European Stocks Hit All-Time Record -- Update

December 16 2019 - 12:18PM

Dow Jones News

By Caitlin Ostroff

Long-suffering investors in European stocks have something to

celebrate, with the region's benchmark equity index hitting its

first record in more than four years thanks in part to the lifting

of geopolitical clouds.

The Stoxx Europe 600 index, which tracks companies across the

continent and in the U.K., has climbed about 24% year to date,

putting it on track for its best performance in a decade. On

Friday, investors' optimism that the U.K. would proceed with Brexit

and the U.S. might halt its trade war with China helped the

benchmark index briefly cross its April 2015 record. It surpassed

that record Monday after climbing 1.4%.

That is still a poor showing compared with the U.S., where the

S&P 500 on Friday notched a new all-time high for the 28th time

this year, underpinned by its long economic expansion and

high-growth technology sector, with the so-called FAANG stocks --

Facebook Inc., Amazon.com Inc., Apple Inc., Netflix Inc. and Google

parent Alphabet Inc. -- dominating the market.

Europe has spent much of the past decade grappling with uneven

economic growth. The aftermath of the sovereign-debt crisis,

vulnerability to global trade tensions and uncertainty around the

U.K.'s plans to leave the European Union added to the woes.

"The experience of equity investors in Europe over the last 20

years has been pretty dreadful," said Tristan Hanson, multiasset

fund manager at M&G Investments. "People have been on the

lookout in thinking `what can go wrong?' all the time." He thinks

European bank stocks, which have risen only tepidly this year, have

room to go higher.

The performance of the European equity market was in line with

that of the U.S. from the end of 1993 until the Greek

sovereign-debt problem erupted in 2009. Since the end of that year,

including dividend reinvestments, the difference remains stark,

with the pan-continental index gaining 129% as the S&P 500 rose

250%.

This year's resurgence in Europe has been led by sectors such as

technology, construction and materials, and financial services,

which includes asset managers and stock exchanges. A flurry of deal

making related to the London Stock Exchange Group sent its shares

up nearly 82%.

And many of the factors weighing on Europe have been the

catalyst for the rebound. Italy has long been a cause for worry

over its weak banks and heavy levels of government debt. This year,

however, it is Europe's best-performing major stock market, as

investors were relieved over a change in the ruling government

coalition that took a less confrontational approach to economic

relations with the rest of Europe.

Since the U.K.'s decision in June 2016 to divorce the trading

bloc, Brexit limbo has weighed on U.K. stocks, which account for

about a quarter of the pan-continental index.

Last week's electoral victory for Prime Minister Boris Johnson,

who has pledged to exit the EU by the end of next month, helped the

FTSE 250 index, which tracks British companies with a significant

domestic focus, close at a record on Friday.

"On the Brexit front, this has broken the paralysis a bit," said

Jonathan Allison, investment director at Aberdeen Standard

Investments. "This sort of extends into the European market as

well."

European stocks have also been at a disadvantage as low interest

rates in much of the developed world pushed investors to place a

higher value on growth stocks, especially in the tech world, where

it has few big players. The information-technology sector makes up

almost a quarter of the S&P 500, compared with about 6% of the

pan-European index.

Easy monetary policy is expected to continue under new European

Central Bank President Christine Lagarde.

Banks have been another drag in Europe, having recovered more

slowly than American counterparts, said Nicholette MacDonald-Brown,

a fund manager at Schroders Asset Management. That is in large part

because the U.S. acted quickly after the financial crisis of

2007-08, forcing some banks to take quick bailouts, while Europe

has been slower to clean up. Negative rates have also weighed on

European banks.

The S&P 500's financials sector has rallied 162% in the past

decade, compared with a 36% decline in the Stoxx Europe 600's

banking sector.

Despite the overall record, European stocks are less expensive

on average compared with American peers based on expected

price-to-earnings. While that has been the case for sometime, Ms.

MacDonald-Brown figures the lifting of geopolitical clouds could

help European stocks jump higher.

"It's still one of the few markets still trading at a discount,"

Ms. MacDonald-Brown said. "There's definitely potential for

upside."

Write to Caitlin Ostroff at caitlin.ostroff@wsj.com

(END) Dow Jones Newswires

December 16, 2019 12:03 ET (17:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

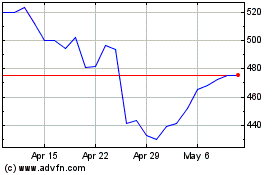

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

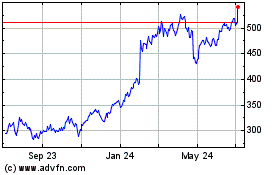

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024