By AnnaMaria Andriotis and Peter Rudegeair

The biggest financial companies that Facebook Inc. recruited to

launch a world-wide cryptocurrency-based payments network have

backed out of the project, threatening to derail an ambitious

initiative to remake global finance before it ever gets off the

ground.

Visa Inc., Mastercard Inc., Stripe Inc. and eBay Inc. said

Friday they were withdrawing from the coalition of companies that

had originally signed on to help launch the libra cryptocurrency,

following PayPal Holdings Inc., which dropped out of the Libra

Association last week.

The moves came after lawmakers, central bankers and regulators

expressed deep concerns about the libra project.

The loss of four of the largest payments companies in the world

leaves Facebook without much of the muscle it assembled for libra,

a digital currency it hoped would make it a player in e-commerce

and global money transfers. The project now mostly hinges on

smaller payments companies, telecommunications providers,

venture-capital firms, e-commerce merchants and nonprofits.

"I would caution against reading the fate of Libra into this

update," David Marcus, the Facebook executive overseeing the

project, wrote Friday on Twitter. "Of course, it's not great news

in the short term, but in a way it's liberating. Stay tuned for

more very soon. Change of this magnitude is hard. You know you're

on to something when so much pressure builds up."

While some of the companies left open the possibility of

rejoining the network in the future, the loss of Visa and

Mastercard is an especially painful setback for libra. The credit

and debit cards that run over their networks would have made it

easier for consumers to buy the digital coins.

"Our ultimate decision will be determined by a number of

factors, including the Association's ability to fully satisfy all

requisite regulatory expectations," a Visa spokesperson said in an

email. Mastercard believes "there are potential benefits in such

initiatives and will continue to monitor the Libra effort," a

spokesperson said.

For Facebook, the withdrawals imperil one of the company's two

major strategy shifts announced in the past year. The other, a push

toward more encrypted messaging, was also called into question

earlier this month when Attorney General William Barr asked the

company to delay implementation, citing public safety.

Both projects to some extent were designed to lessen the

social-media giant's near-complete dependence on targeted

advertising for revenue.

Coming in the wake of multiple privacy scandals and

public-relations fiascoes, Facebook's approach to Libra was

uncommonly cautious, with the company pledging to move slowly and

work with regulators. It said its initial goal with Libra would be

to make international financial transactions and remittance

payments cheaper and more accessible, and it committed to turning

over full control of the project to the Libra Association.

When Facebook unveiled the project in June, it announced that 27

other companies and organizations had agreed to back it. The idea

was that merchants including eBay, Uber Technologies Inc. and

Spotify Technology SA would accept libra as a form of payment, and

that Mastercard, PayPal and Stripe and would enable consumers and

merchants to convert their national currencies into and out of

libra.

Lawmakers and regulators were quick to criticize Facebook for

not supplying enough information about libra's defenses against

money laundering and other financial crime. In response, Facebook

pledged not to launch libra until regulators grew comfortable with

the project. Mr. Marcus, the network's architect, insisted that

libra wouldn't pose a threat to global financial stability.

The regulatory backlash stunned the projects backers. Several

companies that initially signed onto the project believed that

Facebook and the Libra Association had overstated their involvement

when it unveiled the project, people familiar with the matter said.

Facebook described them as "founding members," yet they had signed

nonbinding letters of intent to join the association that gave them

the option to withdraw at any time.

The pressure on libra's financial partners intensified after the

U.S. Treasury Department sent letters to Mastercard, PayPal, Stripe

and Visa asking for a complete overview of their compliance

programs and how libra would fit into them.

Earlier this month, The Wall Street Journal reported that Visa,

Mastercard and other financial partners were reconsidering their

involvement in the network. Mr. Marcus pledged to keep the project

on track.

"I can tell you that we're very calmly, and confidently working

through the legitimate concerns that Libra has raised by bringing

conversations about the value of digital currencies to the

forefront," he wrote on Twitter earlier this month. "Change of this

magnitude is hard and requires courage + it will be a long

journey."

Facebook has shown no signs of dropping its effort to convince

lawmakers and regulators that its digital currency initiative poses

no threat.

On Wednesday, the House Financial Services committee said Chief

Executive Mark Zuckerberg had agreed to testify in a one-man

hearing titled "An Examination of Facebook and Its Impact on the

Financial Services and Housing Sectors." That hearing is scheduled

for Oct. 23.

Libra's remaining partners are set to gather Monday in

Switzerland to formally sign on to the project.

"Although the makeup of the Association members may grow and

change over time, the design principle of Libra's governance and

technology, along with the open nature of this project ensures the

Libra payment network will remain resilient," Dante Disparte, the

head of policy and communications for the Libra Association, said

in an email.

--Liz Hoffman contributed to this article.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

October 11, 2019 18:59 ET (22:59 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

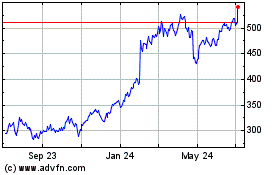

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

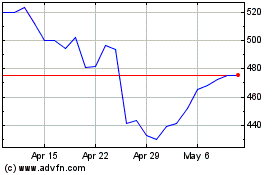

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024