UK Antitrust Watchdog Sets out Proposals to Tackle Tech Giants' Hold of Ad Market -- Update

December 18 2019 - 11:03AM

Dow Jones News

(Adds Google, Facebook responses)

--The U.K.'s Competition and Markets Authority on Wednesday set

out preliminary proposals to regulate online platforms and digital

advertising

--Google and Facebook said they would cooperate with

regulators

--The CMA will present its findings on the GBP13 billion

online-advertising market to the U.K. government at the end of its

study

By Adria Calatayud

The U.K.'s Competition and Markets Authority on Wednesday

outlined a series of preliminary proposals to regulate online

platforms and digital advertising, as regulators worldwide tighten

their grip on the tech industry.

The antitrust regulator, which began examining the sector in

July, said preliminary findings indicate there is a strong argument

for developing a new regulatory regime to govern the behavior of

online platforms and give people greater control over their

data.

Alphabet Inc. (GOOGL)'s Google and Facebook Inc. (FB) vowed to

collaborate with the U.K. government and the competition regulator

on online advertising, a market the CMA said is now worth around 13

billion pounds ($17.15 billion).

The CMA said Google accounted for more than 90% of around GBP6

billion generated in revenue from search advertising in the U.K.

last year. Meanwhile, Facebook received almost half of all

display-advertising revenue in the U.K., which reached more than

GBP2 billion, it said.

The regulator invited comments on a series of proposals to open

up the search market, require Facebook to connect more seamlessly

with rival social networking sites, and address conflicts of

interests and lack of transparency in digital advertising. Its

interim report will be open for consultation until Feb. 12, the CMA

said.

"At the end of the study, we'll present our findings to the new

government as they decide whether and how to regulate what is an

increasingly central sector in all our lives," CMA Chief Executive

Andrea Coscelli said.

The CMA said a lack of real competition for Google and Facebook

could mean people miss out on the next great new idea from a

potential rival and result in a lack of proper choice for consumers

and higher prices for advertisers. Furthermore, the market position

of Google and Facebook may potentially be undermining newspapers

and publishers' ability to produce valuable content, it said.

The regulator said it is also concerned about a lack of

transparency in the way that business on digital platforms

works.

"We've built easy-to-use controls that enable people to manage

their data in Google's services--such as the ability to turn off

personalized advertising and to automatically delete their search

history. We'll continue to work constructively with the CMA and the

government," said Ronan Harris, vice president of Google U.K. and

Ireland.

Facebook said it agrees with the CMA that people should have

control over their data and transparency around how it is used.

"In fact, for every ad we show, we give people the option to

find out why they are seeing that ad and an option to turn off ads

from that advertiser entirely," a Facebook spokesperson said.

Earlier this year, a government-appointed panel of experts led

by Jason Furman, a Harvard University economist who previously

chaired President Obama's Council of Economic Advisers, recommended

establishing a new regulator that would work with big tech

companies to develop a code of conduct.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

December 18, 2019 10:48 ET (15:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

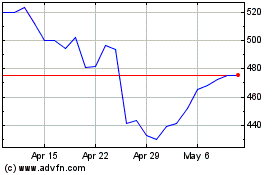

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

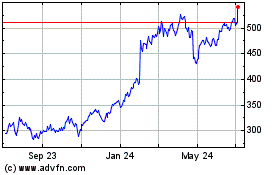

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024