Prospectus Filed Pursuant to Rule 424(b)(5) (424b5)

December 31 2020 - 12:13PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(5)

Registration File No. 333-226686

Gevo, Inc.

Up to $150,000,000

Common Stock

Supplement No. 1 dated December 31, 2020

to

Prospectus, dated August 28, 2018 and

Prospectus Supplement, dated December 30, 2020

This Supplement No. 1 is being filed solely to amend and supplement the Prospectus (as defined below) to add the dilution table and other information under the heading “Dilution” set forth below pursuant to Item 506 of Regulation S-K. On December 30, 2020, Gevo, Inc. (the “Company,” “ we,” “ us” or “ our”) entered into an amendment to the At-The-Market Offering Agreement, dated February 13, 2018 (as amended, the “Sales Agreement”), with H.C. Wainwright & Co., LLC, which provides for the issuance and sale from time to time of the Company’s common stock in an “at-the-market” offering of up to $150 million of shares of the Company’s common stock (the “Shares”) pursuant to the prospectus supplement, dated December 30, 2020. The Shares have been registered under the Securities Act of 1933, as amended, pursuant to the Company’s Registration Statement on Form S-3 (File No. 333-226686), declared effective by the Securities and Exchange Commission on August 28, 2018 (the “Registration Statement”), and a prospectus, which consists of a base prospectus filed with the Registration Statement, and a prospectus supplement, dated December 30, 2020 (collectively, the “Prospectus”). The dilution disclosure is being provided because the assumed offering price exceeds the net tangible book value per share as set forth below.

Except as set forth in this Supplement No. 1, no other changes are being made to the Prospectus. This Supplement No. 1 should be read in conjunction with the Prospectus. You should carefully read the entire Prospectus and this Supplement No. 1 before investing in our common stock.

Investing in our securities involves a high degree of risk. Before buying any securities, you should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page S-11 of the prospectus supplement, on page 3 of the accompanying prospectus and in the documents incorporated by reference into the Prospectus.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Supplement No. 1 is December 31, 2020.

DILUTION

As of September 30, 2020, we had a net tangible book value of approximately $134.6 million, or $1.13 per share of our common stock, based upon 119,578,203 shares of our common stock outstanding as of September 30, 2020. Historical net tangible book value per share is equal to our total tangible assets, less total liabilities, divided by the number of outstanding shares of our common stock. Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of common stock in this offering and the net tangible book value per share of our common stock immediately after this offering.

After giving effect to the assumed sale by us of our common stock in the aggregate amount of $150.0 million in this offering at an assumed public offering price of $4.62 per share, which was the last reported sale price of our common stock on the Nasdaq Capital Market on December 29, 2020, and after deducting commissions and estimated aggregate offering expenses payable by us, our as adjusted net tangible book value as of September 30, 2020 would have been approximately $280.8 million, or $1.85 per share of our common stock. This represents an immediate increase in as adjusted net tangible book value of $0.72 per share to our existing stockholders and an immediate dilution of $2.77 per share to investors purchasing shares of common stock in this offering.

The following table illustrates this per share dilution to new investors:

|

Assumed public offering price per share

|

|

|

|

|

|

$

|

4.62

|

|

|

Historical net tangible book value per share as of September 30, 2020

|

|

$

|

1.13

|

|

|

|

|

|

|

Increase in net tangible book value per share attributable to new investors

|

|

|

0.72

|

|

|

|

|

|

|

As adjusted net tangible book value per share after giving effect to this offering

|

|

|

|

|

|

|

1.85

|

|

|

Dilution per share to investors in this offering

|

|

|

|

|

|

$

|

2.77

|

|

For illustrative purposes, the table above assumes that an aggregate of 32,467,532 shares of our common stock are sold at an assumed price of $4.62 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on December 29, 2020, for aggregate gross proceeds of $150.0 million. The shares sold in this offering, if any, will be sold from time to time at various prices. An increase of $1.00 per share in the price at which the shares are sold from the assumed offering price of $4.62 per share shown in the table above, assuming all of our common stock in the aggregate amount of $150.0 million during the term of the sales agreement with H.C. Wainwright is sold at that price, would result in an increase in the dilution in net tangible book value per share to new investors in this offering to $3.70 per share, after deducting commissions and estimated aggregate offering expenses payable by us. A decrease of $1.00 per share in the price at which the shares are sold from the assumed offering price of $4.62 per share shown in the table above, assuming all of our common stock in the aggregate amount of $150.0 million during the term of the sales agreement with H.C. Wainwright is sold at that price, would result in a decrease in the dilution in net tangible book value per share to new investors in this offering to $1.88 per share, after deducting commissions and estimated aggregate offering expenses payable by us. This information is supplied for illustrative purposes only and may differ based on the actual offering price and the actual number of shares offered.

The number of shares of common stock to be outstanding immediately after this offering as set forth above is based on 119,578,203 shares outstanding as of September 30, 2020, and excludes:

|

|

●

|

1,552 shares of our common stock issuable upon exercise of outstanding options at a weighted-average exercise price of $556.13 per share;

|

|

|

●

|

132,566 shares of our common stock potentially issuable upon the vesting and exercise of outstanding stock appreciation rights at a weighted-average price of $5.23 per share;

|

|

|

●

|

2,734,198 shares of our common stock issuable upon exercise of outstanding warrants at a weighted-average exercise price of $3.64 per share, of which 685,000 shares were issued from October 1, 2020 through December 29, 2020;

|

|

|

●

|

1,242,905 shares of common stock available for future grant under our Amended and Restated 2010 Stock Incentive Plan;

|

|

|

●

|

190 shares of common stock available for issuance pursuant to our Employee Stock Purchase Plan;

|

|

|

●

|

2,175,000 shares of common stock issued under our previous at-the-market offering program from October 1, 2020 through December 29, 2020; and

|

|

|

●

|

5,672,654 shares of our common stock issued in December 2020 upon conversion of $12.7 million in aggregate outstanding principal amount (including the applicable make-whole payment) of our 12% convertible senior secured notes due 2020/2021.

|

To the extent that any of these outstanding options or stock appreciation rights are exercised, or we issue additional shares under equity incentive plans or employee stock purchase plans, there may be further dilution to new investors. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

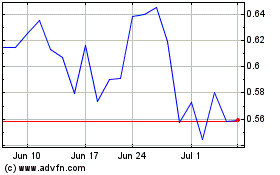

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

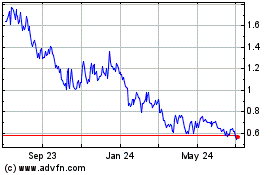

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Apr 2023 to Apr 2024