Amended Statement of Beneficial Ownership (sc 13d/a)

March 31 2020 - 2:22PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO

RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No.

25)*

Sprott Focus Trust, Inc.

(Name of Issuer)

Common Stock, $0.001 par value per share

(Title of Class of

Securities)

85208J109

(CUSIP Number)

W. Whitney George

c/o Sprott Asset Management USA Inc.

777 Post Road, 2nd Floor

Darien, Connecticut 06820

Telephone Number: (203) 656-2432

(Name, Address and Telephone Number

of Person Authorized to Receive Notices and Communications)

March 18, 2020

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of

§§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box o.

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

|

*

|

The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the

Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 85208J109

|

|

13D

|

|

Page 2 of 6 Pages

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

W. Whitney George

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) o (b) o

|

|

3

|

|

SEC

USE ONLY

|

|

4

|

|

SOURCE OF FUNDS

PF; AF

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

o

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

7,971,116

|

|

|

8

|

|

SHARED

VOTING POWER

1,667,328

|

|

|

9

|

|

SOLE

DISPOSITIVE POWER

7,971,116

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

1,667,328

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

9,638,444

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

o

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.4%

|

|

14

|

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSIP No. 85208J109

|

|

13D

|

|

Page 3 of 6 Pages

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

Meredith George

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) o (b) o

|

|

3

|

|

SEC

USE ONLY

|

|

4

|

|

SOURCE OF FUNDS

PF

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

o

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

2,098,677

|

|

|

8

|

|

SHARED

VOTING POWER

0

|

|

|

9

|

|

SOLE

DISPOSITIVE POWER

2,098,677

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

2,098,677

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

o

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.3%

|

|

14

|

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSIP No. 85208J109

|

|

13D

|

|

Page 4 of 6 Pages

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

The Meredith and Whitney George Family Foundation, Inc.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) o (b) o

|

|

3

|

|

SEC

USE ONLY

|

|

4

|

|

SOURCE OF FUNDS

WC

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

o

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

|

7

|

|

SOLE

VOTING POWER

0

|

|

|

8

|

|

SHARED

VOTING POWER

1,667,328

|

|

|

9

|

|

SOLE

DISPOSITIVE POWER

0

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

1,667,328

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

1,667,328

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

o

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.8%

|

|

14

|

|

TYPE OF REPORTING PERSON

CO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSIP No. 85208J109

|

|

13D

|

|

Page 5 of 6 Pages

|

This Amendment No. 25 to Statement of Beneficial Ownership on Schedule 13D (this “Amendment No. 25”) amends the Statement of Beneficial Ownership on Schedule 13D (as

amended, the “Schedule 13D”) filed by the Reporting Persons with respect to the common stock, $0.001 par value per share (the “Shares”), of Sprott Focus Trust, Inc., a diversified closed-end investment company incorporated

under the laws of the State of Maryland (the “Issuer”). Capitalized terms used but not defined in this Amendment No. 25 shall have the meanings set forth in the Schedule 13D. The Reporting Persons are filing this Amendment No. 25 to

Schedule 13D to report a change in their respective beneficial ownership percentages of the Shares, as indicated in Item 5 below. Except as amended and supplemented by this Amendment No. 25, the Schedule 13D remains unchanged.

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

Item 3 of the Schedule 13D is hereby amended by adding the following:

The aggregate purchase price of the Shares being reported in Item 5(c) of this Amendment No. 25, including brokerage commissions, was approximately $840,788. The source of the

funds was personal funds or affiliate funds, as applicable. No borrowed funds were used to purchase such Shares.

|

Item 5.

|

Interest in Securities of the Issuer.

|

Items 5(a) and (c) of the Schedule 13D are hereby amended and restated as follows:

|

|

(a)

|

As of the date hereof, the Reporting Persons beneficially own

in the aggregate 11,737,121 Shares, which represents approximately 40.7% of the Issuer’s outstanding Shares.

Each percentage ownership of Shares set forth in the

Schedule 13D is based on the 28,846,083.383 Shares issued and outstanding as of March 30, 2020.

|

|

|

(c)

|

The transactions in the Shares by the Reporting Persons

since the filing of Amendment No. 24 to the Schedule 13D/A with the Securities and Exchange Commission on March 5, 2020 are set forth on Schedule A to this Schedule 13D. Each of these transactions was effected through the open market, other than the

acquisition of shares pursuant to the Issuer’s dividend reinvestment program.

|

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to

Securities of the Issuer.

|

|

|

|

|

|

Item 6 of the Schedule 13D is hereby amended and restated as follows:

Pursuant to Rule 13d-1(k) promulgated under the Securities Exchange Act of 1934, as amended, the Reporting Persons have entered into an agreement with respect to the joint filing

of this Amendment No. 25, which agreement is set forth on the signature page to this Schedule 13D.

|

CUSIP No. 85208J109

|

|

13D

|

|

Page 6 of 6 Pages

|

SIGNATURE

After reasonable inquiry and to the best of our knowledge and belief, the undersigned certify that the information set forth in this statement is true, complete and correct.

In accordance with Rule 13d-1(k)(1)(iii) under the Securities Exchange Act of 1934, as amended, the persons named below agree to the joint filing on behalf of each of them of this

Statement on Schedule 13D with respect to the Shares of the Issuer.

|

|

|

|

|

|

|

Dated: March 31, 2020

|

|

|

|

W. Whitney George*

|

|

|

|

|

|

|

|

|

|

By: /s/ W. Whitney

George

|

|

|

|

|

|

|

|

|

|

Meredith George*

|

|

|

|

|

|

|

|

|

|

By: /s/ Meredith

George

|

|

|

|

|

|

|

|

|

|

The Meredith and Whitney George Family Foundation, Inc.*

|

|

|

|

|

|

|

|

|

|

By: /s/ W. Whitney

George

|

|

|

|

|

|

Name: W. Whitney George

|

|

|

|

|

|

Title: Chairman

|

|

*

|

Each Reporting Person disclaims beneficial ownership of the reported securities except

to the extent of his, her or its pecuniary interests therein, and this report shall not be deemed an admission that such person or entity is the beneficial owner of these Shares for purposes of Section 16 of the Exchange Act, or for any other

purpose.

|

|

|

|

|

|

|

|

Attention: Intentional misstatements or omissions of fact constitute Federal criminal

violations (see 18 U.S.C. 1001).

Schedule A

Transactions in the

Shares Since the Filing of Amendment No. 24 to the Schedule 13D/A on March 5, 2020:

W. Whitney George

|

|

|

|

|

|

|

|

|

Trade Date

|

|

Transaction

|

|

Number of Shares

Bought/(Sold)

|

|

Price Per

Share

|

|

3/12/2020

|

|

Purchase

|

|

40,000

|

|

$4.921(3)(4)

|

|

3/13/2020

|

|

Purchase

|

|

20,000

|

|

$4.8999(3)(5)

|

|

3/16/2020

|

|

Purchase

|

|

20,000

|

|

$4.6589(3)(6)

|

|

3/17/2020

|

|

Purchase

|

|

200

|

|

$4.6

|

|

3/18/2020

|

|

Purchase

|

|

63,760

|

|

$4.483(3)(7)

|

|

3/19/2020

|

|

Purchase

|

|

16,098

|

|

$4.2

|

|

3/23/2020

|

|

Purchase

|

|

3,902

|

|

$4.1924(3)(8)

|

|

3/24/2020

|

|

Purchase

|

|

17,594(1)

|

|

$4.622(3)(9)

|

|

3/24/2020

|

|

Purchase

|

|

17,594(2)

|

|

$4.622(3)(9)

|

|

3/27/2020

|

|

Dividend Reinvestment

|

|

202,605(15)

|

|

$4.33

|

Meredith George

|

|

|

|

|

|

|

|

|

Trade Date

|

|

Transaction

|

|

Number of Shares

Bought/(Sold)

|

|

Price Per

Share

|

|

3/12/2020

|

|

Purchase

|

|

60,000

|

|

$4.916(3)(10)

|

|

3/13/2020

|

|

Purchase

|

|

19,794

|

|

$4.7977(3)(11)

|

|

3/16/2020

|

|

Purchase

|

|

20,000

|

|

$4.6955(3)(12)

|

|

3/18/2020

|

|

Purchase

|

|

60,000

|

|

$4.4789(3)(13)

|

|

3/19/2020

|

|

Purchase

|

|

16,098

|

|

$4.2

|

|

3/23/2020

|

|

Purchase

|

|

4,934

|

|

$4.173(3)(14)

|

|

3/27/2020

|

|

Dividend Reinvestment

|

|

49,996(16)

|

|

$4.33

|

The Meredith and Whitney George Family Foundation

|

|

|

|

|

|

|

|

|

Trade Date

|

|

Transaction

|

|

Number of Shares

Bought/(Sold)

|

|

Price Per

Share

|

|

3/27/2020

|

|

Dividend Reinvestment

|

|

43,465(17)

|

|

$4.33

|

|

(1)

|

Represents Shares purchased on the open market for the account of a trust established

for the benefit of Mr. George’s children (the “Children’s Trust”). As beneficiaries of the Children’s Trust, Mr. George’s children have a pecuniary interest in the Children’s Trust, and Mr. George may be

deemed to beneficially own the Shares held by the Children’s Trust.

|

|

(2)

|

Represents Shares purchased on the open market for the account of a trust of which Mr. George serves

as a trustee (the “Descendant’s Trust”). As beneficiary of the Descendant’s Trust, Meredith George has a pecuniary interest in the Descendant’s Trust, and Mr. George may be deemed to beneficially own the Shares held by

the Descendant’s Trust.

|

|

(3)

|

The Reporting Persons hereby undertake to provide, upon request by the Securities and Exchange

Commission staff, the issuer, or a stockholder of the issuer, full information regarding the number of Shares purchased at each separate price for all purchases for which the weighted average purchase price of multiple transactions with a range of

prices is disclosed.

|

|

(4)

|

Represents the weighted average purchase price of multiple transactions with a range of prices

between $4.56 and $5.10.

|

|

(5)

|

Represents the weighted average purchase price of multiple transactions with a range of prices

between $4.895 and $4.90.

|

|

(6)

|

Represents the weighted average purchase price of multiple transactions with a range of prices

between $4.00 and $4.70.

|

|

(7)

|

Represents the weighted average purchase price of multiple transactions with a range of prices

between $4.18 and $4.60.

|

|

(8)

|

Represents the weighted average purchase price of multiple transactions with a range of prices

between $4.19 and $4.20.

|

|

(9)

|

Represents the weighted average purchase price of multiple transactions with a range of prices

between $4.52 and $4.70.

|

|

(10)

|

Represents the weighted average purchase price of multiple transactions with a range of prices

between $4.76 and $5.10.

|

|

(11)

|

Represents the weighted average purchase price of multiple transactions with a range of

prices between $4.77 and $4.80.

|

|

(12)

|

Represents the weighted average purchase price of multiple transactions with a range of prices

between $4.66 and $4.70.

|

|

(13)

|

Represents the weighted average purchase price of multiple transactions with a range of prices

between $4.30 and $4.60.

|

|

(14)

|

Represents the weighted average purchase price of multiple transactions with a range of prices

between $4.10 and $4.20.

|

|

(15)

|

Represents Shares acquired pursuant to the Issuer’s dividend reinvestment program by accounts

for which W. Whitney George may be deemed to beneficially own (excluding The Meredith and Whitney George Family Foundation, Inc.), including 23,468 Shares acquired by the Children’s Trust, 12,573 Shares acquired by the Descendant’s Trust

and 3,689 Shares acquired by Mr. George’s minor son.

|

|

(16)

|

Represents Shares acquired by Meredith George pursuant to the Issuer’s dividend reinvestment

program.

|

|

(17)

|

Represents Shares acquired by The Meredith and Whitney George Family Foundation, Inc. pursuant to

the Issuer’s dividend reinvestment program.

|

Sprott Focus (NASDAQ:FUND)

Historical Stock Chart

From Mar 2024 to Apr 2024

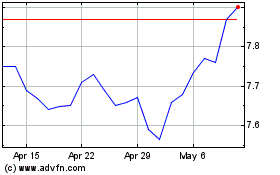

Sprott Focus (NASDAQ:FUND)

Historical Stock Chart

From Apr 2023 to Apr 2024