By Sahil Patel and Nat Ives

In a virtual town hall with marketers and advertising agencies

on Tuesday, Facebook Inc. executives once again tried to answer

complaints that the company hasn't done enough to counter hate

speech and misinformation.

Led by Carolyn Everson, vice president of Facebook's Global

Business Group, executives described efforts to make the Facebook

and Instagram platforms less hostile and the difficulty of

moderating conversations without constraining speech, according to

participants.

It was just the latest effort by Facebook to show that the

social-media giant takes seriously the concerns about its policies.

But the company isn't only confronting the challenge sparked on

June 17, when several civil-rights groups called on advertisers to

pull their spending as a way to pressure Facebook into changing the

way it handles content. Facebook is also facing discontent from

advertisers stretching back years.

"The history really helped everyone feel pretty vindicated in

taking this action and being serious about it," said Katia

Beauchamp, co-founder and chief executive at beauty retailer

Birchbox Inc., which joined the boycott on June 26.

That history includes the revelation in 2018 that personal data

of tens of millions of Facebook users improperly wound up with data

firm Cambridge Analytica, prompting government probes and calls for

stricter privacy protections online.

Marketers have also criticized Facebook for the way it handles

measurement on its platform and what some call a lack of commitment

to brand safety -- keeping their ads away from objectionable

content.

A Facebook spokeswoman pointed to the company's announcement on

Monday about a new audit, run by industry watchdog Media Rating

Council. It will evaluate Facebook's content monetization and

brand-safety tools and practices as part of new initiatives the

company is undertaking in response to recent criticisms.

Other companies that have paused ad spending with Facebook now

include Volkswagen AG, Ford Motor Co., Clorox Co., Denny's Corp.,

Verizon Communications Inc., Coca-Cola Co., Unilever PLC, Levi

Strauss & Co., along with smaller brands.

Some have also suspended advertising elsewhere in social media,

and not all are identifying themselves with the boycott effort.

More have focused directly on Facebook.

"Marketers' dissatisfaction goes way back," said Joy Howard,

chief marketing officer at password manager Dashlane Inc., which

said it won't advertise with Facebook at least through July, the

month targeted by boycott organizers.

Ms. Howard participated in an earlier, one-week boycott of

Facebook advertising over Cambridge Analytica when she was chief

marketing officer at Sonos Inc., she said.

At Dashlane, her team was already trying to reduce reliance on

Facebook over concerns about content even before the boycott call,

she said, but also because of controversy over the potential for

discriminatory advertising several years ago.

Facebook said then it would no longer let marketers target

housing, employment and credit-related ads by ethnic affinity. In

March 2019 the company settled five discrimination lawsuits in part

by also removing age, gender and ZIP Code targeting for housing,

employment and credit-related ads.

Facebook is also still trying to bolster advertisers' trust in

the metrics it provides, going back to the 2016 disclosure that it

had overestimated average viewing time for video ads on its

platform for two years.

The Media Rating Council warned Facebook this spring that it

could be denied a seal of approval that gives companies confidence

they are getting what they pay for when it comes to advertising on

its platforms.

The notice said that Facebook had failed to address advertiser

concerns arising from a 2019 audit performed by Ernst & Young,

most notably concerning how Facebook measures and reports data

about video advertisements.

"These exchanges are part of the audit process," Facebook said

in May. "We will continue working with MRC on accreditation, as we

have since 2016."

Each incident has created blowback from advertisers, but

Facebook has managed to continue to grow ad revenue. It reported

companywide ad revenue of $69.7 billion last year, up from $55

billion in 2018 and $17.1 billion in 2015.

Facebook and Instagram's U.S. ad revenue alone is expected to

grow nearly 5% to $31.43 billion this year, according to research

firm eMarketer.

Even as the list of major marketers now suspending their

advertising grows, Facebook remains somewhat protected because the

bulk of its revenue comes from small and midsize companies.

Facebook's top 100 advertisers comprised less than 20% of its total

ad revenue in the first quarter of 2019, Chief Operating Officer

Sheryl Sandberg said last year.

Many small companies and marketers that sell directly to

consumers without going through retailers would suffer more than a

major multinational from a Facebook boycott, said Kevin Simonson,

vice president of social for digital marketing agency Wpromote

LLC.

The business model of most consumer brands that sell primarily

through the internet relies heavily on Facebook and Instagram, Mr.

Simonson said. "So for them to pause their main source of revenue

would be devastating to their business in ways that it won't for a

vast majority of the big brands participating in the boycott."

Particularly for prominent brands, however, the current

confrontation may be different than past strife because it revolves

around broad ethical issues rather than concerns largely specific

to the ad industry, some ad executives said.

"The difference this time is that CMOs are getting pressure from

their boards, and the boards are getting pressure from the public

and advocacy groups," said an executive at a large ad-agency

holding company.

Facebook said that it invests billions of dollars every year to

keep its platform safe and has banned 250 white-supremacist

organizations from Facebook and Instagram. Facebook's technology

finds nearly 90% of hate speech before anyone flags it, the company

said.

"We know we have more work to do," Facebook said, adding that it

would continue to work with Global Alliance for Responsible Media,

an ad-industry group created to improve the digital ecosystem, and

others.

The fight against hate speech overlaps with a longtime business

concern of marketers in the digital age: keeping their ads far from

offensive content.

Verizon suspended its advertising on Facebook and Instagram

after the Anti-Defamation League released a screenshot showing a

Verizon ad next to a Facebook post alleging that FEMA was getting

ready to put people in concentration camps. The ADL is one of the

organizers of the boycott.

"We're pausing our advertising until Facebook can create an

acceptable solution that makes us comfortable and is consistent

with what we've done with YouTube and other partners," Verizon

Chief Media Officer John Nitti said on June 25.

The Facebook spokeswoman declined to comment on Verizon's

decision.

"There's more to it than issues of misinformation and hate

speech," an ad buyer at a major advertising agency said. "Facebook

needs to invest more in keeping advertisers away from objectionable

content."

Write to Sahil Patel at sahil.patel@wsj.com and Nat Ives at

nat.ives@wsj.com

(END) Dow Jones Newswires

June 30, 2020 19:48 ET (23:48 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

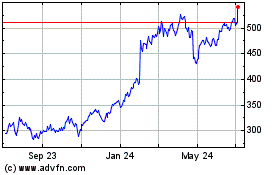

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

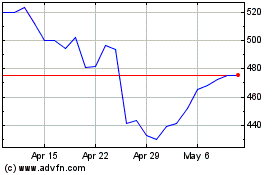

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024