Fed, Congress to Scrutinize Facebook's Libra -- WSJ

June 20 2019 - 3:02AM

Dow Jones News

By Dave Michaels

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 20, 2019).

WASHINGTON -- Facebook Inc. began to learn how Washington will

check its push into digital currencies, with leaders of the Federal

Reserve and an influential Senate committee saying they will

scrutinize its rollout.

Fed Chairman Jerome Powell on Wednesday said the central bank

has "significant input into the payments system," the e-commerce

network that Facebook is seeking to disrupt with its Libra

currency. Banking regulators also can enforce anti-money-laundering

controls on such businesses, Mr. Powell told reporters.

"We will wind up having quite high expectations from a sort of

safety and soundness and regulatory standpoint if they do decide to

go forward with something," Mr. Powell said at a news conference

after the Fed held its benchmark interest rate steady.

Facebook this week unveiled its plans for the Libra "stablecoin"

-- a digital asset backed by a basket of global currencies or other

investments. The digital money is supposed to make it easier to

make online payments, particularly for people around the world who

lack bank accounts, Facebook said.

Mr. Powell said Facebook has met with the Fed about the project,

along with regulators around the world. "It's something we're

looking at," he said. Mr. Powell said Fed officials aren't worried

that Libra will displace national currencies or make it harder to

implement monetary policy. "I think we're a long way from that," he

added.

A Facebook spokeswoman declined to comment.

Cryptocurrencies have become a puzzle for global regulators,

with agencies grappling with rules written decades ago to oversee

market intermediaries that don't exist in cryptocurrency networks.

In the U.S., the Securities and Exchange Commission has asserted

authority over cryptocurrencies it sees as securities, or

investments made with the expectation of profits. Other agencies

are charged with enforcing anti-money-laundering laws that apply to

money transactions.

Facebook's Libra would be run at a new subsidiary, called

Calibra, that would be governed along with external partners,

including companies such as Mastercard Inc. and PayPal Holdings

Inc. and tech giants Uber Technologies Inc. and Spotify Technology

SA.. It would operate using a crypto wallet, or digital app that

can be used to pay send money and make payments, using the

cryptocurrency.

Facebook separately is expected to face critics on Capitol Hill,

where the Senate Banking Committee plans to hold a hearing next

month to probe its venture. Sen. Mike Crapo (R., Idaho) announced

that his panel will examine the project on July 16.

The committee's quick move to stage a hearing indicates "there

will be significant political opposition" to Facebook's involvement

with Libra, Cowen & Co. analyst Jaret Seiberg said. "We believe

the initial hearing is critical for Facebook and its digital

currency expectations," he added.

A hearing is also likely in the House, where House Financial

Services Committee Chairwoman Maxine Waters (D., Calif.) has asked

Facebook to put Libra on hold until regulators and lawmakers decide

how to oversee it.

"Regulators should see this as a wake-up call to get serious

about the privacy and national security concerns, cybersecurity

risks, and trading risks that are posed by cryptocurrencies," Ms.

Waters said.

Operators of stablecoin networks are generally regulated by

state money-transmission laws and federal requirements to guard

against money laundering, said Brian Brooks, chief legal officer of

Coinbase Inc., which boasts 30 million customer accounts and

enables people to trade an array of cryptocurrencies.

Speaking at an event in Washington, Mr. Brooks said banking

regulators could have some sway over how Facebook or its partners

manage the basket of assets that back Libra's value.

Mr. Brooks said Washington could permit a wave of innovation

that makes finance cheaper and more accessible for consumers if it

applies the same hands-off approach to crypto assets that it did to

the internet in the 1990s.

"We have to bring regulation which largely was written between

1900 and 1950 in line with technology that was largely written in

2009," said Mr. Brooks, a former general counsel of Fannie Mae. "We

are at a decision point on this asset. There could be great things

ahead, or there could be nothing ahead."

Officials in France and the U.K. also have said they are looking

at Facebook's cryptocurrency plans. "Anything that works in this

world, will become instantly systemic and will have to be subject

to the highest standards of regulations," Bank of England Gov. Mark

Carney said at a central-bank conference in Portugal.

Write to Dave Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

June 20, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

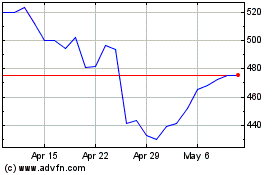

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

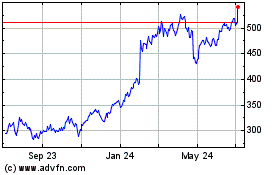

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024