Filed Pursuant to Rule 424(b)(3)

Registration No. 333-262441

Prospectus Supplement No. 1 to Prospectus dated

February 9, 2022

GUARDFORCE AI CO.,

LIMITED

19,799,990 Ordinary Shares

This Prospectus Supplement No. 1 (this

“Supplement”) relates to the prospectus of Guardforce AI Co., Limited, dated February 9, 2022 (the

“Prospectus”), relating to 19,799,990 ordinary shares that may be sold from time to time by the selling shareholders

named in the Prospectus. This Supplement should be read in conjunction with the Prospectus and is qualified by reference to the

Prospectus, except to the extent that the information in this Supplement supersedes the information contained in the Prospectus, and

may not be delivered without the Prospectus.

This Supplement is being filed to include the

information set forth in the Forms 6-K of the Company filed with the Securities and Exchange Commission on February 17, 2022, March 3, 2022, March 14, 2022, March 16, 2022 and March 21, 2022.

Our ordinary shares are quoted on the Nasdaq Capital

Market under the symbol “GFAI.” On March 21, 2022, the closing price of our ordinary shares on the Nasdaq Capital Market was

$1.33.

Investing in our ordinary shares involves a

high degree of risk. See “Risk Factors” beginning on page 8 of the Prospectus to read about factors you should consider before

you make an investment decision.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful

or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement No. 1 is

March 22, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of, February 2022

Commission File Number 001-40848

GUARDFORCE AI CO., LIMITED

(Translation of registrant’s name into English)

10 Anson Road, #28-01 International Plaza

Singapore 079903

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Entry into a Commissioned Development Agreement

On February 8, 2022, Guardforce AI Co., Limited

(the “Company”) entered into a Commissioned Development Agreement (the “Agreement”) with Shenzhen

Kewei Robot Technology Co., Limited (“Kewei”), wherein Kewei will develop a robotics management platform named GFAI

Intelligent Cloud Platform V2.0 (the “Platform”) for the Company. The initial term of the Agreement will be from February

8, 2022 until Decemeber 31, 2024, in accordance with certain development milestones listed in an exhibit to the Agreement. The Company

agreed to deliver payment to Kewei in the amount of USD$5,000,000, discounted to USD$3,000,000 provided the Company were to issue a one-time,

lump sum payment within five (5) business days of the execution of the Agreement, which $3,000,000 amount the Company timely paid. The

Company will be the sole owner of all intellectual property rights in the Platform. The Agreement is governed by and construed in accordance

with the laws of Hong Kong.

Although Kewei is affiliated with the Company,

after careful consideration, the board of directors of the Company unanimously determined that the quotation received from Kewei was

just, equitable and fair to the Company and that it would be in the best interests of the Company to enter into the Agreement with Kewei.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: February 17, 2022 |

Guardforce AI Co., Limited |

| |

|

|

| |

By: |

/s/ Lei Wang |

| |

Lei Wang |

| |

Chief Executive Officer |

Exhibit 99.1

COMMISSIONED DEVELOPMENT AGREEMENT

BETWEEN

GUARDFORCE AI (HONGKONG) CO., LIMITED

(“PARTY A”)

AND

Shenzhen

KEWEI ROBOT TECHNOLOGY CO., LIMITED

(“PARTY B”)

No.: CDA-GFAIHK-SZKW-02082022

THIS COMMISSIONED DEVELOPMENT AGREEMENT (“AGREEMENT”)

is entered into this 8th day of February 2022 (the “Effective Date”)

BY:

(1) Guardforce AI (Hongkong) Co., Limited,

with its registered address at Unit 01, 5/F., Guardforce Centre, No.3 Hok Yuen Street East, Hung Hom, Kowloon, Hongkong (and all

its subsidiaries, “Party A”)

AND

(2) Shenzhen Kewei Robot Technology Co., Limited,

with its registered address at 201, 2/F, BLK C, Wisdom Plaza, 4068 Qiaoxiang RD, Nanshan, Shenzhen 518054, China (“Party

B”)

NOW, both Parties (“Parties”) hereby confirm

their intentions in good faith as follows: -

| 1 | OBJECTIVES. This AGREEMENT expresses the intention of the Parties to embark on a mutual-beneficial

and strategic partnership. Party B will be commissioned to develop a robotics management platform named as GFAI Intelligent Cloud

Platform V2.0 (“GFAI ICP V2.0” or “Platform”, refer to Exhibit 1 for a list of functions)

for Party A. |

| 2 | OBLIGATIONS OF PARTY B. Pursuant to this AGREEMENT, Party B agrees: - |

2.1 Service Location:

Shenzhen

2.2 Service Period:

from February 8, 2022, to December 31, 2024 (i.e., 35 months)

2.3 Service Milestones:

refer to Exhibit 2

| 3 | OBLIGATIONS OF PARTY A. Pursuant to this AGREEMENT, Party A agrees to: - |

3.1 Provide necessary

assistance to PARTY B, including technical data, executing or following necessary agreements with any third parties, working conditions

(providing servers and development accounts etc.).

3.2 Deliver payment

to Party B at a total amount of US$5,000,000, discounted price at US$3,000,000 provided that Party agrees to pay at one time within five

business days after the execution of this Agreement, refer to Exhibit 3 for details of charge standards, the amounts listed above shall

include the expenses of design, development, testing and so forth in connection with the development of the Platform and shall also include

the expenses of any taxation. Party B’s bank account (that can receive payment in US Dollars) details are listed as below:

Account Name:

Shenzhen Kewei Robot Technology Co., Limited

Bank Name: PINGAN

BANK CO, LTD

Bank Address:

PINGAN BANK, 7E, 5047 SHENNAN DONG ROAD, LUOHU, SHENZHEN, CHINA

Account Number:

15000100892373

SWIFT Code: SZDBCNBS

| 4 | CONFIDENTIALITY. Each of the Parties shall keep confidential all proprietary and other non-public

information received from the other party and to use the same only in connection with developing the Platform contemplated hereby in this

AGREEMENT, unless such information is required to be filed by applicable laws, including, but not limited to, the U.S. Securities Exchange

Act of 1934 as amended. |

| 5 | INTELLECTUAL PROPERTY RIGHTS. Party B acknowledges that Party A shall be the sole proprietor of

all intellectual property rights of the Platform. |

| 6 | AMENDMENT. Any amendment to this Agreement shall be mutually agreed upon and confirmed by written

approaches. |

| 7 | INSPECTION AND ACCEPTANCE. Parties hereto agree that the inspection and acceptance for the work

shall be implemented on the basis of the Exhibit 1. |

| 8 | DESIGNATED CONTACT. Parties hereto agree that within the Service Period, Mingchang Liu (leonardo.liu@guardforceai.com)

shall be appointed as the designated contact for Party A, and Dongfang Chen (dongfang.chen@szkwrobot.com) for Party B. The designated

contacts shall be responsible for reporting to each party’s key personnel the timelines and any issues occurred during the development

of the Platform in a timely and precious manner. Any change of designated contacts shall be made via prior written notices. |

| 9 | TERMINATION. Parties hereto agree that this Agreement shall be terminated if any of the following

conditions occurs: |

9.1 Force majeure.

9.2 Provided

that Party A confirms that the developing Platform cannot meet its need of uses during the Service Period (refer to Exhibit 1), after

amical discussion with Party B, Party A may terminate this Agreement, Party B shall return to Party A’s the paid payment on a pro-rate

and monthly basis for the remaining part (total payment divided by 35 months).

| 10 | GOVERNING LAWS AND DISPUTE RESOLUTION |

| 10.1 | This AGREEMENT shall be governed by and construed in accordance

with the laws of Hong Kong. Any disputes arising out of this AGREEMENT shall be amicably resolved by negotiation between the Parties

and shall be submitted to the courts of Hong Kong if the negotiation fails. |

| 11.1 | Any unsolved matters arising out of this AGREEMENT shall be amicably

resolved by negotiation between Parties. |

| 11.2 | Any notices pertaining to this AGREEMENT shall be made in written. |

| 11.3 | Any waiver by either party of a breach of any provision of this

AGREEMENT shall not operate as or be construed to be a waiver of any other breach of such provision or of any breach of any other provision

of this AGREEMENT. |

| 11.4 | No revision or modification of this AGREEMENT shall be effective

unless in writing and agreed by Parties hereto. |

| 11.5 | All exhibits hereto are intended as the complete and exclusive

parts of this AGREEMENT. |

| 11.6 | This Agreement is written by Chinese and English, the Chinese

version shall prevail in the event of any ambiguity in meanings. |

(Signature page to follow)

IN WITNESS WHEREOF, this AGREEMENT has been executed by Parties’

respective authorized signatories hereto as of the Effective Date described on the first page.

|

SIGNED by Lei Wang, Director /s/ Lei

Wang

For and on behalf of

Guardforce AI (Hongkong) Co., Limited

|

)

)

)

)

)

|

|

|

SIGNED by Lin Jia /s/ Lin Jia

For and on behalf of

Shenzhen Kewei Robot Technology Co., Limited

|

)

)

)

)

)

|

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of, March 2022

Commission

File Number 001-40848

GUARDFORCE

AI CO., LIMITED

(Translation

of registrant’s name into English)

10

Anson Road, #28-01 International Plaza

Singapore

079903

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F

☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Entry

into a Strategic Partnership Agreement

On

February 28, 2022, Guardforce AI Co., Limited (the “Company”) entered into a Strategic Partnership Agreement (the

“Agreement”) with SBC Global Holdings Inc. (“SBC”), wherein the Company and SBC will collaborate

on the sale and leasing of robots in the United States. The strategic partnership is in lieu of the previously proposed acquisition.

As part of the partnership the Company will establish a wholly owned U.S. subsidiary and will commit additional resources to develop

the business to meet demand while working closely with SBC to accelerate overall U.S. market penetration. As part of the Agreement, SBC

will refer clients to the Company. The Company and SBC will work together on a non-exclusive basis and each of the Company and SBC may

enter into similar arrangements and agreements with any other parties.

A

press release was issued on March 1, 2022 and is attached as Exhibit 99.1 hereto.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date: March 3, 2022 |

Guardforce

AI Co., Limited |

| |

|

|

| |

By: |

/s/

Lei Wang |

| |

Lei Wang |

| |

Chief Executive Officer |

Exhibit 99.1

Guardforce AI Accelerates U.S. Market Entry

~ Announces Strategic Partnership with SBC and

Establishes Wholly Owned U.S. Subsidiary ~

NEW YORK, March 1, 2022 – Guardforce

AI Co., Limited (“Guardforce AI” or the “Company”) (Nasdaq: GFAI, GFAIW), an integrated security solutions provider,

announced that the Company has established a strategic partnership with SBC Global Holdings Inc. (“SBC”). The strategic partnership

is in lieu of the previously proposed acquisition. Guardforce AI and SBC have mutually agreed to establish the strategic partnership to

enable Guardforce AI a swifter entry into the desired U.S. markets with its robotic and technology solutions.

As part of the partnership the Company will establish

a wholly owned U.S. subsidiary and will commit additional resources to develop the business to meet growing demand while working closely

with SBC to accelerate overall market penetration. As part of the agreement, SBC will refer all clients to Guardforce AI on an exclusive

basis.

Lei Wang, CEO of Guardforce AI stated, “We

are pleased to include the SBC team as part of Guardforce AI’s growing network of international partnerships. By establishing this

strategic partnership, the crucial U.S. market is now also included in our portfolio. As stated previously, this partnership is part of

our commitment to work closely with the right businesses around the world with the goal of expanding the reach of our services and solutions.”

Robert Shiver, Chairman and CEO of SBC, commented,

“I am honored to be part of Guardforce AI’s journey as they develop strategic initiatives in the United States. This partnership

will allow customers in the United States to have access to autonomous robotics solutions that will result in operational efficiencies

and improved environmental safety standards.”

According to Gartner, U.S. Internet of Things

(“IOT”) Robots Revenues and Communications spending is expected to reach approximately $6.5 billion with an installation base

of approximately 1.7 million units by 2028. With sizeable robotic innovation centers emerging globally, the opportunity for partnerships

continues to expand rapidly.

About Guardforce AI Co., Ltd.

Guardforce AI Co. Ltd. (Nasdaq: GFAI, GFAIW) is

a leading integrated security solutions provider that is trusted to protect and transport the high-value assets of public and private

sector organizations. Developing and introducing innovative technologies that enhance safety and protection, Guardforce AI helps clients

adopt new technologies and operate safely as the Asia Pacific business landscape evolves.

For more information, visit www.guardforceai.com

About SBC Holdings

SBC Holdings provides autonomous robotics solutions

that drive business continuity and community health — enabling healthier, safer, and more efficient offices, communities’

commercial real estate, schools, airports, and many other sectors. Leveraging decades of combined management experience developing smart

buildings, campuses, and cities around the world, SBC is committed to increasing the asset value of commercial properties while attracting

and maintaining valuable tenant share in this competitive market. For more information, please visit https://www.sbccobotics.com/.

Forward-Looking Statements

This press release contains statements that do

not relate to historical facts but are “forward-looking statements” within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995. These statements can generally (although not always) be identified by their use

of terms and phrases such as anticipate, appear, believe, continue, could, estimate, expect, indicate, intend, may, plan, possible, predict,

project, pursue, will, would and other similar terms and phrases, as well as the use of the future tense. Forward-looking statements are

neither historical facts nor assurances of future performance. Instead, they are based only on current beliefs, expectations and assumptions

regarding the future of the business of the Company, future plans and strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks

and changes in circumstances that are difficult to predict and many of which are outside of our control, including the risks described

in our registration statements and reports under the heading “Risk Factors” as filed with the SEC. Actual results and financial

conditions may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these

forward-looking statements. Forward-looking statements in this press release speak only as of the date hereof. Unless otherwise required

by law, we undertake no obligation to publicly update or revise these forward-looking statements, whether because of new information,

future events or otherwise.

Media Relations

Patrick Yu

Email: patrick.yu@fleishman.com

Phone: (+852) 2586-7877

Investor Relations

Shannon Devine

Email: GFAI@mzgroup.us

Phone: +1 203-741-8811

Guardforce AI Corporate Communications

Hu Yu

Email : yu.hu@guardforceai.com

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of, March 2022

Commission File Number 001-40848

GUARDFORCE AI CO., LIMITED

(Translation of registrant’s name into English)

10 Anson Road, #28-01 International Plaza

Singapore 079903

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F

or Form 40-F: Form 20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Entry into a Sale and Purchase Agreement

On March 11, 2022, Guardforce AI Co., Limited

(the “Company”) entered into a Sale and Purchase Agreement (the “Agreement”) with Shenzhen Kewei

Robot Technology Co., Limited (“Shenzhen Kewei”) relating to the previously proposed acquisition of Shenzhen Keweien

Robot Service Co., Ltd. and Guangzhou Kewei Robot Technology Co., Ltd. from Shenzhen Kewei. This acquisition is expected to serve an integral

role in the growth of Guardforce AI’s robotics as a service (RaaS) business initiative. This acquisition is expected to be closed

by end of April 2022.

A press release was issued on March 11, 2022 and

is attached as Exhibit 99.1 hereto.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: March 13, 2022 |

Guardforce AI Co., Limited |

| |

|

|

| |

By: |

/s/ Lei Wang |

| |

Lei Wang |

| |

Chief Executive Officer |

Exhibit 99.1

Guardforce AI Enters into Agreement to Expand

Robotics as a Service (RaaS) to China’s Greater Bay Area

~Signs Definitive Agreement to Acquire Shenzhen

Keweien & Guangzhou Kewei~

NEW YORK, March 11, 2022 -- Guardforce

AI Co., Limited (“Guardforce AI” or “Company”) (Nasdaq: GFAI, GFAIW), an integrated security solutions provider,

announced today the signing of the definitive agreement of the previously proposed acquisition of Shenzhen Keweien Robot Service Co.,

Ltd (“SZ”) and Guangzhou Kewei Robot Technology Co., Ltd (“GZ”). This acquisition is expected to serve an integral

role in the growth of Guardforce AI’s robotics as a service (RaaS) business initiative. This acquisition is expected to be closed

by end of April 2022.

The acquisition purchase price of US$10,000,000

will be paid in a mix of cash (10%) and restricted ordinary shares of the Company (90%). Guardforce AI is presently listed on the U.S.

Nasdaq Capital Market under the symbol “GFAI.” For purposes of the definitive acquisition agreement, each share will be valued

at US$4.20.

SZ and GZ are based in the Greater Bay Area, one

of the fastest-growing economic regions in China with both Shenzhen and Guangzhou ranking among the top 10 largest Chinese cities and

among the 30 largest cities globally. Focused on the hospitality, healthcare, property management, and government sectors, SZ and GZ derive

revenues from AI robotic services which automate repetitive tasks, making them less labor intensive.

The Company has reiterated its 2022 full-year

revenue expectations of US$55-60 million, representing growth of more than 66% as compared to 2021.

About Guardforce AI Co., Ltd.

Guardforce AI Co. Ltd. (Nasdaq: GFAI, GFAIW) is

a global integrated security solutions provider that is focused on developing robotic solutions and information security services that

complement its well-established secured logistics business. With more than 40 years of professional experience, Guardforce AI is a trusted

brand name that protects and transports the high-value assets belonging to public and private sector organizations. Guardforce AI develops

and provides innovative technologies and services that enhance safety and protection.

For more information, visit www.guardforceai.com

Forward Looking Statements

This press release contains statements that do

not relate to historical facts but are “forward-looking statements” within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995. These statements can generally (although not always) be identified by their use

of terms and phrases such as anticipate, appear, believe, continue, could, estimate, expect, indicate, intend, may, plan, possible, predict,

project, pursue, will, would and other similar terms and phrases, as well as the use of the future tense. Forward-looking statements are

neither historical facts nor assurances of future performance. Instead, they are based only on current beliefs, expectations and assumptions

regarding the future of the business of the Company, future plans and strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks

and changes in circumstances that are difficult to predict and many of which are outside of our control, including the risks described

in our registration statements and reports under the heading “Risk Factors” as filed with the SEC. Actual results and financial

condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these

forward-looking statements. Forward-looking statements in this press release speak only as of the date hereof. Unless otherwise required

by law, we undertake no obligation to publicly update or revise these forward-looking statements, whether because of new information,

future events or otherwise.

Media Relations

Patrick Yu

Email: patrick.yu@fleishman.com

Phone: (+852) 2586-7877

Investor Relations

Shannon Devine

Email: GFAI@mzgroup.us

Phone: +1 203-741-8811

Guardforce AI Corporate Communications

Hu Yu

Email : yu.hu@guardforceai.com

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of, March 2022

Commission

File Number 001-40848

GUARDFORCE

AI CO., LIMITED

(Translation

of registrant’s name into English)

10

Anson Road, #28-01 International Plaza

Singapore

079903

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date: March 16, 2022 |

Guardforce

AI Co., Limited |

| |

|

|

| |

By: |

/s/

Lei Wang |

| |

Lei Wang |

| |

Chief Executive Officer |

Exhibit

99.1

Guardforce

AI Receives NASDAQ Notification Letter Regarding Minimum Bid Price Deficiency

NEW

YORK, March 16, 2022 -- Guardforce AI Co., Limited (“Guardforce AI” or “Company”) (Nasdaq: GFAI, GFAIW),

an integrated security solutions provider, announced today that it has received a notification letter (the “Notification Letter”)

from the Nasdaq Stock Market LLC (the “NASDAQ”) dated March 9, 2022, notifying the Company that it is not in compliance with

the minimum bid price requirement as set forth under NASDAQ Listing Rule 5550(a)(2) for continued listing on the NASDAQ. This press release

is issued pursuant to NASDAQ Listing Rule 5810(b), which requires prompt disclosure upon the receipt of a deficiency notification.

NASDAQ

Listing Rule 5550(a)(2) requires listed securities to maintain a minimum bid price of US$1.00 per share, and Listing Rule 5810(c)(3)(A)

provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business

days. Based on the closing bid price of the Company’s ordinary shares for the 30 consecutive business days from January 25, 2022 to March

8, 2022 the Company no longer meets the minimum bid price requirement.

In

accordance with the NASDAQ Listing Rule 5810(c)(3)(A), the Company has been provided 180 calendar days, or until September 6, 2022, to

regain compliance with NASDAQ Listing Rule 5550(a)(2). To regain compliance, the Company’s ordinary shares must have a closing bid price

of at least US$1.00 for a minimum of 10 consecutive trading days. In the event that the Company does not regain compliance by September

6, 2022, the Company may be eligible for additional time to regain compliance or may face delisting.

The

receipt of the Notification Letter has no immediate effect on the listing of the Company’s ordinary shares, which will continue to trade

uninterrupted on NASDAQ under the ticker “GFAI”. To address this issue, the Company intends to continuously monitor its closing

bid price and is in the process of considering various measures to improve its financial position and results of operations, which the

Company expects to countervail the short-term adverse effects on its trading price and cure the deficiency in due time.

About

Guardforce AI Co., Ltd.

Guardforce

AI Co. Ltd. (Nasdaq: GFAI, GFAIW) is a global integrated security solutions provider that is focused on developing robotic solutions

and information security services that complement its well-established secured logistics business. With more than 40 years of professional

experience, Guardforce AI is a trusted brand name that protects and transports the high-value assets belonging to public and private

sector organizations. Guardforce AI develops and provides innovative technologies and services that enhance safety and protection.

For

more information, visit www.guardforceai.com

Forward

Looking Statements

This

press release contains statements that do not relate to historical facts but are “forward-looking statements” within the

meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements can generally (although

not always) be identified by their use of terms and phrases such as anticipate, appear, believe, continue, could, estimate, expect, indicate,

intend, may, plan, possible, predict, project, pursue, will, would and other similar terms and phrases, as well as the use of the future

tense. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on

current beliefs, expectations and assumptions regarding the future of the business of the Company, future plans and strategies, projections,

anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they

are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside

of our control, including the risks described in our registration statements and reports under the heading “Risk Factors”

as filed with the SEC. Actual results and financial condition may differ materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking statements. Forward-looking statements in this press release speak only

as of the date hereof. Unless otherwise required by law, we undertake no obligation to publicly update or revise these forward-looking

statements, whether because of new information, future events or otherwise.

Media

Relations

Patrick

Yu

Email:

patrick.yu@fleishman.com

Phone:

(+852) 2586-7877

Investor

Relations

Shannon

Devine

Email: GFAI@mzgroup.us

Phone:

+1 203-741-8811

Guardforce

AI Corporate Communications

Hu

Yu

Email

: yu.hu@guardforceai.com

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of March 2022

Commission

File Number 001-40848

GUARDFORCE

AI CO., LIMITED

(Translation

of registrant’s name into English)

10

Anson Road, #28-01 International Plaza

Singapore

079903

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Entry

into a Letter of Intent

On

March 21, 2022, Guardforce AI Co., Limited (the “Company”) signed a non-binding letter of Intent (the “LOI”)

with Shenzhen Kewei Robot Technology Co., Limited and Shenzhen Yeantec Co., Limited (together, the “Kewei Group”)

to purchase up to 36 of the Kewei Group’s subsidiaries located in China. Under the LOI, in the first of two phases, Guardforce

AI will acquire eight of the Kewei Group companies. The second phase provides Guardforce AI the right of first refusal to purchase the

remaining 28 companies within a period of 24 months from the date of the signing of the LOI. The purchase of the additional 28 companies

will be dependent on the Company’s operational plans. The Company expects to sign the definitive agreement for the phase one acquisitions

before the end of May.

The

purchase price for the eight phase one companies will be based upon a valuation that is equal to one-time (from 2022 to 2026) projected

average revenues for the eight companies estimated to be U.S. $30 million and will be paid in a mix of cash (10%) and Company restricted

shares (90%) at a price of U.S. $2.00 per share. The Company will be required to pay Kewei Group the 10% cash component ($3,000,000)

of the purchase price as a deposit and Kewei Group will deliver to the Company 100% of the outstanding share capital of the eight phase

one companies as a pledge, within 10 days of the signing of the LOI. The acquisition is subject to, among other things, the satisfactory

completion of due diligence by the Company, the entry into definitive agreements and any required third-party consents.

A

press release relating to the signing of the LOI was issued on March 21, 2022 and is attached as Exhibit 99.1 hereto.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date: March 21, 2022 |

Guardforce AI Co., Limited |

| |

|

| |

By: |

/s/ Lei Wang |

| |

|

Lei Wang |

| |

|

Chief Executive Officer |

Exhibit 99.1

Guardforce

AI Continues Expansion of Robotics as a Service (RaaS) and Security Service Roadmap

~

Initiated Acquisition of 8 Companies in China’s Major Cities ~

NEW

YORK, March 21, 2022 -- Guardforce AI Co., Limited (“Guardforce AI” or “Company”) (Nasdaq: GFAI, GFAIW),

an integrated security solutions provider, announced today, the signing of a non-binding Letter of Intent (“LOI”) with Shenzhen

Kewei Robot Technology Co., Limited and Shenzhen Yeantec Co., Limited (together, the “Kewei Group”) to purchase

up to 36 of the Kewei Group’s subsidiaries located in China. Under the LOI, in the first of two phases, Guardforce AI will acquire

eight of the Kewei Group companies. The second phase provides Guardforce AI the right of first refusal to purchase the remaining 28 companies

within a period of 24 months from the date of the signing of the LOI. The purchase of the additional 28 companies will be dependent on

the Company’s operational plans. The Company expects to sign the definitive agreement for the phase one acquisitions before the

end of May.

The

purchase price for the eight phase one companies will be based upon a valuation that is equal to one-time (from 2022 to 2026) projected

average revenues for the eight companies estimated to be U.S. $30 million and will be paid in a mix of cash (10%) and Company restricted

shares (90%) at a price of U.S. $2.00 per share. The Company will be required to pay Kewei the 10% cash component ($3,000,000) of the

purchase price as a deposit and Kewei will deliver to the Company 100% of the outstanding share capital of the eight phase one companies

as a pledge, within 10 days of the signing of the LOI. The acquisition is subject to, among other things, the satisfactory completion

of due diligence by the Company, the entry into definitive agreements and any required third-party consents.

Lei

Wang, CEO of Guardforce AI, commented, “We value the development of robotics and AI applications in our future expansion plans.

Apart from the United States, China has become one of the vital markets with surging needs across our targeted industries. Beijing, Shanghai,Tianjin

and Chongqing are the largest and only four directly-administered municipalities in China, and are among the top 10 cities economically

speaking. To this point, we must not ignore this market when it comes to our global expansion plans. Additionally, Guardforce AI is in

a unique position to lend its global exposure to the acquired companies. The acquisitions will not only enable us to penetrate the most

developed cities and areas in China, but also provide access to evolving markets.”

Seven

of the eight companies are well-established with experienced salesforce and management teams that provide robotics sales and rental services,

serving clients in a variety of industries such as hospitality, healthcare, government facilities, and property management.

The

proposed acquisition includes the following companies:

| ● | Beijing

Keweian Robot Technology Ltd, based in Beijing |

| ● | Shanghai

Nanxiao Kewei Intelligent Technology Ltd, based in Shanghai |

| ● | Tianjin

Kewei Robot Technology Ltd, based in Tianjin |

| ● | Chongqing

Kewei Robot Technology Ltd, based in Chongqing |

| ● | Guangxi

Kewei Robot Technology Ltd, based in Nanning, Guangxi Province |

| ● | Fuzhou

Kewei Robot Technology Ltd, based in Fuzhou, Fujian Province |

| ● | Hainan

Kewei Robot Technology Ltd, based in Haikou, Hainan Province |

| ● | Beijing

Wanjia Security System Ltd, based in Beijing, China |

About

Guardforce AI Co., Ltd.

Guardforce

AI Co. Ltd. (NASDAQ:GFAI)(NASDAQ:GFAIW) is a global integrated security solutions provider that is focused on developing robotic solutions

and information security services that complement its well-established secured logistics business. With more than 40 years of professional

experience, Guardforce AI is a trusted brand name that protects and transports the high-value assets belonging to public and private

sector organizations. Guardforce AI develops and provides innovative technologies and services that enhance safety and protection.

For

more information, visit www.guardforceai.com

Forward

Looking Statements

This

press release contains statements that do not relate to historical facts but are “forward-looking statements” within the

meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements can generally (although

not always) be identified by their use of terms and phrases such as anticipate, appear, believe, continue, could, estimate, expect, indicate,

intend, may, plan, possible, predict, project, pursue, will, would and other similar terms and phrases, as well as the use of the future

tense. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on

current beliefs, expectations and assumptions regarding the future of the business of the Company, future plans and strategies, projections,

anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they

are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside

of our control, including the risks described in our registration statements and reports under the heading “Risk Factors”

as filed with the SEC. Actual results and financial condition may differ materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking statements. Forward-looking statements in this press release speak only

as of the date hereof. Unless otherwise required by law, we undertake no obligation to publicly update or revise these forward-looking

statements, whether because of new information, future events or otherwise.

Media

Relations

Patrick

Yu

Email:

patrick.yu@fleishman.com

Phone:

(+852) 2586-7877

Investor

Relations

Shannon

Devine

Email: GFAI@mzgroup.us

Phone:

+1 203-741-8811

Guardforce

AI Corporate Communications

Hu

Yu

Email

: yu.hu@guardforceai.com

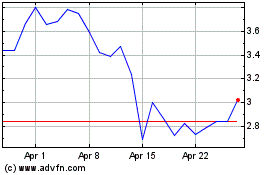

Guardforce AI (NASDAQ:GFAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Guardforce AI (NASDAQ:GFAI)

Historical Stock Chart

From Apr 2023 to Apr 2024