Gilead Swings to Quarterly Loss on Higher Costs -- Update

July 30 2020 - 8:27PM

Dow Jones News

By Joseph Walker and Maria Armental

Gilead Sciences Inc. expects sales of its Covid-19 drug

remdesivir to help lift its full-year revenue by as much as $2.8

billion in 2020, offsetting the negative impact of the pandemic on

some of its other medicines.

The biopharmaceutical company began selling remdesivir, an

antiviral drug shown to help speed recovery times in hospitalized

Covd-19 patients, in July. It said Thursday it expects to sell one

million to 1.5 million treatment courses in the second half of the

year.

Chief Commercial Officer Johanna Mercier said a supply squeeze

because of disruptions to global supply chains was beginning to

ease.

By early October, "we should be in a place where global supply

meets global demand," Ms. Mercier said on a call with analysts

after the company reported second-quarter financial results.

Gilead has struggled to meet demand for remdesivir because of

the drug's complex manufacturing process, and supply chain

slowdowns resulting from pandemic lockdowns.

Gilead charges about $3,120 per patient in the U.S. and about

$2,340 per patient in Europe and other developed countries.

The company said it now expects its 2020 revenue to be in a

range of $23.3 billion to $25 billion, up from its previous

guidance of $21.8 billion to $22.2 billion.

The company also raised its outlook for adjusted operating

profit, which it now expects to be in a range of $10.7 billion to

$13 billion, up from its previous guidance of $10.1 billion to

$10.8 billion.

Evan Seigerman, an analyst with Credit Suisse, said Gilead's

revised revenue projection likely understates potential remdesivir

sales this year. After taking into account an estimated $1 billion

to $2.5 billion decline in sales of the company's other products,

Gilead's guidance indicates that remdesivir sales will be in a

range of $3 billion to $4.5 billion in 2020, Mr. Seigerman said in

a note to clients.

Covid-19 disruptions to routine health care reduced sales by

about $500 million in the first half of 2020, company executives

said Thursday. The company said reduced doctor visits brought down

the number of new patients starting some of its drugs, including

its antiviral drug Biktarvy and its prophylactic treatment Descovy,

which can prevent new HIV infections. But overall demand for the

drugs was still strong.

Gilead swung to a loss in the second quarter, driven by expenses

related to its acquisition of biotech company Forty Seven Inc. and

research and development for remdesivir. The company said expenses

more than doubled in the quarter to $8.13 billion, outpacing

revenue gains. The higher costs were largely related to clinical

trials and manufacturing ramp-up expenses related to

remdesivir.

Overall, Gilead reported a loss of $3.34 billion, or $2.66 a

share, compared with a year-earlier profit of $1.88 billion, or

$1.47 a share. On an adjusted basis, profit fell to $1.11 a share.

Revenue fell 10% to $5.14 billion.

Analysts surveyed by FactSet expected a loss of 69 cents a

share, or adjusted profit of $1.44, on $5.29 billion in

revenue.

The drugmaker had warned that about $200 million in sales had

moved into the March quarter, primarily in the U.S., as customers

stocked up on prescription medicines during the pandemic.

Sales of HIV drug Biktarvy, which more than doubled in the March

quarter, rose 44% to $1.6 billion in the second quarter.

Write to Joseph Walker at joseph.walker@wsj.com and Maria

Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

July 30, 2020 20:12 ET (00:12 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

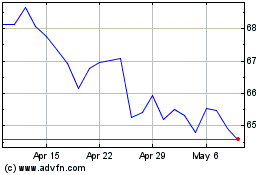

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Apr 2023 to Apr 2024