Current Report Filing (8-k)

October 13 2020 - 6:36AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported) October 9, 2020

EYENOVIA,

INC.

(Exact name of registrant as specified

in its charter)

|

|

Delaware

(State or other jurisdiction of incorporation)

|

|

|

|

|

|

|

001-38365

|

|

47-1178401

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

295 Madison Avenue, New York, NY 10017

(Address of principal executive offices)

(Zip Code)

Registrant's telephone number, including

area code 917-289-1117

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 Par Value

|

EYEN

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company x

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On October 9, 2020, Eyenovia, Inc. (the “Company”)

entered into a License Agreement (the “License Agreement”) with Bausch Health Ireland Limited, an Ireland corporation

and wholly-owned subsidiary of Bausch Health Companies Inc. (“Bausch Health”). Pursuant to the License Agreement, the

Company granted to Bausch Health the rights to the Company’s MicroPine therapeutic candidate (the “Licensed Product”)

in the United States and Canada (the “Territory”). The Licensed Product includes (i) the MicroPine therapeutic candidate

(whether alone or in combination with another pharmaceutical product or medical device and whether used in combination with the

Company’s proprietary medical device microdose dispenser known as Optejet (the “Device”) or not); and (ii) the

Device used in combination with the MicroPine therapeutic candidate.

Within three business days of the

effective date of the License Agreement, Bausch Health must pay the Company an upfront payment of $10,000,000. Bausch Health

might also pay up to an aggregate of approximately $35,000,000 in milestone payments, depending on the achievement of certain

regulatory and launch-based milestones. Under the terms of the License Agreement, on a country-to-country basis and Licensed

Product-by-Licensed Product basis, Bausch Health will pay the Company a royalty on a tiered basis (ranging from mid-single

digit to mid-teen percentages) on gross profits from the sales of the Licensed Product in the United States and Canada,

subject to certain adjustments in the event of generic entry, negative gross profits or patent expiration, for a period of

the later to occur of the 10th anniversary of the first commercial sale of a Licensed Product in such country in

the Licensed Territory or the expiration of the last valid patent claim for a Licensed Product in such country in the

Licensed Territory.

Bausch Health may terminate the License Agreement, with respect

to the Licensed Product to either country in the Territory, at any time for convenience upon 90 days’ written notice. Both

parties have the right to terminate the License Agreement in the event of (i) an uncured material breach after a 60-day period;

or (ii) a bankruptcy event.

The foregoing description of the License Agreement is qualified

in its entirety by the full text of the License Agreement filed as Exhibit 10.1 to this Current Report on Form 8-K.

On October 12, 2020, the Company issued a press release regarding

the matters discussed in this Current Report on Form 8-K. A copy of the press release is attached hereto as Exhibit 99.1 and is

incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

* Portions of this exhibit have been redacted in compliance

with Regulation S-K Item 601(b)(10).

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EYENOVIA, INC.

|

|

|

|

|

|

Date: October 13, 2020

|

By:

|

/s/ John Gandolfo

|

|

|

|

Name: John Gandolfo

|

|

|

|

Title: Chief Financial Officer

|

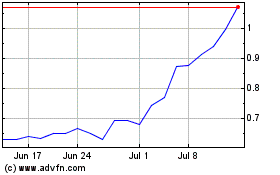

Eyenovia (NASDAQ:EYEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

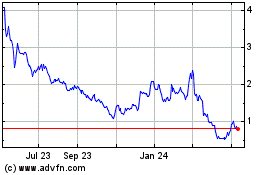

Eyenovia (NASDAQ:EYEN)

Historical Stock Chart

From Apr 2023 to Apr 2024