Current Report Filing (8-k)

May 27 2020 - 4:23PM

Edgar (US Regulatory)

false0000708955

0000708955

2020-05-26

2020-05-26

0000708955

exch:XNMS

2020-05-26

2020-05-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 26, 2020

FIRST FINANCIAL BANCORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Ohio

|

|

001-34762

|

|

31-1042001

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. employer

identification number)

|

|

|

|

|

|

|

|

|

255 East Fifth Street, Suite 800

|

|

Cincinnati,

|

Ohio

|

|

45202

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (877) 322-9530

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading symbol

|

|

Name of exchange on which registered

|

|

Common stock, No par value

|

|

FFBC

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

|

|

|

(e)

|

On May 26, 2020, at the 2020 Annual Meeting of Shareholders, the shareholders of First Financial Bancorp. (the “Company”) approved the 2020 Stock Plan (the “Plan”), a copy of which is included as Exhibit 10.1 to this Current Report on Form 8-K.

|

Under the Plan, the Company may grant equity incentive awards to directors, executive officers, and other eligible participants. A total of 4.4 million shares of the Company’s common stock are reserved for grant under the Plan. The types of awards under the Plan include incentive and non-qualified stock options, stock appreciation rights, restricted common stock, and other stock-based awards such as time- or performance-based restricted stock units. The Plan will be administered by the Compensation Committee of the Board of Directors and will expire on May 26, 2025.

Item 5.07 Submission of Matters to a Vote of Security Holders.

|

|

|

|

(a)

|

On May 26, 2020, the Company held its Annual Meeting of Shareholders for the purpose of considering and acting upon the following matters:

|

|

|

|

|

1.

|

To elect the following nominees as directors with terms expiring in 2021: J. Wickliffe Ach, William G. Barron, Vincent A. Berta, Cynthia O. Booth, Archie M. Brown, Claude E. Davis, Corinne R. Finnerty, Susan L. Knust, William J. Kramer, John T. Neighbours, Thomas M. O’Brien, and Maribeth S. Rahe;

|

|

|

|

|

2.

|

To ratify the appointment of Crowe Horwath LLP as the Company’s independent registered accounting firm for the fiscal year ending December 31, 2020;

|

|

|

|

|

3.

|

To approve the Company’s 2020 Stock Plan; and

|

|

|

|

|

4.

|

To approve, on an advisory basis, the compensation of the Company's executive officers.

|

As of March 27, 2020, the record date for the Annual Meeting, 97,968,911 shares of the Company's common stock were eligible to vote. There were a total of 84,613,616 shares present at the Annual Meeting (86.36% of the shares eligible to vote), constituting a quorum.

|

|

|

|

(b)

|

The voting results for each proposal, including the votes for and against, and any abstentions or broker non-votes, are described below.

|

Proposal 1 - Election of Directors. The Company’s shareholders elected all twelve nominees for director. Each nominee will serve for a one-year term ending in 2021. For each nominee, the votes cast for and withheld, as well as the abstentions and broker non-votes, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director Nominee

|

|

Aggregate Votes

|

|

|

FOR

|

|

WITHHELD

|

|

ABSTENTIONS

|

|

BROKER NON-VOTES

|

|

J. Wickliffe Ach

|

|

71,383,625

|

|

|

1,358,241

|

|

|

N/A

|

|

11,871,750

|

|

|

William G. Barron

|

|

72,104,061

|

|

|

637,805

|

|

|

N/A

|

|

11,871,750

|

|

|

Vincent A. Berta

|

|

72,382,013

|

|

|

359,853

|

|

|

N/A

|

|

11,871,750

|

|

|

Cynthia O. Booth

|

|

72,409,945

|

|

|

331,921

|

|

|

N/A

|

|

11,871,750

|

|

|

Archie M. Brown

|

|

72,084,363

|

|

|

657,503

|

|

|

N/A

|

|

11,871,750

|

|

|

Claude E. Davis

|

|

71,106,112

|

|

|

1,635,754

|

|

|

N/A

|

|

11,871,750

|

|

|

Corrine R. Finnerty

|

|

71,374,234

|

|

|

1,367,632

|

|

|

N/A

|

|

11,871,750

|

|

|

Susan L. Knust

|

|

69,796,347

|

|

|

2,945,519

|

|

|

N/A

|

|

11,871,750

|

|

|

William J. Kramer

|

|

69,509,172

|

|

|

3,232,694

|

|

|

N/A

|

|

11,871,750

|

|

|

John T. Neighbours

|

|

72,411,178

|

|

|

330,688

|

|

|

N/A

|

|

11,871,750

|

|

|

Thomas M. O’Brien

|

|

69,658,938

|

|

|

3,082,928

|

|

|

N/A

|

|

11,871,750

|

|

|

Maribeth S. Rahe

|

|

72,358,662

|

|

|

383,204

|

|

|

N/A

|

|

11,871,750

|

|

Proposal 2 - Ratification of Auditors. The Company’s shareholders ratified the Audit Committee’s selection of Crowe LLP as the Company’s independent registered public account firm for 2020. The votes cast for and against this proposal, as well as the abstentions and broker non-votes, were as follows:

|

|

|

|

|

|

|

|

Aggregate Votes

|

|

FOR

|

AGAINST

|

ABSTENTIONS

|

BROKER NON-VOTES

|

|

84,223,020

|

256,072

|

134,524

|

N/A

|

Proposal 3 - Approval of 2020 Stock Plan. The Company’s shareholders approved the 2020 Stock Plan. The votes cast for and against this proposal, as well as the abstentions and broker non-votes, were as follows:

|

|

|

|

|

|

|

|

Aggregate Votes

|

|

FOR

|

AGAINST

|

ABSTENTIONS

|

BROKER NON-VOTES

|

|

69,710,007

|

1,687,209

|

1,344,650

|

11,871,750

|

Proposal 4 - Advisory Vote on Executive Compensation. The Company’s shareholders approved the advisory vote on the compensation of the Company’s executive officers named in the proxy statement for the 2020 annual meeting of shareholders. The advisory resolution approved by the shareholders is also referred to as “say on pay.” The votes cast for and against this proposal, as well as the abstentions and broker non-votes, were as follows:

|

|

|

|

|

|

|

|

Aggregate Votes

|

|

FOR

|

AGAINST

|

ABSTENTIONS

|

BROKER NON-VOTES

|

|

50,403,680

|

20,888,517

|

1,449,669

|

11,871,750

|

Item 9.01 Financial Statements and Exhibits

(d) Exhibits. The following is filed as an Exhibit to this Current Report on Form 8-K:

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FIRST FINANCIAL BANCORP.

|

|

|

|

|

|

|

|

|

By: /s/ Karen B. Woods

|

|

|

|

Karen B. Woods

|

|

|

|

General Counsel

|

|

|

|

|

|

Date:

|

May 27, 2020

|

|

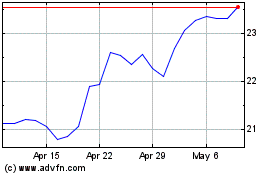

First Financial Bancorp (NASDAQ:FFBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

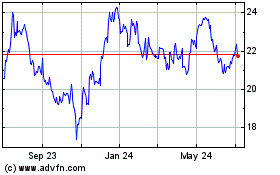

First Financial Bancorp (NASDAQ:FFBC)

Historical Stock Chart

From Apr 2023 to Apr 2024