By Barbara Kollmeyer and Mark DeCambre, MarketWatch

Stocks edged back slightly after Empire State data plummet

U.S. stocks headed higher Monday morning, led by gains in shares

of Facebook and Netflix, amid a broad rally in tech-related shares

and the communication services sector.

How are major indexes faring?

The Dow Jones Industrial Average rose 20 points, or less than

0.1%, to 26,112, while S&P 500 index gained 6 points, or 0.2%,

to 2,892, with the information technology sector (XLK) gaining 0.5%

and the communication services sector (XLC), of which Netflix and

Facebook are members, rising 0.8%. Meanwhile, the Nasdaq Composite

Index added 55 points, or 0.7%, to 7,851.

On Friday, the Dow fell 17.16 points, or 0.1%, to end at

26,089.61, while the S&P 500 declined 4.66 points, or 0.2%, to

2,886.98. The tech-laden Nasdaq Composite Index shed 40.47 points,

or 0.5%, to close at 7,796.66.

What's driving the market?

The Fed will be the focus this week, with a two-day meeting

kicking off Tuesday. Markets have been pricing in more than two

rate reductions this year, on fears of the fallout from global

trade tensions and a slowdown in the economy. Investors will want

to see if those expectations match up to what the Fed is thinking,

though no move on interest rates is expected at this week's

meeting.

A survey of manufacturing activity in the New York state area

showed its largest-ever drop into negative territory in June. The

Empire State manufacturing index plummeted 26

(http://www.marketwatch.com/story/empire-state-manufacturing-index-posts-largest-ever-drop-into-negative-territory-in-june-2019-06-17).4

points to negative 8.6 in June, the New York Fed said Monday,

marking a record decline. Economists had expected a reading of

positive 10, according to a survey by Econoday.

Any reading below zero indicates a contraction in activity. The

last time the index was negative was in October 2016.

Read:Five things to watch in the pivotal Fed meeting

(http://www.marketwatch.com/story/five-things-to-watch-in-the-pivotal-fed-meeting-2019-06-15)

(http://www.marketwatch.com/story/five-things-to-watch-in-the-pivotal-fed-meeting-2019-06-15)Still,

there is a possibility that investors could be disappointed looking

for a near-term rate cut, given recent other data aren't exactly

screaming out for a pre-emptive rate cut

(http://www.marketwatch.com/story/the-fed-may-break-a-lot-of-stock-market-investors-hearts-next-week-2019-06-15).

A reading from the National Association of Home Builders survey

for June is due at 10 a.m. Eastern.

As for global trade, Commerce Secretary Wilbur Ross played down

the likelihood of a major deal at the Group of 20 summit later this

month, if President Donald Trump and China President Xi Jinping

meet. The mostly outcome will be an agreement for the U.S. and

China to keep talking, he told The Wall Street Journal in an

interview

(http://www.marketwatch.com/story/wilbur-ross-lowers-expectations-of-trade-deal-coming-from-g-20-talks-between-trump-xi-2019-06-16).

Which stocks are in focus?

Shares of Orgenesis Inc.(ORGS) were in focus

(http://www.marketwatch.com/story/orgenesis-shares-soar-19-premarket-after-fda-grants-orphan-designation-to-insulin-tech-2019-06-17)after

the U.S. Food and Drug Administration granted Orphan Drug

Designation to the company's Autologous Insulin Producing cells as

a cell replacement therapy for the treatment of severe

hypoglycemia-prone diabetes resulting from total pancreatectomy,

caused by chronic pancreatitis.

Shares of Array BioPharma Inc. (ARRY)rocketed toward a record

(http://www.marketwatch.com/story/array-biopharmas-stock-rockets-after-114-billion-buyout-deal-with-pfizer-2019-06-17)

Monday, after the biopharmaceutical company focused on developing

cancer treatments agreed to be acquired by Pfizer Inc.(PFE) in a

deal valued at $11.4 billion.

Chewy Inc.'s stock remained in focus after the online pet

retailer on Friday made its debut as a publicly traded company,

soaring nearly 60%. Shares of Chewy were down 2.3% in early

trade.

Auction house Sotheby's(BID)announced a deal

(http://www.marketwatch.com/story/sothebys-stock-soars-after-37-billion-buyout-deal-with-altice-chairman-patrick-drahi-2019-06-17)

to be acquired by BidFair U.S.A., which is owned by telecom and

media entrepreneur and art collector Patrick Drahi, in a deal

valued at $3.7 billion. Shares of the company were up 57%.

Dish Network Corp. shares (DISH) jumped on the heels

(http://www.marketwatch.com/story/dishs-rumored-interest-in-purchasing-t-mobilesprint-assets-isnt-sensible-for-anyone-involved-says-analyst-2019-06-17)

of reports that it is the leading bidder to buy assets that

wireless carriers T-Mobile US Inc. (TMUS) and Sprint Corp. (S)

would have to shed for merger approval.

Facebook Inc.'s shares (FB) were gaining as the social-media

company was reportedly set to rollout its foray into

cryptocurrencies, Libra coin, as early as Tuesday.

What are strategists and analysts saying?

"The past few days managed little to no real progress for bulls

nor bears, and by Friday's close, S&P was less than a half

point away from were prices had closed Monday. This coming week

brings about the much anticipated June [Federal Open Market

Committee] meeting, and while a lowering of rates has not been

priced in by the market for Tuesday, such a move IS expected by

July, and failure to do so would be a surprise to markets (based on

current positioning)," wrote Mark Newton, technical analyst at

Newton Advisors, in a research note.

How are other markets trading?

The yield on the 10-year U.S. Treasury note rose 0.6% to

2.107%.

Asian markets closed mixed

(http://www.marketwatch.com/story/asian-markets-mostly-higher-as-investors-await-fed-meeting-2019-06-16),

with Hong Kong's Hang Seng Index rising 0.4% and China's Shanghai

Composite Index inching up 0.2%. Japan's Nikkei 225 was flat, while

in Europe, the Stoxx Europe 600 was flat.

Gold futures

(http://www.marketwatch.com/story/gold-poised-to-snap-4-day-rally-as-metal-hits-a-wall-at-around-1370-2019-06-17)

eased 0.4% to $1,338.30 an ounce and the U.S. dollar also slipped

against a basket of its peers. West Texas Intermediate crude eased

0.6% to $52.18 a barrel.

(END) Dow Jones Newswires

June 17, 2019 10:10 ET (14:10 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

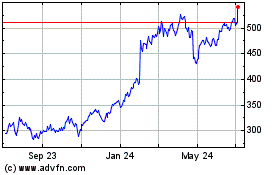

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

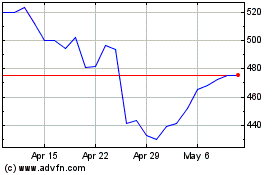

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024