First Citizens Bank and Entegra Bank Announce Receipt of Regulatory Approvals for Merger

December 16 2019 - 4:33PM

First-Citizens Bank & Trust Company (First Citizens Bank) and

Entegra Financial Corp. (Entegra) announced that First Citizens

Bank’s previously announced proposal to acquire (by merger) Entegra

and its wholly-owned subsidiary, Entegra Bank, has received the

required regulatory approvals from the Board of Governors of the

Federal Reserve System, the Federal Deposit Insurance Corporation

and the Office of the North Carolina Commissioner of Banks. No

further regulatory approvals are required to complete the merger.

Completion of the proposed acquisition remains subject to the

satisfaction or waiver of other closing conditions, and is expected

to occur on or about Dec. 31, 2019.

Frank B. Holding Jr., chairman and chief executive officer of

First Citizens Bank, said: “We’re excited to move toward completing

the merger with Entegra and to bring together complementary

companies that share the same core values, philosophies and

commitment to excellent service. We look forward to a smooth

transition.”

Following the legal close, Entegra Bank will operate as a

division of First Citizens Bank. Customers should continue to bank

at their current branches as usual.

About First Citizens Bank

Founded in 1898 and headquartered in Raleigh, N.C., First

Citizens Bank serves customers at more than 550 branches in 19

states. First Citizens Bank is a wholly owned subsidiary of First

Citizens BancShares, Inc. (First Citizens) (Nasdaq: FCNCA), which

has more than $37 billion in assets. For more information, call

toll free 1.888.FC DIRECT (1.888.323.4732) or visit

www.firstcitizens.com. First Citizens Bank. Forever First®.

About Entegra Financial Corp and Entegra

Bank

Entegra Financial Corp. is the holding company of Entegra Bank.

Entegra's common stock trades on the Nasdaq Global Market under the

ticker symbol “ENFC.” Entegra Bank operates a total of 18 branches

located throughout the Western North Carolina counties of Cherokee,

Haywood, Henderson, Jackson, Macon, Polk and Transylvania; the

Upstate South Carolina counties of Anderson, Greenville and

Spartanburg; and the North Georgia counties of Pickens and Hall.

The bank also operates loan production offices in Asheville, N.C.

and Clemson, S.C. For further information, visit the bank's

website: www.entegrabank.com

Cautionary Notes Regarding Forward-Looking

Statements

Certain of the statements made in this Press Release may

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The words “expect,”

“anticipate,” “intend,” “plan,” “believe,” “seek” and “estimate,”

and similar expressions, are intended to identify such

forward-looking statements, but other statements not based on

historical information may also be considered forward-looking.

Forward-looking statements include statements about the benefits to

Entegra or First Citizens and their bank subsidiaries of the

proposed merger (the Merger), Entegra’s and First Citizens’ future

financial and operating results, their respective plans, objectives

and intentions, and when the Merger will be completed. All

forward-looking statements are subject to known and unknown risks,

uncertainties, and other factors that may cause the actual results,

performance or achievements to differ materially from any results,

performance or achievements expressed or implied by such

forward-looking statements, including, among others,

(1) disruption from the Merger, or recently completed mergers,

with customer, supplier or employee relationships, (2) the

requirement by the Department of Justice, Antitrust Division, that

the parties enter into a sale agreement for three Entegra Bank

branches with a competitively suitable purchaser prior to the close

of the Merger (the Branch Divestiture), (3) uncertainties as

to the timing of the Merger and the Branch Divestiture, (4) the

risk that the proposed transactions may not be completed in a

timely manner or at all, (5) the occurrence of any event, change or

other circumstances that could give rise to the termination of the

merger agreement related to the Merger, including under

circumstances that would require a party to pay a termination fee,

(6) the possibility that the amount of the costs, fees,

expenses and charges related to the Merger and the Branch

Divestiture may be greater than anticipated, including as a result

of unexpected or unknown factors, events or liabilities,

(7) the failure or delay of the other conditions to the

consummation of the Merger to be satisfied or waived, (8)

reputational risk and the reaction of the parties’ customers to the

Merger and the Branch Divestiture, (9) the risk of potential

litigation or regulatory action related to the Merger, (10) the

risk that the cost savings and any revenue synergies from the

Merger may not be realized or take longer than anticipated to be

realized, (11) general competitive, economic, political and

market conditions, and (12) difficulties experienced in the

integration of the businesses. Additional factors which could

affect the forward-looking statements can be found in reports filed

with the Securities and Exchange Commission (SEC) by First Citizens

and Entegra and available on the SEC’s website at

http://www.sec.gov. Except as may be required by applicable law,

neither First Citizens nor Entegra undertake any obligation to

update or revise any forward-looking statements contained in this

communication, which speak only as of the date hereof, whether as a

result of new information, future events or otherwise.

| Contacts: |

Barbara Thompson |

Roger Plemens |

| |

919.716.2716 |

828.524.7000 |

| |

First Citizens Bank |

Entegra Financial Corp. |

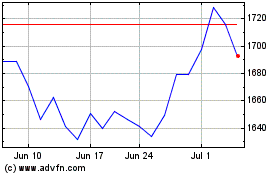

First Citizens BancShares (NASDAQ:FCNCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

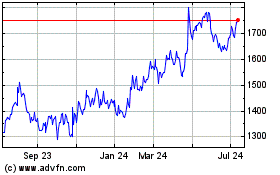

First Citizens BancShares (NASDAQ:FCNCA)

Historical Stock Chart

From Apr 2023 to Apr 2024