The First of Long Island Corporation (Nasdaq: FLIC), the parent

company of The First National Bank of Long Island, reported net

income and earnings per share for the three and six months ended

June 30, 2020. In the highlights that follow, all comparisons

are of the current three or six-month period to the same period

last year unless otherwise indicated.

SECOND QUARTER HIGHLIGHTS

- Net Income and EPS were $10.8 million and $.45,

respectively, compared to $10.7 million and $.43

- ROA and ROE were 1.02% and 11.30%, respectively,

compared to 1.02% and 11.00%

- Net interest margin was 2.64% versus

2.58%

- Cost of interest-bearing deposits declined 51 basis

points to .96% and cost of interest-bearing liabilities declined 43

basis points to 1.14%

- Cash Dividends Per Share increased 5.9% to $.18 from

$.17

- Provided $621 million in loan modifications and

originated $171 million in SBA Paycheck Protection Program (“PPP”)

loans in support of customers during the pandemic

- Effective Tax Rate was 16.8% versus 16.0%

SIX MONTH HIGHLIGHTS

- Net Income and EPS were $19.9 million and $.83,

respectively, compared to $21.6 million and $.86

- ROA and ROE were .96% and 10.34%, respectively,

compared to 1.03% and 11.15%

- Net interest margin was 2.63% versus

2.57%

- Effective Tax Rate was 16.1% versus 16.9%

Analysis of Earnings – Six Months Ended

June 30, 2020

Net income for the first six months of 2020 was

$19.9 million, a decrease of $1.7 million, or 7.8%, versus the same

period last year. The decrease is due to increases in the

provision for credit losses of $2.5 million and noninterest expense

of $607,000, or 2.0%. These items were partially offset by

increases in net interest income of $405,000, or .8%, and

noninterest income of $428,000, or 8.3%, and a decrease in income

tax expense of $581,000.

The increase in net interest income is mainly

attributable to a reduction in deposit rates in response to

decreases in the Federal Funds Target Rate and a very low interest

rate environment. The cost of savings, NOW and money market

deposits declined 28 basis points to .78% and the cost of

interest-bearing liabilities declined 26 basis points to

1.30%. These decreases far outpaced the 10 basis point

decline in yield on securities and loans which are generally not

subject to immediate repricing with changes in market interest

rates. The increase in net interest income was also

attributable to income from SBA PPP loans of $896,000 and a

favorable shift in the mix of funding as an increase in average

checking deposits of $81.9 million and a decline in average

interest-bearing liabilities of $158.1 million resulted in average

checking deposits comprising a larger portion of total

funding. The increase in average checking deposits is mainly

attributable to the SBA PPP.

The decline in yield on securities and loans was

mainly attributable to an increase in prepayment speeds and lower

yields available on securities purchases and loan

originations. The economic impact of the COVID-19 pandemic

(“pandemic”) has slowed loan and overall balance sheet

growth. The average balance of loans decreased $77.8 million,

or 2.4%, and the average balance of investment securities declined

$64.3 million, or 8.2%. The average balance of loans includes

$62.7 million of SBA PPP loans at a weighted average yield of 2.9%

for the current six-month period. The pandemic and measures

taken to contain it significantly disrupted economic activity in

our area, causing businesses and schools to close and an increase

in unemployment. These disruptions made it difficult to

solicit new business, analyze the financial impact on new and

existing customers and grow our loan pipeline. The pandemic

was largely responsible for a mortgage loan pipeline at quarter end

of $39 million and an increase in average interest-earning bank

balances of $66.6 million.

Net interest margin for the second quarter and

first six months of 2020 was 2.64% and 2.63%, respectively, each

increasing 6 basis points over the comparable periods of 2019.

The increases were mainly attributable to our ability to

reduce the rates paid on interest-bearing deposits faster than our

interest-earning assets repriced downward as a significant portion

of our municipal bond and mortgage loan portfolios have fixed

rates.

The provision for credit losses was $2.5 million

for the first six months of 2020 on a current expected credit loss

(“CECL”) basis as compared to a credit provision of ($35,000) for

the 2019 period on an incurred loss basis. The $2.5 million

provision for the current six-month period was largely attributable

to the pandemic and includes $4.2 million to reflect current and

forecasted economic conditions and $576,000 for net chargeoffs,

partially offset by a decline in outstanding residential and

commercial mortgage loans and lower historical loss rates.

The credit provision of ($35,000) for the 2019 period was driven

mainly by declines in outstanding loans and historical loss rates

partially offset by net chargeoffs.

The increase in noninterest income of $428,000

is primarily attributable to an increase in the non-service

components of the Bank’s defined benefit pension plan of

$523,000. Management remains focused on revenue enhancement

initiatives; however, the pandemic is negatively affecting most

categories of noninterest income.

The increase in noninterest expense of $607,000

includes approximately $300,000 of expense attributable to the

pandemic and $128,000 of severance charges related to the pending

closure and consolidation of three branches. Pandemic

expenses include branch and office sanitizing expenses, cleaning

and safety equipment, IT-related expenditures and special staff

bonuses in recognition of COVID-19 work-related challenges and the

SBA PPP. Other factors which increased noninterest expense

include higher salaries, employee benefits and equity compensation

expense mainly related to hiring a middle market lending team,

salary adjustments and the immediate vesting of stock awards

granted to directors in the second quarter of 2020. These

expenses were partially offset by decreases in FDIC insurance

expense of $413,000 and marketing expense of $210,000. The

decrease in FDIC insurance expense was due to assessment credits

received by the Bank which are now fully utilized.

The decrease in income tax expense of $581,000

is primarily attributable to lower pretax earnings in the current

six-month period as compared to the 2019 period and a decline in

the effective tax rate to 16.1%.

Analysis of Earnings – Second Quarter

2020 Versus Second Quarter 2019

Net income for the second quarter of 2020 of

$10.8 million was relatively unchanged from the comparable period

of 2019. Earnings for the second quarter include an increase

in net interest income of $829,000 and a decrease in the provision

for credit losses of $330,000. Substantially offsetting these

items were increases in noninterest expense and income tax expense

of $884,000 and $114,000, respectively, and a decline in service

charges on deposit accounts of $161,000 due to the pandemic.

The increase in net interest income occurred for substantially the

same reasons discussed above with respect to the six-month periods.

The provision for credit losses was $92,000 for the current

quarter on a CECL basis. The $92,000 provision was mainly

attributable to the pandemic and includes $1.5 million to reflect

current and forecasted economic conditions and $146,000 for net

chargeoffs, partially offset by a decline in outstanding

residential and commercial mortgage loans and lower historical loss

rates. The increase in noninterest expense was primarily

attributable to the items discussed above with respect to the

six-month periods. The increase in income tax expense

reflects higher pretax earnings in the current quarter and an

increase in the effective tax rate to 16.8%.

Analysis of Earnings – Second Quarter

Versus First Quarter 2020

Net income for the second quarter of 2020

increased $1.6 million from $9.1 million earned in the first

quarter. The increase is primarily attributable to an

increase in net interest income of $1.1 million and a decrease in

the provision for credit losses of $2.3 million. Partially

offsetting these items were a decrease in service charges on

deposit accounts of $368,000 due to the pandemic and increases in

salaries, employee benefits and equity compensation expense of

$912,000 and income tax expense of $528,000. The increase in

net interest income occurred for substantially the same reasons

discussed above with respect to the six-month periods. The

decrease in the provision for credit losses reflects lower charges

for current and forecasted economic conditions in the second

quarter as a substantial portion of the estimated negative impact

of the pandemic was recorded in the first quarter, a larger decline

in outstanding residential and commercial mortgage loans in the

second quarter and higher net chargeoffs in the first

quarter. The increase in salaries, employee benefits and

equity compensation expense includes the aforementioned special

staff bonuses, severance charges and a charge for stock awards

granted to directors. The increase in income tax expense

reflects higher pretax earnings in the current quarter and an

increase in the effective tax rate.

Asset Quality

The Bank’s allowance for credit losses to total

loans (reserve coverage ratio) was 1.01% at January 1, 2020 on a

CECL basis, 1.09% at March 31, 2020 and 1.08% at June 30,

2020. The reserve coverage ratio increased 8 basis points

during the first quarter and, excluding Federally-guaranteed SBA

PPP loans, increased 4 basis points during the second quarter to

1.13% at June 30, 2020. The lower increase in the reserve

coverage ratio in the second quarter reflects lower charges for

current and forecasted economic conditions as a substantial portion

of the estimated negative impact of the pandemic was recorded in

the first quarter. The January 1, 2020 implementation of CECL

increased the reserve coverage ratio 9 basis points from .92% at

December 31, 2019 on an incurred loss basis.

Nonaccrual loans, troubled debt restructurings

and loans past due 30 through 89 days all remain at low levels.

Nonaccrual loans increased slightly by $2.1 million during

the second quarter with the increase unrelated to the pandemic or

loan modifications.

Loan Modifications

During the second quarter, the Bank entered into

$621 million of loan modifications on 775 loans. These

modifications were done to support borrowers experiencing financial

disruption and economic hardship as a result of the pandemic.

Loan modifications were evaluated on a case-by-case basis for

borrowers that were current as to principal and interest and were

not in default prior to the pandemic. Modifications

outstanding as of June 30, 2020 are as follows:

|

Type of Modification |

Number of Loans |

Type of Loans |

Outstanding Loan Balance |

Accrued Interest |

|

3 Month Deferral of Principal |

274 |

Small Business |

$23 million |

$94,000 |

|

|

|

|

|

|

|

|

3 Month Deferral of Principal and Interest |

28418928 |

Residential Mortgages Commercial MortgagesMainly C&I |

163 million423 million12 million |

1.4 million4.5 million161,000 |

Accrued interest on loan modifications of $6.2

million is included in interest income for the six months ended

June 30, 2020 and is a component of other assets on the balance

sheet.

As of July 27, 2020, approximately $217 million

of loan modifications came due with $189 million, or 87%, making

their scheduled payment, $16 million requesting and receiving a

further deferral of principal and interest and the remaining $12

million making only a partial payment or no payment at

all.

Second deferrals of principal and interest for

up to an additional three months are considered for certain

borrowers that continue to experience a significant reduction in

income or liquidity as a result of the pandemic. Payments on

all modified loans are scheduled to commence on or before October

1, 2020. Management is carefully monitoring the payment

status of modified loans and the extent such loans become past due

or are in default under their modified terms.

Modified residential and commercial mortgage

loans are secured by first liens on underlying real estate,

substantially all of which is in the New York City (“NYC”)

metropolitan area. Such residential and commercial mortgage

loans have median original loan-to-value ratios of 64% and 58%,

respectively. Concentrations of commercial mortgage loans are

as follows:

| By

Location: |

|

By Property

Type: |

|

County |

Numberof Loans |

Balance at6/30/20 |

|

Type |

Numberof Loans |

Balance at6/30/20 |

|

Suffolk |

50 |

$97 million |

|

Multifamily |

79 |

$206 million |

|

Bronx |

27 |

90 million |

|

Retail |

40 |

100 million |

|

Kings |

29 |

62 million |

|

Office |

20 |

64 million |

|

New York |

19 |

49 million |

|

Mixed Use |

27 |

23 million |

|

Nassau |

38 |

46 million |

|

|

|

|

|

Queens |

13 |

34 million |

|

|

|

|

|

|

|

|

|

|

|

|

Loans to borrowers in the hospitality industry,

such as hotels and restaurants, are not significant.

Modified loans present an elevated level of

credit risk to the Bank because they involve borrowers adversely

affected by the pandemic. Such modifications could result in

a higher level of nonaccrual loans, reversal of accrued interest

and loan chargeoffs in the future which could have a material

negative effect on earnings.

Capital

The Corporation adopted the Community Bank

Leverage Ratio framework in 2020. The Corporation’s Leverage Ratio

was approximately 9.3% at June 30, 2020. The Corporation’s

balance sheet remains positioned for lending and growth.

Serving Customers

The Bank remains focused on serving customers

during the pandemic. Our employees have been heroic in their

efforts to assist customers especially during periods of limited

branch access, split shifts and working remotely. Loan

modifications and lending under the SBA’s PPP provide support to

customers adversely affected by the economic downturn. We

maintain open communication with customers, provide ready access to

deposits through our branch network, ATMs and digital offerings and

processed daily transactions such as deposits and fund

transfers.

The Bank’s participation in the SBA’s PPP for

small business customers began in the second quarter of 2020 and

includes 687 loans with a carrying value of $166 million as of June

30, 2020. PPP loans have a 1% rate of interest and 2-year

term with fees paid to the Bank by the SBA ranging from 1% to 5% of

each loan depending on the loan amount. Fees are amortized as

a yield adjustment over the expected life of the loans. PPP

loans are 100% guaranteed by the SBA.

The Bank’s strong capital and liquidity

positions, branch network, lending and deposit platforms and focus

on internal controls and cybersecurity provide a solid foundation

for serving customers during these challenging times. Our

liquidity position is monitored daily and remains strong and

stable. The Bank maintains a series of operating, health and

safety protocols through a pandemic committee to ensure business

continuity and protect customers and employees. As the

severity of the pandemic has subsided in the NYC metropolitan area,

which is the main market the Bank serves, our branches returned to

their traditional service model including hours and methods of

operating and staffing, and back office personnel returned to the

office.

Key Initiatives and Challenges We

Face

The Bank’s strategy is focused on increasing

shareholder value through loan and deposit growth, the maintenance

of strong credit quality, a strong efficiency ratio and an optimal

amount of capital. Key strategic initiatives in 2020 include

enhancing our brand, highlighting our digital offerings, refining

our branch strategy, building on our relationship banking business

and growing fee income. These initiatives are being

negatively impacted by the pandemic.

Notwithstanding the actions taken to mitigate

the impact on earnings of the current interest rate and economic

environment, net interest income, net interest margin, earnings,

profitability metrics and ability to grow remain under

pressure. These items could be negatively impacted by yield

curve inversion, low yields available on loans and securities and

potential credit losses arising from weak economic conditions and

loan modifications. In addition, during the fourth quarters

of 2020 and 2021, corporate bonds with current fair values of $77.6

million and $28.6 million, respectively, and a fixed rate yield of

5.14% will begin to reprice on a quarterly basis to a floating

rate. At current rates, the weighted average floating rate

yield would be approximately .77%.

The pandemic continues to create substantial

challenges for the Bank and its customers. Normal business

activity in the NYC metropolitan area was significantly disrupted

for an extended period of time due to government mandated business

and school closures and stay-at-home orders to protect public

health. As a result, many of the Bank’s customers, which

include small and medium-sized businesses, professionals,

consumers, municipalities and other organizations, experienced a

significant decline in, or complete discontinuance of, business

activity, earnings and cash flow. Although the local economy

is slowly reopening, the full impact of the pandemic on the Bank is

beyond the Bank’s current knowledge and will ultimately be

determined by the pace at which economic activity rebounds and the

extent to which the economy recovers from the high level of

unemployment and business disruption.

Forward Looking Information

This earnings release contains various

“forward-looking statements” within the meaning of that term as set

forth in Rule 175 of the Securities Act of 1933 and Rule 3b-6 of

the Securities Exchange Act of 1934. Such statements are

generally contained in sentences including the words “may” or

“expect” or “could” or “should” or “would” or “believe” or

“anticipate”. The Corporation cautions that these

forward-looking statements are subject to numerous assumptions,

risks and uncertainties that could cause actual results to differ

materially from those contemplated by the forward-looking

statements. Factors that could cause future results to vary

from current management expectations include, but are not limited

to, changing economic conditions; legislative and regulatory

changes; monetary and fiscal policies of the federal government;

changes in interest rates; deposit flows and the cost of funds;

demand for loan products; competition; changes in management’s

business strategies; changes in accounting principles, policies or

guidelines; changes in real estate values; and other factors

discussed in the “risk factors” section of the Corporation’s

filings with the Securities and Exchange Commission (“SEC”).

In addition, the pandemic is having an adverse impact on the

Corporation, its customers and the communities it serves. The

adverse effect of the pandemic on the Corporation, its customers

and the communities where it operates may adversely affect the

Corporation’s business, results of operations and financial

condition for an indefinite period of time. The

forward-looking statements are made as of the date of this press

release, and the Corporation assumes no obligation to update the

forward-looking statements or to update the reasons why actual

results could differ from those projected in the forward-looking

statements.

For more detailed financial information please

see the Corporation’s quarterly report on Form 10-Q for the quarter

ended June 30, 2020. The Form 10-Q will be available through

the Bank’s website at www.fnbli.com on or about August 6, 2020,

when it is electronically filed with the SEC. Our SEC filings are

also available on the SEC’s website at www.sec.gov.

CONSOLIDATED BALANCE

SHEETS(Unaudited)

| |

|

|

|

|

|

|

| |

|

|

|

|

| |

|

6/30/20 |

|

12/31/19 |

| |

|

(dollars in thousands) |

| Assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

173,740 |

|

|

$ |

38,968 |

|

|

Investment securities available-for-sale, at fair value |

|

|

748,032 |

|

|

|

697,544 |

|

|

|

|

|

|

|

|

|

|

Loans: |

|

|

|

|

|

|

|

Commercial and industrial |

|

|

104,673 |

|

|

|

103,879 |

|

|

SBA Paycheck Protection Program |

|

|

165,704 |

|

|

|

— |

|

|

Secured by real estate: |

|

|

|

|

|

|

|

Commercial mortgages |

|

|

1,351,542 |

|

|

|

1,401,289 |

|

|

Residential mortgages |

|

|

1,470,181 |

|

|

|

1,621,419 |

|

|

Home equity lines |

|

|

58,945 |

|

|

|

59,231 |

|

|

Consumer and other |

|

|

1,416 |

|

|

|

2,431 |

|

| |

|

|

3,152,461 |

|

|

|

3,188,249 |

|

|

Allowance for credit losses |

|

|

(34,051 |

) |

|

|

(29,289 |

) |

| |

|

|

3,118,410 |

|

|

|

3,158,960 |

|

| |

|

|

|

|

|

|

|

Restricted stock, at cost |

|

|

29,543 |

|

|

|

30,899 |

|

|

Bank premises and equipment, net |

|

|

39,463 |

|

|

|

40,017 |

|

|

Right of use asset - operating leases |

|

|

13,675 |

|

|

|

14,343 |

|

|

Bank-owned life insurance |

|

|

84,251 |

|

|

|

83,119 |

|

|

Pension plan assets, net |

|

|

18,407 |

|

|

|

18,275 |

|

|

Deferred income tax benefit |

|

|

3,856 |

|

|

|

317 |

|

|

Other assets |

|

|

18,951 |

|

|

|

15,401 |

|

| |

|

$ |

4,248,328 |

|

|

$ |

4,097,843 |

|

|

Liabilities: |

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

Checking |

|

$ |

1,152,945 |

|

|

$ |

911,978 |

|

|

Savings, NOW and money market |

|

|

1,701,266 |

|

|

|

1,720,599 |

|

|

Time, $100,000 and over |

|

|

213,262 |

|

|

|

242,359 |

|

|

Time, other |

|

|

255,449 |

|

|

|

269,080 |

|

| |

|

|

3,322,922 |

|

|

|

3,144,016 |

|

| |

|

|

|

|

|

|

|

Short-term borrowings |

|

|

60,019 |

|

|

|

190,710 |

|

|

Long-term debt |

|

|

439,972 |

|

|

|

337,472 |

|

|

Operating lease liability |

|

|

14,561 |

|

|

|

15,220 |

|

|

Accrued expenses and other liabilities |

|

|

21,116 |

|

|

|

21,317 |

|

| |

|

|

3,858,590 |

|

|

|

3,708,735 |

|

| Stockholders'

Equity: |

|

|

|

|

|

|

|

Common stock, par value $.10 per share: |

|

|

|

|

|

|

|

Authorized, 80,000,000 shares; |

|

|

|

|

|

|

|

Issued and outstanding, 23,848,626 and 23,934,632 shares |

|

|

2,385 |

|

|

|

2,393 |

|

|

Surplus |

|

|

106,047 |

|

|

|

111,744 |

|

|

Retained earnings |

|

|

283,379 |

|

|

|

274,376 |

|

| |

|

|

391,811 |

|

|

|

388,513 |

|

|

Accumulated other comprehensive income (loss), net of tax |

|

|

(2,073 |

) |

|

|

595 |

|

| |

|

|

389,738 |

|

|

|

389,108 |

|

| |

|

$ |

4,248,328 |

|

|

$ |

4,097,843 |

|

| |

| |

CONSOLIDATED STATEMENTS OF

INCOME(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended |

|

Three Months Ended |

|

| |

|

6/30/20 |

|

6/30/19 |

|

6/30/20 |

|

6/30/19 |

|

| |

(dollars in thousands) |

| Interest and dividend

income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

$ |

|

56,888 |

|

$ |

|

59,029 |

|

|

$ |

|

27,957 |

|

$ |

|

29,613 |

|

|

Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

|

6,749 |

|

|

|

7,968 |

|

|

|

|

3,323 |

|

|

|

3,923 |

|

|

Nontaxable |

|

|

|

5,066 |

|

|

|

6,046 |

|

|

|

|

2,501 |

|

|

|

2,954 |

|

| |

|

|

|

68,703 |

|

|

|

73,043 |

|

|

|

|

33,781 |

|

|

|

36,490 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings, NOW and money market deposits |

|

|

|

6,639 |

|

|

|

8,841 |

|

|

|

|

2,359 |

|

|

|

4,841 |

|

|

Time deposits |

|

|

|

5,928 |

|

|

|

7,331 |

|

|

|

|

2,886 |

|

|

|

3,933 |

|

|

Short-term borrowings |

|

|

|

885 |

|

|

|

2,507 |

|

|

|

|

266 |

|

|

|

542 |

|

|

Long-term debt |

|

|

|

4,157 |

|

|

|

3,675 |

|

|

|

|

2,162 |

|

|

|

1,895 |

|

| |

|

|

|

17,609 |

|

|

|

22,354 |

|

|

|

|

7,673 |

|

|

|

11,211 |

|

|

Net interest income |

|

|

|

51,094 |

|

|

|

50,689 |

|

|

|

|

26,108 |

|

|

|

25,279 |

|

| Provision (credit) for credit

losses |

|

|

|

2,450 |

|

|

|

(35 |

) |

|

|

|

92 |

|

|

|

422 |

|

|

Net interest income after provision (credit) for credit losses |

|

|

|

48,644 |

|

|

|

50,724 |

|

|

|

|

26,016 |

|

|

|

24,857 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Management Division income |

|

|

|

1,067 |

|

|

|

998 |

|

|

|

|

519 |

|

|

|

517 |

|

|

Service charges on deposit accounts |

|

|

|

1,606 |

|

|

|

1,485 |

|

|

|

|

619 |

|

|

|

780 |

|

|

Other |

|

|

|

2,916 |

|

|

|

2,678 |

|

|

|

|

1,433 |

|

|

|

1,420 |

|

| |

|

|

|

5,589 |

|

|

|

5,161 |

|

|

|

|

2,571 |

|

|

|

2,717 |

|

| Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

|

18,913 |

|

|

|

17,981 |

|

|

|

|

9,639 |

|

|

|

8,723 |

|

|

Occupancy and equipment |

|

|

|

6,133 |

|

|

|

5,840 |

|

|

|

|

3,061 |

|

|

|

2,903 |

|

|

Other |

|

|

|

5,472 |

|

|

|

6,090 |

|

|

|

|

2,960 |

|

|

|

3,150 |

|

| |

|

|

|

30,518 |

|

|

|

29,911 |

|

|

|

|

15,660 |

|

|

|

14,776 |

|

|

Income before income taxes |

|

|

|

23,715 |

|

|

|

25,974 |

|

|

|

|

12,927 |

|

|

|

12,798 |

|

| Income tax expense |

|

|

|

3,808 |

|

|

|

4,389 |

|

|

|

|

2,168 |

|

|

|

2,054 |

|

|

Net income |

|

$ |

|

19,907 |

|

$ |

|

21,585 |

|

|

$ |

|

10,759 |

|

$ |

|

10,744 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share and Per Share Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares |

|

|

|

23,871,245 |

|

|

|

25,051,412 |

|

|

|

|

23,838,224 |

|

|

|

24,821,026 |

|

|

Dilutive stock options and restricted stock units |

|

|

|

39,135 |

|

|

|

169,048 |

|

|

|

|

23,638 |

|

|

|

181,751 |

|

|

|

|

|

|

23,910,380 |

|

|

|

25,220,460 |

|

|

|

|

23,861,862 |

|

|

|

25,002,777 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic EPS |

|

|

$ |

0.83 |

|

|

$ |

0.86 |

|

|

|

$ |

0.45 |

|

|

$ |

0.43 |

|

|

Diluted EPS |

|

|

$ |

0.83 |

|

|

$ |

0.86 |

|

|

|

$ |

0.45 |

|

|

$ |

0.43 |

|

|

Cash Dividends Declared per share |

|

|

$ |

0.36 |

|

|

$ |

0.34 |

|

|

|

$ |

0.18 |

|

|

$ |

0.17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL RATIOS |

|

(Unaudited) |

| ROA |

|

|

|

0.96 |

% |

|

|

1.03 |

|

% |

|

|

1.02 |

% |

|

|

1.02 |

% |

| ROE |

|

|

|

10.34 |

% |

|

|

11.15 |

|

% |

|

|

11.30 |

% |

|

|

11.00 |

% |

| Net Interest Margin |

|

|

|

2.63 |

% |

|

|

2.57 |

|

% |

|

|

2.64 |

% |

|

|

2.58 |

% |

| Dividend Payout Ratio |

|

|

|

43.37 |

% |

|

|

39.53 |

|

% |

|

|

40.00 |

% |

|

|

39.53 |

% |

|

|

|

|

PROBLEM AND POTENTIAL PROBLEM LOANS AND

ASSETS(Unaudited)

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

6/30/20 |

|

|

12/31/19 |

|

| |

|

|

(dollars in thousands) |

|

| |

|

|

|

|

|

|

|

|

| Loans, excluding troubled debt

restructurings: |

|

|

|

|

|

|

|

|

|

Past due 30 through 89 days |

|

$ |

610 |

|

|

$ |

2,928 |

|

|

Past due 90 days or more and still accruing |

|

|

— |

|

|

|

— |

|

|

Nonaccrual |

|

|

6,964 |

|

|

|

423 |

|

| |

|

|

7,574 |

|

|

|

3,351 |

|

| Troubled debt

restructurings: |

|

|

|

|

|

|

|

|

|

Performing according to their modified terms |

|

|

1,346 |

|

|

|

1,070 |

|

|

Past due 30 through 89 days |

|

|

— |

|

|

|

— |

|

|

Past due 90 days or more and still accruing |

|

|

— |

|

|

|

— |

|

|

Nonaccrual |

|

|

— |

|

|

|

465 |

|

| |

|

|

1,346 |

|

|

|

1,535 |

|

| Total past due, nonaccrual and

restructured loans: |

|

|

|

|

|

|

|

|

|

Restructured and performing according to their modified terms |

|

|

1,346 |

|

|

|

1,070 |

|

|

Past due 30 through 89 days |

|

|

610 |

|

|

|

2,928 |

|

|

Past due 90 days or more and still accruing |

|

|

— |

|

|

|

— |

|

|

Nonaccrual |

|

|

6,964 |

|

|

|

888 |

|

| |

|

|

8,920 |

|

|

|

4,886 |

|

| Other real estate owned |

|

|

— |

|

|

|

— |

|

| |

|

$ |

8,920 |

|

|

$ |

4,886 |

|

| |

|

|

|

|

|

|

|

|

| Allowance for credit

losses |

|

$ |

34,051 |

|

|

$ |

29,289 |

|

| Allowance for credit losses as

a percentage of total loans |

|

|

1.08 |

% |

|

|

.92 |

% |

| Allowance for credit losses as

a multiple of nonaccrual loans |

|

|

4.9 |

x |

|

|

33.0 |

x |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

AVERAGE BALANCE SHEET, INTEREST RATES AND

INTEREST DIFFERENTIAL(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

| |

|

2020 |

|

2019 |

| |

|

Average |

|

Interest/ |

|

Average |

|

Average |

|

Interest/ |

|

Average |

|

(dollars in thousands) |

|

Balance |

|

Dividends |

|

Rate |

|

Balance |

|

Dividends |

|

Rate |

| Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning bank

balances |

|

$ |

91,821 |

|

|

$ |

120 |

|

.26 |

% |

|

$ |

25,253 |

|

|

$ |

300 |

|

2.40 |

% |

| Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

344,932 |

|

|

|

6,629 |

|

3.84 |

|

|

|

368,572 |

|

|

|

7,668 |

|

4.16 |

|

|

Nontaxable (1) |

|

|

375,326 |

|

|

|

6,412 |

|

3.42 |

|

|

|

416,006 |

|

|

|

7,653 |

|

3.68 |

|

| Loans (1) |

|

|

3,170,449 |

|

|

|

56,891 |

|

3.59 |

|

|

|

3,248,214 |

|

|

|

59,032 |

|

3.63 |

|

| Total interest-earning

assets |

|

|

3,982,528 |

|

|

|

70,052 |

|

3.52 |

|

|

|

4,058,045 |

|

|

|

74,653 |

|

3.68 |

|

| Allowance for credit

losses |

|

|

(33,115 |

) |

|

|

|

|

|

|

|

|

(30,501 |

) |

|

|

|

|

|

|

| Net interest-earning

assets |

|

|

3,949,413 |

|

|

|

|

|

|

|

|

|

4,027,544 |

|

|

|

|

|

|

|

| Cash and due from banks |

|

|

32,925 |

|

|

|

|

|

|

|

|

|

36,252 |

|

|

|

|

|

|

|

| Premises and equipment,

net |

|

|

39,814 |

|

|

|

|

|

|

|

|

|

41,217 |

|

|

|

|

|

|

|

| Other assets |

|

|

134,421 |

|

|

|

|

|

|

|

|

|

128,493 |

|

|

|

|

|

|

|

| |

|

$ |

4,156,573 |

|

|

|

|

|

|

|

|

$ |

4,233,506 |

|

|

|

|

|

|

|

| Liabilities and

Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Savings, NOW & money

market deposits |

|

$ |

1,704,484 |

|

|

|

6,639 |

|

.78 |

|

|

$ |

1,685,467 |

|

|

|

8,841 |

|

1.06 |

|

| Time deposits |

|

|

503,364 |

|

|

|

5,928 |

|

2.37 |

|

|

|

637,630 |

|

|

|

7,331 |

|

2.32 |

|

| Total interest-bearing

deposits |

|

|

2,207,848 |

|

|

|

12,567 |

|

1.14 |

|

|

|

2,323,097 |

|

|

|

16,172 |

|

1.40 |

|

| Short-term borrowings |

|

|

92,235 |

|

|

|

885 |

|

1.93 |

|

|

|

196,481 |

|

|

|

2,507 |

|

2.57 |

|

| Long-term debt |

|

|

423,846 |

|

|

|

4,157 |

|

1.97 |

|

|

|

362,461 |

|

|

|

3,675 |

|

2.04 |

|

| Total interest-bearing

liabilities |

|

|

2,723,929 |

|

|

|

17,609 |

|

1.30 |

|

|

|

2,882,039 |

|

|

|

22,354 |

|

1.56 |

|

| Checking deposits |

|

|

1,013,832 |

|

|

|

|

|

|

|

|

|

931,942 |

|

|

|

|

|

|

|

| Other liabilities |

|

|

31,819 |

|

|

|

|

|

|

|

|

|

29,233 |

|

|

|

|

|

|

|

| |

|

|

3,769,580 |

|

|

|

|

|

|

|

|

|

3,843,214 |

|

|

|

|

|

|

|

| Stockholders' equity |

|

|

386,993 |

|

|

|

|

|

|

|

|

|

390,292 |

|

|

|

|

|

|

|

| |

|

$ |

4,156,573 |

|

|

|

|

|

|

|

|

$ |

4,233,506 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income (1) |

|

|

|

|

$ |

52,443 |

|

|

|

|

|

|

|

$ |

52,299 |

|

|

|

| Net interest spread (1) |

|

|

|

|

|

|

|

2.22 |

% |

|

|

|

|

|

|

|

2.12 |

% |

| Net interest margin (1) |

|

|

|

|

|

|

|

2.63 |

% |

|

|

|

|

|

|

|

2.57 |

% |

(1) Tax-equivalent basis. Interest income on a

tax-equivalent basis includes the additional amount of interest

income that would have been earned if the Corporation's investment

in tax-exempt loans and investment securities had been made in

loans and investment securities subject to federal income taxes

yielding the same after-tax income. The tax-equivalent amount of

$1.00 of nontaxable income was $1.27 for each period presented

using the statutory federal income tax rate of 21%.

AVERAGE BALANCE SHEET, INTEREST RATES AND

INTEREST DIFFERENTIAL(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended June 30, |

|

| |

|

2020 |

|

2019 |

|

|

(dollars in thousands) |

|

Average Balance |

|

Interest/ Dividends |

|

Average Rate |

|

Average Balance |

|

Interest/ Dividends |

|

Average Rate |

|

| Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning bank

balances |

|

$ |

153,565 |

|

|

$ |

38 |

|

0.10 |

% |

|

$ |

25,701 |

|

|

$ |

154 |

|

2.40 |

% |

|

| Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

347,202 |

|

|

|

3,285 |

|

3.78 |

|

|

|

363,080 |

|

|

|

3,769 |

|

4.15 |

|

|

|

Nontaxable (1) |

|

|

370,479 |

|

|

|

3,165 |

|

3.42 |

|

|

|

413,145 |

|

|

|

3,738 |

|

3.62 |

|

|

| Loans (1) |

|

|

3,181,365 |

|

|

|

27,958 |

|

3.52 |

|

|

|

3,234,861 |

|

|

|

29,615 |

|

3.66 |

|

|

| Total interest-earning

assets |

|

|

4,052,611 |

|

|

|

34,446 |

|

3.40 |

|

|

|

4,036,787 |

|

|

|

37,276 |

|

3.69 |

|

|

| Allowance for credit

losses |

|

|

(34,119 |

) |

|

|

|

|

|

|

|

|

(30,114 |

) |

|

|

|

|

|

|

|

| Net

interest-earning assets |

|

|

4,018,492 |

|

|

|

|

|

|

|

|

|

4,006,673 |

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

|

31,488 |

|

|

|

|

|

|

|

|

|

35,834 |

|

|

|

|

|

|

|

|

| Premises and equipment,

net |

|

|

39,696 |

|

|

|

|

|

|

|

|

|

41,125 |

|

|

|

|

|

|

|

|

| Other assets |

|

|

139,330 |

|

|

|

|

|

|

|

|

|

127,614 |

|

|

|

|

|

|

|

|

| |

|

$ |

4,229,006 |

|

|

|

|

|

|

|

|

$ |

4,211,246 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities

and Stockholders' Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Savings, NOW & money

market deposits |

|

$ |

1,698,207 |

|

|

|

2,359 |

|

.56 |

|

|

$ |

1,728,112 |

|

|

|

4,841 |

|

1.12 |

|

|

| Time deposits |

|

|

496,691 |

|

|

|

2,886 |

|

2.34 |

|

|

|

668,217 |

|

|

|

3,933 |

|

2.36 |

|

|

| Total

interest-bearing deposits |

|

|

2,194,898 |

|

|

|

5,245 |

|

.96 |

|

|

|

2,396,329 |

|

|

|

8,774 |

|

1.47 |

|

|

| Short-term borrowings |

|

|

61,133 |

|

|

|

266 |

|

1.75 |

|

|

|

92,475 |

|

|

|

542 |

|

2.35 |

|

|

| Long-term debt |

|

|

448,351 |

|

|

|

2,162 |

|

1.94 |

|

|

|

369,142 |

|

|

|

1,895 |

|

2.06 |

|

|

| Total

interest-bearing liabilities |

|

|

2,704,382 |

|

|

|

7,673 |

|

1.14 |

|

|

|

2,857,946 |

|

|

|

11,211 |

|

1.57 |

|

|

| Checking deposits |

|

|

1,109,620 |

|

|

|

|

|

|

|

|

|

932,256 |

|

|

|

|

|

|

|

|

| Other liabilities |

|

|

32,179 |

|

|

|

|

|

|

|

|

|

29,398 |

|

|

|

|

|

|

|

|

| |

|

|

3,846,181 |

|

|

|

|

|

|

|

|

|

3,819,600 |

|

|

|

|

|

|

|

|

| Stockholders' equity |

|

|

382,825 |

|

|

|

|

|

|

|

|

|

391,646 |

|

|

|

|

|

|

|

|

| |

|

$ |

4,229,006 |

|

|

|

|

|

|

|

|

$ |

4,211,246 |

|

|

|

|

|

|

|

|

| Net interest income (1) |

|

|

|

|

$ |

26,773 |

|

|

|

|

|

|

|

$ |

26,065 |

|

|

|

|

| Net interest spread (1) |

|

|

|

|

|

|

|

2.26 |

% |

|

|

|

|

|

|

|

2.12 |

% |

|

| Net interest margin (1) |

|

|

|

|

|

|

|

2.64 |

% |

|

|

|

|

|

|

|

2.58 |

% |

|

(1) Tax-equivalent basis. Interest income on a

tax-equivalent basis includes the additional amount of interest

income that would have been earned if the Corporation's investment

in tax-exempt loans and investment securities had been made in

loans and investment securities subject to federal income taxes

yielding the same after-tax income. The tax-equivalent amount of

$1.00 of nontaxable income was $1.27 for each period presented

using the statutory federal income tax rate of 21%.

For More Information Contact: Jay McConie, EVP

and CFO (516) 671-4900, Ext. 7404

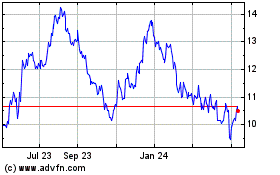

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

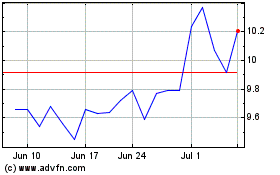

First of Long Island (NASDAQ:FLIC)

Historical Stock Chart

From Apr 2023 to Apr 2024