IP Valuation Firm Sets Gevo IP Portfolio at Greater Than $400M

August 28 2020 - 9:00AM

Gevo, Inc. (NASDAQ: GEVO), is pleased to announce that Peak Value

IP LLC (“Peak Value”), has completed a valuation of intellectual

property including trade secrets, know-how, patents and patent

applications (collectively, the “IP”) across the world that can be

licensed and monetized by Gevo.

Peak Value’s analysis yielded an indication of investment

valuation of $412 million for the IP. Peak Value used an “Income

Approach” to estimate the value, focusing on discounted projected

cash flows from direct Gevo-sponsored projects and potential

out-licensing within a renewable biofuel production

market.

Patrick R. Gruber, Chief Executive Officer of Gevo, says, “I’m

pleased to see our IP valuation increasing. Our products work, our

technology works, our patents cover our proprietary technology. I’m

looking forward to completing the project financing of our large

scale production facilities and getting large plants built. Having

an external point of view on our patent portfolio, I expect, will

be important in attracting investors. Our valuation reflects that

we focused on isobutanol as an enabler for low-carbon renewable

gasoline, jet fuel, and diesel fuel.”

Gevo paid Peak Value to perform the evaluation pursuant to an IP

Valuation Engagement Agreement between Gevo and Peak Value.

About GevoGevo is

commercializing the next generation of renewable premium gasoline,

jet fuel and diesel fuel with the potential to achieve zero carbon

emissions, addressing the market need of reducing greenhouse gas

emissions with sustainable alternatives. Gevo uses low-carbon

renewable resource-based carbohydrates as raw materials, and is in

an advanced state of developing renewable electricity and renewable

natural gas for use in production processes, resulting in

low-carbon fuels with substantially reduced carbon intensity (the

level of greenhouse gas emissions compared to standard petroleum

fossil-based fuels across their lifecycle). Gevo’s products perform

as well or better than traditional fossil-based fuels in

infrastructure and engines, but with substantially reduced

greenhouse gas emissions. In addition to addressing the problems of

fuels, Gevo’s technology also enables certain plastics, such as

polyester, to be made with more sustainable ingredients. Gevo’s

ability to penetrate the growing low-carbon fuels market depends on

the price of oil and the value of abating carbon emissions that

would otherwise increase greenhouse gas emissions. Gevo believes

that its proven, patented, technology enabling the use of a variety

of low-carbon sustainable feedstocks to produce price-competitive

low carbon products such as gasoline components, jet fuel, and

diesel fuel yields the potential to generate project and corporate

returns that justify the build-out of a multi-billion dollar

business. Learn more at our website: www.gevo.com

About Peak Value IP

LLC, an affiliate of Weild & CoPeak Value IP, LLC, an

affiliate of Weild & Co investment bank, is a financial

advisory firm focused on intellectual property and patents. The

service provider reviews and assesses IP for capital raising,

valuation, brokerage, licensing, venture development, litigation

funding, and monetization. The Company’s clients include individual

inventors, venture capital and private equity funds, early and late

stage companies, universities and research institutions, and the

largest technology companies throughout the world.

Weild & Co is an independent investment bank

focused on enabling its independent registered professionals to

provide a broader spectrum of corporate finance and capital raising

services. These services span the gamut from strategic advisory,

M&A, private placements, and public securities offerings to

investor relations services. The investment banks takes particular

pride in helping businesses and funds that contribute to job

formation, economic growth, and quality of life. See more at

www.weildco.com

Forward-Looking

StatementsCertain statements in this press release may

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements relate to a variety of matters,

including, without limitation, statements related to the valuation

of Gevo’s patents and patent applications, Peak Value’s

evaluation, and other statements that are not

purely statements of historical fact. These forward-looking

statements are made based on the current beliefs, expectations and

assumptions of the management of Gevo and are subject to

significant risks and uncertainty. Investors are cautioned not to

place undue reliance on any such forward-looking statements. All

such forward-looking statements speak only as of the date they are

made, and Gevo undertakes no obligation to update or revise these

statements, whether as a result of new information, future events

or otherwise. Although Gevo believes that the expectations

reflected in these forward-looking statements are reasonable, these

statements involve many risks and uncertainties that may cause

actual results to differ materially from what may be expressed or

implied in these forward-looking statements. For a further

discussion of risks and uncertainties that could cause actual

results to differ from those expressed in these forward-looking

statements, as well as risks relating to the business of Gevo in

general, see the risk disclosures in the Annual Report on Form 10-K

of Gevo for the year ended December 31, 2019 and in subsequent

reports on Forms 10-Q and 8-K and other filings made with the U.S.

Securities and Exchange Commission by Gevo.

Investor and Media Contact +1

720-647-9605 IR@gevo.com

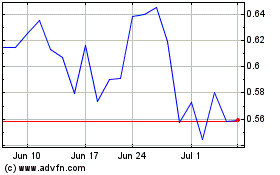

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

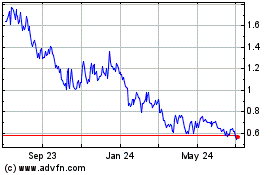

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Apr 2023 to Apr 2024