UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

_____________________________________________

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

|

Filed by the Registrant ¨

|

|

|

Filed by a Party other than the Registrant x

|

|

Check the appropriate box:

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material under §240.14a-12

|

FARMER BROS. CO.

(Name of Registrant as Specified in its

Charter)

JEANNE FARMER GROSSMAN

Jeanne

Grossman Living Trust

1964

Jeanne Ann Farmer Grossman Trust

1969

Jeanne Ann Farmer Grossman Trust

1972

Jeanne Ann Farmer Grossman Trust

1987

Roy F Farmer Trust II

1988

Roy F Farmer Trust II

1988

Roy F Farmer Trust III

1990

Brynn Elizabeth Grossman Trust

1992

Brynn Elizabeth Grossman Trust

Thomas

William Mortensen

Jonathan

Michael Waite

(Name of Person(s) Filing Proxy Statement,

if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

|

x

|

No fee required.

|

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials:

|

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

LEADING INDEPENDENT PROXY ADVISOR FIRM

EGAN-JONES RECOMMENDS FARMER BROS. STOCKHOLDERS VOTE “FOR” BOTH OF CONCERNED STOCKHOLDERS’ DIRECTOR NOMINEES

ON THE GOLD PROXY TO BRING MUCH NEEDED CHANGE TO COMPANY

59% Share Price Decline Over Past Three

Years Attributed to Lack of Strategic Direction, High Management Turn-Over

Nominees Thomas Mortensen and Jonathan

Waite “Will Be a Significant Contribution” to Board

Grossman Calls Out Company for Using

Personal Attacks and False Narratives to Distract from Abysmal Financial, Management, and Board Oversight/Accountability Record

LOS ANGELES, California, December 6, 2019 - Jeanne Farmer

Grossman (individually and as the sole trustee of certain trusts), Thomas William Mortensen, and Jonathan Michael Waite (collectively,

the “Concerned Stockholders”), who together beneficially own approximately 4.9% of the outstanding common stock

of Farmer Bros. Co. (“Farmer Bros.” or the “Company”), today announced that Egan-Jones Proxy

Services, a leading independent proxy advisory service, recommends that stockholders vote for both of Concerned Stockholders’

nominees – Thomas Mortensen and Jonathan Michael Waite – on the GOLD proxy card in connection with the

Company’s 2019 Annual Meeting of Stockholders to be held on December 10, 2019.

Recently, proxy advisor service Institutional Shareholders Services

raised serious concerns about the Company’s poor performance and “perpetual turnaround” status, and even suggested,

“A cynical mind might also view the former CEO as a convenient scapegoat [for the Board], particularly since he was allowed

to step down and remained entitled to receive severance, despite what the Board characterized during discussions with ISS as questionable

candor.”

Egan-Jones elaborates further on the current Board’s

weaknesses in its December 5, 2019, report, concluding1:

|

|

·

|

“We believe that there is a compelling reason to alter the Board composition as evidenced by the abysmal performance

of the Company’s financials coupled with poor management decisions which placed Farmer Bros. in an undesirable state. In

our view, the high management turnover is a clear indication that the Company lacks strategic direction, which we believe is the

root cause of value destruction.”

|

|

|

·

|

“We believe that the addition of Tom Mortensen and Jonathan Waite, together with the newly [appointed] CEO, will be a

significant contribution to the Board, given that its current composition is not the best in class in terms of industry knowledge

and experience. Moreover, the addition of the new members will be a true wake up call to emphasize the urgent need for action and

change.”

|

|

|

·

|

“In our view, the Company’s recurring mistakes in strategy execution and prioritizing short sighted results should

be realigned to efforts which lead to value creation which will maximize shareholders’ interests in the long run.”

|

|

|

1

|

Permission to use quotations neither sought nor obtained.

|

In addition, the Concerned Stockholders pointed out that recent

statements of support for the entrenched Board attributed to Richard Farmer and promoted by the Company are self-serving, largely

misleading and symptomatic of the very issues that have led to decline and value destruction at Farmer Bros. over the past three

years.

Jeanne Farmer Grossman commented, “I believe that the

stockholders and employees of Farmer Bros. have begun to see through the misinformation and false narratives promoted by the Company

on behalf of long-tenured directors like Chuck Marcy and Chris Mottern. With an abysmal track record of share price declines, asset

liquidations and talent loss, these entrenched interests must resort to unfounded and mischaracterized attacks on the Group and

its two talented, qualified and successful nominees and to exploiting a disgruntled family member in their indecorous battle.”

Nevertheless, Ms. Grossman continues to be hopeful that stockholders

recognize that change, even with a new CEO, is unlikely without positive change on the Board. She urges stockholders to vote for

Tom Mortensen and Jonathan Waite, who bring the experience, foresight and trust of employees that the current Board lacks, but

are necessary to turn this business around, in stark contrast with the two incumbent directors up for reelection who have amply

demonstrated their inability to preserve, let alone create, shareholder value.

Farmer Bros.’ stockholders are urged to elect Tom Mortensen

and Jonathan Waite. Once elected, they will work with the Board and new CEO D. Deverl Maserang II to begin the process of returning

Farmer Bros. to the values and principles upon which it was built.

VOTE FOR OUR EXPERIENCED DIRECTORS

TO TURN-AROUND FARMER BROS. AND CREATE VALUE

We urge you to vote using only your GOLD PROXY today.

Your support is extremely important. If you have any questions,

please call our proxy solicitor Okapi Partners toll-free at (877) 274-8654 or email info@okapipartners.com.

Please wait until you receive and review

the Concerned Stockholders’ proxy materials and GOLD proxy card before you cast your vote in connection with the Annual

Meeting.

IMPORTANT

If your shares are held in street name, your bank or broker

can vote your shares only upon receipt of your specific instructions. Please contact the person responsible for your account and

instruct them that you only wish to vote the GOLD proxy card.

If you have any questions or need further assistance, please

contact Okapi Partners at (877) 274-8654 or by e-mail at info@okapipartners.com.

INVESTOR CONTACT:

Okapi Partners LLC

1212 Avenue of the Americas, 24th Floor

New York, NY 10036

+1 877-796-5274

info@okapipartners.com

MEDIA CONTACT:

Dan Gagnier / Jeffrey Mathews

Gagnier Communications

+1 646-569-5897

farmerbros@gagnierfc.com

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

The Concerned Stockholders have filed a definitive proxy statement

and an accompanying GOLD proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit votes

for the election of its nominees at the 2019 Annual Meeting of Stockholders of Farmer Bros. Co.

THE CONCERNED STOCKHOLDERS STRONGLY ADVISE ALL STOCKHOLDERS

OF THE COMPANY TO READ THEIR PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT WWW.SEC.GOV. IN ADDITION, THE CONCERNED

STOCKHOLDERS WILL PROVIDE COPIES OF THEIR PROXY STATEMENT WITHOUT CHARGE UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO

THE CONCERNED STOCKHOLDERS’ PROXY SOLICITOR, OKAPI PARTNERS, AT ITS TOLL-FREE NUMBER: (877) 274-8654 OR AT INFO@OKAPIPARTNERS.COM.

The participants in the proxy solicitation are: Jeanne Farmer

Grossman, the Jeanne Grossman Living Trust, the 1964 Jeanne Ann Farmer Grossman Trust, the 1969 Jeanne Ann Farmer Grossman Trust,

the 1972 Jeanne Ann Farmer Grossman Trust, the 1987 Roy F Farmer Trust II, the 1988 Roy F Farmer Trust II, the 1988 Roy F Farmer

Trust III, the 1990 Brynn Elizabeth Grossman Trust, and the 1992 Brynn Elizabeth Grossman Trust, Thomas William Mortensen, and

Jonathan Michael Waite.

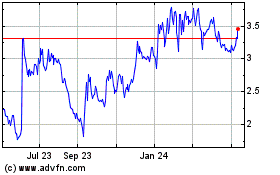

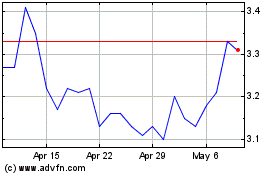

Farmer Brothers (NASDAQ:FARM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Farmer Brothers (NASDAQ:FARM)

Historical Stock Chart

From Apr 2023 to Apr 2024