Prospectus Filed Pursuant to Rule 424(b)(5) (424b5)

May 15 2020 - 4:47PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-223923

PROSPECTUS SUPPLEMENT DATED MAY 15, 2020

(To Prospectus

dated April 2, 2018)

Up

to $31,900,000

Ordinary

Shares

We have entered

into an amended and restated sales agreement, or the Sales Agreement, with Stifel, Nicolaus & Company, Incorporated, or

Stifel, and Cantor Fitzgerald & Co., or Cantor Fitzgerald, and together with Stifel, the Sales Agents, pursuant to which

we may offer and sell our ordinary shares from time to time through the Sales Agents, acting as agents. As of May 14, 2020,

we have sold ordinary shares having an aggregate offering price of $3,032,172.12 under a sales agreement with Stifel pursuant

to the prospectus, dated April 2, 2018, or the Prospectus. Pursuant to this prospectus supplement, or the Prospectus

Supplement, we may offer and sell $31,900,000 of our ordinary shares. This prospectus supplement, supplements the Prospectus

and should be read in conjunction with the Prospectus. Capitalized terms used and not defined herein shall have the meanings

ascribed to such terms in the Prospectus.

Our ordinary shares

are traded on the Nasdaq Capital Market under the symbol “GLMD.” On May 14, 2020, the last reported sale price of

our ordinary shares on the Nasdaq Capital Market was $5.08 per share.

This Prospectus Supplement

is being filed to reflect the amendment and restatement of the sales agreement by and between the Company and Stifel to include

Cantor Fitzgerald & Co., or Cantor Fitzgerald, as an additional sales agent. Accordingly, each reference to the terms “sales

agent” and “Stifel” in the Prospectus are hereby amended to refer to “sales agents” and include

Cantor Fitzgerald.

In addition, the following

sections of the Prospectus are hereby amended and restated as follows:

Plan of Distribution

We

have entered into an amended and restated sales agreement, or the Sales Agreement, with Stifel and Cantor pursuant to which

we may offer and sell our ordinary shares from time to time through the Sales Agents, acting as agents (each, a “sales

agent” and together the “sales agents”). Pursuant to this Prospectus Supplement, we may offer and sell

$31,900,000 of our ordinary shares. This summary of the material provisions of the Sales Agreement does not purport

to be a complete statement of its terms and conditions. The Sales Agreement will be filed as an exhibit to the

current report on Form 6-K filed on May 15, 2020, which will be incorporated by reference in this Prospectus Supplement.

Upon

delivery of a placement notice and subject to the terms and conditions of the Sales Agreement, the sales agents may sell our ordinary

shares by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated

under the Securities Act, including sales made directly on the Nasdaq Capital Market or on any other existing trading market for

our ordinary shares. We may instruct the sales agents not to sell our ordinary shares if the sales cannot be effected at or above

the price designated by us from time to time. We or the sales agents may suspend the offering of our ordinary shares upon notice

and subject to other conditions. We may only instruct one sales agent to issue and sell ordinary shares under the Sales

Agreement on any single given day.

We

will pay the sales agents commissions, in cash, for their services in acting as agent in the sale of our ordinary shares. The

sales agents will be entitled to compensation at a fixed commission rate of up to 3.0% of the aggregate gross sales price per

share sold. Because there is no minimum offering amount required as a condition to close this offering, the actual total public

offering amount, commissions and proceeds to us, if any, are not determinable at this time.

Settlement

for sales of ordinary shares will occur on the second trading day following the date on which any sales are made, or on some other

date that is agreed upon by us and the sales agents in connection with a particular transaction, in return for payment of the

net proceeds to us. Sales of our ordinary shares as contemplated in this Prospectus Supplement and the accompanying prospectus

will be settled through the facilities of The Depository Trust Company or by such other means as we and the sales agents may agree

upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

The

sales agents will use their commercially reasonable efforts, consistent with their sales and trading practices, to solicit offers

to purchase the ordinary shares under the terms and subject to the conditions set forth in the Sales Agreement. In connection

with the sale of the ordinary shares on our behalf, each of the sales agents will be deemed to be an “underwriter”

within the meaning of the Securities Act and the compensation of the sales agents will be deemed to be underwriting commissions

or discounts. We have agreed to provide indemnification and contribution to the sales agents against certain civil liabilities,

including liabilities under the Securities Act.

The

offering of our ordinary shares pursuant to the Sales Agreement will terminate upon the termination of the Sales Agreement as

permitted therein. We and the sales agents may each terminate the Sales Agreement at any time upon ten days’ prior notice.

Each

of the sales agents and its affiliates may in the future provide various investment banking, commercial banking and other financial

services for us and our affiliates, for which services they may in the future receive customary fees. To the extent required by

Regulation M, the sales agents will not engage in any market making activities involving our ordinary shares while the offering

is ongoing under this Prospectus Supplement.

This

Prospectus Supplement and the accompanying prospectus may be made available on a website maintained by the sales agents and the

sales agents may distribute this Prospectus Supplement and accompanying prospectus electronically.

The

address of Stifel is 787 7th Avenue, New York, New York 10019 and the address of Cantor is 499 Park Avenue, New York, New York

10022.

Incorporation of Certain Information

by Reference

The SEC allows us to

“incorporate by reference” the information we file with them, which means that we can disclose important information

to you by referring you to those documents instead of having to repeat the information in this Prospectus Supplement. The information

incorporated by reference is considered to be part of this Prospectus Supplement, and later information that we file with the SEC

will automatically update and supersede this information. We incorporate by reference the document listed below and any future

filings made with the SEC (in each case, other than those documents or the portions of those documents deemed to be furnished and

not filed in accordance with SEC rules) between the date of this Prospectus Supplement and the termination of the offering and

also between the date of the initial registration statement and prior to effectiveness of the registration statement:

|

|

●

|

our Annual Report on

Form 20-F for the year ended December 31, 2019, filed with the SEC on March 12, 2020;

|

|

|

●

|

our Report on Form 6-K filed with the SEC on March 12, 2020 and May

14, 2020 (to the extent expressly incorporated by reference into our effective registration statements filed by us under

the Securities Act); and

|

|

|

●

|

the description of our

ordinary shares contained in our Form 8-A filed with the SEC on March 11, 2014 including any amendment or report filed for the

purpose of updating such description.

|

This Prospectus Supplement

and accompanying prospectus are part of a registration statement on Form F-3 we have filed with the SEC under the Securities Act.

This Prospectus Supplement does not contain all of the information in the registration statement. We have omitted certain parts

of the registration statement, as permitted by the rules and regulations of the SEC. You may inspect and copy the registration

statement, including exhibits, at the SEC’s public reference room or website. Our statements in this Prospectus Supplement

about the contents of any contract or other document are not necessarily complete. You should refer to the copy of each contract

or other document we have filed as an exhibit to the registration statement for complete information.

We will provide, upon

written or oral request, to each person to whom a prospectus is delivered, a copy of any or all of the information that has been

incorporated by reference in the prospectus but not delivered with the prospectus. You may request a copy of these filings, at

No cost, by writing us at Galmed Pharmaceuticals Ltd., 16 Tiomkin Street, Tel Aviv, Israel, 6578317. Our telephone number

is +972-3-693-8448.

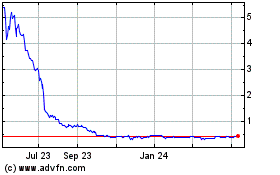

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Apr 2023 to Apr 2024