Gevo, Inc. (“Gevo”) (NASDAQ: GEVO), announces the concept of

Net-Zero Projects for the production of energy dense liquid

hydrocarbons using renewable energy and Gevo’s proprietary

technology. The concept of a Net-Zero Project is to convert

renewable energy (photosynthetic, wind, renewable natural gas,

biogas) from a variety of sources into energy dense liquid

hydrocarbons, that when burned in traditional engines, have the

potential to achieve net-zero greenhouse gas (GHG) emissions across

the whole lifecycle of the liquid fuel: from the way carbon is

captured from the atmosphere, processed to make liquid fuel

products, and including the end use (burning as a fuel for cars,

planes, trucks, and ships). Gevo announces that its project

currently planned to be constructed at Lake Preston, South Dakota

will be the first Net-Zero Project and will be named “Net-Zero 1.”

Gevo expects that Net-Zero 1 would have the capability to produce

liquid hydrocarbons that when burned have a “net-zero” greenhouse

gas footprint.

Net-Zero 1 is currently expected to have a capacity of 45MGPY of

hydrocarbons (for gasoline and jet fuel, based on current

take-or-pay contracts), to produce more than 350,000,000 pounds per

year of high protein feed products for use in the food chain, to

produce enough renewable natural gas to be self-sufficient for the

production process needs, and also to generate renewable

electricity with a combined heat and power system. Net-Zero 1 is

also expected to utilize wind energy.

Because of the low-carbon footprint feedstocks, the sustainable

agricultural practices used to produce feedstock, and the use of

renewable energy for the production processes, much of which is

expected to be generated on-site, the hydrocarbon fuel products

produced at Net-Zero 1 have the potential to achieve net-zero

greenhouse gas emissions as measured across the whole of the

lifecycle based on Argonne National Laboratory’s GREET model, the

pre-eminent science-based lifecycle analysis model. The GREET model

takes into account emissions and impacts "cradle to cradle" for

renewable resource-based fuels including: inputs and generation of

raw materials, agriculture practices, chemicals used in production

processes of both feedstocks and products, energy sources used in

production and transportation, and end fate of products, which for

fuel products is usually burning to release energy.

The capital cost for Net-Zero 1 is projected to be on the order

of $700M including the hydrocarbon production and related renewable

energy infrastructure which includes anaerobic digestion to produce

biogas to run our plant and generate some electricity on-site.

Citigroup is assisting Gevo in raising the necessary capital for

Net-Zero 1.

“This is not a new project but rather the first of the projects

that we have been working on with Citigroup to get financed. We are

naming our future projects Net-Zero to make clear the mission we

are on to reduce GHG emissions. By using carbon from the air as our

raw material source with its inherent low-carbon footprint,

sustainable agriculture, a combination of renewable energy obtained

from photosynthesis, wind, and biogas, we see that it is possible

to transform renewable energy into liquid hydrocarbon fuels that

work with combustion engines typical of cars, planes, and trucks

with the added benefit that these fuels have a net-zero carbon

footprint across the whole lifecycle. Think about it: it is

conceivable to eliminate tailpipe emissions from cars, planes and

trucks on a net GHG basis, while leveraging existing cars, planes,

and trucks on a full 'cradle to cradle' GHG basis. Our Net-Zero 1

Project isn’t just about capturing renewable energy and carbon, and

transforming it into liquid renewable energy; it’s also about

generating enormous quantities of protein, and nutrition for the

food chain. The high protein feed would be low-carbon footprint

too—and we are happy to help farmers raise beef, pigs, chicken, and

dairy in a way that lowers GHG emissions. We’ve got work to do to

make it all happen,” said Dr. Patrick R. Gruber, Chief Executive

Officer, Gevo. “We believe that there will be demand for additional

Net-Zero projects in the future,” Gruber continued.

About Gevo

Gevo has a mission to transform renewable energy into low-carbon

transportation fuels. This next generation of renewable premium

gasoline, jet fuel and diesel fuel with the potential to achieve

zero carbon emissions, addressing the market need of reducing

greenhouse gas emissions with sustainable alternatives. Gevo uses

low-carbon renewable resource-based carbohydrates as raw materials,

and is in an advanced state of developing renewable electricity and

renewable natural gas for use in production processes, resulting in

low-carbon fuels with substantially reduced carbon intensity (the

level of greenhouse gas emissions compared to standard petroleum

fossil-based fuels across their lifecycle). Gevo’s products perform

as well or better than traditional fossil-based fuels in

infrastructure and engines, but with substantially reduced

greenhouse gas emissions. In addition to addressing the problems of

fuels, Gevo’s technology also enables certain plastics, such as

polyester, to be made with more sustainable ingredients. Gevo’s

ability to penetrate the growing low-carbon fuels market depends on

the price of oil and the value of abating carbon emissions that

would otherwise increase greenhouse gas emissions. Gevo believes

that its proven, patented, technology enabling the use of a variety

of low-carbon sustainable feedstocks to produce price-competitive

low carbon products such as gasoline components, jet fuel, and

diesel fuel yields the potential to generate project and corporate

returns that justify the build-out of a multi-billion-dollar

business.

Gevo believes that Argonne National Laboratory GREET model is

the best available standard of scientific based measurement for

life-cycle inventory or LCI.

Learn more at our website: www.gevo.com

Forward-Looking Statements

Certain statements in this press release may constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements relate to a variety of matters, including, without

limitation, statements related to Gevo’s Net Zero Projects, Gevo’s

Net-Zero 1 Project, Gevo’s plans and strategy, Gevo’s ability to

achieve reductions in GHG emissions in the production of its liquid

fuel products, the ability of Gevo’s liquid hydrocarbon fuel

products to be dropped into existing supply chains and

infrastructure, the Citigroup finance process, Gevo’s ability to

raise capital to fund its projects, Gevo’s ability to produce its

products, Gevo’s ability to realize revenue from its proposed

projects, and other statements that are not purely statements of

historical fact. These forward-looking statements are made on the

basis of the current beliefs, expectations and assumptions of the

management of Gevo and are subject to significant risks and

uncertainty. Investors are cautioned not to place undue reliance on

any such forward-looking statements. All such forward-looking

statements speak only as of the date they are made, and Gevo

undertakes no obligation to update or revise these statements,

whether as a result of new information, future events or otherwise.

Although Gevo believes that the expectations reflected in these

forward-looking statements are reasonable, these statements involve

many risks and uncertainties that may cause actual results to

differ materially from what may be expressed or implied in these

forward-looking statements. For a further discussion of risks and

uncertainties that could cause actual results to differ from those

expressed in these forward-looking statements, as well as risks

relating to the business of Gevo in general, see the risk

disclosures in the Annual Report on Form 10-K of Gevo for the year

ended December 31, 2019, and in subsequent reports on Forms 10-Q

and 8-K and other filings made with the U.S. Securities and

Exchange Commission by Gevo.

Investor and Media ContactIR@gevo.com

+1 720-647-9605

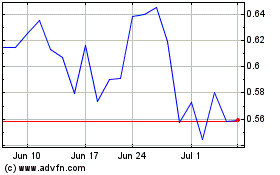

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

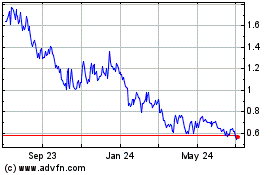

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Apr 2023 to Apr 2024