By Joe Flint and Suzanne Vranica

Advertisers will get their first look this week at what the

broadcast networks have cooked up for the fall TV season during

glitzy, star-filled presentations followed by booze-soaked

parties.

The shows won't be the only new things on display. The major

networks -- ABC, Fox, CBS and NBC -- all have fresh faces calling

the shots on their programming after a year of massive change in

the entertainment industry.

At stake at the "upfronts," as the annual ritual is known:

around $10 billion in ad-spending commitments. In presentations at

New York's Radio City Music Hall, Lincoln Center and other

well-known venues, networks will try to make the case to marketers

that broadcast television, despite suffering significant viewership

declines for several years, is still the best way for brands to

reach large audiences.

Walt Disney Co.'s acquisition of most of the entertainment

assets of the former 21st Century Fox led to new chiefs at both

Disney's ABC and the Fox network, now owned by the newly formed Fox

Corp. At Disney, former Fox executive Dana Walden oversees the bulk

of the TV entertainment operations. Known as a creative executive,

Ms. Walden was involved in several hit shows over the years

including "Modern Family" and "Glee."

Fox Corp. lured Charlie Collier away from his senior role at AMC

Networks to become chief executive of entertainment for Fox. While

at AMC he was involved with "Mad Men," "Breaking Bad" and "The

Walking Dead."

At CBS Corp., Leslie Moonves, who as chief executive put his

personal stamp of approval on every show the network aired, was

forced out last year amid allegations of sexual harassment, which

he denied. Acting CEO Joe Ianniello promoted Showtime Networks head

David Nevins to chief content officer, giving him oversight over

CBS programming. Successful shows during his watch include

"Homeland" and "Billions."

Last fall, Robert Greenblatt resigned as entertainment chairman

of Comcast Corp.'s NBC and now holds a top position at AT&T

Inc.'s WarnerMedia. NBC replaced Mr. Greenblatt with veteran

executives George Cheeks and Paul Telegdy.

"It feels like there is clarity now for these four places," said

Kevin Beggs, chairman of the television group at Lions Gate

Entertainment Corp. Last year, he said, there was a lot of

uncertainty over potential changes coming to the networks and their

parent companies, and how it would impact decision-making.

The ratings picture for broadcasters doesn't look pretty.

Prime-time viewership for three of the big four networks is down,

excluding sports, as consumers flock to Netflix Inc. and other

streaming services. Ratings erosion has been exacerbated by cable

TV cord-cutting.

Despite those challenges, ad spending has been surprisingly

resilient. Spending commitments in the spring TV ad season will

grow an estimated 2.4% to $21.25 billion this year, according to

research firm eMarketer. For 2019 as a whole, networks are expected

to collect $67.23 billion from TV ads, a 1.4% decline from 2018,

according to estimates from media-buyer Zenith.

A few years ago, there were fears in the industry that TV ad

budgets would shrink faster and shift toward tech giants such as

Facebook and Google. "The digital guys have not taken a lot of TV

dollars, surprisingly so," said analyst Michael Nathanson of

MoffettNathanson.

For marketers, getting messages through to consumers continues

to get harder each year. In the fast-growing streaming-video world,

some of the biggest players like Netflix and Amazon.com Inc. show

no ads in their services. Disney's own Disney+ subscription

streaming service, slated to launch this fall, will be ad-free.

"Broadcast television is still the largest storefront window for

advertisers. It's the place that can build brands and move

products," said Fox's Mr. Collier.

Network executives argue that focusing solely on the performance

of their traditional TV shows on the day they air underestimates

their value, since viewership grows over time as people catch up

via DVRs or on-demand services.

"The networks are stuck being judged as they were in 2000 when

there wasn't this explosion of platforms," said Disney's Ms.

Walden. "The business is much more complex now and requires a

longer-range view of the performance of a show."

Jeff Bader, NBC's president of program planning and strategy,

said each episode of the comedy "The Good Place" adds nearly 7

million viewers five weeks after its first airing, through

video-on-demand, Hulu and other outlets. Over the past four years,

NBC is flat in the critical demographic of adults 18 to 49 when

delayed viewing is factored in, he said.

Selling ads to make money off all that delayed viewing is a

major focus for all media companies. "We're getting much better at

monetizing past day seven," said CBS's Mr. Nevins.

The CW Network, a joint-venture between CBS and WarnerMedia,

believes it has boosted viewership with both its online platform

and through an unusual partnership with Netflix, which streams

episodes of CW shows such as "Riverdale" soon after they air on TV.

Viewers who discovered the show on Netflix have returned to the

network for more episodes, the company says.

"We can be everywhere our viewers want to see us," said CW

President Mark Pedowitz.

Jason Kanefsky, chief investment officer at ad buyer Havas

Media, said networks are trying hard to distract from the harsh

reality of a traditional TV ecosystem that is under siege.

"The whole pitch is look over here, please don't look at the

fact that our TV ratings continue to erode," said Jason Kanefsky,

chief investment officer at Havas Media.

Write to Joe Flint at joe.flint@wsj.com and Suzanne Vranica at

suzanne.vranica@wsj.com

(END) Dow Jones Newswires

May 12, 2019 10:14 ET (14:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

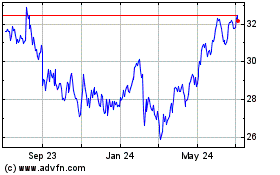

Fox (NASDAQ:FOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

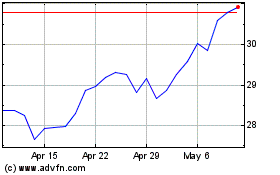

Fox (NASDAQ:FOX)

Historical Stock Chart

From Apr 2023 to Apr 2024