Filed Pursuant to Rule 497(a)

Registration No. 333-239839

Rule 482ad

August 31, 2020

Dear Stockholder:

Great Elm Capital Corp. (“we,” “us,” “our” or “GECC”) (NASDAQ: GECC) announced a

non-transferable subscription rights offering to purchase shares of its common stock, par value $0.01 per share (“Common Stock”). To assist stockholders, set forth below are answers to frequently

asked questions in connection with the announced rights offering.

The questions and answers below highlight only selected information in connection with the

rights offering. They do not contain all of the information that may be important to you. Please refer to the registration statement on Form N-2 (Registration Statement

No. 333-239839) (the “Registration Statement”) filed with the U.S. Securities and Exchange Commission (“SEC”) for more detail.

IMPORTANT DATES TO REMEMBER

|

|

|

|

|

Record Date

|

|

September 4, 2020 at 5:00 p.m. New York City time

|

|

|

|

|

Subscription Period

|

|

From September 8, 2020 to September 28, 2020 (unless the offering is extended)

|

|

|

|

|

Expiration Date

|

|

September 28, 2020 (unless the offering is extended)

|

|

|

|

|

Deadline for Delivery of Subscription Certificates and Payment for Shares

|

|

September 28, 2020 at 5:00 p.m. New York City time (unless the offering is extended)

|

FREQUENTLY ASKED QUESTIONS

TRANSACTION RATIONALE

|

1.

|

Why is GECC conducting a rights offering?

|

After careful consideration with GECC’s board of directors, we announced a non-transferable rights

offering to our stockholders. We believe strengthening GECC’s balance sheet is a prudent course of action in the face of the current market environment in which we are operating. Furthermore, in a period of market dislocation, there may be

attractive new investment opportunities at compelling values on a risk-adjusted return basis, including opportunities in the specialty finance sector. The capital raised in the rights offering will provide support for the following initiatives:

|

|

•

|

|

New Opportunistic Investments Resulting from Dislocation: In periods of extreme market volatility, there are

often undervalued investments that become available on more attractive terms than we would otherwise be able to obtain under typical, less volatile market conditions. Having additional capital to take advantage of these opportunities can provide for

compelling risk-adjusted return opportunities. Based on the advice of Great Elm Capital Management, Inc. (“GECM”), our external investment manager, we may seek to opportunistically pursue new investment opportunities to grow our net

investment income by investing in assets that GECM believes have become undervalued. Furthermore, we will continue implementing the portfolio repositioning we began in the second quarter, including by pursuing additional opportunities in specialty

finance. These opportunities may offer more attractive returns than can be found in syndicated corporate credit and help to make our portfolio more proprietary.

|

|

|

•

|

|

Capital Resources to Support Existing Portfolio Companies: Given the global

COVID-19 pandemic, many businesses have been adversely impacted by a weakened economy. While our portfolio companies are diversified across multiple industries and the overall impact will be dependent on the

specific circumstances of each portfolio company, we believe having capital to support existing portfolio companies can help optimize outcomes for our stockholders. We are focused on liquidity measures to position GECC to support our portfolio

companies and not impact their long-term value propositions.

|

|

2.

|

What are the proceeds of the offering being used for?

|

We intend to use the net proceeds of this offering primarily to (i) make opportunistic investments, in accordance with our investment objectives

and policies, in assets that GECM believes have become undervalued due to the current extreme market volatility, and on more attractive terms than we would otherwise be able to obtain under typical, less volatile market conditions and

(ii) support our existing portfolio companies though the COVID-19 pandemic.

|

3.

|

Are any affiliates of GECC participating in the offering?

|

Yes. Great Elm Capital Group, Inc. and certain of our other stockholders (the “Participating Shareholders”) have indicated that they intend

to fully exercise their rights

2

and over-subscribe in order to make an aggregate investment of up to $24 million in shares of Common Stock. Any over-subscription by the Participating Shareholders will be effected only

after pro rata allocation of over-subscription shares to record date holders (other than Participating Shareholders) who fully exercise all rights issued to them. Accordingly, there can be no assurance that the Participating Shareholders will

acquire any shares of Common Stock through their exercise of over-subscription privileges.

MECHANICS AND PRICING

|

1.

|

Who is entitled to receive the rights?

|

We are issuing rights to stockholders of record, or record date stockholders, as of September 4, 2020 at 5:00 p.m. New York City time.

|

2.

|

How many rights are record date stockholders entitled to?

|

Record stockholders will receive one right for each share of Common Stock owned on the record date. The rights will entitle the holders to purchase

one new share of Common Stock for every one right held.

|

3.

|

Will fractional shares be issued?

|

We will not issue fractional shares of Common Stock upon the exercise of rights.

|

4.

|

What is the subscription price?

|

The subscription price for the shares to be issued pursuant to the rights offering will be 85% of the volume-weighted average of the market prices of

our shares of Common Stock on the Nasdaq Global Market (“Nasdaq”) for the five consecutive trading days ending on the expiration date of the rights offering.

|

5.

|

Will I know the subscription price before I have to exercise my rights?

|

Because the subscription price will be determined on the expiration date, rights holders who decide to acquire shares of Common Stock pursuant to

their primary subscription right or pursuant to the over-subscription privilege will generally not know the actual subscription price at the time of their exercise.

|

6.

|

Why do I have to pay an estimated subscription price?

|

Because the subscription price is based on the volume-weighted average of the market price of our shares of Common Stock on Nasdaq for the five

consecutive trading days ending on the expiration date. The actual subscription price will not be known until the expiration date.

|

7.

|

What happens if the estimated subscription price is more than the actual subscription price?

|

Any excess payment will be refunded to you by mail as promptly as practicable. No interest or penalty will be paid on any

amounts refunded.

3

|

8.

|

What happens if the estimated subscription price is less than the actual subscription price?

|

You will be required to pay any deficiency within 10 business days after the confirmation date. The additional amount will

be equal to the difference between the estimated subscription price and the actual subscription price multiplied by the total number of shares subscribed for and issued to you (including pursuant to the over-subscription privilege). If the full

number of shares that you have subscribed for pursuant to the over-subscription is not available, the estimated subscription price you paid for those shares will be applied to reduce any deficiency owed to you.

|

9.

|

How to obtain subscription information?

|

Contact your broker-dealer, trust company, bank or other nominee where your rights are held, or contact the information agent, AST Fund Solutions,

LLC, toll free at (888) 628-1041.

|

10.

|

How do I exercise my rights?

|

Rights are evidenced by subscription certificates that, except as described below for “Non-U.S.

Stockholders,” will be mailed to record date stockholders or, if a record date stockholder’s shares are held by Cede & Co. (“Cede”) or any other depository or nominee on their behalf, to Cede or such depository or

nominee.

Rights may be exercised by completing and signing the subscription certificate that accompanies the prospectus and mailing it in the

envelope provided, or otherwise delivering the completed and duly executed subscription certificate to the subscription agent, together with payment in full for the shares at the estimated subscription price by the expiration date.

Non-U.S. Stockholders:

Subscription certificates will not be mailed to non-U.S. stockholders.

Non-U.S. stockholders will receive written notice of this offering. The subscription agent will hold the rights to which those subscription certificates relate for these stockholders’ accounts until

instructions are received to exercise the rights, subject to applicable law. If no instructions have been received by the expiration date, such rights will expire.

|

11.

|

Do I have to exercise my rights?

|

No. You are not required to exercise any rights, purchase any shares or otherwise take any action in response to the offering. If you do not exercise

your rights prior to the expiration date, the rights will expire and you will lose any value represented by them.

If you choose not to

participate in the offering, you should expect to own a smaller proportional interest in GECC upon completion of the offering.

|

12.

|

Are my rights transferable?

|

No, your rights are not transferable and will not be listed for trading on Nasdaq or any other stock exchange. The rights may not be purchased or

sold, and there will not be any market for trading the rights.

|

13.

|

What is the over-subscription privilege?

|

Record date stockholders who fully exercise all rights issued to them are entitled to subscribe for additional shares of Common Stock that were not

subscribed for by other

4

stockholders, which we refer to as the remaining shares. If sufficient remaining shares of Common Stock are available, all record date stockholders’ over-subscription requests will be

honored in full. Shares acquired pursuant to the over-subscription privilege are subject to certain limitations and pro rata allocations.

|

14.

|

Does exercising my rights involve any risk?

|

Exercising your rights means buying additional shares of Common Stock at the subscription price, which will not be known until the close of trading on

the expiration date. If the subscription price per share is substantially less than the current net asset value (“NAV”) per share, such dilution could be substantial. Any such dilution will disproportionately affect non-exercising stockholders. If the subscription price is less than our NAV per share, then all stockholders will experience a decrease in the NAV per share held by them, irrespective of whether they exercise all or

any portion of their rights.

Among other things, you should carefully review and consider the risks described under the heading “Risk

Factors” beginning on page 19 of the prospectus.

|

15.

|

Can we change or terminate the offering?

|

We reserve the right to amend the terms and conditions of this offering, whether the amended terms are more or less favorable to you. We will comply

with all applicable laws, including the federal securities laws, in connection with any such amendment. In addition, we may, in our sole discretion, terminate the rights offering at any time prior to delivery of the shares of Common Stock offered

hereby.

If this rights offering is terminated, all rights will expire without value, and the subscription agent will return as soon as

practicable all exercise payments, without interest or penalty.

|

16.

|

What if I want to participate, but my shares are held in the name of a broker-dealer, bank or other nominee?

|

You must contact them and instruct them to exercise your rights on your behalf.

TIMELINE

|

1.

|

When will I receive my rights?

|

Rights will be mailed, accompanied by a prospectus, to record date stockholders or, if a record date stockholder’s shares are held by Cede or any

other depository or nominee on their behalf, to Cede or such depository or nominee. If you hold your shares through a broker-dealer, bank or other nominee, you should contact them for information regarding when the rights will appear in your

account.

|

2.

|

When can I exercise my rights?

|

Rights may be exercised at any time during the subscription period, which commences on September 8, 2020 and ends at 5:00 p.m., New York City

time, on September 28, 2020, unless extended by us in our sole discretion. The rights will expire on the expiration date and may not be exercised afterwards.

5

The offering will expire at 5:00 p.m., New York City time, on September 28, 2020, unless extended by us in our sole discretion. The rights will

expire then and may not be exercised afterwards.

|

4.

|

When will I receive my new shares?

|

Participants in our dividend reinvestment plan will have any shares that they acquire pursuant to the offering credited to their stockholder dividend

reinvestment accounts in the plan.

Stockholders whose shares are held of record by Cede or by any other depository or nominee on their behalf or

their broker-dealers’ behalf will have any shares that they acquire credited to the account of Cede or the other depository or nominee. With respect to stockholders who hold shares in certificated form, stock certificates for all shares

acquired will be mailed after payment for all the shares subscribed for has cleared, which may take up to fifteen days from the date of receipt of the payment. With respect to all other stockholders, the ownership of shares purchased will be

uncertificated and noted in book-entry form. The number of shares purchased will be shown on such stockholders’ statement of account.

PAYMENT

|

1.

|

How do I make payment for shares?

|

A participating rights holder may send the subscription certificate together with payment for the shares acquired in the primary subscription right

and any additional shares subscribed for pursuant to the over-subscription privilege to the subscription agent based on an estimated subscription price of $4.52 per share. To be accepted, the estimated payment, together with a properly completed and

executed subscription certificate, must be received by American Stock Transfer & Trust Company, LLC (“AST”), the subscription agent, at the address set forth below, on or prior to the expiration date.

American Stock Transfer & Trust Company, LLC

Attn: Reorganization Department

6201 15th Avenue

Brooklyn, New York 11219

All payments by a

participating rights holder must be in U.S. dollars by check or bank draft drawn on a bank or branch located in the United States and payable to AST, as subscription agent.

A participating rights holder may also wire the transfer of immediately available funds directly to the account maintained by AST, as subscription

agent, for purposes of accepting subscriptions in this rights offering at:

JP Morgan Chase

SWIFT Code – CHASUS33

ABA # 021000021

Account # 530-354616

6

Beneficiary: American Stock Transfer,

with reference to “American Stock Transfer as Subscription Agent for Great Elm Capital

Corp.” and the rights holder’s name

The subscription agent will deposit all funds received by it prior to the final payment date into a segregated account pending pro-ration and distribution of the shares.

|

2.

|

Will I receive interest or penalty on any payments I make?

|

No.

|

3.

|

What fees or charges apply if I purchase shares?

|

We are not charging any fee or sales commission. If you hold your rights through a broker-dealer, bank or other nominee, you are responsible for

paying any fee or sales commission they charge.

OTHER

|

1.

|

What should I do if I have other questions about the offering?

|

Any questions or requests for additional copies of the prospectus, subscription certificates may be directed to the information agent:

AST Fund Solutions, LLC

48 Wall Street, 22nd

Floor

New York, New York 10005

Phone: (888)

628-1041

Stockholders may also contact their broker-dealer, bank or other nominee.

|

2.

|

Where can I obtain more information about GECC?

|

The most current information about us can be found in the prospectus. Our filings with the SEC (including the prospectus), press releases, earnings

releases and other financial information are available on our website at http://www.greatelmcc.com. Our website is not incorporated or part of this communication.

Investors are advised to carefully consider the investment objectives, risks and charges and expenses of GECC before investing. The prospectus contains this and

other important information you should know before investing in the Common Stock. Please read it and other documents referred to therein carefully in their entirety before you invest. A copy of the prospectus may be obtained by contacting Imperial

Capital, LLC, Attention: Prospectus Department, 10100 Santa Monica Blvd., Suite 2400, Los Angeles, CA 90067 or by phone: 310-246-3700 or Piper Sandler & Co.,

Attention: Prospectus Department, 800 Nicollet Mall, J12S03, Minneapolis, MN 55402, by email at prospectus@psc.com or by phone:

1-800-747-3924.

GECC files

annual, quarterly and current reports, proxy statements and other information about GECC with the Securities and Exchange Commission (“SEC”). You may also obtain free copies of GECC’s annual and quarterly reports and make stockholder

inquiries by contacting Great Elm Capital Corp., 800 South Street, Suite 230, Waltham, Massachusetts

7

02453 or by calling GECC collect at (617) 375-3006. GECC maintains a website at http://greatelmcc.com and makes all of its annual, quarterly and current

reports, proxy statements and other publicly filed information available, free of charge, on or through such website. Information on GECC’s website is not incorporated or a part of the prospectus. The SEC also maintains a website at

http://www.sec.gov where such information is available without charge.

Cautionary Statement Regarding Forward-Looking Statements

Statements in this communication that are not historical facts are “forward-looking” statements within the meaning of the federal securities laws. These

statements are often, but not always, made through the use of words or phrases such as “expect,” “anticipate,” “should,” “will,” “estimate,” “designed,” “seek,”

“continue,” “upside,” “potential” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results

to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are: conditions in the credit markets, the price of

GECC common stock, the performance of GECC’s portfolio and investment manager and risks associated with the economic impact of the COVID-19 pandemic on GECC and its portfolio companies. Information

concerning these and other factors can be found in GECC’s Annual Report on Form 10-K, GECC’s Quarterly Reports on Form 10-Q and other reports filed with the

SEC. GECC assumes no obligation to, and expressly disclaims any duty to, update any forward-looking statements contained in this communication or to conform prior statements to actual results or revised expectations except as required by law.

Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

8

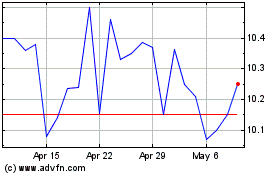

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Mar 2024 to Apr 2024

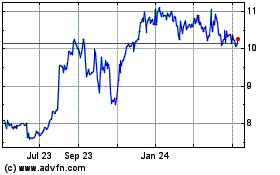

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Apr 2023 to Apr 2024