As filed with the Securities and Exchange Commission on March 2, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

FIBROGEN, INC.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

77-0357827

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification No.)

|

409 Illinois Street

San

Francisco, California 94158

(415) 978-1200

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

ENRIQUE CONTERNO

Chief

Executive Officer and Director

FibroGen, Inc.

409 Illinois Street

San

Francisco, California 94158

(415) 978-1200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

MICHAEL

E. TENTA

Cooley LLP

3175 Hanover Street

Palo

Alto, California 94304

(650) 843-5000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration

statement

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans,

please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D.

filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☒

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐

|

|

Smaller reporting company

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF

REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities To Be Registered

|

|

Amount

To Be

Registered

|

|

Proposed

Maximum

Offering

Price

Per Unit

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount Of

Registration Fee

|

|

Common Stock, $0.01 par value per share

|

|

(1)

|

|

(1)

|

|

(1)

|

|

(2)

|

|

Preferred Stock, $0.01 par value per share

|

|

(1)

|

|

(1)

|

|

(1)

|

|

(2)

|

|

Debt Securities

|

|

(1)

|

|

(1)

|

|

(1)

|

|

(2)

|

|

Warrants

|

|

(1)

|

|

(1)

|

|

(1)

|

|

(2)

|

|

Total

|

|

(1)

|

|

(1)

|

|

(1)

|

|

(2)

|

|

|

|

|

|

(1)

|

Omitted pursuant to General Instructions II.E of Form S-3. An

indeterminate number or amount, as the case may be, of common stock, preferred stock, debt securities and warrants are being registered hereunder as may from time to time be issued at indeterminate prices. The securities being registered hereunder

may be convertible into or exchangeable or exercisable for other securities of any identified class, and may be sold separately or in combination with the other securities registered hereunder. In addition to the securities that may be issued

directly under this registration statement, there is being registered hereunder such indeterminate aggregate number or amount, as the case may be, of the securities of each identified class as may from time to time be issued upon the conversion,

exchange, settlement or exercise of other securities offered hereby. Separate consideration may or may not be received for securities that are issuable upon the conversion or exercise of, or in exchange for, other securities offered hereby.

|

|

(2)

|

In accordance with Rules 456(b) and 457(r), the registrant is deferring payment of all of the registration fees.

|

COMMON STOCK

PREFERRED STOCK

DEBT

SECURITIES

WARRANTS

From time to time, we may offer to sell any combination of the securities described in this prospectus in amounts, at prices and on terms

described in one or more supplements to this prospectus. We may also offer common stock or preferred stock upon conversion of debt securities, common stock upon conversion of preferred stock, or common stock, preferred stock or debt securities upon

the exercise of warrants.

This prospectus describes some of the general terms that may apply to an offering of our common stock,

preferred stock, debt securities or warrants. The specific terms and any other information relating to a specific offering will be set forth in a post-effective amendment to the registration statement of which this prospectus is a part or in a

supplement to this prospectus or may be set forth in one or more documents incorporated by reference in this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with a specific offering.

We may offer and sell common stock, preferred stock, debt securities or warrants to or through one or more underwriters, dealers and agents,

or directly to purchasers, on a continuous or delayed basis. The supplements to this prospectus and any authorized free writing prospectus will provide the specific terms of the plan of distribution.

Our common stock trades on the NASDAQ Global Select Market under the symbol “FGEN.” On February 28, 2020, the last reported

sale price of our common stock on the NASDAQ Global Select Market was $41.80 per share.

Investing in our securities involves a high

degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” contained in the applicable prospectus supplement and in any free writing prospectus we have

authorized for use in connection with a specific offering, and under similar headings in the documents that are incorporated by reference into this prospectus.

This prospectus may not be used to consummate a sale of securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this

prospectus is March 2, 2020

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and

Exchange Commission, or SEC, utilizing an “automatic shelf” registration process available to “well-known seasoned issuers,” as defined in Rule 405 under the Securities Act of 1933, as amended, or the Securities Act. Under this

shelf registration statement, we may offer and sell from time to time in one or more offerings the common stock, preferred stock, debt securities, warrants or any combination of these securities described in this prospectus. No limit exists on the

aggregate number of shares of common stock, preferred stock or warrants, or the amount of debt securities we may sell pursuant to the registration statement. We may also offer common stock or preferred stock upon conversion of debt securities,

common stock upon conversion of preferred stock, or common stock, preferred stock or debt securities upon the exercise of warrants.

Each

time we offer securities under this prospectus, we will provide a prospectus supplement that will contain more specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you

that may contain material information relating to these offerings. The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change any of the information contained in this

prospectus or in the documents that we have incorporated by reference into this prospectus. We urge you to read carefully this prospectus, any applicable prospectus supplement and any free writing prospectuses we have authorized for use in

connection with a specific offering, together with the information incorporated herein by reference as described under the heading “Incorporation of Certain Information by Reference,” before buying any of the securities being offered.

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as

exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More Information.”

This prospectus contains and incorporates by reference market data and industry statistics and forecasts that are based on independent

industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. Although we

are not aware of any misstatements regarding the market and industry data presented in this prospectus and the documents incorporated herein by reference, these estimates involve risks and uncertainties and are subject to change based on various

factors, including those discussed under the heading “Risk Factors” contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that are incorporated by

reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

We have not authorized anyone

to provide any information other than that contained or incorporated by reference in this prospectus or applicable prospectus supplement or free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no

responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not making an offer to sell these securities, or soliciting an offer to buy these securities in any jurisdiction where

the offer or sale is not permitted. You should not assume that the information contained in this prospectus, or in any prospectus supplement or authorized free writing prospectus, is accurate as of any date other than its date regardless of the time

of delivery of the prospectus, prospectus supplement or authorized free writing prospectus or any sale of these securities.

We urge you to

read carefully this prospectus, any applicable prospectus supplement and any authorized free writing prospectus, together with the information incorporated herein by reference as described

1

under the heading “Where You Can Find More Information,” before deciding whether to invest in any of the securities being offered.

This prospectus and the information incorporated herein by reference includes trademarks, service marks and trade names owned by us or other

companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus or any applicable prospectus supplement or any authorized free writing prospectus are the property of their respective owners.

References in this prospectus to “FibroGen,” “we,” “us” and “our” refer to FibroGen, Inc., a Delaware

corporation, and its subsidiaries. Our website address is http://www.fibrogen.com. We do not incorporate the information on our website into this prospectus, and you should not consider it part of this prospectus.

RISK FACTORS

Investing in our securities involves risks. You should review carefully the risks and uncertainties described under the heading “Risk

Factors” contained in any applicable prospectus supplement or authorized free writing prospectus and under similar headings in the other documents that are incorporated by reference into this prospectus before deciding whether to purchase any

of the securities being registered pursuant to the registration statement of which this prospectus is a part. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as adversely affect the

value of an investment in our securities, and the occurrence of any of these risks might cause you to lose all or part of your investment. Moreover, the risks described are not the only ones that we face. Additional risks not presently known to us

or that we currently believe are immaterial may also significantly impair our business operations.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, the documents that we have filed with the SEC that are incorporated by

reference in this prospectus and any authorized free writing prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and within the meaning of

Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are subject to the “safe harbor” created by those sections. These forward-looking statements can generally be identified as such because the

context of the statement will include words such as “may,” “will,” “expect,” “anticipate,” “intend,” “believe,” “hope,” “assume,” “estimate,” “plan,”

“future,” “potential,” “likely,” “unlikely,” “opportunity,” “predict,” “continue,” “should,” or the negative of these terms and similar expressions intended to identify

forward-looking statements. Discussions containing these forward-looking statements may be found, among other places, in “Business” and in “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” incorporated by reference from our most recent Annual Report on Form 10-K and from our Quarterly Reports on Form 10-Q for the quarterly periods ended

subsequent to our filing of such Annual Report on Form 10-K, as well as any amendments thereto reflected in subsequent filings with the SEC. These forward-looking statements include but are not limited to

statements about:

|

|

•

|

|

our ongoing and planned preclinical development and clinical trials;

|

|

|

•

|

|

the timing of and our ability to make regulatory filings and obtain and maintain regulatory approvals for

roxadustat, pamrevlumab and our other product candidates;

|

|

|

•

|

|

our intellectual property position;

|

|

|

•

|

|

the potential safety, efficacy, reimbursement, convenience clinical and pharmaco-economic benefits of our product

candidates;

|

|

|

•

|

|

the potential markets for any of our product candidates;

|

|

|

•

|

|

our ability to develop commercial operations and commercial results;

|

|

|

•

|

|

our ability to operate in China;

|

2

|

|

•

|

|

expectations regarding clinical trial data;

|

|

|

•

|

|

our results of operations, cash needs, spending of the proceeds from any public offerings of securities we have

conducted, financial condition, liquidity, prospects, growth and strategies; and

|

|

|

•

|

|

the industry in which we operate and the trends that may affect the industry or us.

|

These forward-looking statements are based largely on our expectations and projections about future events and future trends affecting our

business, and are subject to risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward-looking statements. Before deciding to purchase our securities, you should carefully consider the risk

factors described in the “Risk Factors” section of this prospectus, in addition to the other information set forth in this prospectus, any applicable prospectus supplement, any authorized free writing prospectus and the documents

incorporated by reference herein and therein.

In addition, past financial and/or operating performance is not necessarily a reliable

indicator of future performance and you should not use our historical performance to anticipate results or future period trends. We can give no assurances that any of the events anticipated by the forward-looking statements will occur or, if any of

them do, what impact they will have on our results of operations and financial condition.

Except as required by law, we undertake no

obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the filing of this prospectus, any applicable prospectus supplement, any authorized free writing prospectus, or documents incorporated

by reference herein and therein, that include forward-looking statements.

USE OF PROCEEDS

Except as described in any prospectus supplement or in any related authorized free writing prospectus that we may authorize to be provided to

you, we intend to use the net proceeds from the sale of securities issued pursuant to this registration statement to develop and commercialize our product candidates such as roxadustat, pamrevlumab and other hypoxia-inducible factor prolyl

hydroxylase inhibitors product candidates, as well as for general corporate purposes. These uses include meeting any short term liquidity needs pending receipt of amounts due or subject to reimbursement under our license and collaboration

agreements. We may also use a portion of the net proceeds from the sale of securities issued pursuant to this registration statement to acquire complementary businesses, products or technologies, although we have no present commitments or agreements

for any specific acquisitions. Accordingly, we will have broad discretion over the uses of the net proceeds from the sale of securities issued pursuant to this registration statement. Pending these uses, we plan to invest these net proceeds in

short-term and long-term interest bearing obligations, investment grade instruments, certificates of deposit or direct or guaranteed obligations of the United States. We will have broad discretion in the application of the net proceeds from the sale

of securities issued pursuant to this registration statement, and investors will be relying on the judgment of our management regarding the application of such net proceeds.

DESCRIPTION OF CAPITAL STOCK

We may issue shares of our common stock from time to time, in one or more offerings. We will set forth in the applicable prospectus supplement

a description of the terms of the offering of common stock, including the offering price, the net proceeds to us and other offering material relating to such offering.

We may issue shares of our preferred stock from time to time, in one or more offerings. We will set forth in the applicable prospectus

supplement a description of the terms of the offering of preferred stock, including the offering price, rights, preferences, privileges, restrictions, the net proceeds to us and other offering material relating to such offering.

3

DESCRIPTION OF DEBT SECURITIES

We may issue shares of our debt securities from time to time, in one or more offerings. We will set forth in the applicable prospectus

supplement a description of the terms of the offering of debt securities, including maturity date, interest, the net proceeds to us and other offering material relating to such offering.

DESCRIPTION OF WARRANTS

We may issue warrants to purchase our common stock, preferred stock and/or debt securities, or any combination of the foregoing. Warrants may

be issued independently or together with any other securities and may be attached to, or separate from, such securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a warrant agent. We

will set forth in the applicable prospectus supplement a description of the terms of the offering of warrants, including the offering price, a description of the material provisions of the applicable warrant agreement, the net proceeds to us and

other offering material relating to such offering.

LEGAL MATTERS

Unless otherwise indicated in the applicable prospectus supplement, the validity of the issuance of the securities offered by this prospectus

and any supplement thereto will be passed upon for us by our counsel, Cooley LLP, Palo Alto, California. As of March 2, 2020, partners and associates of Cooley LLP participating in the preparation of this prospectus and the related Registration

Statement on Form S-3 owned no shares of our common stock.

EXPERTS

The financial statements and management’s assessment of the effectiveness of internal control over financial reporting (which is

included in Management’s Annual Report on Internal Control over Financial Reporting) incorporated in this Prospectus by reference to the Annual Report on Form 10-K for the year ended December 31,

2019 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet site that

contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including FibroGen, Inc. The SEC’s Internet site can be found at http://www.sec.gov.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to incorporate by reference the information we file with it, which means that we can disclose important information to you

by referring you to another document that we have filed separately with the SEC. You should read the information incorporated by reference because it is an important part of this

4

prospectus. We incorporate by reference the following information or documents that we have filed with the SEC (Commission File No. 001-36740):

|

|

•

|

|

our Annual Report on Form

10-K, for the year ended December 31, 2019;

|

|

|

•

|

|

the information specifically incorporated by reference into our 2018 annual report on

Form 10-K from our Definitive Proxy Statement on Schedule 14A, filed with the SEC on

April 23, 2019;

|

|

|

•

|

|

the description of our common stock set forth in our registration statement on Form

8-A, filed with the SEC on November 12, 2014, including any amendments or reports filed for the purposes of updating this description.

|

Any information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information in

this prospectus or in a later filed document that is incorporated or deemed to be incorporated herein by reference modifies or replaces such information.

We also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, until we file a post-effective amendment which indicates the

termination of the offering of the securities made by this prospectus. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to

modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier

statements.

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, without charge upon

written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus but not delivered with the prospectus, including exhibits which are specifically incorporated by reference into such documents.

You may request a copy of these filings at no cost by writing or telephoning us at the following address or telephone number:

FibroGen,

Inc.

Attn: Investor Relations

409 Illinois Street

San Francisco,

California 94158

Telephone number: (415) 978-1200

5

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

|

Item 14.

|

Other Expenses of Issuance and Distribution.

|

The following table sets forth the estimated costs and expenses, other than underwriting discounts and commissions, payable by the registrant

in connection with the offering of the securities being registered. All the amounts shown are estimates.

|

|

|

|

|

|

|

SEC registration fee

|

|

$

|

*

|

|

|

NASDAQ Global Select Market Listing Fee

|

|

|

**

|

|

|

FINRA Fee

|

|

|

**

|

|

|

Accounting fees and expenses

|

|

|

**

|

|

|

Legal fees and expenses

|

|

|

**

|

|

|

Transfer agent and registrar fees

|

|

|

**

|

|

|

Trustee’s Fees

|

|

|

***

|

|

|

Printing and engraving expenses

|

|

|

**

|

|

|

Miscellaneous

|

|

|

**

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

**

|

|

|

*

|

In accordance with Rule 456(b) and 457(r), the registrant is deferring payment of the registration fee for the

securities offered by this prospectus.

|

|

**

|

These fees are calculated based on the securities offered and the number of issuances and, accordingly, cannot

be estimated at this time. The applicable prospectus supplement will set forth the estimated amount of expenses of any offering of securities.

|

|

***

|

The issuance of debt securities under an indenture that we will enter into with a trustee to be covered by this

registration statement is indefinite at this time, for which reason an estimate of trustee’s fees is not currently determinable.

|

|

Item 15.

|

Indemnification of Directors and Officers.

|

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s board of directors to grant,

indemnity to directors and officers under certain circumstances and subject to certain limitations. The terms of Section 145 of the Delaware General Corporation Law are sufficiently broad to permit such indemnification under certain

circumstances for liabilities, including reimbursement for expenses incurred, arising under the Securities Act of 1933, as amended, or the Securities Act.

Our amended and restated certificate of incorporation provides for indemnification of our directors, officers, employees and other agents to

the maximum extent permitted by the Delaware General Corporation Law, and our amended and restated bylaws provide for indemnification of our directors, officers, employees and other agents to the maximum extent permitted by the Delaware General

Corporation Law.

We have entered into indemnification agreements with our directors and officers whereby we have agreed to indemnify our

directors and officers to the fullest extent permitted by law, including indemnification against expenses and liabilities incurred in legal proceedings to which the director or officer was, or is threatened to be made, a party by reason of the fact

that such director or officer is or was a director, officer, employee or agent of FibroGen, provided that such director or officer acted in good faith and in a manner that the director or officer reasonably believed to be in, or not opposed to, the

best interest of FibroGen. At present, there is no pending litigation or proceeding involving a director or officer of FibroGen regarding which indemnification is sought, nor is the registrant aware of any threatened litigation that may result in

claims for indemnification.

The underwriting agreement that the registrant might enter into (Exhibit 1.1) may provide for indemnification

by any underwriters of the registrant, its directors, its officers who sign the registration statement

II-1

and its controlling persons for some liabilities, including liabilities arising under the Securities Act of 1933, as amended.

We maintain insurance policies that indemnify our directors and officers against various liabilities arising under the Securities Act and the

Exchange Act of 1934, as amended, that might be incurred by any director or officer in his capacity as such.

The indemnification

provisions noted above may be sufficiently broad to permit indemnification of the registrant’s officers and directors for liabilities arising under the Securities Act of 1933, as amended.

|

(1)

|

To be filed by amendment or as an exhibit to a current report of the Registrant on Form 8-K.

|

|

(2)

|

Previously filed as Exhibit 3.1 to the Registrant’s Current Report on Form

8-K (File No. 001-36740), filed with the SEC on November 21, 2014, and incorporated by reference herein.

|

|

(3)

|

Previously filed as Exhibit 3.4 to the Registrant’s Registration Statement on Form S-1 (File No. 333-199069), filed with the SEC on October 23, 2014, as amended, and incorporated by reference herein.

|

|

(4)

|

Previously filed as Exhibit 4.1 to the Registrant’s Current Report on Form

8-K (File No. 001-36740), filed with the SEC on November 21, 2014, as amended, and incorporated by reference herein.

|

|

(5)

|

To be filed separately under the electronic form type 305B2, if applicable.

|

The undersigned registrant hereby undertakes:

|

|

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this

registration statement:

|

|

|

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

II-2

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement

(or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in the

volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus

filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of

Registration Fee” table in the effective registration statement; and

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the

registration statement or any material change to such information in the registration statement;

|

provided, however, that

subparagraphs (i), (ii) and (iii) above shall not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to

Section 13 and Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of this registration

statement.

|

|

(2)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective

amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which

remain unsold at the termination of the offering.

|

|

|

(4)

|

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

|

|

|

(A)

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the

registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

|

|

(B)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration

statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of

and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in

Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which

that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of

the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior

to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

|

|

|

(5)

|

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any

purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement,

|

II-3

|

|

regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the

undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

|

|

|

(i)

|

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be

filed pursuant to Rule 424;

|

|

|

(ii)

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or

used or referred to by the undersigned registrant;

|

|

|

(iii)

|

The portion of any other free writing prospectus relating to the offering containing material information about

the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

|

|

|

(iv)

|

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

|

|

|

(6)

|

That, for purposes of determining any liability under the Securities Act of 1933, each filing of the

registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities

Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of the securities at that time shall be deemed to

be the initial bona fide offering thereof.

|

|

|

(7)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to

directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public

policy as expressed in the Securities Act of 1933 and is, therefore unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer

or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Exchange Act and will

be governed by the final adjudication of such issue.

|

|

|

(8)

|

To file an application for the purpose of determining the eligibility of the trustee to act under subsection

(a) of Section 310 of the Trust Indenture Act in accordance with the rules and regulations prescribed by the Securities and Exchange Commission under Section 305(b)(2) of the Trust Indenture Act.

|

II-4

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San

Francisco, State of California, on this 2nd day of March, 2020.

|

|

|

|

|

FIBROGEN, INC.

|

|

|

|

|

By:

|

|

/s/ Enrique Conterno

|

|

Name:

|

|

Enrique Conterno

|

|

Title:

|

|

Chief Executive Officer

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Enrique Conterno and Pat Cotroneo,

jointly and severally, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or her

name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement on Form S-3, and to file the same, with all exhibits

thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them,

full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all

that said attorneys-in-fact and agents, or any of them, or their or his substitutes or substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons

in the capacities and on the dates indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

/S/ ENRIQUE CONTERNO

|

|

Chief Executive Officer and Director

|

|

March 2, 2020

|

|

Enrique Conterno

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

/S/ PAT COTRONEO

|

|

Vice President, Finance, and Chief Financial Officer

|

|

March 2, 2020

|

|

Pat Cotroneo

|

|

|

|

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

|

|

|

/S/ JAMES A. SCHOENECK

|

|

Chairperson of the Board of Directors and Director

|

|

March 2, 2020

|

|

James A. Schoeneck

|

|

|

|

|

|

|

|

/S/ SUZANNE BLAUG

|

|

Director

|

|

March 2, 2020

|

|

Suzanne Blaug

|

|

|

|

|

|

|

|

|

|

/S/ JEFFREY L. EDWARDS

|

|

Director

|

|

March 2, 2020

|

|

Jeffrey L. Edwards

|

|

|

|

|

|

|

|

|

|

/S/ JEFFREY W. HENDERSON

|

|

Director

|

|

March 2, 2020

|

|

Jeffrey W. Henderson

|

|

|

|

|

II-5

|

|

|

|

|

|

|

|

|

|

|

/S/ MAYKIN HO, PH.D.

|

|

Director

|

|

March 2, 2020

|

|

Maykin Ho, Ph.D.

|

|

|

|

|

|

|

|

|

|

/S/ THOMAS F. KEARNS JR.

|

|

Director

|

|

March 2, 2020

|

|

Thomas F. Kearns Jr.

|

|

|

|

|

|

|

|

|

|

/S/ KALEVI KURKIJÄRVI

|

|

Director

|

|

March 2, 2020

|

|

Kalevi Kurkijärvi, Ph.D.

|

|

|

|

|

|

|

|

|

|

/S/ GERALD LEMA

|

|

Director

|

|

March 2, 2020

|

|

Gerald Lema

|

|

|

|

|

|

|

|

|

|

/S/ RORY B. RIGGS

|

|

Director

|

|

March 2, 2020

|

|

Rory B. Riggs

|

|

|

|

|

|

|

|

|

|

/S/ ROBERTO PEDRO

ROSENKRANZ, PH.D. M.B.A.

|

|

Director

|

|

March 2, 2020

|

|

Roberto Pedro Rosenkranz, Ph.D. M.B.A.

|

|

|

|

|

|

|

|

|

|

/S/ TOSHINARI TAMURA, PH.D.

|

|

Director

|

|

March 2, 2020

|

|

Toshinari Tamura, Ph.D.

|

|

|

|

|

II-6

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description of the

Document

|

|

1.1

|

|

Form of Underwriting Agreement (1)

|

|

|

|

|

4.1

|

|

Amended and Restated Certificate of Incorporation of the Registrant, as presently in effect (2)

|

|

|

|

|

4.2

|

|

Amended and Restated Bylaws of the Registrant, as presently in effect (3)

|

|

|

|

|

4.3

|

|

Form of Common Stock Certificate (4)

|

|

|

|

|

4.4

|

|

Form of Preferred Stock Certificate and Form of Certificate of Designation of Preferred Stock (1)

|

|

|

|

|

4.5

|

|

Form of Indenture

|

|

|

|

|

4.6

|

|

Form of Note (1)

|

|

|

|

|

4.7

|

|

Form of Common Stock Warrant Agreement

|

|

|

|

|

4.8

|

|

Form of Preferred Stock Warrant Agreement

|

|

|

|

|

4.9

|

|

Form of Debt Securities Warrant Agreement

|

|

|

|

|

4.10

|

|

Form of Warrant Certificate (1)

|

|

|

|

|

5.1

|

|

Opinion of Cooley LLP

|

|

|

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm

|

|

|

|

|

23.2

|

|

Consent of Cooley LLP (included in Exhibit 5.1)

|

|

|

|

|

24.1

|

|

Power of Attorney (included on signature page)

|

|

|

|

|

25.1

|

|

Statement of Eligibility of Trustee under the Indenture (5)

|

|

(1)

|

To be filed by amendment or as an exhibit to a current report of the Registrant on Form 8-K.

|

|

(2)

|

Previously filed as Exhibit 3.1 to the Registrant’s Current Report on Form

8-K (File No. 001-36740), filed with the SEC on November 21, 2014, and incorporated by reference herein.

|

|

(3)

|

Previously filed as Exhibit 3.4 to the Registrant’s Registration Statement on Form S-1 (File No. 333-199069), filed with the SEC on October 23, 2014, as amended, and incorporated by reference herein.

|

|

(4)

|

Previously filed as Exhibit 4.1 to the Registrant’s Current Report on Form

8-K (File No. 001-36740), filed with the SEC on November 21, 2014, as amended, and incorporated by reference herein.

|

|

(5)

|

To be filed separately under the electronic form type 305B2, if applicable.

|

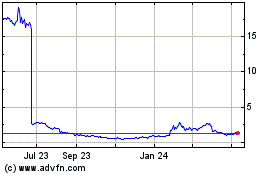

FibroGen (NASDAQ:FGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

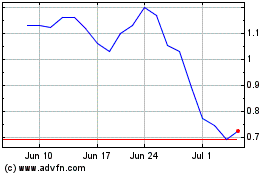

FibroGen (NASDAQ:FGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024