Current Report Filing (8-k)

July 08 2020 - 6:10AM

Edgar (US Regulatory)

0001324424

false

0001324424

2020-07-06

2020-07-07

0001324424

us-gaap:CommonStockMember

exch:XNGS

2020-07-06

2020-07-07

0001324424

expe:SeniorNotes2.500PercentDue2022Member

exch:XNYS

2020-07-06

2020-07-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): July 7, 2020

EXPEDIA GROUP, INC.

(Exact name of

registrant as specified in its charter)

|

Delaware

|

|

001-37429

|

|

20-2705720

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1111 Expedia Group Way W.

Seattle,

Washington 98119

(Address of Principal

Executive Offices, and Zip Code)

(206)

481-7200

(Registrant’s

Telephone Number, Including Area Code)

Not applicable

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered

pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Trading

Symbol(s)

|

Name

of each exchange on which registered

|

|

Common

Stock, par value $0.0001 per share

|

EXPE

|

The

Nasdaq Global Select Market

|

|

Expedia Group, Inc. 2.500% Senior Notes due 2022

|

EXPE22

|

New

York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

|

Emerging growth company

|

¨

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

¨

|

Item 8.01. Other Events.

Pricing of

Notes

On July 7,

2020, Expedia Group, Inc. (“Expedia Group” or the “Company”), entered into an agreement which will

result in the private placement of $500 million of unsecured 3.600% senior notes due 2023 (the “2023 Notes”) and

$750 million of unsecured 4.625% senior notes due 2027 (the “2027 Notes” and, together with the 2023 Notes, the

“Notes”) upon the terms of a preliminary private placement offering memorandum, dated as of July 7, 2020 (the

“Offering Memorandum”). The 2023 Notes will be issued at a price of 99.922% of the aggregate principal amount.

The 2027 Notes will be issued at a price of 99.997% of the aggregate principal amount. The Notes will be guaranteed by

certain subsidiaries of Expedia Group. Expedia Group currently expects to use the net proceeds to redeem outstanding shares

of its 9.5% Series A Preferred Stock after May 5, 2021, when the redemption premium is scheduled to decrease. Depending on

business, liquidity and other trends or conditions, however, the Company may elect to use all or part of the proceeds for

other general corporate purposes, which may include repaying, prepaying, redeeming or repurchasing other indebtedness in lieu

of or pending such redemption. The private placement of the Notes is expected to close on July 14, 2020. The closing of the

Notes offering is subject to customary closing conditions, and there can be no assurance that the issuance and sale of the

Notes will be consummated.

On July 7, 2020,

the Company issued a press release announcing the pricing of the private offering of the Notes. A copy of the Company’s press

release is attached hereto as Exhibit 99.1, which is incorporated by reference herein.

The Notes will

be offered and sold only to qualified institutional buyers pursuant to Rule 144A and outside the United States pursuant to Regulation

S under the Securities Act of 1933, as amended (the “Securities Act”). The Notes have not been registered under the

Securities Act or any state securities laws and may not be offered or sold in the United States absent registration or an applicable

exemption from the registration requirements of the Securities Act and applicable state laws.

This report does

not constitute an offer to sell or a solicitation for an offer to purchase the Notes or any other securities and does not constitute

an offer, solicitation or sale in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful.

Forward Looking Statements

This report, including

the exhibits, contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995 that involve risks and uncertainties. These forward-looking statements are based on assumptions that are inherently

subject to uncertainties, risks and changes in circumstances that are difficult to predict, including the Risk Factors identified

in the Company’s most recently filed annual report on Form 10-K, the Company’s most recently filed quarterly report

on Form 10-Q for the quarter ended March 31, 2020 and Exhibit 99.2 to the Company’s Current Report on Form 8-K filed on April

23, 2020 (File No.: 20809410). The use of words such as “believe,” “estimate,” “expect” and

“will,” or the negative of these terms or other similar expressions, among others, generally identify forward-looking

statements. However, these words are not the exclusive means of identifying such statements. Unless required by law, the Company

undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events

or otherwise. However, readers should carefully review the reports and documents the Company files or furnishes from time to time

with the Securities and Exchange Commission, particularly its annual report on Form 10-K, quarterly reports on Form 10-Q and current

reports on Form 8-K.

Item 9.01. Financial Statements

and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

EXPEDIA GROUP, INC.

|

|

|

|

|

Dated: July 8, 2020

|

By:

|

/s/ Robert J. Dzielak

|

|

|

|

Robert J. Dzielak

|

|

|

|

Chief Legal Officer and Secretary

|

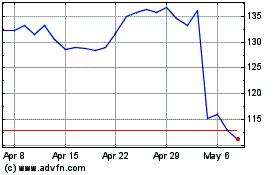

Expedia (NASDAQ:EXPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

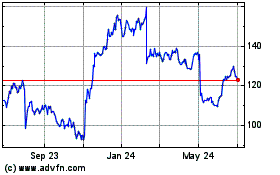

Expedia (NASDAQ:EXPE)

Historical Stock Chart

From Apr 2023 to Apr 2024