|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Issuance of Notes

On May 5, 2020, Expedia Group, Inc., a Delaware corporation (the “Company”), completed its previously announced private placement (the “Notes Offering”) of $2 billion aggregate principal amount of 6.250% senior unsecured notes due May 2025 (the “6.250% Notes”) and $750 million aggregate principal of 7.000% senior unsecured notes due May 2025 (the “7.000% Notes,” and together with the 6.250% Notes, the “Notes”). The 6.250% Notes were issued pursuant to an indenture dated as of May 5, 2020 (the “6.250% Notes Indenture”), by and among the Company, the subsidiary guarantors party thereto and U.S. Bank National Association, as trustee. The 7.000% Notes were issued pursuant to an indenture dated as of May 5, 2020 (the “7.000% Notes Indenture,” and together with the 6.250% Notes Indenture, the “Indentures”), by and among the Company, the subsidiary guarantors party thereto and U.S. Bank National Association, as trustee.

The Notes were offered and sold only to qualified institutional buyers in the United States pursuant to Rule 144A and outside the United States pursuant to Regulation S under the Securities Act of 1933, as amended (the “Securities Act”). The Notes have not been registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and applicable state laws.

The net proceeds from the sale of the Notes, after deducting estimated discounts and commissions and other offering expenses, were approximately $2,714 million. The Company intends to use the net proceeds from the sale of the Notes for general corporate purposes, which may include, without limitation, repayment or redemption of the Company’s 5.95% Senior Notes due 2020.

The Notes are the Company’s senior unsecured obligations and will rank equally in right of payment with all of the Company’s existing and future unsecured and unsubordinated obligations. The Notes are fully and unconditionally guaranteed by the subsidiary guarantors, which include each domestic subsidiary of the Company that is a borrower under or guarantees the obligations under the Company’s existing credit agreement. So long as the guarantees are in effect, each subsidiary guarantor’s guarantee will be the senior unsecured obligation of such subsidiary guarantor and will rank equally in right of payment with all of such subsidiary guarantor’s existing and future unsecured and unsubordinated obligations. The Notes pay interest semiannually in arrears on May 1 and November 1 of each year, beginning on November 1, 2020, at a rate of 6.250% per year with respect to the 6.250% Notes and 7.000% per year with respect to the 7.000% Notes. The Notes will mature on May 1, 2025.

The Company may redeem some or all of the 6.250% Notes at any time prior to February 1, 2025 by paying a “make-whole” premium plus accrued and unpaid interest, if any. The Company may redeem some or all of the 6.250% Notes on or after February 1, 2025 at par plus accrued and unpaid interest, if any.

The Company may redeem some or all of the 7.000% Notes at any time prior to May 1, 2022 at a redemption price equal to 100% of the principal amount of the 7.000% Notes to be redeemed, plus a “make-whole” premium, plus accrued and unpaid interest, if any. The Company may redeem some or all of the 7.000% Notes on or after May 1, 2022 at specified redemption prices set forth in the 7.000% Indenture, plus accrued and unpaid interest, if any. In addition, at any time or from time to time prior to May 1, 2022, the Company may redeem up to 40% of the aggregate principal amount of the 7.000% Notes with the net proceeds of certain equity offerings at the specified redemption price described in the 7.000% Indenture, plus accrued and unpaid interest, if any.

The Company is obligated to offer to repurchase the Notes at a price of 101% of their principal amount plus accrued and unpaid interest, if any, upon the occurrence of certain change of control triggering events, subject to certain qualifications and exceptions. The Indentures contain certain customary covenants (including covenants limiting the Company’s and the Company’s subsidiaries’ ability to create certain liens, enter into sale and lease-back transactions, and consolidate or merge with, or convey, transfer or lease all or substantially all assets to, another person) and events of default (subject in certain cases to customary exceptions, as well as grace and cure periods). The occurrence of an event of default under the applicable Indenture could result in the acceleration of the Notes and could cause a cross-default that could result in the acceleration of other indebtedness of the Company and its subsidiaries.

The foregoing summary is qualified in its entirety by reference to each of the Indentures, which are filed as Exhibits 4.1 and 4.2, respectively, to this Current Report on Form 8-K and incorporated herein by reference.

Credit Facility Amendments

On May 4, 2020, the Company, certain of the Company’s subsidiaries party thereto and the lenders party thereto (the “Consenting Lenders”) executed a restatement agreement, which amends and restates the Company’s existing revolving credit facility (as amended and restated, the “Amended Credit Facility”) to, among other things, suspend the maximum leverage ratio covenant until December 31, 2021, increase the maximum permissible leverage ratio (once such covenant is reinstated) until March 31, 2023 (at which time the maximum permissible leverage ratio will return to the level in effect immediately prior to effectiveness of the Amended Credit Facility), eliminate the covenant imposing a minimum permissible ratio of consolidated EBITDA to consolidated cash interest expense and add a covenant regarding minimum liquidity, as well as to make certain other amendments to the affirmative and negative covenants therein. The Amended Credit Facility became effective on May 5, 2020 (the “Amended Credit Facility Effective Date”), substantially concurrently with the completion of the Notes Offering and the completion of the transactions contemplated by the Investment Agreements (as defined below).

Obligations under the Amended Credit Facility are secured by substantially all of the assets of the Company and its subsidiaries that guarantee the Amended Credit Facility (subject to certain exceptions, including for our new headquarters located in Seattle, WA) up to the maximum amount permitted under the indentures governing the Notes and the Company’s existing 5.95% Senior Notes due 2020, 2.500% Senior Notes due 2022, 4.500% Senior Notes due 2024, 5.000% Senior Notes due 2026, 3.800% Senior Notes due 2028 and 3.25% Senior Notes due 2030 (collectively, the “Existing Notes”) as of the Amended Credit Facility Effective Date without securing such notes. Aggregate commitments under the Amended Credit Facility will initially total $2 billion, and will mature on May 31, 2023.

Pursuant to the terms of the Amended Credit Facility, the Company has agreed to use reasonable best efforts to enter into (and to cause certain of its subsidiaries, including certain of its subsidiaries that are not guarantors of the Notes or the Existing Notes, to enter into), promptly after the Amended Credit Facility Effective Date, a new credit facility incurred by one or more of the Company’s subsidiaries that are not obligors with respect to the Amended Credit Facility, the Notes or the Existing Notes and which will be guaranteed by the Company, its subsidiaries that guarantee the Amended Credit Facility, the Notes and the Existing Notes and certain of the Company’s non-guarantor subsidiaries (the “Additional Credit Facility”), on specified terms in an aggregate principal amount up to approximately $855 million. Upon the establishment of the Additional Credit Facility, the Company will prepay indebtedness, and reduce commitments, under the Amended Credit Facility, in an amount equal to the aggregate commitments in respect of the Additional Credit Facility.

Loans under the Amended Credit Facility held by Consenting Lenders will bear interest (A) in the case of eurocurrency loans, at rates ranging from (i) prior to December 31, 2021, 2.35% per annum for any day that the aggregate unused commitments and funded exposure under the Amended Credit Facility exceed $1.145 billion to 2.25% per annum otherwise and (ii) on and after December 31, 2021, or prior to such date for each quarter that the leverage ratio, as of the end of the most recently ended fiscal quarter for which financial statements have been delivered, calculated on an annualized basis using consolidated EBITDA for the two most recently ended fiscal quarters included in such financial statements multiplied by two, is not greater than 5.00:1.00, 1.10% to 1.85% per annum for any day that the aggregate unused commitments and funded exposure under the Amended Credit Facility exceed $1.145 billion and, otherwise, ranging from 1.00% to 1.75% per annum, in each case, depending on the Company’s credit ratings, and (B) in the case of base rate loans, at rates ranging from (i) prior to December 31, 2021, 1.35% per annum for any day that the aggregate unused commitments and funded exposure under the Amended Credit Facility exceed $1.145 billion to 1.25% per annum otherwise and (ii) on and after December 31, 2021, or prior to such date if the leverage ratio condition referred to above is satisfied, 0.10% to 0.85% per annum for any day that the aggregate unused commitments and funded exposure under the Amended Credit Facility exceed $1.145 billion, and, otherwise, ranging from 0.00% to 0.75% per annum, in each case, depending on the Company’s credit ratings.

Under certain circumstances, loans under the Amended Credit Facility held by Consenting Lenders that do not participate in the Additional Credit Facility, if established, will bear interest at rates ranging from 1.00% to 1.75% per annum, in the case of eurocurrency loans, and ranging from 0.00% to 0.75% per annum, in the case of base rate loans, in each case, depending on the Company’s credit ratings.

The foregoing summary is qualified in its entirety by reference to the Amended Credit Facility, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Investment Agreements

On May 5, 2020, the Company completed its previously announced sale of Series A Preferred Stock (as defined below) and warrants (the “Warrants”) to purchase common stock of the Company (“Common Stock”) to AP Fort Holdings, L.P., an affiliate of Apollo Global Management, Inc. (the “Apollo Purchaser”) and SLP Fort Aggregator II, L.P. and SLP V Fort Holdings II, L.P., affiliates of Silver Lake Group, L.L.C. (the “Silver Lake Purchasers”) pursuant to the Company’s previously announced Investment Agreements, dated as of April 23, 2020, with the Apollo Purchaser and the Silver Lake Purchasers (together, the “Investment Agreements”).

Registration Rights Agreement

In connection with and concurrently with the effective time of the transactions contemplated by the Investment Agreements, the Company, the Apollo Purchaser and the Silver Lake Purchasers entered into a Registration Rights Agreement (the “Registration Rights Agreement”), pursuant to which the Apollo Purchaser and the Silver Lake Purchasers are entitled to certain registration rights. Under the terms of the Registration Rights Agreement, the Apollo Purchaser and the Silver Lake Purchasers are entitled to customary registration rights with respect to the shares of Common Stock for which the Warrants may be exercised and, from and after the fifth anniversary of the closing, the Series A Preferred Stock (as defined below).

The foregoing description of the Registration Rights Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Registration Rights Agreement, which is attached hereto as Exhibit 10.2, and is incorporated herein by reference.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information in Item 1.01 above is incorporated by reference into this Item 2.03.

|

Item 3.03.

|

Material Modification to Rights of Security Holders.

|

The information in Item 5.03 below is incorporated by reference into this Item 3.03.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Pursuant to the Investment Agreements and immediately following the effective time of the transactions contemplated thereby, David Sambur and Greg Mondre were appointed as members of the Board of Directors of the Company (the “Board”).

Messrs. Sambur and Mondre will not receive compensation from the Company in connection with their position on the Board. Neither Mr. Sambur nor Mr. Mondre has been appointed to serve as a member of any committee of the Board.

Except as described in this Current Report on Form 8-K, there are no transactions between Messrs. Sambur or Mondre, on the one hand, and the Company, on the other hand, that would be reportable under Item 404(a) of Regulation S-K. The terms of the Investment Agreements are more fully described in Item 1.01 of the Company’s Current Report on Form 8-K filed with the SEC on April 23, 2020, which is incorporated by reference herein.

David Sambur, age 40, is Co-Lead Partner, Private Equity at Apollo Global Management, Inc., having joined Apollo in 2004. Prior to that time, Mr. Sambur was a member of the Leveraged Finance Group of Salomon Smith Barney Inc. Mr. Sambur serves on the board of directors of PlayAGS, CareerBuilder, Coinstar, Cox Media Group, ClubCorp, Diamond Resorts International, ecoATM, Gamenet Group, Mood Media, Rackspace, Redbox Automated Retail, and Shutterfly, among others. Mr. Sambur previously served on the boards of directors of Caesars Entertainment Corporation, Hexion Holdings, LLC, Momentive Performance Materials, Inc. and Verso Paper Corporation. Mr. Sambur is also a member of the Mount Sinai Department of Medicine Advisory Board, the Arbor Brothers Inc. Board of Directors and the Emory College Dean’s Advisory Council. Mr. Sambur graduated summa cum laude and Phi Beta Kappa from Emory University with a BA in Economics.

Greg Mondre, age 45, is Co-CEO of Silver Lake, a global private equity firm, based in New York. Mr. Mondre joined Silver Lake in 1999 as a founding principal and was previously Managing Partner and Managing Director from January 2013 to December 2019. Prior to joining Silver Lake, Mr. Mondre was a principal at Texas Pacific Group, where he focused on private equity investments across a wide range of industries, with a particular focus on technology. He serves on the board of directors of Motorola Solutions, Inc. Previously, he served on the boards of GoDaddy Inc. from May 2014 to February 2020 and Sabre Corporation from March 2007 to December 2018. Mr. Mondre graduated from The Wharton School of the University of Pennsylvania with a B.S. in Economics.

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On May 5, 2020, the Company filed with the Secretary of State of the State of Delaware a Certificate of Designations (the “Certificate of Designations”) for the purposes of amending its Certificate of Incorporation to establish the terms of the Company’s Series A Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”). The terms of the Series A Preferred Stock are more fully described in Item 1.01 of the Company’s Current Report on Form 8-K filed with the SEC on April 23, 2020, which is incorporated by reference herein, and in the Certificate of Designations attached hereto as Exhibit 3.1, which is incorporated by reference herein.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit

Number

|

|

|

Description

|

|

|

|

|

|

|

|

|

3.1

|

|

|

Certificate of Designations with respect to Series A Preferred Stock.

|

|

|

|

|

|

|

|

|

4.1

|

|

|

Indenture, dated as of May 5, 2020, among Expedia Group, Inc., the guarantors party thereto and U.S. Bank National Association relating to the 6.250% Notes.

|

|

|

|

|

|

|

|

|

4.2

|

|

|

Indenture, dated as of May 5, 2020, among Expedia Group, Inc., the guarantors party thereto and U.S. Bank National Association relating to the 7.000% Notes.

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Restatement Agreement, dated as of May 4, 2020, among Expedia Group, Inc., the borrowing subsidiaries party thereto, the lenders party thereto and JPMorgan Chase Bank, N.A., as administrative agent and London agent.

|

|

|

|

|

|

|

|

|

10.2

|

|

|

Registration Rights Agreement, dated as of May 5, 2020, by and among Expedia Group, Inc., AP Fort Holdings, L.P., SLP Fort Aggregator II, L.P. and SLP V Fort Holdings II, L.P.

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

EXPEDIA GROUP, INC.

|

|

|

|

|

|

By:

|

|

/s/ Robert J. Dzielak

|

|

|

|

Robert J. Dzielak

|

|

|

|

Chief Legal Officer and Secretary

|

Dated: May 5, 2020

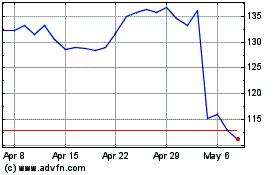

Expedia (NASDAQ:EXPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

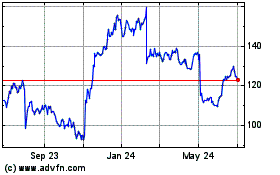

Expedia (NASDAQ:EXPE)

Historical Stock Chart

From Apr 2023 to Apr 2024