Anti-Money-Laundering Watchdog Calls for Stronger Cryptocurrency Regulations

June 21 2019 - 6:53PM

Dow Jones News

By Kristin Broughton

The global standard setter for anti-money-laundering laws called

on countries to apply more scrutiny to virtual currency firms that

transfer customer funds.

The Paris-based Financial Action Task Force said Friday that

countries should adopt regulations requiring virtual currency

companies -- including exchanges and wallet providers -- to collect

information about their customers and share it with other

institutions, including other crypto firms, that receive fund

transfers.

The FATF, established three decades ago by the Group of Seven

leading nations, evaluates the policies countries have in place to

combat money laundering and terrorist financing.

The updated guidance, published Friday following a meeting in

Orlando, Fla., comes as financial regulators grapple with how to

regulate virtual currency firms.

U.S. policy makers this week said they would scrutinize plans by

Facebook Inc. to launch its own cryptocurrency, looking at issues

including anti-money-laundering controls. In prepared remarks for

an annual address to bankers in London's financial district, Bank

of England Gov. Mark Carney also said Facebook's Libra project

should be carefully vetted by regulators.

At the FATF meeting, U.S. Treasury Secretary Steven Mnuchin said

the guidelines will provide more transparency to markets that have

allowed financial criminals to transact anonymously.

"This will enable the emerging fintech sector to stay one step

ahead of rogue regimes and sympathizers of illicit causes searching

for avenues to raise and transfer funds without detection," Mr.

Mnuchin said, according to a copy of his prepared remarks.

In adopting what is known as the travel rule, the FATF will

require virtual currency companies to identify senders and

receivers involved in fund transfers, similar to the way banks

provide each other with customer information for wire transfers.

Additionally, the FATF guidance says countries should designate an

authority responsible for licensing or registering virtual currency

companies.

The FATF expects to incorporate the new guidance into its

assessment methodology in October, and then will begin assessing

countries' compliance, according to a spokesman.

Crypto companies across the globe may face hurdles in

implementing the new standards, according to executives who advise

the firms.

Among the challenges: Virtual currency companies currently don't

have a secure way to share customer information with each other,

similar to the way banks use the Swift interbank messaging network

for wire transfers, said Alma Angotti, managing director with the

global investigations and compliance practice at Navigant

Consulting in London.

And while some crypto companies have invested heavily in

compliance, others have a long way to go to build the systems

necessary for collecting and managing customer information, said

Michael Nonaka, co-chair of the financial services group at

Covington & Burling LLP.

"We don't know right now the extent to which the new rule will

pose difficulties," Mr. Nonaka said.

Write to Kristin Broughton at kristin.broughton@wsj.com

(END) Dow Jones Newswires

June 21, 2019 18:38 ET (22:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

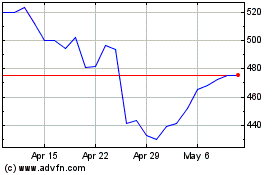

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

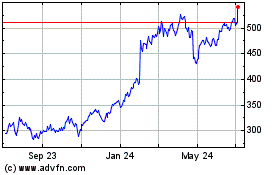

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024