BOE's Carney Says Libra Needs Scrutiny

June 20 2019 - 12:53PM

Dow Jones News

By Jason Douglas

LONDON--Facebook Inc.'s (FB) Libra project should be carefully

vetted by regulators, Bank of England Governor Mark Carney is due

to say Thursday, offering an early insight into how the U.K.

central bank will approach the new cryptocurrency.

In an annual address to bankers in London's financial district,

Mr. Carney is expected to say Libra has the potential to be a

critical part of the global financial system given the social media

giant's reach and as such will need to be scrutinized by regulators

and central banks.

"Libra, if it achieves its ambitions, would be systemically

important," Mr. Carney will say, according to a text of his remarks

published in advance by the BOE.

Facebook this week said that Libra, a secure blockchain-based

payment system backed by hard assets, would be designed for

ordinary users, making it among the boldest efforts yet to bring

digital currencies into the mainstream.

Facebook named a series of corporate partners--including

financial-services heavyweights Mastercard Inc. (MA) and PayPal

Holdings Inc. (PYPL), and tech giants Uber Technologies Inc. (UBER)

and Spotify Technology SA (SPOT)--that it said would help create

what it described as a "secure, scalable and reliable"

cryptocurrency.

The Wall Street Journal reported in May that the initiative

involved developing a "stablecoin"--a digital asset backed by a

basket of global currencies or other investments--unlike other

cryptocurrencies, such as bitcoin, whose values can fluctuate

sharply.

Facebook and its partners will need to satisfy regulators on

issues ranging from antimoney laundering to data protection, and

central banks will need to consider the implications of Libra for

financial and monetary stability, Mr. Carney is expected to

say.

All this must happen before the payment system's formal launch,

he will say.

"Unlike social media, for which standards and regulations are

being debated well after it has been adopted by billions of users,

the terms of engagement for innovations such as Libra must be

adopted in advance of any launch," Mr. Carney will say.

Still, he will say the BOE will approach Libra "with an open

mind," acknowledging it may extend access to financial services and

lower the cost of cross-border payments.

Libra is just one of a host of innovative payment systems that

are upending traditional banking. In many parts of Europe, cash use

is shrinking rapidly as consumers use electronic alternatives and

smartphone apps to pay for goods and transfer money.

The BOE plans to launch a public consultation on whether to

permit nonbank payment providers to hold accounts at the central

bank like commercial banks, giving them access to central-bank

reserves in times of financial stress, Mr. Carney is due to say.

Such a change would bring down costs for consumers and aid

financial stability, he will argue.

Mr. Carney is also expected to say that banks in the U.K. will

be tested in 2021 for their resilience to financial risks arising

from climate change, a first for a major central bank.

Write to Jason Douglas at Jason.Douglas@wsj.com

(END) Dow Jones Newswires

June 20, 2019 12:38 ET (16:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

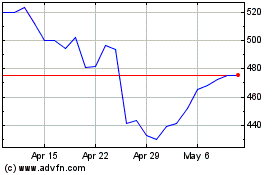

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

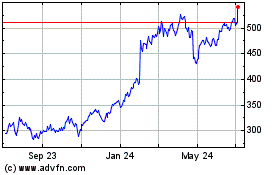

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024