By Jeff Horwitz and Parmy Olson

Facebook Inc. formally announced plans to launch a

cryptocurrency, an ambitious move that could diversify its business

from advertising while claiming a larger role in its users'

financial lives.

The cryptocurrency, called Libra, will be a secure

blockchain-based payment system backed by hard assets and designed

for ordinary users -- making it among the boldest efforts yet to

bring digital currencies into mainstream use.

Facing continuing scrutiny of its privacy practices, Facebook

said it is creating a regulated subsidiary, called Calibra, to

ensure "the separation between social and financial data." Calibra

will roll out a crypto wallet -- a digital app that can be used to

pay for items online and send money -- using Libra.

Facebook on Tuesday named a series of big, corporate partners --

including financial-services heavyweights Mastercard Inc. and

PayPal Holdings Inc. and tech giants Uber Technologies Inc. and

Spotify Technology SA -- that it said would help it create a

"secure, scalable and reliable" cryptocurrency. The Wall Street

Journal reported in May that the initiative involved the creation

of a "stablecoin" -- a digital asset backed by a basket of global

currencies or other investments -- unlike other cryptocurrencies,

such as bitcoin, whose values are susceptible to sharp

fluctuation.

Facebook said Libra would be available by 2020 on its Messenger

and WhatsApp services and as a stand-alone app. In a blog post

early Tuesday morning, the company said one of the Libra network's

early goals would be to provide basic financial services to people

around the world who lack bank accounts and to save some of the $25

billion "lost by migrants every year through remittance fees."

The company has worked quietly on a blockchain-based payments

system for more than a year, with the effort headed former PayPal

President David Marcus. Facebook has large ambitions for the

project and its use by the social platform's 2.4 billion monthly

active users. The company envisions Libra potentially being used to

make everyday financial transactions like paying bills, making

retail purchases and paying for public transport.

Early reactions from bank analysts covering Facebook were

ecstatic, in part because the Libra project would help the company

move away from a near-complete reliance on targeted advertising.

Though wildly successful, that business model has exposed the

company to criticism regarding its privacy practices and its

handling of misinformation on public platforms. The company is also

shifting toward more private communications, and payments would

potentially provide a way to make money in those channels.

JPMorgan's Doug Anmuth said Libra would help Facebook diversify

its sources of revenues beyond advertising "while also empowering

billions of people." In a note to clients after Facebook's Libra

disclosures, Royal Bank of Canada analysts Mark Mahaney and Zachary

Schwartzman described the project as the foundation for fundamental

changes to the digital consumer economy.

"In terms of scale and importance, we believe this new financial

infrastructure could be viewed similar to Apple's introduction of

iOS to developers over a decade ago," they said.

Still, the potential advantages Facebook's proposal might offer

over more conventional means of digital payments aren't yet

clear.

"What makes this better than what exists?" asked Raina Haque, a

Wake Forest University professor who says it's too early to say

whether Facebook's plan poses a real threat to the existing global

payments industry. "It's almost like the term 'crypto' is so sexy

it puts the blinders on anyone asking all the questions that should

be asked."

Many questions indeed remain. Facebook said the Libra subsidiary

would be regulated, but didn't say from where or by which agency.

It is also notable that the original list of Calibra partners

didn't include any major U.S. banks, raising the possibility that

Wall Street would see Facebook's effort as a potential competitor

that it should try to impede.

To the extent Facebook acts as a money transmitter, it would

have to comply with U.S. anti-money-laundering rules, including

taking steps to verify who is sending transactions through its

platform and to report suspicious transactions to the government.

Among other requirements, it also would have to form an internal

anti-money-laundering program, train key personnel and conduct

independent compliance reviews. The Treasury Department's Financial

Crimes Enforcement Network has said those requirements extend to

cryptocurrency companies.

French Finance Minister Bruno Le Maire said on French radio

Tuesday that Facebook is free to issue a transaction tool but that

Libra shouldn't replace sovereign currencies, citing a risk that

such a currency could be used to finance terrorism. Mr. Le Maire

said he would ask the central bank governors of G-7 countries to

prepare a report on what guarantees to demand from Facebook to

avoid such risks ahead of a meeting of finance ministers planned

for mid-July in Chantilly, north of Paris.

"It is out of the question that it become a sovereign currency,"

Mr. Le Maire said of Libra. "Sovereignty must remain in the hands

of states, not private companies that respond to private

interests."

Mr. Le Maire also said that the currency's planned launch

"reinforces my conviction that we must regulate digital giants to

ensure they aren't monopolies," including by pushing for additional

taxes on digital services, which policy makers are pursuing both in

France and at the international level.

Facebook's effort also raises questions about the company's

suitability to play a larger role in users' financial lives.

The tech giant is under investigation in the U.S. for its

privacy practices. The Federal Trade Commission began such an

investigation more than a year ago, following reports that the

personal information of tens of millions of users improperly wound

up in the hands of Cambridge Analytica, a data firm tied to

President Trump's 2016 campaign. The FTC also has secured

jurisdiction on any possible antitrust matters related to

Facebook.

The existence of Facebook's new subsidiary, Calibra, could help

the company head off some potential regulatory concerns by keeping

separate the personal data held by the social-media site and the

financial data needed to make the crypto wallet work.

How Libra would differ from existing digital money-transfer

technologies in practice remains unclear. At least initially, it

will neither be fully decentralized nor fully anonymous, two of

bitcoin's defining anarchic features.

In some respects, bitcoin and Libra look alike; both are

essentially digital versions of cash designed to allow users to

directly exchange value online. There are major differences,

though. Facebook is looking to build a new payments network around

Libra by creating an online ecosystem on which users can buy things

and pay each other. Bitcoin, though initially conceived as a

payment mechanism, has evolved into a kind of digital gold used to

store value rather than exchange it.

This is largely due to the bitcoin network's inability to

process a large number of transactions quickly, a volume that tops

out at around seven transactions per second -- minuscule compared

with the roughly 24,000 transactions Visa's network handles every

second. Alibaba Group Holding Ltd.'s Alipay said it processed more

than 250,000 payment transactions per second one busy day in

2017.

Facebook's rollout of Libra will be limited at first. In a

document published for developers Tuesday, the company said it

expects its network will be able to support just 1,000 payment

transactions per second initially. However, Facebook said its

cryptocurrency was still "at the prototype stage" and expects to

increase the number of people who can use the system.

Libra also will be set up to avoid the wild price swings that

have plagued bitcoin. It will be backed by a basket of global

currencies and other stable assets, making it far less likely to

experience the volatility of other cryptocurrencies that aren't

pegged to anything.

--Sam Schechner, Lalita Clozel and Paul Vigna contributed to

this article.

(END) Dow Jones Newswires

June 18, 2019 16:19 ET (20:19 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

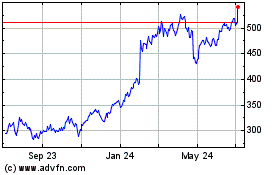

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

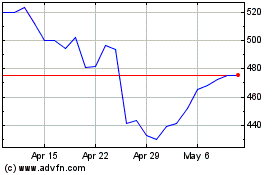

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024