FuelCell Energy, Inc. (Nasdaq: FCEL), a global leader in delivering

clean, innovative and affordable fuel cell solutions for the

supply, recovery and storage of energy, today reported financial

results for its first fiscal quarter ended January 31, 2019 and key

business highlights.

Financial ResultsFuelCell Energy, Inc. (the

Company) reported total revenues for the first quarter of fiscal

2019 of $17.8 million, compared to total revenues of $38.6 million

for the first quarter of fiscal 2018, including:

- Service and license revenues totaled $11.8 million for the

first quarter of fiscal 2019 compared to $4.1 million for the first

quarter of fiscal 2018. The increase is primarily due to a

higher number of scheduled module replacements under the Company’s

service agreements in the first quarter of fiscal 2019, as well as

the benefit of the long-term service agreement with Korea Southern

Power Company (“KOSPO”) in South Korea entered into during fiscal

2018.

- Generation revenues totaled $1.5 million for the first quarter

of fiscal 2019 compared to $1.9 million for the first quarter of

fiscal 2018. Revenue was lower primarily due to the timing of plant

maintenance in the first quarter of fiscal 2019 compared with the

first quarter of fiscal 2018.

- Advanced technologies contract revenues totaled $4.5 million

for the first quarter of fiscal 2019 compared to $3.1 million for

the first quarter of fiscal 2018. Revenue was higher for the

first quarter of fiscal 2019 primarily due to the timing and mix of

activity under existing contracts.

- Product revenues decreased $29.5 million for the first quarter

of fiscal 2019 compared to the first quarter of fiscal 2018. The

decrease is primarily a result of the completion of deliveries in

fiscal 2018 under a 20 megawatt (MW) order for a utility project

owned by KOSPO.

The gross loss generated in the first quarter of fiscal 2019

totaled $2.2 million, compared to $4.6 million of gross profit

generated in the first quarter of fiscal 2018.

Operating expenses for the first quarter of fiscal 2019

totaled $13.0 million compared to $10.2 million for the first

quarter of fiscal 2018. This increase is related to spending

to complete the development and construction of the SureSource 4000

plant located in Danbury, Connecticut as well as higher

professional related and sales and marketing expenditures due to

business activities in the first quarter of fiscal 2019.

Net loss attributable to common stockholders for the first

quarter of fiscal 2019 totaled $33.0 million, or $0.33 per basic

and diluted share, compared to $8.4 million, or $0.12 per basic and

diluted share, for the first quarter of fiscal 2018. Net loss

attributable to common stockholders in the first quarter of fiscal

2019 includes a deemed dividend totaling $0.5 million and

redemption value adjustments of $8.6 million on the Company’s

Series C Convertible Preferred Stock, as well as a deemed dividend

of $1.9 million and $3.8 million of redemption accretion on the

Company’s Series D Convertible Preferred Stock. See the appendix at

the end of this release for further details regarding the deemed

dividend, redemption value adjustments and redemption accretion.

Together, these non-cash items accounted for approximately $0.15 of

the loss per share in the quarter.

Adjusted earnings before interest, taxes, depreciation and

amortization (Adjusted EBITDA, a Non-GAAP measure) in the first

quarter of fiscal 2019 totaled ($12.1) million compared to ($2.8)

million in the first quarter of fiscal 2018. Refer to the

discussion of Non-GAAP financial measures below regarding the

Company’s calculation of Adjusted EBITDA.

Backlog and Project AwardsThe Company had a

contract backlog totaling approximately $1.3 billion as of January

31, 2019 compared to contract backlog of approximately $638.5

million as of January 31, 2018.

- Services and license backlog totaled $291.2 million as of

January 31, 2019 compared to $178.7 million as of January 31,

2018. Services backlog includes future contracted revenue

from routine maintenance and scheduled module exchanges for power

plants under service agreements.

- Generation backlog totaled $982.4 million as of January 31,

2019 compared to $414.5 million as of January 31, 2018.

Generation backlog represents future contracted energy sales under

contracted power purchase agreements between the Company and the

end-user of the power. The previously announced 7.4 MW Long

Island Power Authority (“LIPA”) project in Yaphank, New York was

added to Generation backlog during the first quarter of fiscal

2019.

- Advanced technologies contract backlog totaled $37.0 million as

of January 31, 2019 compared to $43.1 million as of January 31,

2018.

Backlog represents definitive agreements executed by the Company

and our customers. Projects with respect to which the Company

intends to retain ownership are included in generation backlog,

which represents future revenue under long-term power purchase

agreements. Projects sold to customers (and not retained by the

Company) are included in product and service backlog. Project

awards referenced by the Company are notifications that the Company

has been selected, typically through a competitive bidding process,

to enter into definitive agreements. These awards have been

publicly disclosed. The Company is working to enter into definitive

agreements with respect to these project awards and, upon execution

of a definitive agreement with respect to a project award, that

project award will become backlog. Project awards that were not

included in backlog as of January 31, 2019 include the remaining

32.4 MW LIPA project awards (which are expected to become

generation backlog). These awards in total represent approximately

$636.3 million of future revenue potential over the life of such

LIPA projects, assuming the Company retains ownership of the LIPA

projects.

Cash, restricted cash and borrowing

abilityCash, cash equivalents, restricted cash, and

restricted cash equivalents totaled $68.2 million as of January 31,

2019, including $27.8 million of unrestricted cash and cash

equivalents and $40.5 million of restricted cash and cash

equivalents.

The

Company also has $90 million of borrowing ability under the project

financing loan agreement with Generate Capital, which may be

available for the manufacture, construction, installation,

commissioning and start-up of stationary fuel cell projects

approved by Generate Capital.

Project Assets Long term project assets

consist of projects developed by the Company that are structured

with power purchase agreements (PPAs), which generate recurring

monthly Generation revenue and cash flow, as well as projects the

Company is developing and expects to retain and operate. Long

term project assets totaled $109.8 million as of January 31, 2019,

with such project assets consisting of five previously completed

projects totaling 11.2 MW plus costs incurred to date for

previously announced projects that are under various stages of

construction.

Business Highlights and Recent

Developments – First Quarter Fiscal 2019

- Entered into a $100 million project finance facility with

Generate Lending that the Company expects to use to finance the

construction, installation and commissioning of certain of the

Company’s current and future project backlog and awards.

- Completed construction of the first SureSource 4000 fuel cell

located in Danbury, Connecticut.

- Continued to execute on 83.1 MW of projects in the generation

portfolio backlog.

“Overall, our first quarter was about executing on our longer

term vision of building a sustainably profitable and growth

oriented business focused on service solutions” said Chip Bottone,

President and Chief Executive Officer, FuelCell Energy. “Core to

this was the establishment of a number of new project financing

relationships that provide FuelCell Energy with efficient capital

to continue to develop and build out our project backlog. In

addition, we just completed the development and construction of our

high efficiency utility scale SureSource 4000 located in Danbury,

Connecticut. We are committed to driving our business towards

profitability, and this quarter’s accomplishments were major steps

towards that goal.”

Conference Call InformationFuelCell Energy

management will host a conference call with investors beginning at

10:00 a.m. Eastern Time on Thursday, March 7, 2019 to discuss the

first quarter results for fiscal 2019. Participants can access the

live call via webcast on the Company website or by telephone as

follows:

- The live webcast of this call and supporting slide presentation

will be available at www.fuelcellenergy.com. To listen to the call,

select “Investors” on the home page, proceed to the “Events &

Presentations” page and then click on the “Webcast” link listed

under the March 7th earnings call event listed, or click here.

- Alternatively, participants can dial 647-689-4106 and state

FuelCell Energy or the conference ID number 5884968.

The replay of the conference call will be available via webcast

on the Company’s Investors’ page at www.fuelcellenergy.com

approximately two hours after the conclusion of the call.

Cautionary Language This news release

contains forward-looking statements within the meaning of the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995, including, without limitation, statements with respect to

the Company’s anticipated financial results and statements

regarding the Company’s plans and expectations regarding the

continuing development, commercialization and financing of its fuel

cell technology and business plans. All forward-looking statements

are subject to risks and uncertainties that could cause actual

results to differ materially from those projected. Factors that

could cause such a difference include, without limitation, changes

to projected deliveries and order flow, changes to production rate

and product costs, general risks associated with product

development, manufacturing, changes in the regulatory environment,

customer strategies, unanticipated manufacturing issues that impact

power plant performance, changes in critical accounting policies,

potential volatility of energy prices, rapid technological change,

competition, and the Company’s ability to achieve its sales plans

and cost reduction targets, as well as other risks set forth in the

Company’s filings with the Securities and Exchange Commission. The

forward-looking statements contained herein speak only as of the

date of this press release. The Company expressly disclaims any

obligation or undertaking to release publicly any updates or

revisions to any such statement to reflect any change in the

Company’s expectations or any change in events, conditions or

circumstances on which any such statement is based.

About FuelCell Energy

FuelCell Energy, Inc. (NASDAQ: FCEL) delivers

state-of-the-art fuel cell power plants that provide

environmentally responsible solutions for various applications such

as utility-scale and on-site power generation, carbon capture,

local hydrogen production for both transportation and industry, and

long duration energy storage. Our systems cater to the needs

of customers across several industries, including utility

companies, municipalities, universities, government entities and a

variety of industrial and commercial enterprises. With our

megawatt-scale SureSource™ installations on three continents and

with more than 8.0 million megawatt hours of ultra-clean power

produced, FuelCell Energy is a global leader in designing,

manufacturing, installing, operating and maintaining

environmentally responsible fuel cell distributed power solutions.

Visit us online at www.fuelcellenergy.com and follow us on Twitter

@FuelCell_Energy.

SureSource, SureSource 1500, SureSource 3000, SureSource 4000,

SureSource Recovery, SureSource Capture, SureSource Hydrogen,

SureSource Storage, SureSource Service, SureSource Capital,

FuelCell Energy, and FuelCell Energy logo are all trademarks of

FuelCell Energy, Inc.

|

Contact: |

FuelCell Energy,

Inc.ir@fce.com203.205.2491 Source: FuelCell

Energy |

FUELCELL ENERGY,

INC.Consolidated Balance

Sheets(Unaudited)(Amounts in thousands, except

share and per share amounts)

|

|

|

January 31,2019 |

|

|

October 31,2018 |

|

ASSETS |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

| Cash and cash

equivalents, unrestricted |

$ |

27,750 |

|

|

$ |

39,291 |

|

| Restricted cash

and cash equivalents – short-term |

|

5,601 |

|

|

|

5,806 |

|

| Accounts

receivable, net |

|

8,321 |

|

|

|

9,280 |

|

| Unbilled

receivables |

|

12,387 |

|

|

|

13,759 |

|

| Inventories |

|

54,802 |

|

|

|

53,575 |

|

| Other current

assets |

|

8,273 |

|

|

|

8,592 |

|

| Total

current assets |

|

117,134 |

|

|

|

130,303 |

|

| |

|

|

|

|

|

| Restricted cash and

cash equivalents – long-term |

|

34,863 |

|

|

|

35,142 |

|

| Project assets |

|

109,819 |

|

|

|

99,600 |

|

| Property, plant and

equipment, net |

|

47,405 |

|

|

|

48,204 |

|

| Goodwill |

|

4,075 |

|

|

|

4,075 |

|

| Intangible assets |

|

9,592 |

|

|

|

9,592 |

|

| Other assets |

|

23,067 |

|

|

|

13,505 |

|

| Total

assets |

$ |

345,955 |

|

|

$ |

340,421 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

| Current portion

of long-term debt |

$ |

38,869 |

|

|

$ |

17,596 |

|

| Accounts

payable |

|

19,905 |

|

|

|

22,594 |

|

| Accrued

liabilities |

|

11,051 |

|

|

|

7,632 |

|

| Deferred

revenue |

|

17,213 |

|

|

|

11,347 |

|

|

Preferred stock obligation of subsidiary |

|

951 |

|

|

|

952 |

|

| Total

current liabilities |

|

87,989 |

|

|

|

60,121 |

|

| |

|

|

|

|

|

| Long-term deferred

revenue |

|

22,769 |

|

|

|

16,793 |

|

| Long-term preferred

stock obligation of subsidiary |

|

15,282 |

|

|

|

14,965 |

|

| Long-term debt and

other liabilities |

|

66,883 |

|

|

|

71,619 |

|

| Total liabilities |

|

192,923 |

|

|

|

163,498 |

|

| Redeemable Series B

preferred stock (liquidation preference of $64,020 at

January 31, 2019 and October 31, 2018) |

|

59,857 |

|

|

|

59,857 |

|

| Redeemable Series C

preferred stock (liquidation preference of $7,470 and $8,992

as of January 31, 2019 and October 31, 2018,

respectively) |

|

7,470 |

|

|

|

7,480 |

|

| Redeemable Series D

preferred stock (liquidation preference of $25,426 and

$30,680 as of January 31, 2019 and October 31, 2018,

respectively) |

|

26,851 |

|

|

|

27,392 |

|

| Total

Equity: |

|

|

|

|

|

| Stockholders’

equity Common stock ($0.0001 par value;

225,000,000 shares authorized at January

31, 2019 and October 31, 2018; 108,415,259 and 95,672,237

shares issued and outstanding at January 31,

2019 and October 31, 2018,

respectively) |

|

11 |

|

|

|

10 |

|

| Additional

paid-in capital |

|

1,074,308 |

|

|

|

1,073,454 |

|

| Accumulated

deficit |

|

(1,015,069 |

) |

|

|

(990,867 |

) |

| Accumulated

other comprehensive loss |

|

(396 |

) |

|

|

(403 |

) |

| Treasury stock,

Common, at cost (156,501 at January 31, 2019 and October 31,

2018) |

|

(363 |

) |

|

|

(363 |

) |

| Deferred

compensation |

|

363 |

|

|

|

363 |

|

| Total

stockholders’ equity |

|

58,854 |

|

|

|

82,194 |

|

| Total

liabilities and stockholders’ equity |

$ |

345,955 |

|

|

$ |

340,421 |

|

FUELCELL ENERGY,

INC.Consolidated Statements of

Operations(Unaudited)(Amounts in thousands, except

share and per share amounts)

| |

Three Months EndedJanuary

31, |

| |

2019 |

|

|

2018 |

|

| Revenues: |

|

|

|

|

|

| Product |

$ |

- |

|

|

$ |

29,530 |

|

| Service and

license |

|

11,772 |

|

|

|

4,104 |

|

| Generation |

|

1,479 |

|

|

|

1,892 |

|

| Advanced

Technologies |

|

4,532 |

|

|

|

3,087 |

|

|

Total revenues |

|

17,783 |

|

|

|

38,613 |

|

| |

|

|

|

|

|

| Costs of revenues: |

|

|

|

|

|

| Product |

|

3,422 |

|

|

|

26,137 |

|

| Service and

license |

|

12,319 |

|

|

|

3,406 |

|

| Generation |

|

1,636 |

|

|

|

1,609 |

|

| Advanced

Technologies |

|

2,611 |

|

|

|

2,826 |

|

|

Total cost of revenues |

|

19,988 |

|

|

|

33,978 |

|

| |

|

|

|

|

|

| Gross (loss)

profit |

|

(2,205 |

) |

|

|

4,635 |

|

| |

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

| Administrative

and selling expenses |

|

6,759 |

|

|

|

6,142 |

|

| Research and

development expense |

|

6,280 |

|

|

|

4,046 |

|

| Total

costs and expenses |

|

13,039 |

|

|

|

10,188 |

|

|

|

|

|

|

|

|

| Loss from

operations |

|

(15,244 |

) |

|

|

(5,553 |

) |

| |

|

|

|

|

|

| Interest

expense |

|

(2,464 |

) |

|

|

(2,141 |

) |

| Other income,

net |

|

160 |

|

|

|

476 |

|

| |

|

|

|

|

|

| Loss before benefit for

income taxes |

|

(17,548 |

) |

|

|

(7,218 |

) |

| |

|

|

|

|

|

| Benefit

for income taxes |

|

- |

|

|

|

3,035 |

|

| |

|

|

|

|

|

| Net loss |

|

(17,548 |

) |

|

|

(4,183 |

) |

| |

|

|

|

|

|

| Series B

preferred stock dividends |

|

(800 |

) |

|

|

(800 |

) |

| Series C

preferred stock deemed dividend and redemption value

adjustment |

|

(9,005 |

) |

|

|

(3,463 |

) |

| Series D

preferred stock deemed dividend and redemption accretion |

|

(5,685 |

) |

|

|

- |

|

| |

|

|

|

|

|

| Net loss attributable

to common stockholders |

$ |

(33,038 |

) |

|

$ |

(8,446 |

) |

| |

|

|

|

|

|

| Loss per share basic

and diluted: |

|

|

|

|

|

| Net loss

per share attributable to common stockholders |

$ |

(0.33 |

) |

|

$ |

(0.12 |

) |

| Basic and

diluted weighted average shares outstanding |

|

99,860,421 |

|

|

|

72,024,811 |

|

Appendix

Further Detail on Statement of Operations Accounting for

the Series C Convertible Preferred Stock and the Series D

Convertible Preferred Stock:

Net loss attributable to common stockholders in the first

quarter of fiscal 2019 includes a deemed dividend totaling $0.5

million on the Company’s Series C Convertible Preferred Stock,

redemption value adjustments of $8.6 million also on the Company’s

Series C Convertible Preferred Stock, deemed dividends totaling

$1.9 million on the Company’s Series D Convertible Preferred Stock,

as well as $3.8 million of redemption accretion on the Company’s

Series D Convertible Preferred Stock. Installment conversions of

the Company’s Series C Convertible Preferred Stock in which the

conversion price was below the adjusted conversion price of $1.50

per share, $0.58 per share, $0.50 per share, or $0.43 per share (as

in effect on applicable installment conversion dates) resulted in a

variable number of shares being issued to settle the installment

amount and were treated as a partial redemption of the Series C

Convertible Preferred Stock. Installment conversions of the

Company’s Series D Convertible Preferred Stock in which the

conversion price was below $1.38 (the conversion price of the

Series D Convertible Preferred Stock as of January 31, 2019)

resulted in a variable number of shares being issued to settle the

installment amount and were treated as a partial redemption of the

Series D Convertible Preferred Stock. The Series C

Convertible Preferred adjustment of $8.6 million for the first

quarter of fiscal 2019 reflects the trigger of a beneficial

conversion feature resulting from the reduction in conversion price

and the resulting adjustment of the instrument to redemption

value. The Series D Convertible Preferred Stock redemption

accretion of $3.8 million for the first quarter of fiscal 2019

reflects the accretion of the difference between the carrying value

and the amount that would be redeemed should stockholder approval

not be obtained for common stock issuance equal to 20% or more of

the Company’s outstanding voting stock prior to the issuance of the

Series D Convertible Preferred Stock.

Non-GAAP Financial Measures

Financial Results are presented in accordance with accounting

principles generally accepted in the United States (“GAAP”).

Management also uses non-GAAP measures to analyze and make

operating decisions on the business. Earnings before interest,

taxes, depreciation and amortization (EBITDA) and Adjusted EBITDA

are alternate, non-GAAP measures of cash utilization by the

Company.

These supplemental non-GAAP measures are provided to assist

readers in determining operating performance. Management believes

EBITDA and Adjusted EBITDA are useful in assessing performance and

highlighting trends on an overall basis. Management also believes

these measures are used by companies in the fuel cell sector and by

securities analysts and investors when comparing the results of

FuelCell Energy with those of other companies. EBITDA differs from

the most comparable GAAP measure, net loss attributable to FuelCell

Energy, Inc., primarily because it does not include finance

expense, income taxes and depreciation of property, plant and

equipment and project assets. Adjusted EBITDA adjusts EBITDA for

stock-based compensation and restructuring charges, which are

considered either non-cash or non-recurring.

While management believes that these non-GAAP financial measures

provide useful supplemental information to investors, there are

limitations associated with the use of these measures. The measures

are not prepared in accordance with GAAP and may not be directly

comparable to similarly titled measures of other companies due to

potential differences in the exact method of calculation. The

Company's non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable GAAP

financial measures, and should be read only in conjunction with the

Company's consolidated financial statements prepared in accordance

with GAAP.

The following table calculates EBITDA and Adjusted EBITDA and

reconciles these figures to the GAAP financial statement measure

Net loss.

| |

Three Months Ended January 31, |

|

| (Amounts in

thousands) |

|

2019 |

|

|

|

2018 |

|

|

| Net loss |

$ |

(17,548 |

) |

|

$ |

(4,183 |

) |

|

| Depreciation |

|

2,199 |

|

|

|

2,128 |

|

|

| Benefit for income

taxes |

|

- |

|

|

|

(3,035 |

) |

|

| Other (income)/expense,

net (1) |

|

(160 |

) |

|

|

(476 |

) |

|

| Interest expense |

|

2,464 |

|

|

|

2,141 |

|

|

| EBITDA |

$ |

(13,045 |

) |

|

$ |

(3,425 |

) |

|

| Stock-based compensation

expense |

|

982 |

|

|

|

617 |

|

|

|

Adjusted EBITDA |

$ |

(12,063 |

) |

|

$ |

(2,808 |

) |

|

- Other (income) expense, net includes gains and losses from

transactions denominated in foreign currencies, changes in fair

value of embedded derivatives, and other items incurred

periodically, which are not the result of the Company’s normal

business operations.

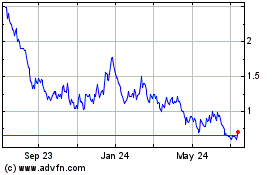

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024