By Joseph Walker

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 3, 2020).

Gilead Sciences Inc. will pay $4.9 billion to buy Forty Seven

Inc., a five-year-old biotech company with a promising blood-cancer

medicine that could be on the market within two years.

Gilead said Monday it has agreed to pay $95.50 a share in cash

for Forty Seven, a nearly 65% premium to Friday's closing price of

$58 for the Menlo Park, Calif., company.

The deal is the first major outright acquisition under Gilead

Chief Executive Daniel O'Day, who took over the company a little

over a year ago with a mandate to jump-start sales growth and turn

around the company's sagging stock price. The transaction will

deepen Gilead's pipeline of cancer drugs.

Gilead, based in Foster City, Calif., is grappling with a sharp

decline in revenue from its hepatitis C drug franchise and the

threat of generic competition to its HIV drugs.

Mr. O'Day said Monday that he will make more deals similar to

the size and scope of Forty Seven, despite calls by some analysts

to buy a larger, established company that would immediately boost

sales and profit.

"At the end of the day, there's no immediate quick fix in this

industry, " Mr. O'Day said in an interview. "Myself and the board

are firmly committed to the long-term strategy of the company."

Yet some analysts expressed disappointment that Gilead didn't do

a deal with a more immediate impact on the company's bottom

line.

Evan Seigerman, a Credit Suisse analyst, in a note to clients,

said: "The company should have undertaken a more transformative

approach to M&A in acquiring an asset or company that would

have impacted revenue and earnings growth over the next couple of

years."

Gilead had sales of $22.45 billion in 2019. This year, sales are

projected to decline 0.2% to $22.4 billion, according to analysts

polled by FactSet.

Mr. O'Day has made acquisitions and partnerships a key plank in

his turnaround strategy for the company, which he has dubbed

"Gilead's next chapter" and includes the ambitious goal of

launching 10 new drugs over the next decade.

Last year, Gilead paid $3.95 billion to form a drug-development

partnership with European-biotech Galapagos NV in addition to

purchasing a 22% stake in the company for $1 billion. The deal gave

Gilead rights to develop and market six experimental drugs already

in clinical trials, including a potential rheumatoid arthritis

treatment called filgotinib.

Filgotinib is now under review by the U.S. Food and Drug

Administration and could be approved this year; analysts project

the drug to reach sales of $1.23 billion in 2025, according to

FactSet.

In buying Forty Seven, Gilead hopes to extend its toehold in the

lucrative and competitive cancer-drug market.

Gilead's most successful cancer drug, Yescarta, uses genetically

engineered immune cells to treat lymphoma and had sales of $456

million last year. Gilead acquired Yescarta in its $11.9 billion

acquisition of Kite Pharma in 2017.

Oncology drugs are attractive for pharmaceutical companies

because they can command high prices and receive relatively fast

regulatory approvals. U.S. spending on cancer drugs more than

doubled to $56.7 billion in 2018 from $27.3 billion in 2013,

according to health-care data provider IQVIA. Development of the

drugs has been aided by scientific advances that enabled a more

precise targeting of genetic mutations that drive tumors.

Forty Seven has one drug, called magrolimab, being tested in

humans. The molecule has shown promising early-stage results in

treating the blood cancers myelodysplastic syndrome and acute

myeloid leukemia in combination with chemotherapy. The drug is part

of a class of medicines known as immunotherapies that harness the

immune system to kill tumor cells.

Tumors sometimes use a protein called CD47 that blocks the

immune system from killing the cancerous cells by sending what

researchers call "don't eat me" signals. Magrolimab is designed to

block the CD47 protein, allowing the immune system to destroy the

cancerous cells.

If ongoing studies continue to be positive, Gilead aims to win

an accelerated approval from the FDA in the latter part of 2022,

Chief Medical Officer Merdad Parsey told analysts on a conference

call to discuss the deal.

"That was one of the key things that [we were] interested in,"

Dr. Parsey said. "The ability to get to market relatively

quickly."

About 14,000 people annually in the U.S. are diagnosed with MDS,

according to the company.

Gilead shares rose 8.7% to $75.40 in Monday trading. The stock

is up about 16% so far this year, driven largely by the potential

of the company's experimental drug remdesivir to treat the Covid-19

virus.

Shares of Forty Seven surged 62% to $93.91.

--Colin Kellaher contributed to this article.

Write to Joseph Walker at joseph.walker@wsj.com

(END) Dow Jones Newswires

March 03, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

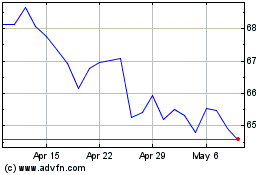

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Apr 2023 to Apr 2024