 2022, the Company received an additional written notice from Nasdaq indicating that, for the last 30 consecutive business days,

the market value of our listed securities (the “MVLS”) has been below the minimum requirement of $35 million for continued

listing on the Nasdaq Capital Market under Nasdaq Listing Rule 5550(b)(2). In accordance with Nasdaq listing rule 5810(c)(3)(C), the

Company has 180 calendar days, or until December 5, 2022, to regain compliance. The notice states that to regain compliance, the Company’s

MVLS must close at $35 million or more for a minimum of 10 consecutive business days (or such longer period of time as the Nasdaq staff

may require in some circumstances, but generally not more than 20 consecutive business days) during the compliance period ending December

5, 2022. As of September 9, 2022, we have not yet regained compliance with the $35 million MVLS requirement.

March

2022 Warrants

On

March 2, 2022 the Company closed an offering (the “March 2022 Offering”) in which it sold 15,000,000 units at $1.00 consisting

of one share of common stock and one warrant for a total of 15,000,000 warrants with an exercise price of $1.00 (the “March 2022

Warrants”). The March 2022 Offering provided net cash proceeds of $13,605,000. On April 1,

2022 the underwriters of the March 2022 Offering exercised the Over-Allotment option of 2,250,000 warrants to purchase shares at a price

of $0.01 per warrant. The Company received net proceeds of $20,925. The March 2022 Warrants trade on the Nasdaq Capital Market

under the symbol GMBLZ.

Senior

Convertible Note

On

June 2, 2021, the Company issued a senior convertible note (the “Old Senior Convertible Note”) before it was exchanged for

a new senior convertible note (the “New Note”) on February 22, 2022. The Old Senior Convertible Note was issued to the lender

(the “Holder”) in the principal amount of $35,000,000 with the Company receiving proceeds at issuance of $32,515,000, net

of debt issuance costs of $2,485,000. The Old Senior Convertible Note would have matured on June 2, 2023, at which time the Company would

have been required to repay the original principal balance and a minimum return (“Premium on Principal”) equal to 6% of any

outstanding principal. The aggregate principal of the Old Senior Convertible Note repayable at maturity was $37,100,000.

On

February 22, 2022, the Company agreed to enter into an exchange agreement (the “Exchange Agreement”) with the Holder whereby

the Old Senior Convertible Note of the Company, with a remaining principal amount of $29,150,001, was exchanged for the New Note in the

aggregate principal amount of $35,000,000.

The

New Note is convertible, at the option of the Holder, into shares of the Company’s common stock at a conversion price of $17.50

per share.

If

an Event of Default has occurred under the New Note, the Holder may elect to alternatively convert the New Note at the Alternate Conversion

Price (as defined in the New Note). In connection with an Event of Default, the Holder may require us to redeem in cash any or all of

the New Note. The redemption price will equal 100% of the outstanding principal of the New Note to be redeemed, and accrued and unpaid

interest and unpaid late charges thereon, or an amount equal to market value of the shares of our common stock underlying the New Note,

as determined in accordance with the New Note, if greater. The Holder will not have the right to convert any portion of a New Note, to

the extent that, after giving effect to such conversion, the Holder (together with certain related parties) would beneficially own in

excess of 4.99% of the shares of our common stock outstanding immediately after giving effect to such conversion. The Holder may from

time to time increase this limit to 9.99%, provided that any such increase will not be effective until the 61st day after

delivery of a notice to us of such increase. From and after the occurrence and during the continuance of any Event of Default, the Interest

Rate shall automatically be increased to 12.0% per annum. The Company is currently in default and the Holder has not yet elected to alternatively

convert.

In

addition, unless approval of our stockholders as required by Nasdaq is obtained, the Company

is prohibited from issuing any shares of common stock upon conversion of the New Note or otherwise pursuant to the terms of the New Note,

if the issuance of such shares of common stock would exceed 19.99% of our outstanding shares of common stock or otherwise exceed the

aggregate number of shares of common stock which the Company may issue without breaching our obligations under the rules and regulations

of Nasdaq.

Under

the New Note, and consistent with the Old Senior Convertible Note, the Company is subject to certain customary affirmative and negative

covenants regarding the incurrence of indebtedness, the existence of liens, the repayment of indebtedness, the payment of cash in respect

of dividends, distributions or redemptions, and the transfer of assets, among other matters. The Company is also subject to certain financial

covenants relating to available cash, our ratio of debt to market capitalization and minimum cash flow. The Company is also subject to

financial covenants as it relates minimum revenues that commenced on June 30, 2022. As of the date of this offering, the Company was

in default with regards to the debt covenants of the New Note and the Holder may request the Company to begin paying monthly cash interest

a default rate of 12%. The Holder has not elected at this time to require us to redeem any portion or the principal balance of the New

Note for cash. The Holder also has not elected to convert any portion or the principal balance of the New Note into shares of Common

Stock.

It

was previously determined that the Company had not maintained compliance with the Old Senior Convertible Note covenants at September

30, 2021 and subsequent reporting dates. The Company therefore requested and received a waiver dated October 13, 2021 for (i) any known

breaches or potential breaches of financial covenants in effect related to the available cash test and minimum cash flow test through

December 25, 2021, (ii) any known breach resulting from the placement of a lien on the outstanding share capital of Prozone Limited,

the entity that holds the assets of Bethard, and (iii) any known breach which would result from the Company’s announcement that

it would purchase an equity interest in Game Fund Partners Group LLC through the contribution of up to 200,000 shares of common stock.

In addition, the Company requested and received an amendment to the Old Senior Convertible Note wherein the permitted ratio of outstanding

debt to market capitalization was increased temporarily from 25% to 35% through December 25, 2021.

In

consideration for the October 13, 2021 waiver, the Company agreed to permit the conversion of up to $7,500,000 of the original principal

balance of the Old Senior Convertible Note at the Alternate Conversion Price into shares of common stock, exclusive of the Premium on

Principal and Incremental Premium that applies to an Alternate Conversion. During the three months and nine months ended March 31, 2022,

the Holder of the Old Senior Convertible Note had converted the full principal amount of $7,500,000 into 2,514,459 shares of common stock.

During

the three months ended December 31, 2021, the Company had not maintained compliance with the covenants of the Old Senior Convertible

Note, having identified non-compliance with the same financial covenants previously identified at September 30, 2021. The Company obtained

a waiver from the compliance with certain covenants, as of December 31, 2021 and through March 30, 2022. The Company further entered

into a non-binding term sheet dated February 22, 2022, to restructure the New Note to mitigate the risk of default on the covenants in

future periods. This term sheet expired without a new debt facility being completed. Since the expiration of the waiver on March 30,

2022, the Company is not in compliance with its covenants. The Company has not remitted payment to the Holder of an amount equal to 30%

of the gross proceeds from the March 2022 Offering to be applied as a reduction of principal.

The

New Note agreement includes provision that should the Company be in both breach of its debt covenants and its price per common share

trade below the Conversion Floor Price of $2.1832, the Holder may elect the Alternate Conversion option that includes a make-whole provision

payable to the Holder in cash. At March 31, 2022, June 30, 2022 and through the date of this offering, the Company was both in breach

of its debt covenants and the price per share of its common stock had declined below the Conversion Floor Price. As a result, the make-whole

provision in the New Note agreement was determined to represent an obligation of the Company under the terms of the New Note.

At

June 30, 2022, the Company estimates it would be required to issue up to 16,031,513 shares of common stock under the Alternate Conversion

make-whole provision of the New Note. At June 30, 2022, the Company also estimates the fair value of the derivative liability, which

gives effect to the cash amount payable to the Holder under the Alternate Conversion make-whole provisions of the New Note, to be $9,399,620

($20,573,051 at March 31, 2022). While the Company records a derivative liability at each reporting period for the amount contingently

payable to the Holder under the Alternate Conversion make-whole provision, a strict application of the formula in the New Note indicates

the cash liability to the Holder may be materially higher than the derivative liability. A calculation of the cash liability due to the

Holder under the Alternate Conversion make-whole provision of the New Note indicated a liability of approximately $180,000,000 at June

30, 2022.

The

derivative liability amount recognized by the Company for its obligation to the Holder under the Alternate Conversion make-whole provision

of the New Note is subject to material fluctuation at each reporting date. The output of the Monte Carlo model that is used to estimate

the fair value of the derivative liability will fluctuate based on the Company’s share price, market capitalization, estimated

enterprise value, and the Company’s estimate of credit and non-performance risk.

We will

remit to the holder of the New Note an amount equal to fifty percent (50%) of all net proceeds above $2 million (following the

payment of up to 7% in offering fees including Underwriting discounts and commissions). We will have broad discretion in the use

of the remaining net proceeds upon satisfying our obligation to the holder of the New Note and payment of offering

expenses.

In addition, to the extent the Holder purchases securities

in this offering, the Company will pay the Holder the amount the Holder has invested in order to reduce the principal of the New Note

on a dollar-for-dollar basis. By way of example only, if the Holder purchases securities with a cost of $200,000, the Company

will repay $200,000 to the Holder to reduce the principal of the New Note by that amount.

At-the

Market Equity Offering Program

On

September 3, 2021, the Company entered “at the market” equity offering program (“ATM”) with Maxim Group LLC,

one of the underwriters of this offering, to sell up to an aggregate of $20,000,000 of common stock. The shares were issued pursuant

to the Company’s shelf registration statement on Form S-3 (File No. 333-252370) and the Company filed a prospectus supplement,

dated September 3, 2021 with the SEC in connection with the offer and sale of the shares pursuant to the Equity Distribution Agreement

with the broker. The Company sold an aggregate of 1,165,813 shares (790,000 shares subsequent to December 31, 2021) through the ATM through

September 2, 2022, for gross proceeds of $4,005,267. The agreement between the Company and Maxim Group LLC governing the ATM expired

on September 3, 2022. At this time, the Company does not plan on signing a new ATM agreement.

THE

OFFERING

The

following summary contains basic information about this offering. The summary is not intended to be complete. You should read the full

text and more specific details contained elsewhere in this prospectus supplement. See “Description of the Securities that we are

Offering” and “Underwriting.”

| Issuer |

|

Esports

Entertainment Group, Inc. |

| |

|

|

| Securities

Offered |

|

We

are offering: (a shares of Common Stock at a price per share of $ ; and (b) warrants to purchase

up to shares of Common Stock, at an exercise price of $ per share. Warrants are exercisable

upon issuance and expire five years from the date they first became exercisable. The Warrants

will be issued in registered form under a warrant agency agreement between Vstock Transfer

LLC, as warrant agent, and us. This prospectus also includes the offering of the shares of

Common Stock issuable upon exercise of the Warrants.

We

are also offering to each purchaser that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of

our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase securities consisting

of one pre-funded warrant (in lieu of one share of common stock) and one Warrant. Subject to limited exceptions, a holder of pre-funded

warrants will not have the right to exercise any portion of its pre-funded warrants if the holder, together with its affiliates,

would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the

number of common stock outstanding immediately after giving effect to such exercise. Each pre-funded warrant will be exercisable

for one share of common stock. The purchase price of each pre-funded warrant and Warrant will be equal to the price of each Common

Stock and Warrant, minus $0.01, and the remaining exercise price of each pre-funded warrant will equal $0.01 per share. The pre-funded

warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of

the pre-funded warrants are exercised in full. For each pre-funded warrant we sell (without regard to any limitation on exercise

set forth therein), the number of shares of common stock we are offering will be decreased on a one-for-one basis. The common stock

and pre-funded warrants, if any, can each be purchased in this offering only with the accompanying Warrant (other than pursuant to

the option of the representatives of the underwriters to purchase additional common stock and/or pre-funded warrants and/or Warrants).

This prospectus also includes the offering of the shares of Common Stock issuable upon exercise of the pre-funded warrants. |

| |

|

|

| Offering

Price |

|

$

per share. |

| |

|

|

| Common

Stock Outstanding Immediately Before This Offering |

|

40,922,944

|

| |

|

|

| Common

Stock Outstanding Immediately After This Offering |

|

|

| |

|

|

| Over-allotment

Option |

|

We

have granted to the representatives of the underwriters the option, exercisable for 45 days from the date of this prospectus supplement,

to purchase up to an additional [●] shares of Common Stock and/or pre-funded warrants and/or Warrants to cover over-allotments. |

| Exchange

Listing |

|

Our

Common Stock trades on the Nasdaq Capital Market under the symbol “GMBL.” On

September 13, 2022, the last reported sale price of our Common Stock was $0.4433

per share.

We

currently have two classes of Common Stock Purchase Warrants that trade on the Nasdaq Capital Market under the symbols “GMBLW”

and “GMBLZ.”

Our

Common Stock Purchase Warrants that have an exercise price of $4.25 per share and expire in April 2025 trade under the symbol GMBLW

and, on September 13, 2022, the last reported sale price of our GMBLW warrants was $0.17 per warrant.

Our

Common Stock Purchase Warrants that have an exercise price of $1.00 per share and expire in March 2027 trade under the symbol GMBLZ

and, on September 13, 2022, the last reported sale price of our GMBLZ warrants was $0.14 per warrant.

There

is no established public trading market for the Warrants or pre-funded warrants being offered in this offering and we do not expect

an active trading market to develop. We do not intend to list the Warrants or pre-funded warrants on any securities exchange or other

trading market. Without an active trading market, the liquidity of the Warrants and pre-funded warrants will be limited. |

| |

|

|

| Use

of Proceeds |

|

We

will remit to the holder of the New Note an amount equal to fifty percent (50%) of all net proceeds above $2

million (following the payment of up to 7% in offering fees including Underwriting discounts

and commissions). The balance of the net proceeds will be used for working capital and general

corporate purposes. See “Use of Proceeds.”

|

| |

|

|

| Risk

Factors |

|

This

investment involves a high degree of risk. See “Risk Factors” and other information included or incorporated by reference

in this prospectus supplement and the accompanying prospectus for a discussion of certain factors you should carefully consider before

deciding to invest in our securities. |

| |

|

|

| Transfer

Agent and Warrant Agent |

|

The

registrar and transfer agent in respect of our Common Stock is VStock Transfer, LLC (the “Transfer Agent”). VStock Transfer,

LLC will also act as Warrant Agent pursuant to a warrant agency agreement between it and us. |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider

carefully the risks described below and discussed under the sections captioned “Risk Factors” contained in our Annual Report

on Form 10-K/A and Form 10-K for our fiscal year ended June 30, 2021 filed with the SEC, on October 22, 2021 and October 13, 2021, respectively,

and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2022, December 31, 2021 and September 30, 2021 filed with the

SEC on May 23, 2022, February 22, 2022, and November 15, 2021, respectively, which are incorporated by reference into this prospectus

supplement and the accompanying base prospectus in their entirety, together with other information in this prospectus supplement, the

accompanying base prospectus, the information and documents incorporated by reference herein and therein, and in any free writing prospectus

that we have authorized for use in connection with this offering. If any of these risks actually occurs, our business, financial condition,

results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting

in a loss of all or part of your investment.

Risks

Related to Regulation

Recent

regulatory changes in the Netherlands and Finland have had a material impact on our financial results.

As

a result of a new licensing regime that was implemented in the Netherlands for online gaming operators, we have discontinued our iGaming

operations in this market and net revenues for our Bethard business declined from approximately $5.7 million for the three months ended

September 30, 2021 to approximately $3.5 million for the three months ended December 31, 2021. Net revenues for our Bethard business

represented approximately 35% and 24% of our total net revenues for, respectively, the three months ended September 30, 2021 and three

months ended December 31, 2021.

In

addition, as a result of regulatory developments in Finland and a communication from the Finnish regulator, we estimate that net revenues

for our Lucky Dino business have declined from approximately $6.5 million for the three months ended March 31, 2022 to approximately

$4.2 million for the three months ended June 30, 2022 (a preliminary estimate based on currently available information and subject to

change). Net revenues for our Lucky Dino business represented approximately 42% of our consolidated net revenues for the three months

ended March 31, 2022. There can be no assurance that revenues from the Company’s Finnish iGaming operations will rise in the future.

Risks

Related to Owning our Common Stock

If

we fail to comply with the continued listing requirements of the Nasdaq Capital Market, our common stock may be delisted and the price

of our common stock and our ability to access the capital markets could be negatively impacted.

We

must continue to satisfy the Nasdaq Capital Market’s continued listing requirements, including, among other things, a minimum closing

bid price requirement of $1.00 per share for 30 consecutive business days. If a company fails for 30 consecutive business days to meet

the $1.00 minimum closing bid price requirement, Nasdaq will send a deficiency notice to the company, advising that it has been afforded

a “compliance period” of 180 calendar days to regain compliance with the applicable requirements.

A

delisting of our common stock from the Nasdaq Capital Market could materially reduce the liquidity of our common stock and result in

a corresponding material reduction in the price of our common stock. In addition, delisting could harm our ability to raise capital through

alternative financing sources on terms acceptable to us, or at all, and may result in the potential loss of confidence by investors and

employees.

On

April 11, 2022, we received a deficiency notification letter from the Listing Qualifications Staff

of Nasdaq indicating that the Company was not in compliance with Nasdaq Listing Rule 5550(a)(2) because the bid price for the

Company’s common stock had closed below $1.00 per share for the previous 30 consecutive business days.

In

accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has 180 calendar days from the date of such notice, or until October 8,

2022, to regain compliance with the minimum bid price requirement. To regain compliance, the bid price for the Company’s common

stock must close at $1.00 per share or more for a minimum of 10 consecutive business days. As of September 9, 2022, we have not yet regained

compliance with the $1.00 bid price requirement. There can be no assurance that we will regain compliance with this requirement.

On

June 7, 2022, we received an additional written notice from Nasdaq indicating that, for the last 30 consecutive business days, the market

value of our listed securities (the “MVLS”) has been below the minimum requirement of $35 million for continued listing on

the Nasdaq Capital Market under Nasdaq Listing Rule 5550(b)(2).

In

accordance with Nasdaq listing rule 5810(c)(3)(C), the Company has 180 calendar days, or until December 5, 2022, to regain compliance.

The notice states that to regain compliance, the Company’s MVLS must close at $35 million or more for a minimum of 10 consecutive

business days (or such longer period of time as the Nasdaq staff may require in some circumstances, but generally not more than 20 consecutive

business days) during the compliance period ending December 5, 2022. As of September 9, 2022, we have not yet regained compliance with

the $35 million MVLS requirement. There can be no assurance that we will regain compliance with this requirement.

Any

failure to maintain compliance with continued listing requirements of the Nasdaq Capital Market could result in delisting of our common

stock from the Nasdaq Capital Market and negatively impact our company and holders of our common stock, including by reducing the willingness

of investors to hold our common stock because of the resulting decreased price, liquidity and trading of our common stock, limited availability

of price quotations and reduced news and analyst coverage. Delisting may adversely impact the perception of our financial condition,

cause reputational harm with investors, our employees and parties conducting business with us and limit our access to debt and equity

financing.

Risks

Related to the New Note

If

we do not comply with our obligations pursuant to our New Note, the noteholder could require us to redeem in cash any or all of the New

Note which would have a material adverse effect on our business and financial condition.

On

June 2, 2021, the Company issued the Old Senior Convertible Note before it was exchanged for the New Note on February 22, 2022. The Old

Senior Convertible Note was issued to the Holder in the principal amount of $35,000,000 with the Company receiving proceeds at issuance

of $32,515,000, net of debt issuance costs of $2,485,000.

On

February 22, 2022, the Company agreed to enter into the Exchange Agreement with the Holder whereby the Old Senior Convertible Note of

the Company, with a remaining principal amount of $29,150,001, was exchanged for New Note in the aggregate principal amount of $35,000,000.

The

New Note agreement includes provision that should the Company be in both breach of its debt covenants and its price per common share

trade below the Conversion Floor Price of $2.1832, the Holder may elect the Alternate Conversion option that includes a make-whole provision

payable to the Holder in cash. At March 31, 2022, June 30, 2022 and through the date of this offering, the Company was both in breach

of its debt covenants and the price per share of its common stock had declined below the Conversion Floor Price. As a result, the make-whole

provision in the New Note agreement was determined to represent an obligation of the Company under the terms of the New Note.

At

June 30, 2022, the Company estimates it would be required to issue up to 16,031,513 shares of common stock under the Alternate Conversion

make-whole provision of the New Note. At June 30, 2022, the Company also estimates the fair value of the derivative liability, which

gives effect to the cash amount payable to the Holder under the Alternate Conversion make-whole provisions of the New Note, to be $9,399,620.

While the Company records a derivative liability at each reporting period for the amount contingently payable to the Holder under the

Alternate Conversion make-whole provision, a strict application of the formula in the New Note indicates the cash liability to the Holder

may be materially higher than the derivative liability. A calculation of the cash liability due to the Holder under the Alternate Conversion

make-whole provision of the New Note indicated a liability of approximately $180,000,000 at June 30, 2022.

The

derivative liability amount recognized by the Company for its obligation to the Holder under the Alternate Conversion make-whole provision

of the New Note is subject to material fluctuation at each reporting date. The output of the Monte Carlo model that is used to estimate

the fair value of the derivative liability will fluctuate based on the Company’s share price, market capitalization, estimated

enterprise value, and the Company’s estimate of credit and non-performance risk.

While

the Company is currently in default with regards to the New Note, the Holder has not yet elected to require us to redeem in cash any

or all of the New Note. In addition, the Holder has not elected to convert any or all of the New Note into shares of Common Stock

If

the Holder required us to redeem in cash any or all of the New Note, it would have a material adverse effect on our business and financial

condition.

Risks

Related to this Offering

Management

will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

We

will remit fifty percent (50%) of all net proceeds above $2 million (following the payment of up to 7% in offering fees including

Underwriting discounts and commissions) to the holder of the New Note. After satisfying our obligation to the holder to the New

Note and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us, our management

will have broad discretion in the application of the net proceeds from this offering. We may utilize the net proceeds in ways that

do not improve our results of operations or enhance the value of our Common Stock. Our failure to apply these funds effectively

could have a material adverse effect on our business and cause the price of our Common Stock to decline.

You

will experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase.

Since

the price per share of our Common Stock being offered is substantially higher than the net tangible book value per share of our Common

Stock, you will suffer immediate and substantial dilution in the net tangible book value of the Common Stock you purchase in this offering.

Based on a public offering price of $ per share, if you purchase shares of Common Stock in this offering, you will suffer immediate and

substantial dilution of $ per share with respect to the net tangible book value of the Common Stock. See the section entitled “Dilution”

below for a more detailed discussion of the dilution you will incur if you purchase Common Stock in this offering.

You

may experience future dilution as a result of future equity offerings and other issuances of our common stock or other securities. In

addition, this offering and future equity offerings and other issuances of our common stock or other securities may adversely affect

our common stock price.

In

order to raise additional capital, we may in the future offer additional shares of our Common Stock or other securities convertible into

or exchangeable for our Common Stock at prices that may not be the same as the price per share in this offering. We may not be able to

sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid

by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing

stockholders. The price per share at which we sell additional shares of our Common Stock or securities convertible into Common Stock

in future transactions may be higher or lower than the price per share in this offering. In addition, we are issuing warrants to purchase

shares of Common Stock as part of this offering. In addition, the sale of shares in this offering and any future sales of a substantial

number of shares of our Common Stock in the public market, or the perception that such sales may occur, could adversely affect the price

of our Common Stock. We cannot predict the effect, if any, that market sales of those shares of Common Stock or the availability of those

shares of Common Stock for sale will have on the market price of our Common Stock.

There

is no public market for the Warrants or pre-funded warrants being offered in this offering and we do not expect one to develop.

There

is no established public trading market for the Warrants or pre-funded warrants being offered in this offering and we do not expect an

active trading market to develop. We do not intend to list the Warrants or pre-funded warrants on any securities exchange or other trading

market. Without an active trading market, the liquidity of the Warrants and pre-funded warrants will be limited.

Speculative

nature of Warrants and pre-funded warrants.

The

Warrants and pre-funded warrants offered in this offering do not confer any rights of common stock ownership on their holders, such as

voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of our common stock at a fixed

price for a limited period of time. Specifically, commencing on the date of issuance, holders of the Warrants and pre-funded warrants

may exercise their right to acquire the common stock and pay an exercise price of $ per share ($0.01 per share in the case of the pre-funded

warrants), prior to five years from the date of issuance, after which date any unexercised warrants will expire and have no further value.

There can be no assurance that the market price of the common stock will ever equal or exceed the exercise price of the Warrants, and

consequently, whether it will ever be profitable for holders of the Warrants to exercise the Warrants.

USE

OF PROCEEDS

We

estimate that the net proceeds from the issuance and sale of shares of Common Stock and Warrants in this offering will be approximately

$[●], after deducting the underwriting discounts and commissions and estimated offering expenses payable by us, assuming no exercise

of the over-allotment option and approximately $[●] if the over-allotment option is exercised in full.

We

will remit to the holder of the New Note an amount equal to fifty percent (50%) of all net proceeds above $2 million (following

the payment of up to seven percent (7%) in offering fees including Underwriting discounts and commissions). The New Note has a June 2023

maturity date and an interest rate of twelve percent (12%). We will have broad discretion in the use of the remaining net proceeds

upon satisfying our obligation to the holder of the New Note and payment of offering expenses.

We

intend to use the net proceeds of this offering following the payments listed in the paragraph above for working

capital and general corporate purposes to support ongoing business operations.

CAPITALIZATION

The

following table sets forth our capitalization as of March 31, 2022:

| |

●

|

On

an actual basis; |

| |

|

|

| |

● |

On

a pro forma, as adjusted basis to give effect to (i) the sale of shares of Common Stock in this offering at the public offering price

of $ per share, after deducting underwriting discounts and commissions and other estimated offering expenses payable by us, but giving

no effect to the exercise of the over-allotment option; and (ii) the remittance of fifty percent (50%) of all net proceeds

above $2 million (following the payment of up to seven percent (7%) in offering fees including Underwriting discounts and commissions)

to the holder of the New Note. |

This

capitalization table should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results

of Operations and our consolidated financial statements and related notes incorporated by reference in this prospectus supplement, and

other financial information included and incorporated by reference in this prospectus supplement. See “Where You Can Find More

Information.”

| | |

As

of March 31, 2022 | |

| | |

Actual

(Unaudited) | | |

Pro Forma,

As Adjusted

(Unaudited) | |

| Assets: | |

| | |

| |

| Cash | |

$ | 9,404,637 | | |

$ | | |

| Restricted

cash | |

$ | 2,968,183 | | |

$ | | |

| Liabilities: | |

| | | |

| | |

| Derivative

liability (1) | |

$ | 20,573,051 | | |

$ | | |

| Contingent

consideration for Bethard acquisition (2) | |

$ | 3,732,976 | | |

| | |

| Warrant

liability (3) | |

$ | 4,411,580 | | |

| | |

| Debt: | |

| | | |

| | |

| Senior

convertible note | |

$ | 35,000,000 | | |

$ | | |

| Notes

payable and other long-term debt | |

| 370,810 | | |

| | |

| Total

Debt | |

$ | 35,370,810 | | |

$ | | |

| Mezzanine

equity: | |

| | | |

| | |

| 10%

Series A cumulative redeemable convertible preferred stock, $0.001 par value, 1,725,000 authorized, 835,950 shares issued and outstanding,

aggregate liquidation preference $9,195,450 at March 31, 2022 actual and pro forma, as adjusted | |

$ | 7,707,543 | | |

$ | | |

| Stockholders’

equity: | |

| | | |

| | |

| Preferred

stock, $0.001 par value; 10,000,000 shares authorized | |

$ | - | | |

$ |

| |

| Common

stock $0.001 par value; 500,000,000 shares authorized, 40,722,944 shares outstanding as of March 31, 2022 actual and [●] shares

outstanding as of March 31, 2022 pro forma, as adjusted | |

| 40,723 | | |

| | |

| Additional

paid-in capital | |

| 144,528,035 | | |

| | |

| Accumulated

deficit | |

| (145,364,841 | ) | |

| | |

| Accumulated

other comprehensive loss | |

| (4,517,325 | ) | |

| | |

| Total

stockholders’ deficit | |

$ | (5,313,408 | ) | |

$ |

| |

| Total

capitalization | |

$ | 37,764,945 | | |

$ |

| |

| (1) |

The Company has recorded a derivative liability at March 31,

2022 for the alternate conversion feature included the New Note of $20,573,051. The amount of the derivative liability representing for

amounts that may be due to the holder of the New Note under the provisions of the agreement was determined using a Monte Carlo valuation

model. The derivative liability calculation is subject to material fluctuation at each reporting date and the inputs to the valuation

model are effected by the share price of the Company, its market capitalization as well as the Company’s estimates of credit and

non-performance risk. |

| (2) |

The estimated contingent consideration at March 31, 2022 is

based on the estimated fair value of payments due to the sellers in the Bethard acquisition and is calculated based on the estimated

revenues that will be generated from the net gaming revenues of the Bethard business through June 2023. |

| |

|

| (3) |

The warrant liability at March 31, 2022 includes the fair value

of 15,000,000 warrants that had been issued by us in the offering of common stock and warrants on March 2, 2022, as well as the fair

value of 4,000,000 warrants issued to the Holder of our New Note. The warrants issued in connection with the offering on March 2, 2022

had an estimated fair value of $4,050,000 at March 31, 2022. The 4,000,000 warrants issued to the Holder of the New Note, consisting

of 2,000,000 Series A Warrants and 2,000,000 Series B Warrants, had an estimated fair value of $361,580 at March 31, 2022. |

The

Company determined the warrants issued in connection with this offering to be liability classified as the warrants are redeemable for

cash in the event of a fundamental transaction. The Company has therefore recorded the preliminary fair value of the warrant liability

as of [●] using a Black-Scholes option pricing model, with a corresponding amount recorded to additional paid-in capital. The estimated

fair value of the warrant liability resulting from this offering is preliminary pending completion of a valuation performed by a third

party specialist.

The

foregoing table excludes the following as of March 31, 2022:

| ● |

16,031,513

shares of common stock issuable upon a conversion of the remaining principal outstanding under the New Note, into shares of Common

Stock at a floor conversion price of $2.1832; |

| ● |

shares

contingently issuable in connection with the Bethard acquisition, whereby the amount issuable in shares shall be determined prior

to the 24 month anniversary date of the acquisition, or July 13, 2023, and based on U.S. dollar equivalent of up to a maximum contingent

share consideration amount of €7,600,000 (equivalent to $8,971,519 using exchange rates in effect at the acquisition date) divided

by the 30-day volume weighted average unit price per share of common stock at the time of issuance.; |

| ● |

1,359,401

shares issuable upon the exercise of outstanding stock options with a weighted average exercise price of $6.28; |

| ● |

835,950

shares of 10% Series A Cumulative Redeemable Convertible Preferred Stock that are convertible into one share of the Company’s

common stock at a conversion price of $17.50 per common share; |

| ● |

20,350,558

shares issuable upon the exercise of outstanding warrants with a weighted average exercise price of $4.47; and |

| ● |

608,535

shares reserved for future issuances under our equity compensation plan. |

DILUTION

A

purchaser of our shares of our common stock in this offering will be diluted immediately to the extent of the difference between the

offering price per share and the as adjusted net book value per share of our common stock upon closing of this offering. Our historical

net book value as of March 31, 2022, was a deficit of $(5,313,408), or approximately $(0.13) per share of outstanding common stock, based

on 40,722,944 shares of common stock outstanding as of March 31, 2022. Net book value per share of our common stock is determined at

any date by subtracting total liabilities from the amount of total assets, and dividing this amount by the number of shares of common

stock deemed to be outstanding as of that date.

After