As filed with the Securities and

Exchange Commission on May 8, 2020

Registration Statement No. 333-237790

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No.

1

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

EYENOVIA, INC.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

47-1178401

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

295 Madison Avenue, Suite 2400

New York, New York 10017

Telephone: (917) 289-1117

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Tsontcho Ianchulev

Chief Executive Officer

295 Madison Avenue, Suite 2400

New York, New York 10017

Telephone: (917) 289-1117

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Copies to:

Donald R. Reynolds

S. Halle Vakani

Lorna A. Knick

Wyrick Robbins Yates & Ponton LLP

4101 Lake Boone Trail, Suite 300

Raleigh, North Carolina 27607

Telephone: (919) 781-4000

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being

offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for

an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General

Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to

Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment filed pursuant to

General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under

the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer x

|

Smaller reporting company x

|

|

|

Emerging growth company x

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment

that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

The information in this

prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is

not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion,

Dated May 8, 2020

PRELIMINARY PROSPECTUS

6,019,447 Shares of Common Stock

This prospectus relates to the resale from

time to time of up to 2,675,293 shares of our common stock, and 1,337,659 shares of our common stock that are issuable upon the

exercise of Class A warrants and 2,006,495 shares of our common stock that are issuable upon the exercise of Class B warrants (together,

the “Warrants”) held by the selling stockholders named in this prospectus, including their transferees, pledgees,

donees or successors, that were issued in connection with a private placement offering completed on March 24, 2020, or the Private

Placement. We are registering these shares as required by the Registration Rights Agreement we entered into with the selling stockholders

on March 23, 2020.

We are not selling any shares of common

stock and will not receive any proceeds from the sale of the shares under this prospectus. We have agreed to bear all of the expenses

incurred in connection with the registration of these shares. The selling stockholders will pay or assume brokerage commissions

and similar charges, if any, incurred for the sale of shares of our common stock.

The selling stockholders may sell the shares

described in this prospectus in a number of different ways and at varying prices. We provide more information about how the selling

stockholders may sell their shares of common stock in the section entitled “Plan of Distribution” on page 13. The

selling stockholders will pay all brokerage fees and commissions and similar expenses. We will pay all expenses (except brokerage

fees and commissions and similar expenses) relating to the registration of the shares with the Securities and Exchange Commission.

No underwriter or other person has been engaged to facilitate the sale of shares of our common stock in this offering.

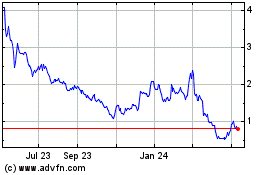

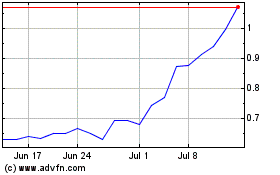

Our common stock is traded on the NASDAQ

Capital Market under the symbol “EYEN.” On May 7, 2020, the last reported sales price of our common stock was $3.67

per share.

Investing in our common stock

involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading

“Risk Factors” beginning on page 6 of this prospectus, and under similar headings in any amendments or

supplements to this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of

this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement that we filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process.

Under this shelf registration process, the selling stockholders named in this prospectus may from time to time sell shares of our

common stock in one or more offerings.

This prospectus provides you with a general

description of the shares of common stock the selling stockholders may offer. Each time the selling stockholders sell shares of

our common stock using this prospectus, to the extent necessary, we will provide a prospectus supplement that will contain specific

information about the terms of that offering, including the number of shares being offered, the manner of distribution, the identity

of any underwriters or other counterparties and other specific terms related to the offering. The prospectus supplement may also

add, update or change information contained in this prospectus. To the extent that any statement made in an accompanying prospectus

supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified

or superseded by those made in the accompanying prospectus supplement. You should read both this prospectus and any accompanying

prospectus supplement together with the additional information described under the heading “Where You Can Find Additional Information”

beginning on page 15 of this prospectus.

Neither we nor the selling stockholders

have authorized anyone to provide you with information different from that contained in this prospectus, any accompanying prospectus

supplement or in any related free-writing prospectus filed by us with the SEC. Neither we nor the selling stockholders take any

responsibility for, or provide any assurance as to the reliability of, any information other than the information in this prospectus,

any accompanying prospectus supplement or in any related free-writing prospectus filed by us with the SEC. This prospectus and

any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities

other than the securities described in this prospectus or any accompanying prospectus supplement or an offer to sell or the solicitation

of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that

the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and any related

free-writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations

and prospects may have changed materially since those dates.

Unless the context indicates otherwise,

references in this prospectus to “Eyenovia,” “Company,” “we,” “us” and “our”

refer to Eyenovia, Inc.

PROSPECTUS SUMMARY

This summary highlights certain information

about us and this offering contained elsewhere in this prospectus. Because it is only a summary, it does not contain all of the

information that you should consider before investing in shares of our securities and it is qualified in its entirety by, and should

be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest

in our securities, you should read the entire prospectus carefully, including “Risk Factors” beginning on page 6,

and the consolidated financial statements and related notes incorporated by reference into this prospectus.

Company Overview

We are a clinical stage ophthalmic biopharmaceutical

company developing a pipeline of microdose therapeutics utilizing our patented piezo-print delivery technology, branded the OptejetTM.

Eyenovia aims to achieve clinical microdosing of next-generation formulations of well-established ophthalmic pharmaceutical agents

using its high-precision targeted ocular delivery system, which has the potential to replace conventional eye dropper delivery

and improve safety, tolerability, patient compliance and topical delivery success for ophthalmic eye treatments. In the clinic,

the Optejet has demonstrated the ability to horizontally deliver ophthalmic medication with a success rate significantly higher

than that of traditional eye drops (~90% vs. ~ 50%). Eyenovia’s technology also can deliver up to a 75% reduction in ocular

drug and preservative exposure and has demonstrated significant improvement in the therapeutic index in drugs used for mydriasis

and IOP lowering through three Phase II and two Phase III trials. Using the Optejet, Eyenovia is developing the next generation

of smart ophthalmic therapeutics which target new indications or new combinations where there are currently no comparable drug

therapies approved by the United States Food and Drug Administration, or the FDA. Eyenovia’s microdose therapeutics follow

the FDA-designated pharmaceutical registration and regulatory process. Its products are classified by the FDA as drugs, and not

medical devices or drug-device combination products.

On October 29, 2019, we announced that we

were advancing the development of our MicroLine program for the improvement in the near vision in patients with presbyopia towards

Phase III clinical studies. As a result of prioritizing MicroLine, in tandem with our MicroPine (progressive myopia) and MicroStat

(mydriasis) programs, Eyenovia deferred development activities for its MicroProst (glaucoma and ocular hypertension) and MicroTears

(red eye and itch relief lubrication) programs.

Presbyopia is a non-preventable, age-related

hardening of the lens, which causes the gradual loss of the eye’s ability to focus on nearby objects. There currently are

no known FDA-approved drugs for the improvement of near vision in patients with presbyopia, although other companies have related

therapies in their pipeline. Eyenovia has planned Phase III VISION trials for MicroLine.

MicroPine is the Company’s first-in-class

topical therapy for the treatment of progressive myopia, a back-of-the-eye ocular disease associated with pathologic axial elongation

and sclero-retinal stretching affecting approximately five million people in the United States. In February 2019, the FDA accepted

Eyenovia’s investigational new drug application, or IND, to initiate its Phase III registration trial of MicroPine (the CHAPERONE

study) to reduce the progression of myopia in children. Eyenovia enrolled its first patient in the CHAPERONE study in June 2019.

MicroStat is Eyenovia’s fixed combination

formulation of phenylephrine-tropicamide for mydriasis, designed to be a novel approach for the estimated 80 million office-based

comprehensive and diabetic eye exams performed every year in the United States. Eyenovia has completed its Phase III trials for

MicroStat and announced positive results from these studies, known as MIST-1 and MIST-2.

Results from Eyenovia’s previous Phase

II clinical trials have been published in peer-reviewed literature. Two studies evaluating mydriatic agents demonstrated how the

Optejet consistently delivered precision dosing at the volume of the eye’s natural tear film capacity of 6-8 µL, which

reduced ocular and systemic drug and preservative exposure, while demonstrating pupil dilation comparable to conventional eye drops

with fewer side effects. In the third study, Eyenovia evaluated usability, patient tolerability and IOP lowering of microdosed

latanoprost administered with the Optejet. In this study, eyes receiving microdosed latanoprost achieved IOP reduction consistent

with published literature on latanoprost eye drops, and administration of the medication was successful in a single attempt in

more than 90% of cases. Based on the results from these clinical trials, we are advancing MicroLine, MicroPine, MicroStat, and

MicroProst (should we resume the program) utilizing the 505(b)(2) pathway. Where possible, we also intend to use this pathway for

future clinical trials in new indications with significant unmet needs.

Corporate Information

We were organized as a corporation under

the laws of the State of Florida on March 12, 2014 under the name “PGP Holdings V, Inc.” On May 5, 2014, we changed

our name to Eyenovia, Inc. On October 6, 2014, we reincorporated in the State of Delaware by merging into Eyenovia, Inc., a Delaware

corporation. Our principal executive office is located at 295 Madison Avenue, Suite 2400, New York, NY 10017, and our phone

number is 917-289-1117. Our website is http://www.eyenovia.com. Information contained on, or that can be accessed through,

our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be

part of this prospectus.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion

in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our

Business Startups Act of 2012, or the JOBS Act. For so long as we remain an emerging growth company, we are permitted and

intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not

emerging growth companies. These exemptions include:

|

|

·

|

being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial

statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” disclosure;

|

|

|

·

|

not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial

reporting;

|

|

|

·

|

not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding

mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and

the financial statements;

|

|

|

·

|

reduced disclosure obligations regarding executive compensation; and

|

|

|

·

|

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of

any golden parachute payments not previously approved.

|

We may take advantage of these provisions

through 2023 or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company

if we have more than $1.0 billion in annual revenues, have more than $700 million in market value of our capital stock held by

non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage

of some, but not all, of the available exemptions. We have taken advantage of some reduced reporting burdens in this prospectus

and the documents incorporated by reference into this prospectus. Accordingly, the information contained herein may be different

than the information you receive from other public companies in which you hold stock.

In addition, the JOBS Act provides

that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting

standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards

would otherwise apply to private companies. We have elected to avail ourselves of this exemption from new or revised accounting

standards and, therefore, will not be subject to the same new or revised accounting standards as other public companies that are

not emerging growth companies.

THE OFFERING

Up to 6,019,447 Shares of Common Stock

This prospectus relates to the resale by the selling stockholders

identified in this prospectus of up to 6,019,447 shares of our common stock:

|

|

•

|

2,675,293 shares of common stock issued in the Private

Placement;

|

|

|

•

|

Class A Warrants for 1,193,403 shares of common stock

issued in the Private Placement to investors with an exercise price of $2.058 per share that expire on March 24, 2021;

|

|

|

•

|

Class A Warrants for 144,256 shares of common stock

issued in the Private Placement to certain directors and officers of the Company with an exercise price of $2.27 per share that

expire on March 24, 2021;

|

|

|

•

|

Class B Warrants for 1,790,115 shares of common stock

issued in the Private Placement to investors with an exercise price of $2.4696 per share that expire on March 24, 2025;

|

|

|

•

|

Class B Warrants for 216,380 shares of common stock

issued in the Private Placement to certain directors and officers of the Company with an exercise price of $2.724 per share that

expire on March 24, 2025;

|

|

Common stock offered by the selling stockholders

|

|

6,019,447 shares

|

|

Common stock outstanding before the offering (1)

|

|

19,776,019 shares

|

|

Common stock to be outstanding after the offering

|

|

23,120,173 shares

|

|

Common stock Nasdaq Capital Market Symbol

|

|

EYEN

|

|

|

(1)

|

The number of shares of common stock outstanding is based

on an aggregate of 19,776,019 shares outstanding as of March 31, 2020, and excludes:

|

|

|

•

|

2,322,793 shares of common stock issuable upon the

exercise of options outstanding as of March 31, 2020 at a weighted average exercise price of $3.54 per share, under the 2014 Equity

Incentive Plan and 2018 Omnibus Stock Incentive Plan, as amended;

|

|

|

•

|

15,333 shares of common stock reserved for future issuance

under the 2014 Equity Incentive Plan as of March 31, 2020, as amended;

|

|

|

•

|

81,074 shares of common stock reserved for future issuance

under the 2018 Omnibus Stock Incentive Plan as of March 31, 2020; and

|

|

|

•

|

3,344,154 shares of common stock are issuable upon

the exercise of warrants outstanding as of March 31, 2020.

|

Private Placement of Common Shares and Warrants

On March 23, 2020, we entered into a Securities

Purchase Agreement with various investors pursuant to which the Company agreed to sell approximately $6.0 million of units, with

each unit consisting of (i) one share of our common stock, (ii) a Class A Warrant to purchase 0.5 of a share of our common stock,

which expires on March 24, 2021, and (iii) a Class B Warrant to purchase 0.75 of a share of our Common Stock, which expires on

March 24, 2025. The units were sold at a price to the public of $2.21425 per unit. The units were sold to certain directors and

executive officers at a price of $2.42625 per unit.

The offering closed on March 24, 2020. At

closing, we received net proceeds of approximately $5.3 million after deducting placement agent fees and offering expenses.

National Securities Corporation, a wholly

owned subsidiary of National Holdings Corporation (NASDAQ: NHLD), acted as the sole Placement Agent for the offering.

In the offering, the Company issued an aggregate

of 2,675,293 shares of Common Stock, Class A Warrants to purchase up to 1,337,659 shares of Common Stock and Class B Warrants to

purchase up to 2,006,495 shares of Common Stock.

The exercise price of the Class A Warrants

issued to the public is $2.058 per share and the exercise price of the Class A Warrants issued to the directors and officers is

$2.27 per share, both subject to adjustment for stock splits, stock dividends and similar corporate events. All the Class A Warrants

terminate in one year after date of issuance and are exercisable at any time or times on or after the date of issuance.

The exercise price of the Class B Warrants

issued to the public is $2.4696 per share and the exercise price of the Class B Warrants issued to the directors and officers is

$2.724 per share, both subject to adjustment for stock splits, stock dividends and similar corporate events. All the Class B Warrants

terminate in five years after date of issuance. The Class B Warrants are exercisable at any time or times on or after the date

of issuance.

In connection with the offering, on March

23, 2020, the Company also entered into a Registration Rights Agreement with the investors. Pursuant to the Registration Rights

Agreement, the Company must file with the SEC, no later than 30 days following the date on which the Company files its Form 10-K

for the year ended December 31, 2019 with the SEC, a registration statement on Form S-3 covering the shares of common stock issued

in the offering and the shares of common stock underlying the Warrants.

Use of Proceeds

The 2,675,293 shares of common stock and

3,344,154 shares of common stock issuable upon the exercise of currently outstanding warrants and that are being offered for resale

by the selling stockholders will be sold for the accounts of the selling stockholders named in this prospectus. As a result, all

proceeds from the sales of the 6,019,447 shares of common stock offered for resale hereby will go to the selling stockholders and

we will not receive any proceeds from the resale of those shares of common stock by the selling stockholders.

We may receive up to a total of approximately

$7.8 million in gross proceeds if all of the warrants are exercised hereunder. However, as we are unable to predict the timing

or amount of potential exercises of the warrants, we have not allocated any proceeds of such exercises to any particular purpose.

Accordingly, all such proceeds are allocated to working capital. It is possible that the warrants may expire and may never be exercised.

We will incur all costs associated with

this registration statement and prospectus.

Dividend Policy

We have never paid dividends on our capital

stock and do not anticipate paying any dividends for the foreseeable future.

Risk Factors

Investing in our common stock involves

a high degree of risk. Please read the information contained under the heading “Risk Factors” beginning on page 6

of this prospectus.

RISK FACTORS

Investing in our common stock involves a

high degree of risk. You should consider carefully the risks and uncertainties described in the section entitled “Risk Factors”

contained in our Annual Report on Form 10-K for the year ended December 31, 2019, as filed with the SEC on March 30, 2020. These

risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not currently known

to us, or that we currently view as immaterial, may also impair our business. If any of the risks or uncertainties described in

our SEC filings or any additional risks and uncertainties actually occur, our business, financial condition, results of operations

and cash flow could be materially and adversely affected. In that case, the trading price of our common stock could decline and

you might lose all or part of your investment.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus contains a number of “forward-looking

statements.” Specifically, all statements other than statements of historical facts included in this prospectus regarding

our financial position, business strategy and plans and objectives of management for future operations are forward-looking statements.

These forward-looking statements are based on the beliefs of management at the time these statements were made, as well as assumptions

made by and information available to management at that time. When used in this prospectus and the documents incorporated by reference

herein, the words “anticipate,” “believe,” “estimate,” “expect,” “may,”

“might,” “will,” “continue” and “intend,” and words or phrases of similar import,

as they relate to our financial position, business strategy and plans, or objectives of management, are intended to identify forward-looking

statements. These statements reflect our view, as of the date hereof, with respect to future events and are subject to risks, uncertainties

and assumptions related to various factors.

You should understand that the following important factors,

in addition to those discussed in our periodic reports to be filed with the SEC under the Securities Exchange Act of 1934, as amended,

or the Exchange Act, could affect our future results and could cause those results to differ materially from those expressed in

such forward-looking statements:

|

|

·

|

impacts

of and uncertainty related to COVID-19;

|

|

|

·

|

fluctuations in our financial results and stock price, particularly

given market conditions and the potential economic impact of COVID-19;

|

|

|

·

|

our need to raise additional money to fund our operations for the

next twelve months as a going concern;

|

|

|

·

|

risks of our clinical trials including, but not limited to, the costs,

design, initiation and enrollment (which could be adversely impacted by COVID-19 and resulting social distancing), timing, progress

and results of such trials;

|

|

|

·

|

our expectations related to the use of proceeds from our financings;

|

|

|

·

|

our expectations regarding our ability to fund our operating expenses

and capital expenditure requirements with our cash on hand and proceeds from our financings;

|

|

|

·

|

our estimates regarding expenses, future revenue, timing of any future

revenue, capital requirements and needs for additional financing;

|

|

|

·

|

the potential advantages of our reprioritized pipeline;

|

|

|

·

|

our estimates regarding cost savings related to our reprioritized

pipeline;

|

|

|

·

|

our estimates regarding the potential market opportunity for our product

candidates;

|

|

|

·

|

our ability to develop and implement our anticipated commercialization,

marketing and manufacturing capabilities and strategies;

|

|

|

·

|

the potential advantages of our product candidates;

|

|

|

·

|

the rate and degree of market acceptance and clinical utility of our

products;

|

|

|

·

|

our intellectual property position;

|

|

|

·

|

our ability to identify additional products, product candidates or

technologies with significant commercial potential that are consistent with our commercial objectives;

|

|

|

·

|

our ability to attract and retain key personnel;

|

|

|

·

|

the impact of government laws and regulations;

|

|

|

·

|

our competitive position;

|

|

|

·

|

developments relating to our competitors and our industry;

|

|

|

·

|

our ability to maintain and establish collaborations or obtain additional

funding;

|

|

|

·

|

general or regional economic conditions;

|

|

|

·

|

changes in U.S. GAAP; and

|

|

|

·

|

changes in the legal, regulatory and legislative environments in the

markets in which we operate, including impacts of United States government shut-downs on our ability to raise money and obtain

regulatory approval for our products.

|

Although we believe that our expectations (including those on

which our forward-looking statements are based) are reasonable, we cannot assure you that those expectations will prove to be correct.

Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual

results may vary materially from those described in our forward-looking statements.

Except for our ongoing obligations to disclose material information

under the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether

as a result of new information, future events or any other reason. All subsequent forward-looking statements attributable to us

or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred

to herein. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus and

the documents incorporated by reference herein might not occur.

USE OF PROCEEDS

We are not selling any common stock under

this prospectus and will not receive any of the proceeds from the sale of shares by the selling stockholders. We may receive up

to a total of approximately $7.8 million in gross proceeds if all of the Warrants are exercised hereunder. However, as we are unable

to predict the timing or amount of potential exercises of the Warrants, we have not allocated any proceeds of such exercises to

any particular purpose. Accordingly, all such proceeds are allocated to working capital. It is possible that the Warrants may expire

and may never be exercised.

The selling stockholders will pay any underwriting

discounts and commissions and expenses incurred by them for brokerage, accounting, tax or legal services or any other expenses

incurred in disposing of the shares. We will bear all other costs, fees and expenses incurred in effecting the registration of

the shares covered by this prospectus, including, without limitation, all registration and filing fees, NASDAQ Capital Market listing

fees and fees and expenses of our counsel and our auditors.

SELLING STOCKHOLDERS

The common stock being

offered by the selling stockholders are those issued to the selling stockholders in the offering that closed on March 24, 2020,

and those issuable to the selling stockholders, upon exercise of the Warrants issued in such offering. For additional information

regarding the issuances of those shares of common stock and Warrants, see “Private Placement of Common Shares and Warrants”

above. We are registering the shares of common stock in order to permit the selling stockholders to offer the shares for resale

from time to time. Except, as disclosed below and for the ownership of the shares of common stock and the Warrants, the selling

stockholders have not had any material relationship with us within the past three years.

The following table

sets forth information as of April 15, 2020, with respect to the selling stockholders for whom we are registering shares for sale

to the public, the number of shares of our common stock owned by the each selling stockholder prior to this offering, the percentage

of common stock owned by each selling stockholder prior to this offering, the maximum number of shares of our common stock to be

sold by each selling stockholder pursuant to this prospectus, the number of shares of our common stock to be owned by each selling

stockholder upon completion of this offering, assuming all such shares are sold, and the percentage of common stock owned by each

selling stockholder after this offering, assuming all such shares are sold.

Applicable percentage

ownership is based on 19,776,019 shares of our common stock outstanding as of April 15, 2020. Beneficial ownership is determined

in accordance with Rule 13d-3(d) promulgated by the SEC under the Exchange Act. The percentage of shares beneficially owned prior

to the offering is based on 19,776,019 shares of our common stock outstanding as of April 15, 2020.

This table is prepared

based on information supplied to us by the selling stockholders. As used in this prospectus, the term “selling stockholders”

includes the selling stockholders listed below, and any donees, pledges, transferees or other successors in interest selling shares

received after the date of this prospectus from the selling stockholders as a gift, pledge, or other non-sale related transfer.

The numbers of shares in the column “Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus”

represents all of the shares that each selling stockholder may offer under this prospectus. The selling stockholders may sell some,

all or none of their shares. The selling stockholders may sell or transfer all or a portion of their shares of our common stock

pursuant to an available exemption from the registration requirements of the Securities Act. We do not know how long the selling

stockholders will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with

any selling stockholder regarding the sale of any of the shares.

In accordance with

the terms of a registration rights agreement with the selling stockholders, this prospectus generally covers the resale of at least

the sum of (i) the maximum number of shares of common stock issued and (ii) the maximum number of shares of common stock issuable

upon exercise of the related Warrants, determined as if the outstanding warrants were exercised in full as of the trading day immediately

preceding the date this registration statement was initially filed with the SEC, each as of the trading day immediately preceding

the applicable date of determination and all subject to adjustment as provided in the registration right agreement, without regard

to any limitations on the exercise of the warrants.

|

|

|

Shares of Common

Stock Owned Prior to

Offering

|

|

Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus

|

|

Shares of

Common Stock

Owned After Offering

|

|

Name of Selling Stockholder

|

|

Number

|

|

Percent

|

|

|

|

Number

|

|

Percent

|

|

Kurtis Krentz

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

Scott M. Curran

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Andreas Ammelounx Living Trust

|

|

101,615

|

|

*

|

|

101,615

|

|

-

|

|

*

|

|

Robert Richard Keehan

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Gerard J Verweij

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

Peter A. Casey

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Scott Joseph Schueller

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Joseph C. Atkinson

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Chad F Mueller

|

|

40,644

|

|

*

|

|

40,644

|

|

-

|

|

*

|

|

Chetan R Vagholkar

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

Carlo Alberici

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

Paul G. Elie

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Mario Dellaera

|

|

101,615

|

|

*

|

|

101,615

|

|

-

|

|

*

|

|

Daniel DiFilippo

|

|

30,483

|

|

*

|

|

30,483

|

|

-

|

|

*

|

|

Steven J. Shanker Living Trust DTD 4-9-1997

|

|

30,483

|

|

*

|

|

30,483

|

|

-

|

|

*

|

|

Henry A. Padinha & Terri A. Padinha

|

|

101,615

|

|

*

|

|

101,615

|

|

-

|

|

*

|

|

Dennis D. Howarter & Pamela J. Howarter

|

|

101,615

|

|

*

|

|

101,615

|

|

-

|

|

*

|

|

Ballington Living Trust DTD 8-5-14

|

|

76,210

|

|

*

|

|

76,210

|

|

-

|

|

*

|

|

Jayeshkumar R. Patel

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

Eric D. Janson

Ruth Ann Janson

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Charles Tyson Cornell

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Mario Family Partners LP

|

|

185,470

|

|

*

|

|

185,470

|

|

-

|

|

*

|

|

Mario 2002 Grandchildren's Trust

|

|

92,734

|

|

*

|

|

92,734

|

|

-

|

|

*

|

|

Ernest Mario(1)

|

|

508,077

|

|

2.5%

|

|

185,470

|

|

322,607

|

|

1.4%

|

|

John M. Brady

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

Dennis T. Whalen & Linda P. Whalen

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Mark W. Boyer

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

Timothy L. Carpenter & Julie L. Carpenter

|

|

40,644

|

|

*

|

|

40,644

|

|

-

|

|

*

|

|

Jeffery L. Miller & Khristen N. Zar

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Michael A. Page

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Alan W Page

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

James M Koch

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Jeffrey Ronald Boyle

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

Alpesh Shah

Hina Shah

|

|

101,615

|

|

*

|

|

101,615

|

|

-

|

|

*

|

|

Vijay Singh

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Miles E Everson

|

|

101,615

|

|

*

|

|

101,615

|

|

-

|

|

*

|

|

Amaresh Tripathy

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Richard Joseph Call IV

|

|

15,242

|

|

*

|

|

15,242

|

|

-

|

|

*

|

|

Eugene Zaino

|

|

101,615

|

|

*

|

|

101,615

|

|

-

|

|

*

|

|

Thorne Joseph Brown Matteson

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Michael P Niland & Jill K Niland

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

Mark Demich

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Robert J. Smik

|

|

30,483

|

|

*

|

|

30,483

|

|

-

|

|

*

|

|

Christopher Finnerty

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

Vaidyanathan Chandrashekhar

|

|

20,322

|

|

*

|

|

20,322

|

|

-

|

|

*

|

|

John D. Merriam

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Glenn E. Phillips

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Maz Partners LP

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

James C Leslie

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Robert Forster

|

|

127,017

|

|

*

|

|

127,017

|

|

-

|

|

*

|

|

Mark T Nash

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Jeffrey E Zaleski

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

John C Koppin

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Charles Kevin Ferrell

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Sean Ianchulev(2)

|

|

2,198,143]

|

|

10.8%

|

|

185,470

|

|

2,012,673

|

|

8.5%

|

|

Applebaum Family LTD Partnership

|

|

30,483

|

|

*

|

|

30,483

|

|

-

|

|

*

|

|

Rogco Management

|

|

45,725

|

|

*

|

|

45,725

|

|

-

|

|

*

|

|

Perry Sutaria

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

Stuart M. Grant(3)

|

|

4,389,178

|

|

21.0%

|

|

2,032,290

|

|

2,356,888

|

|

10.2%

|

|

Ramachandra C. Reddy

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

Richard Dyke Rogers

|

|

71,130

|

|

*

|

|

71,130

|

|

-

|

|

*

|

|

Scott A. Brody

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

The Temkin Family Legacy Trust No. 2

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

Wuethrich Investments, LLC

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

Edmond P Brady

Kathleen M. Brady

|

|

45,725

|

|

*

|

|

45,725

|

|

-

|

|

*

|

Joann Marie Fiore Borlack

Alan Borlack JTWROS

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

District 2 Captial Fund LP

|

|

152,422

|

|

*

|

|

152,422

|

|

-

|

|

*

|

|

Bret Harvey Balonick

|

|

15,242

|

|

*

|

|

15,242

|

|

-

|

|

*

|

|

James P Kolar

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Edmond Allen Morrison

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Charles Christensen

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

William E Marx

|

|

30,483

|

|

*

|

|

30,483

|

|

-

|

|

*

|

|

Steven R Lilley

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Stephen Zawoyski

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Alexandre Palma

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Keith Jackson

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Mohibullah Yousufani

|

|

20,322

|

|

*

|

|

20,322

|

|

-

|

|

*

|

|

Joseph Michalczyk

|

|

30,483

|

|

*

|

|

30,483

|

|

-

|

|

*

|

|

Denis Naughter

|

|

50,808

|

|

*

|

|

50,808

|

|

-

|

|

*

|

|

Mark M Watermasysk

|

|

20,322

|

|

*

|

|

20,322

|

|

-

|

|

*

|

|

James Douglas Summa

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

Scott J. Gehsmann

|

|

25,403

|

|

*

|

|

25,403

|

|

-

|

|

*

|

|

|

(1)

|

Includes (i) 319,201 shares of common stock, (ii) 8,038

restricted stock units that vest within 60 days of April 15, 2020, (iii) 77,799 shares underlying options that are exercisable

within 60 days of April 15, 2020, and (iv) 103,039 shares of common stock underlying Warrants that are exercisable within 60 days

of April 15, 2020.

|

|

|

(2)

|

Includes (i) 508,679 shares of common stock, 380,424

shares underlying options and 103,039 shares underlying Warrants held by Dr. Ianchulev directly that are exercisable within 60

days of April 15, 2020, (ii) 606,667 shares of common stock and 140,000 shares of common stock underlying options held by PME

that are exercisable within 60 days of April 15, 2020, (iii) 453,334 shares of common stock held by PME Investor Services Eyenovia,

LLC, and (iv) 6,000 shares of common stock held by The Meliora Trust. Dr. Ianchulev is one of the two principal shareholders of

PME and a manager of PME Investor Services Eyenovia, LLC and therefore may be deemed to have beneficial ownership of the shares

of common stock held by PME and PME Investor Services Eyenovia, LLC.

|

|

|

(3)

|

Includes (i) 3,260,128 shares of common stock and (ii)

1,129,050 shares of common stock underlying Warrants that are exercisable within 60 days of April 15, 2020.

|

Relationship with Selling Stockholders

As discussed in greater detail above under

the section entitled “Private Placement of Common Shares and Warrants,” on March 23, 2020, we entered into the Securities

Purchase Agreement with the selling stockholders, pursuant to which we sold shares of common stock and warrants to purchase shares

of common stock to the selling stockholders on March 24, 2020, and agreed with the selling stockholders to file a registration

statement to enable the resale of the shares of common stock covered by this prospectus. Sean Ianchulev, our Chief Executive Officer

and a member of our board of directors, and Ernest Mario, a member of our board, participated in the offering and have shares of

common stock covered by this prospectus.

PLAN OF DISTRIBUTION

The selling stockholders,

which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests

in shares of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership

distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of common

stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or

in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices

related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The selling stockholders

may use any one or more of the following methods when disposing of shares or interests therein:

|

|

·

|

ordinary brokerage transactions and transactions in

which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt

to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale

by the broker-dealer for its account;

|

|

|

·

|

an exchange distribution in accordance with the rules

of the applicable exchange;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

short sales effected after the date the registration

statement of which this prospectus is a part is declared effective by the SEC;

|

|

|

·

|

through the writing or settlement of options or other

hedging transactions, whether through an options exchange or otherwise;

|

|

|

·

|

broker-dealers may agree with the selling stockholders

to sell a specified number of such shares at a stipulated price per share;

|

|

|

·

|

a combination of any such methods of sale; and

|

|

|

·

|

any other method permitted by applicable law.

|

The selling stockholders

may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if

they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of

common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other

applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other

successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer the shares of

common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling

beneficial owners for purposes of this prospectus.

In connection with

the sale of our common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions

they assume. The selling stockholders may also sell shares of our common stock short and deliver these securities to close out

their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling

stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation

of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares

offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus

(as supplemented or amended to reflect such transaction).

The aggregate proceeds

to the selling stockholders from the sale of the common stock offered by them will be the purchase price of the common stock less

discounts or commissions, if any. Each of the selling stockholders reserves the right to accept and, together with their agents

from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents.

We will not receive any of the proceeds from this offering.

The selling stockholders

also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act of

1933, provided that they meet the criteria and conform to the requirements of that rule.

The selling stockholders

and any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein may be "underwriters"

within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale

of the shares may be underwriting discounts and commissions under the Securities Act. Selling stockholders who are "underwriters"

within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities

Act.

To the extent required,

the shares of our common stock to be sold, the names of the selling stockholders, the respective purchase prices and public offering

prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer

will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement

that includes this prospectus.

In order to comply

with the securities laws of some states, if applicable, the common stock may be sold in these jurisdictions only through registered

or licensed brokers or dealers. In addition, in some states the common stock may not be sold unless it has been registered or qualified

for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the

selling stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the

market and to the activities of the selling stockholders and their affiliates. In addition, to the extent applicable we will make

copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling stockholders for the

purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any broker-dealer

that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under

the Securities Act.

We have agreed to indemnify

the selling stockholders against liabilities, including liabilities under the Securities Act and state securities laws, relating

to the registration of the shares offered by this prospectus.

We have agreed with

the selling stockholders to keep the registration statement of which this prospectus constitutes a part effective until the earlier

of (1) such time as all of the shares covered by this prospectus have been disposed of pursuant to and in accordance with the registration

statement or (2) the date on which all of the shares may be sold without restriction pursuant to Rule 144 of the Securities Act.

DIVIDEND POLICY

We have never declared dividends on our

equity securities, and currently do not plan to declare dividends on shares of our common stock in the foreseeable future. We expect

to retain our future earnings, if any, for use in the operation and expansion of our business. Subject to the foregoing, the payment

of cash dividends in the future, if any, will be at the discretion of our Board of Directors and will depend upon such factors

as earnings levels, capital requirements, our overall financial condition and any other factors deemed relevant by our Board.

LEGAL MATTERS

The validity of the securities being offered

hereby will be passed upon for us by Wyrick Robbins Yates & Ponton LLP, Raleigh, North Carolina.

EXPERTS

The financial statements of Eyenovia,

Inc. as of December 31, 2019 and 2018 and for each of the two years in the period ended December 31, 2019 appearing in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2019 have been audited by Marcum LLP, independent registered public accounting firm, as set forth in their report,

which includes an explanatory paragraph as to the Company’s ability to continue as a going concern, thereon and

incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance on such report

given upon the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

This prospectus, which constitutes a part

of the registration statement on Form S-3 that we have filed with the SEC under the Securities Act, does not contain all of

the information in the registration statement and its exhibits. For further information with respect to us and the securities offered

by this prospectus, you should refer to the registration statement and the exhibits filed as part of that document. Statements

contained in this prospectus as to the contents of any contract or any other document referred to are not necessarily complete,

and in each instance, we refer you to the copy of the contract or other document filed as an exhibit to the registration statement.

Each of these statements is qualified in all respects by this reference.

We are subject to the reporting requirements

of the Exchange Act and file annual, quarterly and current reports, proxy statements and other information with the SEC.

You can read our SEC filings, including the registration statement, over the Internet at the SEC’s website at http://www.sec.gov.

We also maintain a website at http://www.eyenovia.com, at which you may access these materials free of charge as soon

as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The information contained in, or

that can be accessed through, our website is not part of this prospectus.

INCORPORATION OF CERTAIN INFORMATION

BY REFERENCE

The SEC allows us to “incorporate

by reference” information that we file with them. Incorporation by reference allows us to disclose important information

to you by referring you to those other documents. The information incorporated by reference is an important part of this prospectus

and any applicable accompanying prospectus supplement, and information that we file later with the SEC will automatically update

and supersede this information. We filed a registration statement on Form S-3 under the Securities Act with the SEC with respect

to the securities being offered pursuant to this prospectus and any applicable accompanying prospectus supplement. This prospectus

omits certain information contained in the registration statement, as permitted by the SEC. You should refer to the registration

statement, including the exhibits, for further information about us and the securities being offered pursuant to this prospectus

and any applicable accompanying prospectus supplement. Statements in this prospectus and any applicable accompanying prospectus

supplement regarding the provisions of certain documents filed with, or incorporated by reference in, the registration statement

are not necessarily complete, and each statement is qualified in all respects by that reference.

Copies of all or any part of the registration

statement, including the documents incorporated by reference or the exhibits, may be obtained over the Internet at the SEC’s

website at http://www.sec.gov. We also maintain a website at http://www.eyenovia.com, at which you may

access these materials free of charge as soon as reasonably practicable after they are electronically filed with, or furnished

to, the SEC. The information contained in, or that can be accessed through, our website is not part of this prospectus. We are

incorporating by reference the documents listed below, which we have already filed with the SEC, and all documents subsequently

filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of any offering, except

as to any portion of any future report or document that is not deemed filed under such provisions:

|

|

·

|

our Annual Report on Form 10-K for the fiscal year ended December

31, 2019, filed with the SEC on March 30, 2020;

|

|

|

·

|

the description of our common stock contained in our registration

statement on Form 8-A filed with the SEC on January 24, 2018.

|

Any statement contained in this prospectus

and any applicable prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this prospectus

and any applicable prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus and any prospectus

supplement to the extent that a statement contained in this prospectus and any applicable prospectus supplement or other subsequently

filed document that also is or is deemed to be incorporated by reference into this prospectus and any applicable prospectus supplement

modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded,

to constitute a part of this prospectus and any applicable prospectus supplement.

We will furnish without charge to you, on

written or oral request, a copy of any filing or report incorporated by reference, including exhibits to the document. You should

direct any requests for documents to Eyenovia, Inc., 295 Madison Avenue, Suite 2400, New York, NY 10017, (917) 289-1117, Attention:

Corporate Secretary.

You should rely only on information contained

in, or incorporated by reference into, this prospectus and any applicable prospectus supplement. We have not authorized anyone

to provide you with information different from that contained in this prospectus and any applicable prospectus supplement or incorporated

by reference in this prospectus and any applicable prospectus supplement. We are not making offers to sell the securities in any

jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation

is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance

and Distribution.

The following table sets forth the estimated

costs and expenses payable by us in connection with the common stock being registered. The selling stockholders will not bear any

portion of such expenses. All the amounts shown are estimates, except for the SEC registration fee.

|

SEC registration fee

|

|

$

|

2,231

|

|

|

Accounting fees and expenses

|

|

$

|

40,000

|

|

|

Legal fees and expenses

|

|

$

|

50,000

|

|

|

Miscellaneous

|

|

$

|

2,769

|

|

|

Total

|

|

$

|

95,000

|

|

Item 15. Indemnification of Directors

and Officers.

We

are incorporated under the laws of the State of Delaware. Section 145 of the Delaware General Corporation Law (“DGCL”)

provides that a Delaware corporation may indemnify any persons who are, or are threatened to be made, parties to any threatened,

pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative (other than an action

by or in the right of such corporation), by reason of the fact that such person was an officer, director, employee, or agent of

such corporation, or is or was serving at the request of such person as an officer, director, employee, or agent of another corporation

or enterprise. The indemnity may include expenses (including attorneys’ fees), judgments, fines, and amounts paid in settlement

actually and reasonably incurred by such person in connection with such action, suit, or proceeding, provided that such person

acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the corporation’s best interests

and, with respect to any criminal action or proceeding, had no reasonable cause to believe that his or her conduct was illegal.

A Delaware corporation may indemnify any person who is, or is threatened to be made, a party to any threatened, pending, or completed

action or suit by or in the right of the corporation by reason of the fact that such person was a director, officer, employee,

or agent of such corporation, or is or was serving at the request of such corporation as a director, officer, employee, or agent

of another corporation or enterprise. The indemnity may include expenses (including attorneys’ fees) actually and reasonably

incurred by such person in connection with the defense or settlement of such action or suit provided such person acted in good

faith and in a manner he or she reasonably believed to be in or not opposed to the corporation’s best interests, except that

no indemnification is permitted without judicial approval if the officer or director is adjudged to be liable to the

corporation. Where an officer or director is successful on the merits or otherwise in the defense of any action referred to above,

the corporation must indemnify him or her against the expenses which such officer or director has actually and reasonably incurred.

Our certificate of incorporation and bylaws provide for the indemnification of our directors and officers to the fullest

extent permitted under the DGCL.

Section 102(b)(7) of the DGCL permits a

corporation to provide in its certificate of incorporation that a director of the corporation shall not be personally liable to

the corporation or its stockholders for monetary damages for breach of fiduciary duties as a director, except for liability for

any:

|

|

•

|

breach of a director’s duty of loyalty to the corporation or its stockholders;

|

|

|

•

|

act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

|

|

|

•

|

unlawful payment of dividends, stock purchase or redemption of shares; or

|

|

|

•

|

transaction from which the director derives an improper personal benefit.

|

Our certificate of incorporation includes

a provision providing for the limitation of liability to the maximum extent permitted under the DGCL. Expenses incurred by any

officer or director in defending any proceeding in advance of its final disposition shall be paid by us upon delivery to us of

an undertaking by or on behalf of such director or officer, to repay all amounts advanced if it should ultimately be determined

that such director or officer is not entitled to be indemnified by us.

Section 174 of the DGCL provides, among

other things, that a director, who willfully or negligently approves of an unlawful payment of dividends or an unlawful stock purchase

or redemption, may be held liable for such actions. A director who was either absent when the unlawful actions were approved, or

dissented at the time, may avoid liability by causing his or her dissent to such actions to be entered on the books containing

minutes of the meetings of the board of directors at the time such action occurred or immediately after such absent director receives

notice of the unlawful acts.

We maintain a directors’ and officers’

liability insurance policy. The policy insures directors and officers against unindemnified losses arising from certain wrongful

acts in their capacities as directors and officers and reimburses us for those losses for which we have lawfully indemnified the

directors and officers. The policy contains various exclusions.

Item 16. Exhibits.

Item 16. Exhibits and Financial Statement Schedules.

|

|

|

|

|

Incorporated

by Reference (Unless Otherwise Indicated)

|

|

Exhibit Number

|

|

Exhibit Description

|

|

Form

|

|

File No.

|

|

Exhibit

|

|

Filing Date

|

|

4.1

|

|

Third Amended and Restated Certificate of Incorporation

|

|

8-K

|

|

001-38365

|

|

3.1

|

|

January 29, 2018

|

|

|

|

|

|

|