UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐

Definitive Proxy Statement

☐

Definitive Additional Materials

☒

Soliciting Material under §240.14a-12

FARMER BROS. CO.

(Name of Registrant as Specified in its Charter)

JEANNE FARMER GROSSMAN

Jeanne Grossman Living Trust

1964 Jeanne Ann Farmer Grossman Trust

1969 Jeanne Ann Farmer Grossman Trust

1972 Jeanne Ann Farmer Grossman Trust

1987 Roy F Farmer Trust II

1988 Roy F Farmer Trust II

1988 Roy F Farmer Trust III

1990 Brynn Elizabeth Grossman Trust

1992 Brynn Elizabeth Grossman Trust

Thomas William Mortensen

Jonathan Michael Waite

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒

No fee required.

☐

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

☐

Fee paid previously with preliminary materials:

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

Strengthening the Farmer Bros. Board for the Benefit of All Shareholders Concerned Stockholders of Farmer Bros. November 2019

Executive Summary • Over the past three years, Farmer Bros. shares have lost 59% of their value, compared to a 45% rise in the S&P 500, destroying tremendous shareholder value • Farmer Bros.’s erratic growth, declining profitability, management turnover and poor employee morale reflect a failing strategy, led by a Board that lacks critical experience and vision • Led by Jeanne Farmer Grossman, Concerned Stockholders of Farmer Bros. (CSFB), who beneficially own approximately 4.9% of the outstanding common stock, have nominated two outstanding directors to bring positive change for the benefit of all shareholders • CSFB’s nominees, Tom Mortenson and Jonathan Waite, bring deep, relevant experience, lacking currently on the Board but necessary for the success of the Company and its new CEO • CSFB also supports new CEO Deverl Maserang’s election as a director 2

Farmer Bros. History • Farmer Bros. was established by Roy E. Farmer, along with his brother, in 1912 to brew and distribute coffee to homes and businesses in the Los Angeles area • In 1951, Roy passed away and his son, Roy F. Farmer, took over as CEO and soon took the Company public • In 2003, Roy F. handed the reins of the Company over to his son Roy E. Farmer • In 2005, with the passing of Roy E., the Company appointed an internal candidate, Guenter Berger, as interim CEO before a first - time external CEO was chosen • During this period, the Company struggled to be profitable • These struggles were compounded by poor leadership, poor cash management and the 2008 financial crisis which eventually led the Company to suspend dividend payments in 2011 • In 2012, Mike Keown was named CEO of the Company (six months after Farmer Bros.’ stock price had stabilized from the financial crisis) • In April 2015, management announced that the Company was moving its headquarters from Torrance, California to Northlake, Texas • In September 2016, a shareholder group led by Carol Farmer Waite and certain other members of the founding family, nominated three director candidates at the 2016 Annual Meeting. Those candidates were not elected to the Board 3

Concerned Farmer Bros. Stockholders • Jeanne Farmer Grossman, a member of the founding family, on behalf of a group of Concerned Stockholders of Farmer Bros. (CSFB) , beneficially owns approximately 4.9% of the outstanding common stock • Ms. Grossman served on the Board from December 2009 to December 2018. • On September 5, 2019, after many months of the Board ignoring employee, vendor, customer and Board concerns, Ms. Grossman nominated Tom Mortenson and Jonathan Waite for election to the Board • Like other shareholders, CSFB’s investment has suffered as a result of poor decisions, inept management, questionable governance and a complete lack of support for the culture and employee value and for vendor service and customer - focused strategy • CSFB believes changes to the composition of the Board of Directors of the Company are necessary in order to ensure that the Company is being run in a manner consistent with your best interests • CSFB’s nominees, Tom Mortensen and Jonathan Waite, have strong, relevant experience and are committed to fully exploring all opportunities to unlock stockholder value • In addition to Tom and Jonathan, CSFB is supporting new CEO Deverl Maserang’s election as a director • CSFB is seeking your support at the annual meeting of stockholders 4

Background to the Solicitation Jeanne Farmer Grossman served on the Company’s Board During this period: • She saw significant failings on the Board and at the Company’s executive levels, particularly in recent years • She regularly expressed her concerns at Board meetings and with the Company’s officers, leading to a program of marginalization of both her and legacy employees who were ignored because they questioned management actions and decisions • The Company chose not to nominate her to stand at the 2018 Annual Meeting, apparently because it did not want to deal with concerns that were not lock - step with Management December 2009 – December 2018 Ms. Grossman delivered a position paper to the Board: • Detailing her concerns regarding the Company’s leadership, governance, culture, operations and direction • Suggesting how the Board and the Company could significantly improve in these areas • Requesting that she be afforded an opportunity to meet with the Board to discuss the concerns raised in her position paper Spring of 2019 Ms. Grossman was granted a 30 - minute meeting to discuss her 30 - page analysis with the Board • At that meeting, the Board chose not to engage in any meaningful discussion regarding any of her concerns. Ms. Grossman delivered a letter to the Company. • In the letter, she nominated the two candidates for election to the Board and submitted a proposal to declassify the Board. June 6, 2019 September 5, 2019 5

Under the current Board, expenses continue to grow, revenue is erratic due to multiple acquisitions of questionable value, and losses increase -$50 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $550 $600 $650 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 Other expense G&A Selling & Marketing COGS Operating Income (Loss) Revenue 6

Declining, inconsistent results have spooked investors, causing many to abandon Farmer Bros. stock $10 $15 $20 $25 $30 $35 $40 1 1 / 1 / 1 6 1 / 1 / 1 7 3 / 1 / 1 7 5 / 1 / 1 7 7 / 1 / 1 7 9 / 1 / 1 7 1 1 / 1 / 1 7 1 / 1 / 1 8 3 / 1 / 1 8 5 / 1 / 1 8 7 / 1 / 1 8 9 / 1 / 1 8 1 1 / 1 / 1 8 1 / 1 / 1 9 3 / 1 / 1 9 5 / 1 / 1 9 7 / 1 / 1 9 9 / 1 / 1 9 1 1 / 1 / 1 9 7

Significant value for Farmer Bros. shareholders has been destroyed – and continues to be destroyed – as a result Total Shareholder Returns -80% -60% -40% -20% 0% 20% 40% 60% 80% 100% 1-Year 3-Year 5-Year FARM Proxy group peer median 1 Russell 2000 1. Using Company’s peer group companies in 2019 proxy statement: B&G Foods, Inc., John B. Sanfilippo & Son, Inc., The Boston Beer Company, Inc., Lancaster Colony Corporation, Calavo Growers, Inc., MGP Ingredients Inc., Cal-Maine Foods, Inc., Primo Water Corporation, The Chef’s Warehouse Inc., Seneca Foods Corp., Craft Brew Alliance Inc., The Simply Good Foods Company, Hostess Brands, Inc., SunOpta Inc. and J & J Snack Foods Corp 8

Responsibility for Farmer Bros.’ current situation begins and ends with the current Board, which lacks important experience with the Company’s business or history Board that does not understand the fundamentals of Farmer Bros.’ business or history Significant management turnover and a failing strategy Eroding culture and employee morale Worsening customer service and productivity Declining sales, margins and profitability 9

The current Board lacks the experience Farmer Bros. needs Current Directors Coffee Production Direct - Store - Delivery Randy E. Clark ✘ ✘ Allison M. Boersma ✘ ✘ Charles F. Marcy ✘ ✘ Christopher P. Mottern ✘ ✘ David W. Ritterbush ✘ ✘ Deverl Maserang ✘ ✘ Hamideh Assadi ✘ ✘ Stacy Loretz - Congdon ✘ ✘ 1 1. Mr. Mottern and Mr. Maserang have each held a high - level, executive role at coffee retailers, among other positions / indust ries in their career, but have not been directly responsible for coffee operations 1 The Farmer Bros. Board lacks directors with direct operational experience in coffee production and direct - store - delivery , which has historically differentiated the company and driven its long - term growth. 10

A failing strategy has contributed to significant management turnover, and vice versa Failing Management CEOs in 2019 CFOs since 2017 • Position currently unfilled Multiple executive departures in 2019 • SVP & GM, COO, Chief Legal Counsel Failing Strategy • Misguided pivot away from Direct - Store - Delivery , company’s traditional and most profitable channel • HQ move that failed to deliver promised savings • Multiple acquisitions of questionable value have led to erratic revenue streams • Replaced significant number of DSD leadership with "sales" unfamiliar with business, industry and how to sell 3 2 + 11

A lack of vision and leadership has led to a significant decline in employee morale … “The senior executives get on calls and brag about their extravagant lifestyles and vacations while no other employee has got ten a bonus for years, and we struggle financially to make ends meet.” - Current Employee (full - time for more than 8 years), Sales in Los Angeles, CA (Jun 30, 2019) “Unresolved IT issues that impact productivity and profitability. Many new hires in leadership positions with no knowledge of the core business, putting unrealistic expectations on the employees, losing staff and customers.” - Current Employee (full - time for more than 5 years), Manager (March 3, 2019) “*There is no vision for the company *Dishonest senior management *Poor decision making *Senior management is disloyal to the employees *Morale is super low in many departments My advice to the board of directors is to clean house. Fire all of senior management and bring in a team with a vision. People who care about the employees, and the future of the company.” - Current Employee (full - time for more than 5 years), Anonymous (Nov 16, 2018) “Things have gotten so bad, I no longer have faith that the Senior Leadership Team is capable of correcting course. It becomes a question of why the Board of Directors has not taken steps to eliminate those SLT members who are clearly incapable of leading this company and making good decisions.” - Current Employee (full - time for more than 3 years), Anonymous Employee in Northlake, TX (Sep 23, 2018) 12

… and declining customer service and productivity. “It took two months to get the equipment for my account, so I switched to Sysco.” - $50,000 annual NSV account “I could not get service in a timely manner or my equipment replaced when I needed it”, she also said “ I had the same sales rep forever and then started getting a new one every few months.” - 12 Health Care facilities with annual revenue of $60,000 to $75,000 13

Ultimately, the Company’s margins have suffered as a result 2% 1% -5% 1% 1% 6% 8% 8% 8% 8% 28% 23% 25% 25% 23% 64% 69% 65% 66% 70% 1% -.0.4% 7% 0% -2% -10% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 Other expense G&A Selling & Marketing COGS Operating Income (Loss) 14

CSFB supports the Company’s new CEO for election to director, but seeks to replace the Company’s two nominees who have overseen tremendous value destruction D. Deverl Maserang (Director since 2019) • Promising new CEO, who deserves the support of an experienced Board, with deep knowledge of the B2B / DSD coffee business and Farmer Bros. history Charles F. Marcy (Director since 2013) • Incumbent director, who has failed shareholders, including by pushing for a failed strategy and unfailingly supporting for his friend and former CEO Keown Chris P. Mottern (Director since 2013) • Incumbent director, who has failed shareholders, including during his disastrous period as interim CEO and his mentorship of the former CEO Keown 15

Directors Marcy & Mottern must be held accountable for Farmer Bros. failed strategy and the value destruction that has resulted Concerned Stockholders for Farmer Bros. believes Mr. Marcy and Mr. Mottern bear significant responsibility for the current state of the Company, especially its decline since 2016, for: • Pushing for non - proven, failing strategies • Supporting the former failed CEO Keown on the basis of personal relationships, not shareholder interest • Undermining the Company culture, through their support of indiscriminate lay - offs and dismissals • Shirking their oversight responsibilities, including contributing to a strategic plan or succession plan, or properly holding management accountable • Silencing dissent on the Board and among employees • Holding to preconceived beliefs, arrived at before joining the Company, that cause them to reject any input from employees, to not seek alternatives or resolutions, to not begin attempts to learn about the Company and how it works • Failing to understand, support or engage with the Company’s core DSD business 16

Our nominees bring experience and the Farmer Bros. values that the current Board lacks • We have nominated two highly qualified candidates to stand for election to the Board at the 2019 Annual Meeting, who have strong, relevant backgrounds and are committed to fully exploring all opportunities to unlock stockholder value Tom Mortensen Jonathan Waite 17

Tom Mortensen • Tom Mortensen contributed 37 years of service to Farmer Bros., where he worked from 1978 to 2015 • During his tenure at the Company, Tom occupied several positions including branch manager, sales promotion, division manager, regional sales manager, national sales manager, vice president (western region) and senior vice president of route sales • Tom’s extensive knowledge of coffee, tea and culinary product sales and distribution, long - term interest in the success of the Company, exemplary leadership and employee relationship skills, and process improvement would make him a valuable addition to the Board 18

Jonathan Waite • Jonathan Waite spent 13 years with Farmer Bros., where he worked from 2004 to 2017 • During his time at Farmer Bros., Jonathan held various positions including special projects manager, director of green coffee operations, vice president of coffee and vice president of construction development • In 2005, after the loss of the Company’s then CEO, Jonathan was solely responsible for building the Company’s green coffee division • Jonathan’s extensive knowledge of the Company’s products, operations, quality assurance, vendors and customers and long - term interest in the success of the Company would make him a valuable addition to the Board 19

Concerned Farmer Bros. Stockholders CONTACT INFORMATION Media Dan Gagnier / Jeffrey Mathews Gagnier Communications +1 646 - 569 - 5897 farmerbros@gagnierfc.com Investors Okapi Partners LLC 1212 Avenue of the Americas, 24 th Floor New York, NY 10036 +1 877 - 796 - 5274 info@okapipartners.com 20

Important Additional Information and Where to Find It 21 The Concerned Stockholders of Farmer Bros . have filed a definitive proxy statement and an accompanying GOLD proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit votes for the election of its nominees at the 2019 Annual Meeting of Stockholders of Farmer Bros . Co . THE CONCERNED STOCKHOLDERS ADVISE ALL STOCKHOLDERS OF THE COMPANY TO READ THEIR PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION . SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT WWW . SEC . GOV . IN ADDITION, THE CONCERNED STOCKHOLDERS WILL PROVIDE COPIES OF THEIR PROXY STATEMENT WITHOUT CHARGE UPON REQUEST . REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE CONCERNED STOCKHOLDERS’ PROXY SOLICITOR, OKAPI PARTNERS, AT ITS TOLL - FREE NUMBER : ( 877 ) 274 - 8654 OR AT INFO@OKAPIPARTNERS . COM . The participants in the proxy solicitation are: Jeanne Farmer Grossman, the Jeanne Grossman Living Trust, the 1964 Jeanne Ann Farmer Grossman Trust, the 1969 Jeanne Ann Farmer Grossman Trust, the 1972 Jeanne Ann Farmer Grossman Trust, the 1987 Roy F Farmer Trust II, the 1988 Roy F Farmer Trust II, the 1988 Roy F Farmer Trust III, the 1990 Brynn Elizabeth Grossman Trust, and the 1992 Brynn Elizabeth Grossman Trust, Thomas William Mortensen, and Jonathan Michael Waite.

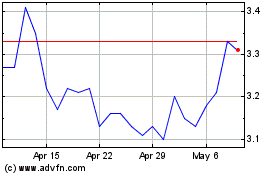

Farmer Brothers (NASDAQ:FARM)

Historical Stock Chart

From Mar 2024 to Apr 2024

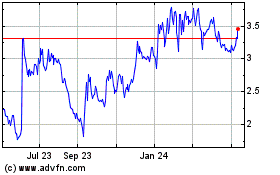

Farmer Brothers (NASDAQ:FARM)

Historical Stock Chart

From Apr 2023 to Apr 2024