Guardion Health Sciences, Inc. (“Guardion” or the “Company”)

(Nasdaq: GHSI), previously announced the pricing of an underwritten

public offering of 13,000,000 shares of its common stock (or

pre-funded warrants to purchase common stock in lieu thereof) and

warrants to purchase up to 13,000,000 shares of the Company’s

common stock. Each share of common stock is being sold together

with one warrant to purchase one share of common stock at a

combined price to the public of $0.45 per share and warrant, which

is an increase of $0.05 per share and warrant than previously

disclosed. The amount of securities being issued and sold in this

offering will remain the same. The shares of common stock or

pre-funded warrants and the accompanying warrants can only be

purchased together in this offering, but will be issued separately

and will be immediately separable upon issuance. Gross proceeds,

before underwriting discounts and commissions and estimated

offering expenses, are expected to be approximately $5.85 million,

an increase of $650,000 in gross proceeds that previously

disclosed.

The warrants will be immediately exercisable at

a price of $0.5850 per share of common stock and will expire on

August 15, 2024, five years from the date of issuance. The warrants

also provide that if during the period of time between the date

that is the earlier of (i) 30 days after the effective date of the

registration statement filed in connection with this offering and

(ii) the trading day on which a total of more than 40,000,000

shares of the common stock has traded since the pricing of this

offering, and ending 12 months after the effective date of the

registration statement, if the volume weighted-average price of

common stock immediately prior to the exercise date is lower than

the then-applicable exercise price per share, each warrant may be

exercised, at the option of the holder, on a cashless basis for one

share of common stock. The offering is expected to close on or

about August 15, 2019, subject to customary closing conditions.

Maxim Group LLC and WallachBeth Capital, LLC are

acting as joint-bookrunning managers in connection with the

offering. Westpark Capital, Inc. is acting as co-manager in the

offering.

Guardion also has granted to the underwriter a

45-day option to purchase up to an additional 1,950,000 shares of

common stock and/or warrants to purchase up to 1,950,000 shares of

common stock, at the public offering price less discounts and

commissions.

The offering is being conducted pursuant to the

Company's registration statement on Form S-1 (File No. 333-233067)

previously filed with, and subsequently declared effective by, the

Securities and Exchange Commission ("SEC") on August 12, 2019. A

final prospectus relating to the offering will be filed with the

SEC and will be available on the SEC's website at

http://www.sec.gov. Electronic copies of the final prospectus

relating to this offering, when available, may be obtained from

Maxim Group LLC, 405 Lexington Avenue, 2nd Floor, New York, NY

10174, at (212) 895-3745. Before investing in this offering,

interested parties should read in their entirety the registration

statement that the Company has filed with the SEC, which provides

additional information about the Company and this offering.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

other jurisdiction in which such offer, solicitation or sale would

be unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

About Guardion Health Sciences, Inc.

Guardion is an ocular health sciences company

that develops, formulates and distributes conditionspecific medical

foods supported by evidence-based protocols, with an initial

medical food product, Lumega-Z®, that addresses a depleted macular

protective pigment, a known risk factor for agerelated macular

degeneration (“AMD”) and a significant component of functional

vision performance. Guardion Health Sciences, Inc. has also

developed a proprietary medical device, the MapcatSF®, which

accurately measures the macular pigment density, therefore

providing the only two-pronged evidence-based protocol for the

treatment of a depleted macular protective pigment. Information and

risk factors with respect to Guardion and its business, including

its ability to successfully develop and commercialize its

proprietary products and technologies, may be obtained in the

Company’s filings with the Securities and Exchange Commission

(“SEC”) at www.sec.gov.

About VectorVision®

VectorVision®, operating through a wholly-owned

subsidiary of the Company, specializes in the standardization of

contrast sensitivity, glare sensitivity, low contrast acuity, and

ETDRS acuity vision testing. Its patented standardization system

provides the practitioner or researcher the ability to delineate

very small changes in visual capability, either as compared to the

population or from visit to visit. VectorVision®’s CSV-1000 device

is considered the standard of care for clinical trials.

Forward-Looking Statement

Disclaimer

With the exception of the historical information

contained in this news release, the matters described herein may

contain forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. Statements

preceded by, followed by or that otherwise include the words

“believes,” “expects,” “anticipates,” “intends,” “projects,”

“estimates,” “plans” and similar expressions or future or

conditional verbs such as “will,” “should,” “would,” “may” and

“could” are generally forwardlooking in nature and not historical

facts, although not all forward-looking statements include the

foregoing. The forward-looking statements include statements

regarding the Company’s process to expand into the large Asian

markets and considering additional business opportunities across

Asia. These statements involve unknown risks and uncertainties that

may individually or materially impact the matters discussed herein

for a variety of reasons that are outside the control of the

Company, including, but not limited to, the Company’s ability to

expand into the large Asian markets as planned, the Company’s

ability to conclude additional business opportunities across Asia,

the Company’s ability to raise sufficient financing to implement

its business plan, the Company’s ability to successfully develop

and commercialize its proprietary products and technologies and

statements regarding the proposed public offering. Readers are

cautioned not to place undue reliance on these forward-looking

statements, as actual results could differ materially from those

described in the forward-looking statements contained herein.

Readers are urged to read the risk factors set forth in the

Company’s filings with the SEC, which are available at the SEC’s

website (www.sec.gov). The Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise.

Company Contact: Michael Favish

Chief Executive Officer. Telephone: (858) 605-9055 x 201 E-mail:

mfavish@guardionhealth.com

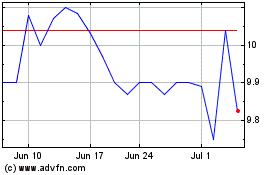

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

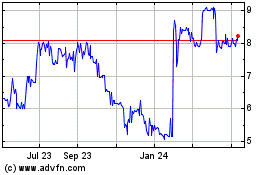

Guardion Health Sciences (NASDAQ:GHSI)

Historical Stock Chart

From Apr 2023 to Apr 2024