UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of, January 2022

Commission File Number 001-40848

GUARDFORCE AI CO., LIMITED

(Translation of registrant’s name into English)

10 Anson Road, #28-01 International Plaza

Singapore 079903

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Entry into a Material Definitive Agreement

On January 20, 2022,

Guardforce AI Co., Limited (the “Company”) completed a private placement with several investors, wherein a total of

7,919,997 ordinary shares of the Company (the “Shares”), par value $0.003 per share (the “Ordinary Shares”)

were issued at a purchase price of $1.30 per share, with each investor also receiving a warrant to purchase up to a number of Ordinary

Shares equal to 150% of the number of Ordinary Shares purchased by such investor in the Offering (the “Warrant Shares”),

at an exercise price of $1.30 per share (the “Purchaser Warrants”), for a total purchase price of approximately $10.3

million (the “Offering”). The Purchaser Warrants are immediately exercisable on the date of issuance, expire five years

from the date of issuance and have certain downward pricing adjustment mechanisms, including with respect to any subsequent equity sale

that is deemed a dilutive issuance, in which case the warrants will be subject to a floor price of $0.238 per share, as set forth in the

Purchaser Warrants.

The Offering raised net

cash proceeds of approximately $9.36 million (after deducting the placement agent fee and expenses of the Offering). The Company intends

to use the net cash proceeds from the Offering for acquisitions and partnerships, investments in technology and expanding corporate infrastructure,

expansion of its sales team and marketing efforts and for general working capital and administrative purposes.

The Company engaged EF

Hutton, division of Benchmark Investments, LLC (“EF Hutton”) as the Company’s placement agent for the Offering

pursuant to a Placement Agency Agreement (the “PAA”) dated as of January 18, 2022. Pursuant to the PAA, the Company

agreed to pay EF Hutton a cash placement fee equal to 7.5% of the gross proceeds of the Offering, an additional cash fee equal to 0.5%

of the gross proceeds raised by the Company in the offering for non-accountable expenses, and also agreed to reimburse EF Hutton up to

$100,000 for accountable expenses.

In connection with the

Offering, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with investors containing

customary representations and warranties. The Company and investors also entered into a Registration Rights Agreement (the “Registration

Rights Agreement”), pursuant to which the Company will be required to file a resale registration statement (the “Registration

Statement”) with the Securities and Exchange Commission (the “SEC”) to register for resale the Shares and

the Ordinary Shares issuable upon exercise of the Purchaser Warrants, promptly following the Closing Date but in no event later than 15

calendar days after the effective date of the Registration Rights Agreement, and to have such Registration Statement declared effective

by the Effectiveness Date (as defined in the Registration Rights Agreement). The Company will be obligated to pay certain liquidated damages

to the investors if the Company fails to file the Registration Statement or fails to file or cause the Registration Statement to be declared

effective by the SEC within the period of time provided in the Registration Rights Agreement, or fails to maintain the effectiveness of

the Registration Statement pursuant to the terms of the Registration Rights Agreement. The liquidated damages are generally equal to 2% of the aggregate subscription amount upon the occurrence of the default event and 2%

per month thereafter until the default event is cured.

The representations,

warranties and covenants contained in the Purchase Agreement and the Registration Rights Agreement were made solely for the benefit of

the parties to the Purchase Agreement and may be subject to limitations agreed upon by the contracting parties. In addition, such representations,

warranties and covenants (i) are intended as a way of allocating the risk between the parties to the Purchase Agreement and not as

statements of fact, and (ii) may apply standards of materiality in a way that is different from what may be viewed as material by

shareholders of, or other investors in, the Company. Accordingly, forms of the Purchase Agreement and the Registration Rights Agreement

are filed with this report only to provide investors with information regarding the terms of transaction, and not to provide investors

with any other factual information regarding the Company. Shareholders should not rely on the representations, warranties and covenants

or any descriptions thereof as characterizations of the actual state of facts or condition of the Company. Moreover, information concerning

the subject matter of the representations and warranties may change after the date of the Purchase Agreement and the Registration Rights

Agreement, which subsequent information may or may not be fully reflected in public disclosures.

The Offering was exempt

from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”) pursuant to the

exemption for transactions by an issuer not involving any public offering under Section 4(a)(2) of the Securities Act and Rule 506

of Regulation D of the Securities Act and in reliance on similar exemptions under applicable state laws. Each of the Purchasers represented

that it is an accredited investor within the meaning of Rule 501(a) of Regulation D, and was acquiring the securities for investment only

and not with a view towards, or for resale in connection with, the public sale or distribution thereof. The securities were offered without

any general solicitation by the Company or its representatives.

Previously, the Company

sold 3,614,458 units in connection with a public offering, and 542,168 warrants as the result of the representative’s exercise of

the over-allotment option. Each unit consisted of one ordinary share and a warrant to purchase one ordinary share. The public warrants

sold as a component of the units contain an antidilution provision. As a result of the Offering, the exercise price of the Company’s

public warrants is being adjusted to $1.30 pursuant to the antidilution provisions of the public warrants.

The foregoing description

of each of the Purchase Agreement, PAA, Registration Rights Agreement and form of Purchaser Warrant is qualified in its entirety by reference

to the forms of such documents which are filed hereto as Exhibits 10.1, 10.2, 10.3, and 10.4 respectively.

Unregistered

Sales of Equity Securities

The matters described

above of this Report on Form 6-K are incorporated herein by reference. In connection with the issuance of Shares, and the issuance of

Warrant Shares upon proper exercise of the Purchaser Warrants, the Company relied upon the exemption from registration provided by Section

4(a)(2) of the Securities Act of 1933, as amended, and Regulation D promulgated thereunder for transactions not involving a public offering.

Other Events.

On January 18, 2022,

the Company issued a press release announcing the pricing of the Offering. On January 20, 2022, the Company issued a press release announcing

the closing of the Offering. The press releases, which are furnished in this report as Exhibits

99.1 and 99.2, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or

otherwise subject to the liabilities of that section.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: January 21, 2022

|

Guardforce AI Co., Limited

|

|

|

|

|

|

|

By:

|

/s/ Lei Wang

|

|

|

Lei Wang

|

|

|

Chief Executive Officer

|

4

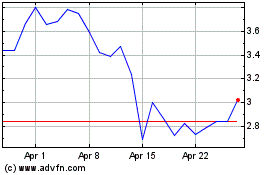

Guardforce AI (NASDAQ:GFAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Guardforce AI (NASDAQ:GFAI)

Historical Stock Chart

From Apr 2023 to Apr 2024