UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

Filed by the Registrant x

|

|

Filed by a Party other than the Registrant ¨

|

|

|

|

|

|

Check the appropriate box:

|

|

¨ Preliminary Proxy Statement

|

|

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x Definitive Proxy Statement

|

|

¨ Definitive Additional Materials

|

|

¨ Soliciting Material under § 240.14a-12

|

FOX FACTORY HOLDING CORP.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than Registrant)

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x No fee required.

|

|

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

1) Title of each class of securities to which transaction applies:

|

|

2) Aggregate number of securities to which transaction applies:

|

|

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

|

|

4) Proposed maximum aggregate value of transaction:

|

|

5) Total fee paid:

|

|

¨ Fee paid previously with preliminary materials.

|

|

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

1) Amount Previously Paid:

|

|

2) Form, Schedule or Registration Statement No.:

|

|

3) Filing Party:

|

|

4) Date Filed:

|

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Page

|

|

LETTER TO STOCKHOLDERS

|

|

|

NOTICE OF ANNUAL MEETING

|

|

|

PROXY SUMMARY

|

|

|

QUESTIONS AND ANSWERS ABOUT THIS PROXY STATEMENT AND THE ANNUAL MEETING

|

|

|

ELECTION OF CLASS I DIRECTORS (Proposal 1)

|

|

|

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (Proposal 2)

|

|

|

DIRECTOR COMPENSATION

|

|

|

CORPORATE GOVERNANCE

|

|

|

The Board of Directors

|

|

|

Certain Relationships and Related Transactions and Director Independence

|

|

|

Nominations of Directors and Diversity

|

|

|

Corporate Social Responsibility

|

|

|

Communications with the Directors

|

|

|

Board of Directors, Executive Officers and Committees

|

|

|

EXECUTIVE COMPENSATION

|

|

|

Compensation Discussion and Analysis

|

|

|

Summary Compensation Table - Fiscal Years 2019, 2018, and 2017

|

|

|

Grants of Plan-Based Awards Table - Fiscal Year 2019

|

|

|

Outstanding Equity Awards at Fiscal Year-End Table - Fiscal Year 2019

|

|

|

Option Exercises and Stock Vested Table - Fiscal Year 2019

|

|

|

Equity Compensation Plan Information

|

|

|

COMPENSATION COMMITTEE REPORT

|

|

|

AUDIT COMMITTEE REPORT

|

|

|

ADVISORY VOTE ON THE COMPANY'S EXECUTIVE COMPENSATION (Proposal 3)

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

|

|

DELINQUENT SECTION 16(a) REPORTS

|

|

|

SUBMISSION OF STOCKHOLDER PROPOSALS FOR 2021

|

|

|

ATTENDING THE VIRTUAL ANNUAL MEETING VIA WEBCAST

|

|

|

DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS

|

|

|

ANNEX A - NON-GAAP MEASURES

|

|

|

PROXY CARD*

|

|

|

|

|

|

*Please note that the location of the 2020 Annual Meeting of Stockholders has been updated since the proxy card was printed. The 2020 Annual Meeting of Stockholders will now be held virtually via webcast.

|

|

|

This Proxy Statement contains “forward-looking” statements regarding Fox’s current expectations within the meaning of the applicable securities laws and regulations. These statements are subject to a variety of risks and uncertainties that could cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to, the risks detailed in the Company filings with the Securities and Exchange Commission, including the “Risk Factors” section of Fox Factory Holding Corp.’s Annual Report on Form 10-K for the fiscal year ended January 3, 2020. We assume no obligation to update any of these forward-looking statements.

|

|

March 26, 2020

A Message from Our Board of Directors,

Thank you for your support of Fox Factory Holding Corp. in 2019. The Company achieved record financial results last year, demonstrating the management team’s ability to execute strategic initiatives across the Company’s diversified product portfolio. The Board not only committed significant time and discussion to advance these strategic priorities, but also dedicated its focus to continuously improving and adapting the Company’s corporate governance to best complement the evolving needs of the Company. As our 2020 Annual Meeting of Stockholders approaches, we would like to provide an update on matters that we believe are key to our stakeholders.

Following a vigorous succession planning process approved by the Board, Michael Dennison, FOX’s former President of Powered Vehicles Group, succeeded Larry Enterline as Chief Executive Officer when Mr. Enterline retired from his position on June 29, 2019. Mr. Enterline, after having led FOX for eight years as Chief Executive Officer, continues to serve our valued stockholders, customers, and employees as Executive Chair of the Board. Concurrently, former Chair, Dudley W. Mendenhall, became the Lead Independent Director of the Board on June 29, 2019.

Under Mr. Enterline's leadership, FOX transitioned from a private to publicly traded company on August 8, 2013 and generated a total stockholder return of over 300%. We believe the best leadership structure for the Board is for Mr. Enterline to continue working with Mr. Dennison and the management team on corporate strategy and business development initiatives as Executive Chair, with Mr. Mendenhall representing the strong independent voice of the non-executive directors as Lead Independent Director.

After more than 10 years with FOX, Zvi Glasman resigned from his role as Chief Financial Officer and Treasurer effective November 1, 2019. In connection with Mr. Glasman's resignation, the Board appointed John Blocher, who has been with FOX since 2012 and recently served as Senior Vice President, Finance of the Company, as the Company's Interim Chief Financial Officer and Interim Treasurer effective November 2, 2019.

We also welcomed Jean Hlay as the newest member of our Board on February 25, 2019. Ms. Hlay possesses over 25 years of executive and senior leadership experience in the consumer branded products manufacturing and distribution industries. The depth of Ms. Hlay’s financial, operational, and strategic expertise exceeds the criteria that the Nominating and Corporate Governance Committee identified and desired in a new Board member.

The Board is committed to working closely with the management team to ensure FOX’s long-term strategic direction will continue to deliver value to all of its stockholders. We appreciate the important role that our stockholders play in our success, and are grateful for your continued support.

We are pleased to invite you to attend the 2020 Annual Meeting of Stockholders of Fox Factory Holding Corp., which will be held via webcast on Thursday, May 7, 2020, at 1:00 p.m. EDT. Please note that this year's Annual Meeting of Stockholders will be held in virtual meeting format only, which means that you will be able to participate in the meeting, vote and submit your questions during the meeting online by visiting www.virtualshareholdermeeting.com/FOXF2020. You will not be able to attend this year's Annual Meeting in person.

We look forward to your participation in our 2020 Annual Meeting of Stockholders.

Sincerely,

|

|

|

|

|

|

|

/s/ Michael C. Dennison

|

|

Michael C. Dennison

|

|

Director and Chief Executive Officer

|

|

|

|

/s/ Larry L. Enterline

|

|

Larry L. Enterline

|

|

Director and Executive Chair of the Board

|

|

|

|

/s/ Dudley Mendenhall

|

|

|

Dudley Mendenhall

|

|

Lead Independent Director

|

|

|

|

/s/ Thomas E. Duncan

|

|

|

Thomas E. Duncan

|

|

Director

|

|

|

|

/s/ Elizabeth A. Fetter

|

|

Elizabeth A. Fetter

|

|

Director

|

|

|

|

/s/ Jean Hlay

|

|

Jean Hlay

|

|

Director

|

|

|

|

/s/ Ted Waitman

|

|

Ted Waitman

|

|

Director

|

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 7, 2020

Fox Factory Holding Corp.’s 2020 Annual Meeting of Stockholders (the "Annual Meeting") will be held via webcast on Thursday, May 7, 2020, at 1:00 p.m. EDT. This year's Annual Meeting will be in virtual meeting format only, which means that you will be able to participate in the meeting, vote and submit your questions during the meeting online by visiting www.virtualshareholdermeeting.com/FOXF2020. You will not be able to attend the Annual Meeting in person.

The purposes of the meeting are:

1. To elect two Class I directors, described in the Proxy Statement, each to serve for a term to expire at the 2023 Annual Meeting of Stockholders;

2. To ratify the appointment of Grant Thornton LLP as our independent public accountants for fiscal year 2020;

3. To vote on a resolution to approve the Company’s executive compensation; and

4. To consider and act upon such other matters as may properly come before the meeting, or any adjournment or postponement thereof.

These matters are more fully described in the Proxy Statement. The Board of Directors recommends that you vote "FOR ALL" the nominated directors, "FOR" the ratification of the independent public accountants, and "FOR" the advisory approval of the Company’s executive compensation. The Board of Directors knows of no other matters at this time that may be properly brought before the meeting.

Stockholders of record at the close of business on March 9, 2020 are entitled to notice of, and to vote at, the Annual Meeting and any subsequent adjournments or postponements thereof. A list of these stockholders will be available for inspection for 10 days preceding the Annual Meeting at our principal executive offices located at 6634 Highway 53, Braselton, GA 30517. The notice of annual meeting, proxy statement, proxy card, and other proxy materials are first being sent or made available to stockholders on or about March 26, 2020.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

We are pleased to save costs and help protect the environment by using the Notice and Access method of delivery. Instead of receiving paper copies of our proxy materials in the mail, many stockholders will receive a Notice of Internet Availability of Proxy Materials ("Notice") which provides an internet website address where stockholders can access electronic copies of proxy materials and vote. This website also has instructions for voting by telephone and for requesting paper copies of the proxy materials and proxy card. The Company's 2020 Proxy Statement and Annual Report for fiscal year 2019 are available online at www.proxyvote.com. We encourage you to access and review such materials before voting.

Your vote is very important to us. Whether or not you expect to attend the Annual Meeting via webcast, we urge you to consider the Proxy Statement carefully and to promptly vote your shares either by (1) voting through the internet at the website shown on the proxy card or Notice or by telephone at the telephone number shown on the proxy card or Notice; or (2) if you received paper copies of your proxy materials in the mail, complete, date, sign, and return the enclosed proxy card as promptly as possible. Completing a proxy card or voting through the internet or telephone will not prevent you from voting by following the instructions on the website during the webcast, but will assure that your vote is counted, if, for any reason, you are unable to attend.

Our proxy tabulator, Broadridge Financial Solutions, Inc., must receive any proxy that will not be delivered during the webcast to the Annual Meeting by 11:59 p.m. Eastern Daylight Time on Wednesday, May 6, 2020.

|

|

|

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

David Haugen

|

|

Vice President, General Counsel and Corporate Secretary

|

Braselton, GA

March 26, 2020

PROXY SUMMARY

2020 Annual Meeting of Stockholders

|

|

|

|

|

|

|

|

Date and Time

|

Virtual Stockholder Meeting (Via Webcast)

|

|

May 7, 2020, 1:00 p.m. EDT

|

www.virtualshareholdermeeting.com/FOXF2020

|

|

Record Date

|

Voting Eligibility

|

|

March 9, 2020

|

Owners of our common stock as of the Record Date are entitled to vote on all matters

|

Voting Items and Board Recommendations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

Proposal

|

Board Vote Recommendation

|

Page Reference

|

|

|

|

|

|

|

1

|

Elect two Class I directors

|

FOR ALL

|

|

|

|

|

|

|

|

2

|

Ratify the appointment of Grant Thornton LLP as our independent public accountants for fiscal year 2020

|

FOR

|

|

|

|

|

|

|

|

3

|

Approve an advisory resolution on our executive compensation

|

FOR

|

|

|

|

|

|

|

2019 Performance Highlights

Overview of Business

Our company, Fox Factory Holding Corp., designs, engineers, manufactures and markets premium performance-defining products and systems for customers worldwide. Our premium brand, performance-defining products and systems are used primarily on bicycles ("bikes"), side-by-side vehicles ("Side-by-Sides"), on-road vehicles with and without off-road capabilities, off-road vehicles and trucks, all-terrain vehicles ("ATVs"), snowmobiles, specialty vehicles and applications, motorcycles and commercial trucks.

Many of our products are specifically designed and marketed to some of the leading cycling and powered vehicle original equipment manufacturers, including Giant, Santa Cruz Bicycles, Specialized, Scott, Trek, Yeti Cycles and YT in bikes and BRP, Ford, Honda, Jeep, Polaris, Toyota, Triumph, and Yamaha in powered vehicles, while others are distributed to consumers through a global aftermarket channel of dealers and distributors.

Additionally, we up-fit trucks to be off-road capable, on-road vehicles with product offerings such as lift kits and components with our shock products, superchargers, interior accessories, wheels, tires, lighting, and body enhancements. We also offer mountain and road bike wheels and other performance-defining cycling components including cranks, chainrings, pedals, bars, stems, and seat posts.

FOX is an aspirational brand and we believe many of our OEMs often prominently display and incorporate our products to improve the marketability and consumer demand for their performance models, while professional athletes using our products are consistently successful in elite events around the world providing our products exposure and demonstrating their performance capabilities, all of which, we believe, reinforces our premium brand image and positively influences the purchasing habits of enthusiasts and other consumers.

Based on our strong operational and financial results in 2019, discussed below, as well as our outlook for 2020, we continue to opportunistically make strategic investments to expand our manufacturing capacity, primarily in our U.S. operations, to better support the needs of our growing business over the next several years. We are also evaluating “white space” opportunities to expand our premium brand into relevant performance-defining adjacencies.

In addition, we believe there is an opportunity to expand our total available market through potential acquisitions beyond our current product categories. We believe there may be opportunities to acquire other recognized brands that are valued by that same passionate customer.

2019 Performance Highlights and Key Accomplishments

Record Financial Results

We delivered record financial results in fiscal year 2019. We benefited from consistent execution and favorable business fundamentals in our Powered Vehicles Group and in our Specialty Sports Group. Our broad-based growth led to annual sales and profitability well above our initial expectations.

FY2019 RESULTS

|

|

|

|

|

|

|

|

Sales

|

$751.0 million

|

|

|

|

|

Net income attributable to FOX stockholders

|

$93.0 million

|

|

|

|

|

Earnings per diluted share

|

$2.38

|

|

|

|

|

Non-GAAP adjusted net income*

|

$106.3 million

|

|

|

|

|

Adjusted earnings per diluted share*

|

$2.72

|

|

|

|

|

Adjusted EBITDA*

|

$146.2 million

|

|

|

|

* Reconciliations of non-GAAP measures are provided in Annex A, attached hereto.

FY2019 Percentage Increases (Year over Year)

Strong Historical Financial Performance for Stockholders

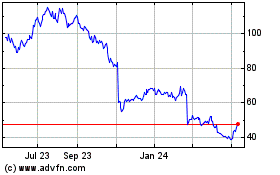

Our record of strong performance is reflected in our one-, three- and five-year total stockholder returns ("TSRs"), which significantly outperformed those of our peers.

Total Stockholder Return

* Represent annualized figures

** Based on compensation peer group discussed further under "Use of Market Data Analyses"

Key 2019 Accomplishments

On the Powered Vehicles Group side, more OEM vehicles are featuring FOX shocks, strengthening our presence in the off-road capable on-road vehicle market. New vehicles featuring FOX suspension include the all-new 2020 Jeep Gladiator Mojave, and the 2020 Toyota Sequoia TRD Pro. The 2020 Gladiator Mojave is designed to take on the extreme desert at high speeds, featuring six FOX suspension components, the most FOX products ever on a production vehicle. It is designed with and incorporates four FOX 2.5 Internal Bypass shocks and includes two of our bump stops that feature an internal floating piston that increases damping performance and bottom-out-control in the last few inches of travel. The Sequoia is the fourth model in Toyota’s TRD Pro lineup, and we are pleased that the entire TRD Pro lineup is on FOX.

In the automotive aftermarket, our Tuscany subsidiary launched the first ever Harley-Davidson edition GMC pickup truck. Tuscany worked closely with Harley-Davidson to create a vehicle that is distinctively Harley. The team drew inspiration from the Harley-Davidson Fat Boy model and included over 65, edition-specific components in the model 2020 truck. Honda recently announced two new sport side-by-side models for 2021 that feature FOX Live Valve technology: the Talon 1000X and Talon 1000R. This was in response to customer requests for two-seat models featuring electronic suspension after the launch of the four-seat version with Live Valve last year, the Talon 1000X-4.

On the Specialty Sports Group side, momentum continues on the back of a strong model year 2019 product portfolio. Our products have been well received by our OEM and our aftermarket customers.

FOX was named the number one fork and shock by the readers of VitalMTB. Our Live Valve technology-enabled products took home the Eurobike Gold Award, won the Design & Innovation Award, and were named Gear of the Year by Bicycling Magazine. The Marzocchi Bomber Z2 suspension fork was named Value Product of the Year by Pinkbike and rated as a Must Buy product by Mountain Bike Magazine in Germany. In the Bike Magazine Readers’ Awards, Race Face was voted the number one brand in bars and stems for traditional and e-mountain bikes. Our sponsored athletes earned 14 Enduro World Series podiums at four EWS rounds, 40 UCI MTB World Cup podiums at five events, 14 podiums at Crankworx Whistler, and 7 podiums at the UCI MTB World Championships in Quebec, Canada.

As previously announced, the Company’s subsidiary, Fox Factory, Inc., entered into a Stock Purchase Agreement, dated February 11, 2020, with Southern Rocky Holdings, LLC (the "Seller") and SCA Performance Holdings, Inc. (the "Target"). On March 11, 2020, Fox Factory, Inc. completed its acquisition of all of the outstanding equity interests of the Target from the Seller. As a result, Fox Factory, Inc. paid to the Seller approximately $328 million, excluding vehicle inventory and $13 million of contingent performance-based retention incentives for key management of the Target payable over the next two years.

Key Management and Governance Developments

On June 29, 2019, our Chief Executive Officer, Larry L. Enterline, retired from the role of Chief Executive Officer after eight years with the Company, and became Executive Chair of the Board. Concurrently, Michael C. Dennison, FOX’s former President, Powered Vehicles Group, became Chief Executive Officer and remained a director on the Board of Directors. Upon the appointment of Mr. Enterline to Executive Chair, Dudley W. Mendenhall transitioned from Chair of the Board of Directors to Lead Independent Director. The implementation of this succession planning was the result of careful planning and consideration by the Board and the Nominating and Corporate Governance Committee, which undertakes an annual assessment of our Chief Executive Officer succession plan in accordance with our Corporate Governance Guidelines. The Board believes the succession plan resulted in a seamless transition of leadership from Mr. Enterline to Mr. Dennison. Mr. Enterline has stayed with FOX as Executive Chair of the Board to continue to work with Mr. Dennison, the Board, and our FOX management team on strategy and business development initiatives.

After more than 10 years with FOX, Zvi Glasman resigned from his role as the Company’s Chief Financial Officer and Treasurer effective November 1, 2019. In connection with Mr. Glasman’s resignation, the Board appointed John Blocher, who has been with FOX since 2012 and recently served as Senior Vice President, Finance of the Company, as the Company’s Interim Chief Financial Officer and Interim Treasurer effective November 2, 2019.

Say-on-Pay Responsiveness

We value our stockholders' perspectives regarding our corporate governance, sustainability and executive compensation practices, as well as our business strategy and public disclosures. In May 2019, we were pleased to receive approximately 99% stockholder support for our Say-on-Pay proposal.

We regularly conduct ongoing reviews of both our governance and executive compensation practices to ensure that we maintain best practices and enhanced disclosure in our Proxy Statement and other Securities and Exchange Commission ("SEC") filings. We have also worked to expand and enhance our public disclosure around the topics of interest to our stockholders.

Compensation Program that Aligns Pay and Performance

Our compensation programs are designed with the general goals and objectives of creating a compensation program that:

•Attracts;

•Engages;

•Rewards for results; and

•Retains

individuals, in an effort to build a workforce that advances the interests of the Company and its stockholders.

In making compensation decisions for fiscal year 2019, the Compensation Committee considered our prior year’s financial results and our operating strategy and goals.

The Company performance metric we believe is most important to our stockholders is the same metric we used in determining performance-based compensation in fiscal year 2019, adjusted EBITDA. We believe adjusted EBITDA directly correlates to stock price and is a good indicator of net income and cash flow health. For this reason, we tie all annual cash bonuses to adjusted EBITDA targets. For the majority of our Named Executive Officers annual cash bonuses are the only portion of their compensation that is directly tied to a performance metric. However, the Compensation Committee takes into account Company performance when determining the number of RSUs to be awarded to our Named Executive Officers (making such compensation “at-risk” to the performance of the Company).

The above charts reflect incentive amounts at the Target level.

*Reflects Mr. Dennison who was appointed as our Chief Executive Officer on June 29, 2019.

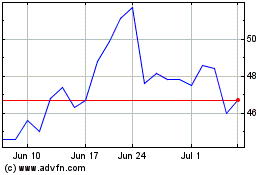

While "Total Stockholder Return" is not used as a performance metric, the Compensation Committee when determining the total compensation packages of our Named Executive Officers considered it, along with other metrics. As evidenced below, we believe our Chief Executive Officer’s compensation is commensurate with the total return to stockholders of the Company over the past five years.

CEO compensation vs. tsr

*The above chart reflects information contained in our Summary Compensation Table, which included in 2017 the grant date fair value of a front-loaded RSU award that vests over three years for Mr. Enterline. No portion of such RSU award vested in 2017.

** 2019 CEO Compensation amount reflects Mr. Enterline and Mr. Dennison's prorated compensations based on Mr. Enterline's resignation date of June 29, 2019.

In addition to the above, the table below outlines some key facets of our executive compensation program.

|

|

|

|

|

|

|

|

What We Do

|

What We Do Not Do

|

|

|

|

|

ü Pay for Performance

|

œ Hedging Transactions

|

|

|

|

|

ü Use of Market Data

|

œ Short-Term Trading

|

|

|

|

|

ü Clawback Policy

|

œ Reprice Awards

|

|

|

|

|

ü Independent Compensation Consultant

|

œ Recycle Stock Awards

|

|

|

|

|

ü Double-Triggers for Cash Severance

|

|

|

|

|

|

ü RSU Awards to Promote Long-Termism

|

|

Strong, Well-Balanced Corporate Governance Practices

•Highly Qualified Board. Our Directors bring deep industry experience to provide effective oversight in the boardroom.

•Independent Board Leadership. The Board does not have a policy as to whether the Chair should be an independent director, but when the Chair is not an independent director, the independent directors appoint a “Lead Independent Director.” Mr. Mendenhall, an independent director, is our “Lead Independent Director” and serves in a leadership capacity on our Board. As Lead Independent Director, Mr. Mendenhall is responsible for: approving Board meeting agendas; in consultation with the non-employee directors and the Executive Chair, when applicable, approving Board meeting schedules to ensure there is sufficient time for discussion of all agenda items; approving the type of information to be provided to directors for Board meetings; presiding at all executive sessions of the non-employee directors (which are held after every Board meeting); when applicable, serving as liaison between the Executive Chair and the independent directors; being available for consultation and direct communication with the Company’s stockholders; calling meetings of the non-employee directors when necessary and appropriate; and performing such other duties as the Board may from time to time designate.

•Focus on Board Diversity. Our Nominating and Corporate Governance Committee has adopted a formal Diversity Policy within the Nominating and Corporate Governance Committee Charter. Our Board believes that differences in experiences, knowledge, skills and viewpoints enhance the Board’s overall performance.

•Mix of Company History and Fresh Ideas. We became a public company in 2013 and at such time, we had a controlling stockholder who appointed our Board. Over the past few years, directors have departed from our Board for a number of different reasons, but we are fortunate to have several of our original directors remain with us, including our current Lead Independent Director, Mr. Dudley W. Mendenhall. We believe our current board tenure composition reflects an appropriate mix of historical company knowledge and fresh perspectives.

*We became a public company on August 8, 2013. The longest possible tenure is 5+ years from that date

•Awareness and Oversight of Environmental, Social and Governance (ESG) Matters. Our Board has increased the Company's efforts on issues such as environmental sustainability and culture and human capital, in order to have a more positive impact on our business and society. As a reflection of the importance of these matters, in 2019, the Board approved a number of amended policies, including, the Anti-Corruption Policy, the Environmental and Energy Policy and Practices and Insider Trading Policy. Certain members of management are responsible for the oversight of these policies and report to the Board with any updates with respect to the implementation of these policies and general performance of the Company in the ESG areas. The Board, with the assistance of management, consistently monitors the Company’s ESG initiatives in an effort to reflect best practices.

Director Nominees

The table below provides summary information about our two director nominees. Our directors are elected by a plurality of votes cast. For more information, refer to section Election of Class I Directors (Proposal 1). The Board recommends that you vote "FOR ALL" of the director nominees.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Age

|

Director Since

|

Occupation

|

Committee(s)

|

|

Independent Directors

|

|

|

|

|

|

Dudley W. Mendenhall

|

65

|

June 2013

|

Independent Financial Consultant.

Former VP, Strategy, Planning, and Operations of HP

|

Chair of Audit and Member of Compensation

|

|

Elizabeth A. Fetter

|

61

|

|

June 2017

|

Former CEO and President of Symmetricom Inc.

|

Chair of Compensation and Member of Nominating and Corporate Governance

|

PROXY STATEMENT

Fox Factory Holding Corp. (which we refer to as “we,” “us,” “our,” “FOX” or the “Company”) is furnishing this Proxy Statement in connection with the solicitation by our Board of Directors (our “Board”) of proxies to vote at the 2020 Annual Meeting of Stockholders ("the Annual Meeting"), which will be held via webcast on Thursday, May 7, 2020, at 1:00 p.m. EDT, or at any adjournment or postponement thereof.

We first sent or made available these Proxy Materials (as defined below) to our stockholders on or about March 26, 2020. A copy of this Proxy Statement, the proxy card and our Annual Report for fiscal year 2019 (collectively, the "Proxy Materials") can be found at the web address www.proxyvote.com. When we refer to the Company’s fiscal year, we mean the annual period ending on the Friday closest to December 31 of the stated year. Information in this Proxy Statement for 2019 generally refers to our 2019 fiscal year, which was from December 29, 2018 through January 3, 2020 (“fiscal year 2019”).

2020 ANNUAL MEETING INFORMATION

Date and Time. The Annual Meeting will be held “virtually” through a webcast on Thursday, May 7, 2020, at 1:00 p.m. EDT. There will be no physical meeting location. The meeting will only be conducted via a webcast.

Access to the Webcast of the Annual Meeting. The webcast of the Annual Meeting will begin promptly at 1:00 p.m. EDT. Online access to the webcast will open approximately 30 minutes before the start of the Annual Meeting to allow time for you to log in and test your computer system. We encourage you to access the meeting prior to the start time.

Login Instructions. As the Annual Meeting is being conducted via a webcast, there is no physical meeting location. To attend the Annual Meeting, log in at www.virtualshareholdermeeting.com/FOXF2020. You will need your unique control number included on your proxy card (printed in the box and marked by an arrow) or on the instructions that accompanied your proxy materials. We recommend that you log in a few minutes before the Annual Meeting to ensure you are logged in when the Annual Meeting starts.

Submitting Questions at the Annual Meeting. Once online access to the Annual Meeting is open, stockholders may submit questions, if any, on www.virtualshareholdermeeting.com/FOXF2020. You will need your unique control number included on your proxy card (printed in the box and marked by an arrow) or on the instructions that accompanied your proxy materials. Questions pertinent to Annual Meeting matters will be answered during the Annual Meeting, subject to time constraints.

Voting Your Shares at the Annual Meeting. You may vote your shares at the Annual Meeting even if you have previously submitted your vote. For instructions on how to do so, see the section below titled “How do I vote my shares at the Annual Meeting?”.

QUESTIONS AND ANSWERS ABOUT

THIS PROXY STATEMENT AND THE ANNUAL MEETING

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will consider and vote on the following matters:

•Proposal 1: To elect two Class I directors, described in the Proxy Statement, each to serve for a term to expire at the 2023 Annual Meeting of Stockholders.

•Proposal 2: To ratify the appointment of Grant Thornton LLP as our independent public accountants for fiscal year 2020.

•Proposal 3: To vote on a resolution to approve the Company's executive compensation.

The stockholders will also consider and act on any other matters as may properly come before the meeting, or any adjournment or postponement thereof.

How are the Proxy Materials being delivered?

The SEC has adopted a “Notice and Access” rule that allows companies to deliver a Notice of Internet Availability of Proxy Materials, which we refer to as the Notice, to stockholders in lieu of a paper copy of the Proxy Materials. The Notice provides instructions as to how shares can be voted. Shares must be voted either by telephone, internet or by completing and returning a proxy card. Shares cannot be voted by marking, writing on and/or returning the Notice. Any Notices that are returned will not be counted as votes. Instructions for requesting a paper copy of the Proxy Materials are set forth on the Notice.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING:

The Proxy Materials are available at www.proxyvote.com. Enter the unique control number located on the Notice or proxy card to access the Proxy Materials.

Who may attend the Annual Meeting?

Anyone who was a stockholder as of the close of business on March 9, 2020 may attend the Annual Meeting via webcast. Broadridge Financial Solutions, Inc. (“Broadridge”) has been selected as our inspector of election. As part of its responsibilities, Broadridge is required to independently verify that you are a FOX stockholder eligible to attend the Annual Meeting and to determine whether you may vote in person at the Annual Meeting (via webcast).

Who is entitled to vote at the Annual Meeting?

Only stockholders of record of our common stock at the close of business on March 9, 2020, the record date, are entitled to vote at the Annual Meeting. There were 38,602,699 shares of our common stock outstanding on March 9, 2020. Such stockholders of record are entitled to cast one vote per share on all matters.

How do I participate in the Annual Meeting?

Instructions on how to connect and participate in the Annual Meeting, including how to demonstrate proof of ownership of our common stock, are posted at www.proxyvote.com. To attend the Annual Meeting, log in at www.virtualshareholdermeeting.com/FOXF2020. If you do not have your unique control number that is printed in the box marked by the arrow on your Notice or your proxy card (if you received a printed copy of the proxy materials), you will only be able to listen to the Annual Meeting.

How do I vote my shares at the Annual Meeting?

You may vote your shares at the Annual Meeting even if you have previously submitted your vote. To vote at the Annual Meeting, log in at www.virtualshareholdermeeting.com/FOXF2020. You will need your unique control number included on your proxy card (printed in the box and marked by the arrow) or on the instructions that accompanied your proxy materials. If you do not have your unique control number, you will only be able to listen to the Annual Meeting.

How do I vote my shares without attending the Annual Meeting?

Stockholders of record may vote their shares by appointing a proxy to vote on your behalf by promptly submitting the proxy card, which is solicited by the Board. Our Board has designated the persons named in the proxy card as proxies. The designated proxies are officers of the Company. They will vote as directed by the completed proxy card. Stockholders of record also have the opportunity to appoint another person to attend the Annual Meeting (via webcast) and vote on their behalf by inserting such other person’s name on the proxy card and returning the duly executed proxy card to us.

There are three ways to vote by proxy:

1.By Mail -

Complete, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing; c/o Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717.

2.By Telephone - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. EDT on May 6, 2020. Have your proxy card in hand when you call and then follow the instructions.

3.By Internet - www.proxyvote.com

Use the internet to transmit your voting instructions and for electronic delivery of information until 11:59 p.m. EDT on May 6, 2020. Have your proxy card in hand when you access the website and then follow the instructions to obtain your records and to create an electronic voting instruction form.

If you received a proxy card in the mail but choose to vote by telephone or internet, you do not need to return your proxy card.

If your shares are held in the name of a bank, broker or other record holder, follow the voting instructions on the form that you receive from them. The availability of telephone or internet voting will depend on the bank’s, broker’s or other record holder’s voting process. Your bank, broker or other record holder may not be permitted to exercise voting discretion as to some of the matters to be acted upon. Therefore, please give voting instructions to your bank, broker or other record holder.

You may vote by telephone or internet until 11:59 p.m. EDT on May 6, 2020, or Broadridge must receive your paper proxy card by 11:59 p.m. EDT on May 6, 2020.

How will my proxy be voted?

All properly completed, unrevoked proxies, which are received prior to the close of voting at the Annual Meeting, will be voted in accordance with the specifications made. If a properly executed, unrevoked written proxy card does not specifically direct the voting of shares covered, the proxy will be voted:

•FOR ALL the individuals nominated as a director in Proposal 1, described in this Proxy Statement, for a term to expire at the 2023 Annual Meeting of Stockholders;

•FOR Proposal 2, the ratification of the appointment of Grant Thornton LLP as our independent public accountants for fiscal year 2020;

•FOR Proposal 3, the approval of the Company’s executive compensation; and

•in accordance with the judgment of the persons named in the proxy as to such other matters as may properly come before the Annual Meeting, or any adjournment or postponement thereof.

The Board is not aware of any other matters that may properly come before the Annual Meeting. However, should any such matters come before the Annual Meeting, it is the intention of the persons named in the proxy card to vote all proxies (unless otherwise directed by stockholders) in accordance with their judgment on such matters.

May I revoke or change my vote?

If you are a stockholder of record, you may revoke your proxy at any time before it is actually voted by giving written notice of revocation to our Corporate Secretary, by delivering a proxy bearing a later date or by attending and voting at the Annual Meeting. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically make that request. If you are a beneficial owner of shares, you may submit new voting instructions by contacting your bank, broker or other record holder or, if you have obtained a legal proxy from your bank, broker or other record holder giving you the right to vote your shares, by attending and voting at the Annual Meeting.

Will my vote be made public?

All proxies, ballots and voting materials that identify the votes of specific stockholders will generally be kept confidential, except as necessary to meet applicable legal requirements and to allow for the tabulation of votes and certification of the vote.

What constitutes a quorum, permitting the meeting to conduct its business?

The presence at the Annual Meeting, in person or by proxy, of holders of a majority of the issued and outstanding shares of common stock entitled to vote as of the record date is considered a quorum for the transaction of business. If you submit a properly completed proxy or if you attend the Annual Meeting to vote in person, your shares of common stock will be considered part of the quorum. Stockholders who participate in the Annual Meeting online at www.virtualshareholdermeeting.com/FOXF2020 will be considered to be attending the meeting in person for purposes of determining whether a quorum has been met.

Shares represented by proxies that are marked “Abstain” or "Withhold" will be counted as shares present for purposes of determining the presence of a quorum. Shares of stock entitled to vote that are represented by broker non-votes will be counted as shares present for purposes of determining the presence of a quorum. A broker non-vote occurs when the broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power to vote on that proposal without specific voting instructions from the beneficial owner.

How many votes are needed to approve a proposal?

Proposal 1

Assuming the presence of a quorum, each director nominee receiving a plurality of the votes cast at the Annual Meeting (in person or by proxy) will be elected as a director. No stockholder shall be permitted to cumulate votes for the election of directors. The election of directors is a non-discretionary item and brokers may not vote on Proposal 1 without specific voting instructions from beneficial owners, resulting in a broker non-vote. Broker non-votes and withheld votes are not counted toward the election of directors or toward the election of the individual nominees specified on the proxy, and therefore, have no effect on Proposal 1.

Proposal 2

Assuming the presence of a quorum, the affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting (via webcast) and entitled to vote is required to ratify the appointment of Grant Thornton LLP as our independent registered public accountants for fiscal year 2020. An abstention is not counted toward the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm, and the effect of an abstention is the same as a vote “Against” the ratification. Ratification of this appointment is a discretionary item upon which your bank or broker has the authority to vote uninstructed shares. Should your broker not indicate their vote relating to the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for fiscal year 2020, but otherwise appoint the proxies, your shares will be voted “For” the ratification of the appointment of Grant Thornton LLP as the independent registered public accounting firm for fiscal year 2020.

Proposal 3

Assuming the presence of a quorum, the affirmative vote of a majority of the shares present in person or by proxy, at the Annual Meeting and entitled to vote on the proposal is required to approve the advisory vote on executive compensation. Proposal 3 is a non-discretionary item and brokers may not vote on Proposal 3 without specific voting instructions from beneficial owners, resulting in a broker non-vote. Neither a broker-non vote nor an abstention is counted toward the approval, and the effect of each is the same as a vote “Against” the approval. Because the vote on this proposal is advisory in nature, it will not be binding on the Board. However, the Board will consider the outcome of the vote along with other factors when making its decision about the compensation of our Named Executive Officers. See "Compensation Discussion and Analysis - Say-on-Pay Outcome and Stockholder Outreach Efforts" for additional information.

Who will count the vote?

Representatives of Broadridge will tabulate the votes and act as the inspectors of election.

How can I find the voting results of the Annual Meeting?

We will report the voting results in a Current Report on Form 8-K within four business days of the Annual Meeting.

How is the solicitation being made?

We, the Company, are making this solicitation and as such, the cost of solicitation of proxies will be borne by us. Our directors, officers, and employees may make solicitation, personally or by telephone, email or fax. The Notice and, if requested, the Proxy Materials will be distributed to beneficial owners of common stock through brokers, custodians, nominees and other like parties, and we expect to reimburse such parties for their charges and expenses.

Where can I find more information about Fox Factory Holding Corp.?

We file reports and other information with the SEC. You may read and copy this information at the SEC’s public reference facilities. Please call the SEC at 1-800-SEC-0330 for information about these facilities. This information is also available at our website at http://investor.ridefox.com/ and at the internet site maintained by the SEC at http://www.sec.gov.

ELECTION OF CLASS I DIRECTORS

(PROPOSAL 1)

The Board of Fox Factory Holding Corp. is currently comprised of seven individuals and is divided into three classes serving staggered three year terms. The terms of office of Classes I, II and III expire at different times in annual succession, with one class being elected at each Annual Meeting of Stockholders. Mr. Mendenhall and Ms. Fetter are Class I directors and are up for election at this year’s Annual Meeting of Stockholders. Mr. Waitman and Mr. Dennison are Class II directors and will serve until the 2021 Annual Meeting of Stockholders, or earlier in the case of their death, resignation or removal. Ms. Hlay, Mr. Enterline and Mr. Duncan are Class III directors and will serve until the 2022 Annual Meeting of Stockholders, or earlier in the case of their death, resignation or removal.

The Class I directors are proposed to be elected at the Annual Meeting to serve for a term to expire at the 2023 Annual Meeting of Stockholders or earlier in the case of their death, resignation or removal. The Board has nominated Mr. Mendenhall and Ms. Fetter for election as Class I directors. The nominees have indicated a willingness to stand for election and to serve if elected. You may vote "For All" or "Withhold All" for the nominees or "For All Except" and indicate which nominee for which you are withholding your vote. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Unless otherwise indicated in your proxy, the persons named as proxies in the proxy card, or their substitutes, will vote your proxy for the nominee, who has been designated as such by the Board. In the event that a nominee for director withdraws or for any reason is not able to serve as a director, we will vote your proxy for any replacement nominee designated by the Nominating and Corporate Governance Committee and the Board, if such a replacement nominee is designated. The Nominating and Corporate Governance Committee recommended each nominee that the Board recommends to stockholders to the Board. The following paragraphs describe the business experience and education of our directors.

Directors Up for Re-Election

|

|

|

|

|

|

|

|

|

|

|

|

|

Dudley W. Mendenhall

Lead Independent Director

Age: 65

Independent Director Since: June 2013

Committees: Chair of Audit and Member of Compensation

Financial Expert

|

Dudley W. Mendenhall was named Lead Independent Director in June 2019 after serving as Chair of FOX's Board since July 2017. He joined FOX as a director of its subsidiary in February 2012 and was appointed to serve as a member of the Company's Board in June 2013. Since July 2012, Mr. Mendenhall has been an independent consultant providing financial advisory services. He was Vice President, Strategy, Planning and Operations in the office of Strategy and Technology at Hewlett-Packard Co. from January 2010 to July 2012; Chief Financial Officer of Solera Holdings Inc., a provider of software and services to the automobile insurance claims processing industry, from March 2009 to August 2010; and Chief Financial Officer of Websense Inc. from September 2007 to March 2009. From April 2003 to September 2007, Mr. Mendenhall was Senior Vice President and Chief Financial Officer of K2 Inc., an international sporting equipment manufacturer. He earned a Bachelor of Arts degree in economics from Colorado College.

Mr. Mendenhall’s experience as chief financial officer at public companies and his background in finance and accounting assists our Board with financial review and risk management obligations.

|

|

|

|

|

|

|

|

|

|

|

|

|

Elizabeth A. Fetter

Director

Age: 61

Independent Director Since: June 2017

Committees: Chair of Compensation and Member of Nominating and Corporate Governance

|

Elizabeth A. Fetter has served on our Board since June 2017. She has served on the Talend S.A. Board of Directors since January 2020, and the McGrath Rentcorp Board of Directors since 2014. She served on the Alliant International University Inc. Board of Directors from 2015 to 2017 and on the Connexed Technologies Inc. Board of Directors since 2004. Ms. Fetter served as a member of the Symmetricom Inc. Board of Directors from 2000 to 2013 and was appointed President and Chief Executive Officer of Symmetricom Inc. in April 2013. She served in this capacity until Microsemi Corp. acquired Symmetricom Inc. in November 2013. Ms. Fetter previously was President and Chief Executive Officer of NxGen Modular LLC from 2011 to 2012, and was President, Chief Executive Officer and a Director of Jacent Technologies in 2007. She also served on the Quantum Corp. Board of Directors from 2005 to 2013 and on the Ikanos Corp. Board of Directors from 2008 to 2009. She previously was the Alliant International University Inc. chair of the board of trustees and served as a trustee from 2004 to 2013. Ms. Fetter earned a Bachelor of Arts degree in communications from Pennsylvania State University, a Master of Science degree in industrial administration from Carnegie Mellon University (Tepper & Heinz Schools) and an Advanced Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization.

Ms. Fetter's more than 25 years of public and private company board service and past chief executive officer experience at multiple firms gives her the qualifications to serve on our Board.

Directors Not Up for Re-Election

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael C. Dennison

Director and Chief Executive Officer

Age: 52

Non-Independent Director Since: February 2018

|

Mr. Dennison has served as a director on FOX's Board since February 2018. In August 2018, he assumed the role of President, Powered Vehicles Group, and he was later named Chief Executive Officer in June 2019. Prior to FOX, he most recently was President and Chief Marketing Officer for Flex Ltd. (NASDAQ:FLEX) from February 2012 to August 2018. While at Flex Ltd., Mr. Dennison served in a number of leadership roles, from leading the procurement and global supply chain organizations for the company to serving as Senior Vice President of Business Management for both the High-Velocity Solutions Group and the Mobile and Consumer Segment. Prior to joining Flex Ltd., he was the Regional Director at Arrow Electronics, based in New York. Mr. Dennison earned a Bachelor of Arts degree in liberal arts from Oregon State University in 1989.

Mr. Dennison’s current position as Chief Executive Officer and extensive management experience with international consumer products, high-technology, and global supply chain management qualifies him to serve on our Board.

|

|

|

|

|

|

|

|

|

|

|

|

|

Larry L. Enterline

Executive Chair of the Board

Age: 67

Non-Independent Director Since: June 2013

|

Larry L. Enterline joined FOX in March 2011 as the Company’s Chief Executive Officer, was appointed to the Board in June 2013, and was appointed Executive Chair of the Board in June 2019 upon his retirement as Chief Executive Officer. Prior to joining FOX, he was Chief Executive Officer of Vulcan Holdings Inc., a private investment holding and consulting services company he founded. Before founding Vulcan Holdings, Mr. Enterline was Chief Executive Officer of COMSYS IT Partners Inc., an IT staffing and solutions company. Mr. Enterline served in various management roles earlier in his career, including Senior Vice President of Worldwide Sales and Service Organization at Scientific-Atlanta Inc., a Georgia-based manufacturer of cable television, telecommunications and broadband equipment. Mr. Enterline earned a Bachelor of Science degree in electrical engineering from Case Western Reserve University in 1974, and a Master of Business Administration degree from Cleveland State University in 1988.

Mr. Enterline’s experience as our former Chief Executive Officer, service on other public company boards and leadership experience give him the qualifications and skills to serve on our Board.

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas E. Duncan

Director

Age: 55

Independent Director Since: July 2017

Committees: Chair of Nominating and Corporate Governance

|

Thomas E. Duncan joined the Board in July 2017. He is President and Chief Executive Officer of the North American division of Positec Tool Corp., a global manufacturer and marketer of power tools and lawn and garden equipment and accessories, including the Rockwell and WORX brands. Prior to this he was a Vice President of Robert Bosch Tool Corp. from June 2001 to September 2003, and was a Vice President at Vermont American Corp. from September 1992 to June 2001 and until it was acquired by Robert Bosch Tool Corp. Mr. Duncan has been a director on the Outdoor Power Equipment Institute Board of Directors since October 2015 and a director on the Folks Center for International Business Board of Directors at University of South Carolina's Darla Moore School of Business since September 2016. In 2018, Mr. Duncan joined the Board of Directors of Fast Growing Trees (SP FGT Holdings LLC), a privately held e-commerce company. He earned a Bachelor of Arts degree in rhetoric from the University of Virginia and a Master of International Business from University of South Carolina's Darla Moore School of Business.

Mr. Duncan's over 25 years of experience in the manufacturing and consumer durable goods industry gives him the qualifications to serve on our Board.

|

|

|

|

|

|

|

|

|

|

|

|

|

Jean Hlay

Director

Age: 60

Independent Director Since: February 2019

Committees: Member of Audit and Compensation

|

Jean Hlay has served on the Board since February 2019. She has more than 25 years of executive and senior leadership experience in the consumer branded products manufacturing and distribution industries. Ms. Hlay most recently was President and Chief Operating Officer of MTD Products, Inc., a privately owned, global manufacturer and distributor of residential and commercial outdoor power equipment with over 7,000 employees in 16 major locations worldwide. She was named to the MTD Products, Inc. Board of Directors in 2002, was appointed President and COO in 2009, and continued in both roles until 2018. Prior to MTD, Ms. Hlay was Chief Financial Officer of Crossville Rubber Products, Inc./Plastivax, Inc., a manufacturer of rubber and vinyl floor mats serving the automotive industry, and she began her career at Price Waterhouse (now PwC). She has been serving on the Pella Corp. Board of Directors since 2012. From 2006 to 2018, she served on the Outdoor Power Equipment Institute Board of Directors. Additionally, in 2019, Ms. Hlay joined the Boards of Directors of both Blain's Supply Inc. and Buckeye Corrugated Inc. Ms. Hlay earned a Bachelor of Science, Business Administration degree in accounting from Bowling Green State University and is a CPA.

Ms. Hlay's over 25 years of experience in the consumer products manufacturing industry as well as her background in finance and accounting gives her the qualifications to serve on our Board.

|

|

|

|

|

|

|

|

|

|

|

|

|

Ted Waitman

Director

Age: 70

Independent Director Since: June 2013

Committees: Member of Audit and Nominating and Governance

|

Ted Waitman has served on our Board since June 2013. Since 1978, he has held various leadership positions, including President and Chief Executive Officer of CPM Holdings Inc. from 1996 to 2019 and Director at the same organization since 2003. He resigned as CEO of CPM Holdings Inc. in July 2019 and now serves as Director and Special Advisor. From 2006 to 2008, Mr. Waitman was an independent director of Compass Diversified Holdings. He previously was a Director of the American Feed Industry Association and President of the Process Equipment Manufacturers’ Association. Mr. Waitman earned a Bachelor of Science degree in industrial engineering from the University of Evansville.

Mr. Waitman’s various leadership positions and extensive management and operating experience qualifies him to serve on our Board.

Required Vote for Election of Directors

The election of directors is by plurality vote of holders present, in person or by proxy at the Annual Meeting and entitled to vote thereon, with each nominee receiving a plurality of the votes cast to be elected as a director.

Recommendation of the Board

The Board recommends that you vote “FOR ALL” the nominees, Mr. Mendenhall and Ms. Fetter, to be elected to our Board as Class I directors for a term ending at our 2023 Annual Meeting of Stockholders or earlier in the case of their death, resignation or removal.

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

(PROPOSAL 2)

General

Our Audit Committee has appointed Grant Thornton LLP as independent public accountants to examine our consolidated financial statements for fiscal year 2020, and has determined that it would be desirable to request that the stockholders ratify the appointment.

You may vote “For” or “Against” this proposal, or you may “Abstain” from voting.

Grant Thornton LLP is an independent registered public accounting firm and audited our financial statements for the fiscal years ended January 3, 2020, December 28, 2018, and December 29, 2017. Based on its past performance during these audits, the Audit Committee has selected Grant Thornton LLP as the independent auditor to perform the audit of our financial statements for fiscal year 2020. Information regarding Grant Thornton LLP can be found at www.grantthornton.com.

Representatives of Grant Thornton LLP are expected to be present at the Virtual Annual Meeting, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

Fees

The following table sets forth the total amount billed to us for the fiscal years ended January 3, 2020 December 28, 2018, and December 29, 2017 by Grant Thornton LLP.

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year

2019

|

Fiscal Year

2018

|

|

Audit Fees (1)

|

$

|

1,740,260

|

|

$

|

1,617,935

|

|

|

Audit-Related Fees (2)

|

42,601

|

|

71,924

|

|

|

Tax Fees (3)

|

81,301

|

|

113,172

|

|

|

Total

|

$

|

1,864,162

|

|

$

|

1,803,031

|

|

(1)“Audit Fees” are aggregate fees billed by Grant Thornton LLP for professional services for the audit of our annual financial statements included in our annual reports on Form 10-K and for the review of our interim financial statements included in our quarterly reports on Form 10-Q or services that are normally provided by Grant Thornton LLP in connection with statutory and regulatory filings or engagements.

(2) "Audit-Related Fees" are aggregate fees billed by Grant Thornton LLP for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported under "Audit Fees. "These services include consultations and audits related to mergers and acquisitions; and services related to offering of common stock and consents for

registration statements.

(3)“Tax Fees” are aggregate fees billed by Grant Thornton LLP for professional services rendered in connection with tax compliance, tax advice and tax planning.

The Audit Committee has evaluated Grant Thornton LLP’s qualification, performance and independence and has determined that services provided by Grant Thornton LLP were permitted under the rules and regulations concerning public accountant's independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as amended, as well as by the Public Company Accounting Oversight Board (the “PCAOB”).

Pre-Approval Policy

The Audit Committee’s policy is to pre-approve any independent accountant’s engagement to render audit and or permissible non-audit services (including the fees charged and proposed to be charged by independent accountants) subject to the de minimus exceptions under Section 10A(i)(1)(B) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and as otherwise required by law. Non-audit services may include audit-related services, tax services, or other services. The Audit Committee annually reviews whether the provision of permitted non-audit services is compatible with maintaining the accountant’s independence. The Audit Committee pre-approved all "Audit Fees", "Audit-Related Fees" and "Tax Fees" in fiscal years 2019 and 2018.

Required Vote for Stockholder Approval

The affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting and entitled to vote thereon is required to ratify the appointment.

Recommendation of the Board

The Board recommends that you vote “FOR” the ratification of the appointment of Grant Thornton LLP to serve as independent auditor for the Company for the fiscal year ending January 1, 2021.

DIRECTOR COMPENSATION

Non-employee Director Compensation for Fiscal Year 2019

Any non-employee director who, directly, indirectly, or beneficially owns 5% or more of outstanding securities or is employed by or represents a stockholder of us that, directly, indirectly, or beneficially owns 5% or more of the Company’s outstanding securities is not entitled to receive any cash compensation or equity-based compensation for his or her service on the Board. Such non-employee director is, however, entitled to receive reimbursement for reasonable expenses that he or she properly incurs in connection with attending Board meetings and performing duties as a director.

For fiscal year 2019 our Non-employee Director Compensation Plan, as amended and restated, provided for an annual cash retainer of $50,000, payable quarterly, for service as a non-employee director of FOX. A non-employee director who serves as Chair of the Board is paid an additional annual retainer of $25,000 and an additional equity award outlined below, plus the other retainers and compensation he may receive. The chairpersons of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee are provided additional annual retainers of $15,000, $7,500 and $7,500, respectively. The Lead Independent Director is paid an additional annual retainer of $25,000. Each non-employee director serving on the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee is provided additional annual retainers of $4,000, $3,000, and $3,000, respectively. Finally, each of the non-employee directors is entitled to receive reimbursement for reasonable expenses that they properly incur in connection with attending Board meetings and their duties as a director. For fiscal year 2019, such annual retainers were prorated for mid-year appointments with respect to Mr. Mendenhall.

Pursuant to our Non-employee Director Compensation Plan, as amended and restated, non-employee directors are also granted annual equity-based compensation awards in the form of restricted stock units ("RSUs") pursuant to the 2013 Omnibus Plan, as amended. These awards vest on the day immediately prior to the next Annual Meeting of Stockholders, subject to accelerated vesting in the event of the director’s death or a change in control of the Company and are subject to such additional terms and conditions as may be set forth in the applicable award agreement and plan. Subject to applicable laws and our policies in place for equity-based awards, through fiscal year 2019, the non-employee directors were entitled to receive an annual award of RSUs determined by dividing $100,000, by the closing price of our common stock on the date of grant. In fiscal year 2019, each non-employee director received an award of 1,328 RSUs on May 2, 2019. These awards will vest on the day immediately prior to the Annual Meeting, subject to accelerated vesting in the event of a director’s death or a change in control of the Company. The non-employee director who serves as the Chair or the Lead Independent Director is entitled to receive an additional award of RSUs determined by dividing $15,000 by the closing price of our common stock on the date of grant. Executive Chair is considered an employee of the Company and is not eligible for the aforementioned $15,000 additional RSU award.

The following table sets forth information for the year ended January 3, 2020 regarding the compensation awarded to, earned by or paid to persons who served as our directors during fiscal year 2019 who are not Named Executive Officers.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIRECTOR COMPENSATION - FISCAL YEAR 2019

|

|

|

|

|

|

|

Name

|

Fees earned or paid in cash

|

|

Stock awards (1)

|

|

Total

|

|

Dudley W. Mendenhall

|

$

|

96,000

|

|

|

$

|

115,000

|

|

|

$

|

211,000

|

|

|

Thomas E. Duncan

|

57,500

|

|

|

100,000

|

|

|

157,500

|

|

|

Elizabeth A. Fetter

|

57,900

|

|

|

100,000

|

|

|

157,900

|

|

|

Jean Hlay

|

32,162

|

|

|

109,176

|

|

(2)

|

|

141,338

|

|

|

Ted Waitman

|

61,850

|

|

|

100,000

|

|

|

161,850

|

|

(1)Amounts in this column represent the aggregate grant date fair value computed in accordance with FASB Topic 718 of RSUs awarded in 2019 pursuant to the 2013 Omnibus Plan. The RSUs vest on the day before the Company's Annual Meeting.

(2)Ms. Hlay was appointed to our Board on February 25, 2019 and was granted an additional prorated award for her Board services from February 2019 to May 2019.

CORPORATE GOVERNANCE

Our business and affairs are managed under the direction of our Board, which currently consists of seven members. The primary responsibilities of our Board are to provide oversight, strategic guidance, counseling and direction to our management.

The Board of Directors

Governance Guidelines

Our Board has adopted a set of governance guidelines (the "Governance Guidelines") to assist our Board and its committees in performing their duties and serving the best interests of our Company and our stockholders. The Governance Guidelines cover topics including, but not limited to, director selection and qualification, director responsibilities and operation of our Board, director access to management and independent advisors, director compensation, director orientation and continuing education, succession planning, recoupment of performance-based compensation and the annual evaluations of our Board.

Code of Ethics

Our Board has adopted a Code of Ethics that applies to all of our employees, officers and directors, including our principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing similar functions. The Code of Ethics is posted on our website http://investor.ridefox.com/. The Code of Ethics can only be amended by the approval of a majority of our Board, including a majority of our independent directors. Any waiver to the Code of Ethics for an executive officer or director may only be granted by our Board and must be timely disclosed as required by applicable law. Any amendments to the Code of Ethics, or any waivers of its requirements, will be disclosed on our website at http://investor.ridefox.com/ or by filing with the SEC a Current Report on Form 8-K, in each case, if such disclosure is required by rules of the SEC or Nasdaq Listing Rules.

Leadership Structure

The Board believes its current leadership structure best serves the interest of the stockholders. The Board does not have a policy as to whether the Chair should be an independent director, but when the Chair is not an independent director, the independent directors appoint a “Lead Independent Director.” Mr. Mendenhall, an independent director, is our “Lead Independent Director” and serves in a leadership capacity on our Board. As Lead Independent Director, Mr. Mendenhall is responsible for: approving Board meeting agendas; in consultation with the non-employee directors and the Executive Chair, when applicable, approving Board meeting schedules to ensure there is sufficient time for discussion of all agenda items; approving the type of information to be provided to directors for Board meetings; presiding at all executive sessions of the non-employee directors (which are held after every Board meeting); when applicable, serving as liaison between the Executive Chair and the independent directors; being available for consultation and direct communication with the Company’s stockholders; calling meetings of the non-employee directors when necessary and appropriate; and performing such other duties as the Board may from time to time designate. The Chief Executive Officer has general charge and management of the affairs, property and business of the corporation, under the oversight, and subject to the review and direction, of the Board, but does not serve in a leadership capacity on the Board. The separation of the roles of Chief Executive Officer and the Executive Chair allows the Chief Executive Officer to focus primarily on leading the day-to-day operations of the Company while the Executive Chair can focus on leading the Board in its consideration of strategic issues and monitoring corporate governance, community relations and stockholder issues.

Our Board has three standing committees, comprised solely of independent directors, the Audit Committee, chaired by Mr. Mendenhall; the Compensation Committee, chaired by Ms. Fetter; and the Nominating and Corporate Governance Committee, chaired by Mr. Duncan. The responsibilities and authority of each committee are described later in this Proxy Statement.

Risk Oversight

The Board believes risk management is an important aspect of our business. The Board oversees and regularly reviews the Company's management of material risks. While the Board as a whole ultimately has the responsibility for overseeing risk management, the Board has delegated certain duties with respect to risk oversight to our Audit Committee. In furtherance of such purpose, the Audit Committee Charter specifically requires the Audit Committee to discuss with management, the internal auditor or internal audit service provider, as the case may be, and the independent public accountant the Company’s major risk exposures (whether financial, operations or both) and the steps management has taken to monitor and control such exposure, including the Company’s risk assessment and risk management policies. The Audit Committee reports to the Board with its findings.

Board Meetings

During fiscal year 2019, the Board held five meetings. All of our directors who served in fiscal year 2019 attended or participated in 75% or more of the aggregate of (1) the total number of meetings of the Board (held during the period for which such person has been a director) and (2) the total number of meetings held by all committees of the Board on which such person served (during the periods that such person served).

Attendance of Directors at the Annual Meeting

Pursuant to our Governance Guidelines, our directors are encouraged to attend our Annual Meetings of Stockholders. Three of our directors attended our 2019 Annual Meeting of Stockholders.

Policies

Hedging and Pledging Policy

Our Board has adopted the Policy Regarding Insider Trading, Tipping and Other Wrongful Disclosures, or the Insider Trading Policy. The Insider Trading Policy prohibits employees (including part-time and temporary employees), officers, directors, consultants and contractors of the Company from hedging transactions with respect to shares of our common stock. The Insider Trading Policy also requires directors, executive officers and designated insiders to obtain pre-approval from one of the Company's Compliance Officers before pledging shares of our common stock.

Clawback Policy