UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to Section 240.14a-12 |

Expeditors International of Washington, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

(2) |

Form, Schedule or Registration Statement No.: |

Expeditors® 2019 Notice of Annual Meeting & Proxy Statement EXPEDITORS INTERNATIONAL OF WASHINGTON, INC. CORPORATE HEADQUARTERS SEATTLE, WA

March 23, 2021

To Our Stakeholders

Resilience. Adaptability. Fortitude.

There are so many adjectives that could describe 2020, but just a few words suffice to describe how Expeditors’ 17,500-strong workforce rallied as one to address the myriad of challenges that we all confronted during a year most notable for the COVID-19 pandemic. Not even the best-laid plans contemplated factories and transportation hubs along with entire cities and nations completely shutting down all at once. Many feared for the worst, as cargo vessels were quickly moored and nearly the entire global fleet of passenger airplanes were grounded. Truly, 2020 was unprecedented and nobody, including everyone at Expeditors, had ever seen anything like it.

Many companies took actions to control costs, terminate employees and reduce benefits. We did not. During the very early stages of the pandemic, we again adopted a “no layoff” policy for many of the same reasons that we did in 2008-2009. During the financial crisis, even as we were witnessing a significant downturn in our industry, we knew that business would come back eventually and that we would need our valuable employees to execute and grow our business once it did. Looking back on these two decisions, we know they were the right thing to do, both for our employees and for our business. We still believe that today.

Of course, the world did not stop in 2020 – not even for a pandemic. Instead, it was quickly and radically disrupted as a new and sudden demand exploded for such things as personal protective equipment, sanitizers and other supplies to keep people safe. Additionally, demand significantly increased for laptop computers and other electronics to support a world that was isolated, working from home, and locked inside. People around the globe became completely dependent on an internet connection for all business and personal matters. Demand for critical goods soared, even as air capacity was reduced to a mere fraction of what it had been, and many ocean ports were overwhelmed by the influx.

Throughout all of this, Expeditors executed as well as it ever has. Despite the challenges associated with the pandemic, we recorded one of our best years in our history – even as roughly 80% of our employees were working off-site and at home. Our performance is a testament to the resiliency of Expeditors’ network, the dedication of our people and our strong relationships with our customers and service providers. It is during times of crisis that these things come in to play and matter most and 2020 was all about working through the COVID-19 crisis.

We are incredibly humbled and grateful for what we were able to achieve during times that have been so difficult for so many around the world. There are already signs that 2021 may be different from last year as vaccines are rolled out and the world manages through the end of pandemic. Nevertheless, we remain disciplined and dedicated first and foremost to protecting our people. This includes work-from-home directives for those that can along with social distancing and layers of personal protection for our essential workers who must be in our warehouses and distribution centers in order to handle the vital needs of a world that remains in various stages of lockdown. No matter what the rest of 2021 brings, our people remain vigilant, strong, and customer-focused. We cannot help but be optimistic about the future.

We ask for your vote:

You are asked to vote FOR the Board’s eight recommended director nominees and two proposals put forth by the Board of Directors.

We thank you for investing with us and remain dedicated to sustaining your trust.

On behalf of the entire Board of Directors, we thank our employees, customers, service providers, communities and you, our shareholders, for your continued support and your investment in our business.

Sincerely,

/s/ Robert R. Wright

Robert R. Wright

Chairman of the Board

TABLE OF CONTENTS

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

|

|

Tuesday |

• Election of Directors |

|

May 4, 2021 |

• Approve (advisory) Named Executive Officer Compensation |

|

8:00 A.M. Pacific Time |

• Ratification of Independent Registered Public Accounting Firm |

|

|

|

|

Expeditors International |

|

|

1015 Third Avenue |

|

|

Seattle, WA 98104 |

Record Date: Close of business on March 9, 2021 |

Attending the Annual Meeting

Attendance at the Meeting is limited to shareholders able to present evidence of ownership as of the Record Date. All shareholders must be prepared to present valid photo identification to be admitted to the Meeting. Cameras (including cellular phones), recording devices and other electronic devices, and the use of cellular phones, will not be permitted at the Meeting. Representatives will be at the entrance to the Meeting, and these representatives will have the authority, on the Company’s behalf, to determine whether the admission policy and procedures have been followed and whether you will be granted admission to the Meeting.

Availability of Proxy Materials

This Notice of Annual Meeting of Shareholders and related proxy materials are being distributed or made available to shareholders beginning on or about March 23, 2021. This includes instructions on how to access these materials (including our Proxy Statement and 2020 Annual Report to shareholders) online.

Please vote your shares

We encourage shareholders to vote promptly, as this will save the expense of additional proxy solicitation.

You may vote in the following ways:

By Order of the Board of Directors,

Expeditors International of Washington, Inc.

/s/ Jeffrey F. Dickerman

Jeffrey F. Dickerman

Corporate Secretary

Seattle, Washington

March 23, 2021

Notice of Annual Meeting & Proxy Statement | 1

PROXY SUMMARY

This Proxy Statement and the accompanying form of proxy are furnished in connection with the solicitation of proxies by the Board of Directors of Expeditors International of Washington, Inc. (the Company, Expeditors, we, us, our) for use at the Annual Meeting of Shareholders (the Annual Meeting). This proxy summary is intended to provide a broad overview of the items that you will find elsewhere in this Proxy Statement. As this is only a summary, we encourage you to read the entire Proxy Statement for more information about these topics prior to voting.

|

|

|

|

|

Meeting Agenda & Voting Recommendations |

|

|

|

|

Proposal |

Board's Voting

Recommendation |

Page |

|

No. 1: Election of Directors |

✓ |

FOR (each nominee) |

pg. 5 |

|

No. 2: Advisory Vote to Approve Named Executive Officer Compensation |

✓ |

FOR |

pg. 23 |

|

No. 3: Ratification of Independent Registered Public Accounting Firm |

✓ |

FOR |

pg. 39 |

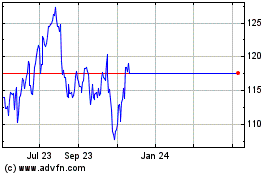

2018-2020 Financial Performance

(Data in millions except dividends and earnings per share)

In 2020, the Company achieved record revenues, operating income and EPS in one of the most challenging periods in the Company’s history. The Company activated its business continuity plans in the first quarter of 2020 and our employees quickly adapted to the challenges presented by the pandemic. Enhanced health and safety programs were established globally and we executed millions of shipments, including Personal Protective Equipment (PPE), medical equipment and technology needed to support people working from home.

ESG OVERSIGHT: EXPEDITORS’ COMMITMENT TO SUSTAINABILITY

Expeditors has always been committed to the fundamental values of good environmental, social and governance (ESG) corporate citizenship since our Company’s inception. Indeed, this commitment is part of our business model and is reflected in the various long-standing mechanisms that we have put in place to promote the best interests of all Expeditors’ stakeholders – including our shareholders, employees, service providers, customers and communities. We are honored to be named as the highest ranked logistics company (and 14th overall) in the 2020 Best ESG Companies Top 50 list published by Investor’s Business Daily and receive a AAA rating (their highest rating) from MSCI, an investment research firm. We are proud of the fact that this achievement is a natural consequence of executing our core business strategy effectively and ethically. Our executive team is firmly committed to good ESG principles and we have well-established ESG employee committees, all undertaken with continuous oversight by our Board of Directors. We also work to provide meaningful disclosures on our various sustainability efforts, mapped against industry metrics relevant to our non-asset, knowledge-based business model.

We are also committed to creating a positive and inclusive work environment, free from discrimination and harassment of any kind, for all our employees – our most important asset. Fostering workplace diversity and upward mobility are part and parcel of this important commitment. Case in point, eight out of the last 11 promotions into Expeditors’ senior executive team (consisting of the top Senior Vice President roles or above) have been women and/or a person of a diverse background (race, ethnicity, or sexual orientation). All of these recently promoted individuals are very long tenured, with an average length of service with Expeditors of 24 years (ranging between 17 and 37 years). We are also proud of the fact that we immediately adopted a “no layoff” policy at the start of the COVID-19 pandemic and

2 | Expeditors International of Washington, Inc.

were able to maintain safe and secure working environments for our global workforce throughout the year. Additionally, despite the many challenges of the ongoing pandemic, we did not pause our commitment to making our communities better places to live and work. Our offices around the world continued to support local charities and children's programs while encouraging our employees to volunteer and participate in grassroots projects in order to improve the diverse communities we serve.

Additional information about our programs to sustain a healthy environment and reduce greenhouse gas emissions, as well as our approach to social responsibility and sound governance is set forth on pages 17 to 22 of this proxy statement, and can also be found in our latest ESG report, which is updated annually: www.expeditors.com/sustainability.

Compensation Highlights Include Increased Shift to Long-Term Equity

We value our shareholders’ views on Named Executive Officer (NEO) compensation, and we continue to regularly engage with those representing more than half of the outstanding shares to understand their perspectives on our Company, including our compensation programs. Shareholders supported our 2020 and 2019 advisory vote on NEO compensation by 95% and 94%, respectively, by voting FOR our proposals. In 2019, the Board implemented changes to compensation for senior executive management, including all NEO and these programs continued in 2020.

Highlights of our compensation program include:

|

|

|

― |

A minimum 5% growth in operating income is required for senior managers to earn an unreduced payout from the Executive Incentive Compensation Plan |

|

― |

Senior managers’, including all NEOs except our CEO, allocations and payouts from the Executive Incentive Compensation Pool were reduced by an annual amount equal to the target value of performance share unit (PSU) awards that will vest only if 3-year performance goals are achieved for Net Revenues (a non-GAAP measure hereafter defined as revenues less directly related cost of transportation and other expenses) and EPS |

|

― |

Pay for performance (over 75% of CEO pay is 'at risk' and directly linked to performance) |

|

― |

No guaranteed bonuses |

|

― |

No retirement bonuses |

|

― |

No perquisites |

|

― |

NEO allocation of the Executive Incentive Compensation Pool is reduced over time |

|

― |

NEO allocation of the Executive Incentive Compensation Pool is limited to preset allocation percentages |

|

― |

NEO Executive Incentive Compensation is strictly tied to U.S. GAAP operating income |

|

― |

Double trigger vesting of unvested equity upon a change in control |

Notice of Annual Meeting & Proxy Statement | 3

DIRECTOR IDENTIFICATION & NOMINATION PROCESS

The Policy on Director Nominations, which can be found on the Company’s website at https://investor.expeditors.com, describes the process by which Director nominees are selected by the Nominating and Corporate Governance Committee, and includes the criteria the Committee will consider in determining the qualifications of any candidate for Director. In reviewing candidates for the Board, the Committee considers the entirety of each candidate’s credentials in the context of these standards. With respect to the nomination of continuing Directors for re-election, the individual’s contributions to the Board are also considered.

The Committee annually reviews its nomination procedures to assess the effectiveness of the Policy on Director Nominations. The Committee considers candidates for Director who are recommended by its members, by management, and by search firms retained by the Committee. Per the Policy on Director Nominations, the Committee will also consider any candidate proposed by a shareholder satisfying certain notice provisions, and will take into account the size and duration of the recommending shareholder's ownership. In addition, the Committee ensures that, with respect to any new candidates recruited from outside the Company, the initial list of new candidates includes qualified female and racially/ethnically diverse individuals. Furthermore, the Committee will instruct any retained search firms to include the same on their initial lists of potential candidates submitted to the Committee.

All candidates for Director who, after evaluation, are then recommended by the Committee and approved by the Board of Directors will be included in the Company’s recommended slate of Director nominees in its Proxy Statement.

In addition, any shareholder or group of up to 20 shareholders that has continuously beneficially owned at least 3% of the Company’s Common Stock for at least three years, and who satisfies certain notice, information and consent provisions, may nominate up to 20% of the Directors standing for election and include such nominees on the Company's proxy statement pursuant to the Company's proxy access rights. Lastly, a shareholder may nominate a Director candidate for election outside of the Company's proxy statement if the shareholder complies with the notice, information and consent provisions of Article II of the Company’s Bylaws, which can be found on our website at https://investor.expeditors.com.

Our Bylaws and our Policy on Director Nominations require any notice for Director nominees for shareholder consideration or recommendation of candidates to the Committee be submitted by certain deadlines, which are explained in detail under the heading “Deadlines for Shareholder Proposals for the 2022 Annual Meeting of Shareholders.”

4 | Expeditors International of Washington, Inc.

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

The Company’s Bylaws require a Board of Directors composed of not less than 6 nor more than 11 members. The Board is currently set at eight members. Expeditors’ Directors are elected at each Annual Meeting to hold office until the next Annual Meeting or until the election or qualification of his or her successor. Any vacancy resulting from the non-election of a Director may be filled by the Board of Directors. The eight nominees are named below. Proxies cannot be voted for a greater number of persons than the number of nominees named in this proposal.

Nominees for Election

This year’s nominees consist of six independent Directors and two non-independent Directors. Unless otherwise instructed, it is the intention of the persons named in the accompanying form of proxy to vote shares represented by properly executed proxies for the eight nominees of the Board of Directors named below. Although the Board anticipates that all of the nominees will be available to serve as Directors of the Company, should any one or more of them be unwilling or unable to serve, it is intended that the proxies will be voted for the election of a substitute nominee or nominees designated by the Board of Directors or the seat will remain open until the Board of Directors identifies a nominee.

The following persons are nominated to serve as Directors until the Company’s 2022 Annual Meeting of Shareholders:

ROBERT R. WRIGHT

Robert R. Wright became a Director in May 2008, served as Lead Director beginning May 2010 and was appointed Chairman of the Board in May 2014. Since 2002, Mr. Wright has been the President and Chief Executive Officer of Matthew G. Norton Co., a real estate investment, development and management firm based in Seattle, Washington. Prior to joining Matthew G. Norton, Mr. Wright was a Regional Managing Partner of Tax for Arthur Andersen. He currently serves on the Board of Directors for two privately held companies, Matthew G. Norton Co. and Stimson Lumber Company.

Specific Qualifications, Attributes, Skills & Experience

|

• |

Over 20 years of senior leadership and management in private industry and the public accounting environment. |

|

• |

Expertise in tax, finance and real estate, succession planning and business operations. |

|

• |

Member of audit, nominating and compensation committees of various company boards. |

GLENN M. ALGER

Glenn M. Alger became a Director in May 2017. He is one of the founders of Expeditors and served in various management and senior executive positions over a 25-year period, culminating as President and Chief Operating Officer from September 1999 to May 2007. Prior roles included leading business and operational development in the Americas region and management and evolution of the Company's global products and services. Since his retirement from the Company in 2007, Mr. Alger has been principally engaged as an active investor and manager of his family trust and charitable activities. He is credentialed as a National Association of Corporate Directors (NACD) Governance Fellow. In 2015 and 2016, Mr. Alger provided consulting services to the Company. As a founder, former senior executive of the Company and a long-term shareholder, Mr. Alger brings a deep understanding of both Company operations specifically and the logistics industry generally.

Specific Qualifications, Attributes, Skills & Experience

|

• |

More than 30 years of entrepreneurial, business development, management and senior leadership in global logistics. |

|

• |

Direct experience building a business from a startup to a global industry leader. |

|

• |

Industry expertise in customer markets, strategy, competition, organization, technology and finance. |

|

• |

Over 20 years of governance and oversight experience as a senior executive of a public company. |

Notice of Annual Meeting & Proxy Statement | 5

ROBERT P. CARLILE

Robert “Bob” Carlile became a director in May 2019. Prior to that, he was a Partner at KPMG LLP from 2002 to 2016, and Partner at Arthur Andersen LLP from 1987 to 2002. During his 39-year career in public accounting, Mr. Carlile served as the lead audit partner on numerous public company engagements operating across different industries including technology, retail, transportation, bio-science, and manufacturing. In addition to his experience as a lead audit partner, Mr. Carlile held a variety of operating leadership positions at KPMG and Arthur Andersen in the Pacific Northwest. Since 2017, Mr. Carlile has served on the Board of Directors of publicly traded MicroVision Inc, where he is the Audit Committee Chair. Mr. Carlile also serves on the Board of Directors of Virginia Mason Franciscan Health and was past Chairman of the Northwest Chapter Board of the National Association of Corporate Directors (NACD). He is credentialed as a NACD Board Leadership Fellow.

Specific Qualifications, Attributes, Skills & Experience

|

• |

More than 30 years of senior leadership and management experience. |

|

• |

Extensive audit and accounting experience. |

|

• |

Served as Lead Audit Partner on many global publicly traded companies. |

|

• |

Experienced in corporate board governance and engages in continuous education on leading governance practices. |

JAMES M. DuBOIS

James “Jim” DuBois became a Director in May 2016. He was Corporate Vice President and Chief Information Officer (CIO) at Microsoft Corporation from 2014 to 2017. As CIO, he was responsible for the company’s global security, infrastructure, collaboration systems, and business applications. Mr. DuBois was appointed CIO in January 2014 after serving as interim CIO since May 2013. Mr. DuBois served in various other roles at Microsoft, mostly in IT, after joining the company in 1993. These roles include leading IT and product teams for application development, infrastructure and service management. He also served as Microsoft’s Chief Information Security Officer and spent several years working from Asia and then Europe, learning the Microsoft field business while running the respective regional IT teams. He has degrees in computer science and business (accounting). Since leaving Microsoft in September 2017, Mr. DuBois has authored a book on modern IT and currently speaks on this topic and also serves on the technical advisory boards of several startups, private companies, and venture capital partnerships.

Specific Qualifications, Attributes, Skills & Experience

|

• |

Extensive information technology experience. |

|

• |

Experience overseeing investments in technology to support business objectives. |

|

• |

Expertise in cybersecurity. |

|

• |

Experience leading global IT teams. |

MARK A. EMMERT

Mark A. Emmert became a Director in May 2008. Since 2010, he has been President of the National Collegiate Athletic Association. From 2004 to 2010, Dr. Emmert served as the President of the University of Washington (UW), a $5 billion per year organization with more than 30,000 employees, and is now President Emeritus. Prior to the UW, he was chancellor of Louisiana State University. He also served as the chancellor of the University of Connecticut and held administrative and academic positions at the University of Colorado and Montana State University. Dr. Emmert is a Life Member of the Council on Foreign Relations, a Fellow of the National Academy for Public Administration, and a former Fulbright Fellow. Dr. Emmert is currently on the Board of Directors of the Weyerhaeuser Company.

Specific Qualifications, Attributes, Skills & Experience

|

• |

30 years of experience in executive leadership and administration of educational, healthcare and athletics enterprises. |

|

• |

Expertise in public policy, governmental affairs, and personnel development programs. |

|

• |

Expertise in the leadership and management of complex operations with rigid public oversight requirements. |

|

• |

Expertise in international affairs. |

|

• |

Extensive experience with governance of public and private organizations. |

6 | Expeditors International of Washington, Inc.

DIANE H. GULYAS

Diane H. Gulyas became a Director in November 2015. Ms. Gulyas worked for DuPont from 1978 until her retirement as President of their $4 billion global Performance Polymers business in September of 2014. During her 36-year career at DuPont, Ms. Gulyas served also as Chief Marketing and Sales Officer, President of Electronic and Communication Technologies Platform, and President of the Advanced Fibers divisions. Ms. Gulyas’ qualifications to serve on the Company’s Board of Directors include over 35 years of senior leadership and global business expertise. Since 2006, Ms. Gulyas has served as a public company director and is currently on the Board of Directors of W.R. Grace & Company and Ingevity Corporation.

Specific Qualifications, Attributes, Skills & Experience

|

• |

More than 35 years of senior leadership and global business expertise. |

|

• |

Substantial and varied management experience and strong skills in engineering, manufacturing (domestic and international), marketing and sales and distribution. |

|

• |

Governance and oversight experience from service as a senior executive of a public company and prior service on a public company board. |

JEFFREY S. MUSSER

Jeffrey S. Musser became a Director in March 2014. He joined the Company in February 1983 and was promoted to District Manager in October 1989. Mr. Musser became Regional Vice President in September 1999, Senior Vice President-Chief Information Officer in January 2005 and Executive Vice President and Chief Information Officer in May 2009. Mr. Musser was appointed President and Chief Executive Officer in March 2014.

Specific Qualifications, Attributes, Skills & Experience

|

• |

Over 35 years of experience in the international transportation industry. |

|

• |

Many years of corporate leadership responsibilities. |

|

• |

Background in the information technology discipline. |

LIANE J. PELLETIER

Liane J. Pelletier became a Director of the Company in May 2013. Ms. Pelletier is the former Chairperson, Chief Executive Officer and President of Alaska Communications Systems, a telecommunication and information technology services provider, leading the firm from October 2003 to April 2011. From November 1986 to October 2003, Ms. Pelletier held a number of executive positions at Sprint Corporation, a telecommunications company. Ms. Pelletier is lead independent director and member of the Compensation Committee on the Board of Directors of ATN International, serves on the board of Frontdoor as member of the Audit and Compensation Committees, and serves on the board of Switch as member of the Nominating and Corporate Governance Committee. She is credentialed as a NACD Board Leadership Fellow and has earned the certificate in Cybersecurity Oversight from Carnegie Mellon's Software Engineering Institute.

Specific Qualifications, Attributes, Skills & Experience

|

• |

Experience as a public company CEO and more than 25 years of senior leadership and management experience in the telecommunications industry. |

|

• |

Past and current positions as chair, lead independent Director, and member of audit, risk, nominating and compensation committees of various company boards. |

|

• |

Experienced in corporate board governance and engages in continuous education on information technology and security as well as leading governance practices. |

|

• |

Corporate career and board service spans firms where there is material focus on regulation, information technology and security, foreign operations and customer service. |

Notice of Annual Meeting & Proxy Statement | 7

Summary of Director Experience, Qualifications, Attributes & Skills

|

|

|

|

|

|

|

|

|

|

|

INDEPENDENT DIRECTORS |

NON |

|

INDEPENDENT |

|

DIRECTORS |

|

Summary of Director |

Wright |

Carlile |

DuBois |

Emmert |

Gulyas |

Pelletier |

Alger |

Musser |

|

Experience, Qualifications, |

|

Attributions & Skills |

|

Operations |

● |

● |

● |

● |

● |

● |

● |

● |

|

Logistics Industry |

|

|

|

|

● |

|

● |

● |

|

International |

|

|

● |

● |

● |

|

● |

● |

|

Financial |

● |

● |

|

● |

● |

● |

● |

● |

|

Sales & Marketing |

|

|

|

|

● |

● |

● |

● |

|

Information Technology |

|

|

● |

|

|

● |

|

● |

|

Leadership & Strategy |

● |

● |

● |

● |

● |

● |

● |

● |

|

Governance/Business |

● |

● |

● |

● |

● |

● |

● |

● |

|

Conduct/Legal |

|

|

|

|

|

|

|

|

|

|

|

Additional Information |

|

|

|

|

|

|

|

|

|

Age |

61 |

65 |

57 |

68 |

64 |

63 |

64 |

55 |

|

Tenure |

12 |

2 |

5 |

12 |

5 |

8 |

4 |

7 |

|

Other Public Company Boards |

— |

1 |

— |

1 |

2 |

3 |

0 |

0 |

The Board of Directors unanimously recommends a vote FOR the election of each of the Director Nominees

|

|

|

|

✓ |

|

The Board of Directors recommends a vote FOR the election of each of the Director Nominees. |

8 | Expeditors International of Washington, Inc.

CORPORATE GOVERNANCE

Board Operations

The Board of Directors has policies and procedures to ensure effective operations and governance. Our corporate governance materials, including our Corporate Governance Principles, the Charters of each of the Board’s Committees and our Code of Business Conduct, can be found on our website at https://investor.expeditors.com/corporate-governance/governance-documents. In 2020, the Board was composed of six independent Directors and two non-independent Directors. Mr. Wright serves as the independent Chair of the Board of Directors. The primary functions of Expeditors’ Board of Directors include:

|

|

• |

Ensuring that the long-term interests of the Company are being served; |

|

|

• |

Assuring that Board discussions focus on forward-looking strategies, approving such strategies and monitoring related performance; |

|

|

• |

Overseeing the conduct of our business and monitoring significant enterprise risks; |

|

|

• |

Overseeing our processes for maintaining the integrity of our financial statements and other public disclosures, and compliance with laws and ethical conduct; |

|

|

• |

Evaluating CEO and senior management performance and determining executive compensation; |

|

|

• |

Planning CEO succession and monitoring management’s succession planning for other key executive officers; taking into consideration the diverse experiences, qualifications, and perspectives each potential succession candidate can bring to the Company including gender, race, and ethnicity; |

|

|

• |

Establishing tone at the top, effective governance structure, including appropriate Board evaluation, composition and planning for Board succession; and |

|

|

• |

Ensuring the Company's commitment to maintain proper sustainability/Environmental, Social and Governance (ESG) standards. |

The Board of Directors has determined that all current Directors except Messrs. Musser and Alger are independent under the applicable independence standards set forth in the rules promulgated under the Securities Exchange Act of 1934, as amended (Exchange Act) and the rules of the NASDAQ Stock Market. The Board has designated that only independent Directors can serve as Committee members.

The Board currently has the following Committees: Nominating and Corporate Governance, Compensation, and Audit. Each Committee operates under a written charter, all of which are available on our website https://investor.expeditors.com/corporate-governance/governance-documents.

Board Practices & Procedures

|

|

• |

The Board’s Committees analyze and review the Company’s activities in key areas such as financial reporting, internal controls over financial reporting; compliance with Company policies; corporate governance, social and environmental matters; significant risks; succession planning and executive compensation. |

|

|

• |

The Board and its Committee Chairs review the agendas and matters to be considered in advance of each meeting. Each Board and Committee member is free to raise matters that are not on the agenda at any meeting and to suggest items for inclusion on future agendas. |

|

|

• |

Each Director is provided in advance with materials to be considered at every meeting of the Board and Committees and has the opportunity to provide comments and suggestions. |

|

|

• |

The Board and its Committees provide feedback to management and management answers questions raised by the Directors during Board and Committee meetings. |

|

|

• |

Independent Board and Committee members meet separately at each Board and Committee meeting and as otherwise needed. |

|

|

• |

Independent Directors regularly hold executive sessions without management. |

Notice of Annual Meeting & Proxy Statement | 9

Board Attendance

The Board met six times in 2020 and each Director attended at least 75% of the total number of Board of Directors meetings and Committee meetings on which they served. While the Company has no established policy requiring Directors to attend the Annual Meeting, all members attended the 2020 Annual Meeting.

Director Retirement Policy

The Board established a guideline, whereby an individual Director will not be nominated to stand for election to the Board of Directors at the next Annual Meeting if the Director has reached an age of 72 years, absent a waiver of such guideline by the Board.

Board’s Role in Risk Oversight

Senior executive management is responsible for the assessment and day-to-day management of risk and brings to the attention of the Board the material risks to the Company. The Board provides oversight and guidance to management regarding material enterprise risks. Oversight responsibilities for certain areas of risk are assigned to the Board's three standing Committees and others are assigned to the full Board. The Board and its Committees regularly discuss with management the Company’s strategies, operations, compliance, policies and inherent associated risks in order to assess appropriate levels of risk taking and steps taken to monitor, mitigate and control such exposures. The Board believes the Company’s risk management processes are appropriate and that the active oversight role played by the Board and its Committees provides the right level of oversight for the Company.

SEC Filings & Reports

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports, are available free of charge on our website at https://investor.expeditors.com under the heading “Investor Relations” (see SEC Filings) immediately after they are filed with or furnished to the SEC.

10 | Expeditors International of Washington, Inc.

Director Compensation Program

The Board uses a combination of cash and stock-based compensation to attract and retain qualified non-employee candidates to serve on the Board. In setting Director compensation, the Compensation Committee considers the amount of time that Directors expend in fulfilling their duties, as well as the skill level required as members of the Board and its Committees.

Board of Directors' Annual Compensation & Stock Ownership Requirements

|

|

|

Board Retainer |

$90,000 in cash and $200,000 worth of Company restricted stock. |

|

Chair Retainers |

An additional $175,000 retainer for the Chair of the Board.

An additional $25,000 retainer for the Chair of the Audit Committee.

An additional $20,000 retainer for the Chair of each of the Compensation Committee and the Nominating and Corporate Governance Committee. |

|

Stock Ownership Policy |

Each Director is required to retain a minimum of 5x the cash Board retainer in Expeditors’ Common Stock, which is to be accumulated within the first 5 years of a Director joining the Board. |

Director Compensation Table

The table below summarizes the compensation paid by the Company to non-employee Directors for the fiscal year ended December 31, 2020:

|

Name |

Fees Earned

or Paid in

Cash |

Stock

Awards (1) |

Option

Awards |

Non-Equity

Incentive Plan

Compensation |

All Other

Compensation |

Total |

|

Robert R. Wright |

$265,000 |

$199,965 |

— |

— |

— |

$464,965 |

|

Glenn M. Alger |

$90,000 |

$199,965 |

— |

— |

— |

$289,965 |

|

Robert P. Carlile |

$115,000 |

$199,965 |

— |

— |

— |

$314,965 |

|

James M. DuBois |

$90,000 |

$199,965 |

— |

— |

— |

$289,965 |

|

Mark A. Emmert |

$110,000 |

$199,965 |

— |

— |

— |

$309,965 |

|

Diane H. Gulyas |

$90,000 |

$199,965 |

— |

— |

— |

$289,965 |

|

Liane J. Pelletier |

$110,000 |

$199,965 |

— |

— |

— |

$309,965 |

|

(1) |

This column represents the aggregate fair value of restricted shares issued to non-employee Directors in 2020 from the Amended and Restated 2017 Omnibus Incentive Plan (the “Amended 2017 Plan”). The fair value of restricted stock awards is based on the fair market value of the Company’s shares of Common Stock on the date of award. These restricted shares vested immediately upon award. |

Notice of Annual Meeting & Proxy Statement | 11

SHAREHOLDER ENGAGEMENT & STOCK OWNERSHIP INFORMATION

Shareholder Engagement

We seek our shareholders’ views on environmental, social, and governance (ESG) and compensation matters throughout the year. Management provides regular updates concerning shareholder feedback to the Board, which considers shareholder perspectives along with the interests of all stakeholders when overseeing company strategy, formulating governance practices, and designing compensation programs.

In 2020, we engaged with shareholders representing approximately 50% of our shares outstanding to discuss matters related to our strategies, compensation programs, ESG and/or operations.

Management welcomes the opportunity to engage with our investors who express a desire to visit our corporate offices during the period after quarterly earnings releases when we are not in a quiet period. However, given the COVID-19 pandemic, these visits will be scheduled only once it is safe to do so given the current social distancing requirements in place.

Shareholder Feedback: Enhanced ESG Disclosure

We have always taken sustainability seriously and published our first public sustainability report in 2017, highlighting our commitments and progress across the ESG spectrum. We continue to enhance our disclosure on ESG matters while monitoring developments in ESG reporting. In response to shareholder feedback, we have mapped and linked our many disclosures on a range of environmental, social, and governance topics to metrics outlined by the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD) voluntary disclosure frameworks. Further details are included in the Nominating and Corporate Governance Committee Report in this proxy filing. Additional information about our programs to sustain a healthy environment and programs to reduce greenhouse gas emissions, as well as our approach social responsibility and sound governance – ESG – can be found in our in our latest ESG report, which is updated annually: www.expeditors.com/sustainability.

Communicating with the Board of Directors

Shareholders may communicate with the Board of Directors and the procedures for doing so are located on the Company’s website at https://investor.expeditors.com. Any matter intended for the Board of Directors, or for one or more individual members, should be directed to the Corporate Secretary of the Company at 1015 Third Avenue, Seattle, Washington 98104, with a request to forward the same to the intended recipient(s). All shareholder communications delivered to the Corporate Secretary of the Company for forwarding to the Board of Directors or specified members will be forwarded in accordance with the instructions received.

Information regarding the submission of comments or complaints relating to the Company’s accounting, internal accounting controls or auditing matters can be found in the Company’s Code of Business Conduct on the Company’s website at https://investor.expeditors.com.

Information Requests

We ask that all requests for corporate information concerning Expeditors’ operations be submitted in writing. This policy applies equally to securities analysts and current and potential shareholders. Requests can be made to Expeditors International of Washington, Inc., 1015 Third Avenue, Seattle, Washington 98104, Attention: Chief Financial Officer, or by email to investor@expeditors.com.

Written responses to selected inquiries will be released to the public by a posting on our website at https://investor.expeditors.com and by simultaneous filing with the Securities and Exchange Commission (SEC) under Item 7.01 on Form 8-K.

Fair Disclosure

Any other analyst or investor contact, whether by telephone or in person, will be conducted with the understanding that questions directed at ongoing operations will not be discussed. Management will limit responses to discussions of previously disclosed information, including informational discussions directed to the history and operating philosophy of the Company and an understanding of the global logistics industry and its competitive environment. Expeditors will, of course, make public disclosures at other times as required by law, regulation or commercial necessity.

12 | Expeditors International of Washington, Inc.

Five Percent Owners of Company Stock

The following table sets forth information, as of December 31, 2020, with respect to all shareholders known by the Company to be beneficial owners of more than 5% of its outstanding Common Stock. Except as noted below, each entity has sole voting and dispositive powers with respect to the shares shown.

|

Name & Complete Mailing Address |

Number of Shares |

|

|

Percent of Common Stock Outstanding |

|

|

The Vanguard Group

100 Vanguard Boulevard, Malvern, PA 19355 |

|

20,058,362 |

|

(1) |

|

11.85 |

% |

|

BlackRock, Inc.

55 East 52nd Street, New York, NY 10055 |

|

17,220,162 |

|

(2) |

|

10.20 |

% |

|

Loomis Sayles & Co., L.P.

One Financial Center, Boston, MA 02111 |

|

14,472,190 |

|

(3) |

|

8.55 |

% |

|

State Street Corporation

State Street Financial Center

One Lincoln Street, Boston, MA 02111 |

|

8,855,158 |

|

(4) |

|

5.23 |

% |

|

(1) |

The holding shown is as of December 31, 2020, according to Schedule 13G/A dated February 8, 2021 filed by The Vanguard Group, an investment adviser. With respect to Expeditors' Common Stock, The Vanguard Group reports that it has the following: sole voting power over 0 shares; shared voting power over 298,174 shares; sole dispositive power over 19,297,822 shares; and shared dispositive power over 760,540 shares. |

|

(2) |

The holding shown is as of December 31, 2020, according to Schedule 13G/A dated January 8, 2021 filed by BlackRock, Inc., a parent holding company. With respect to Expeditors' Common Stock, BlackRock reports that it has the following: sole voting power over 14,717,118 shares; and shared voting power over 0 shares. |

|

(3) |

The holding shown is as of December 31, 2020, according to Schedule 13G/A dated February 12, 2021 filed by Loomis Sayles & Co., L.P, an investment adviser. With respect to Expeditors' Common Stock, Loomis Sayles reports that it has the following: sole voting power over 11,805,769 shares; and shared voting power over 0 shares. |

|

(4) |

The holding shown is as of December 31, 2020, according to Schedule 13G dated February 9, 2021 filed by State Street Corporation. With respect to Expeditors' Common Stock, State Street Corporation reports that it has the following: sole voting power over 0 shares; shared voting power over 7,701,516 shares; sole dispositive power over 0 shares; and shared dispositive power over 8,841,250 shares. |

Notice of Annual Meeting & Proxy Statement | 13

Security Ownership of Directors & Executive Officers

The following table lists the names and the amount and nature of the beneficial ownership of Common Stock of each Director and nominee, of each of the NEO described in the Summary Compensation Table, and all Directors and Executive Officers as a group at March 9, 2021. Except as noted below, each person has sole voting and dispositive powers with respect to the shares shown.

|

DIRECTORS |

Amount & Nature of

Beneficial Ownership |

|

Percent of Class |

|

Robert R. Wright |

|

19,280 |

|

* |

|

Glenn M. Alger (1) |

|

517,838 |

|

* |

|

Robert P. Carlile |

|

5,451 |

|

* |

|

James M. Dubois |

|

16,141 |

|

* |

|

Mark A. Emmert |

|

15,390 |

|

* |

|

Diane H. Gulyas (2) |

|

16,141 |

|

* |

|

Jeffrey S. Musser (3) |

|

214,576 |

|

* |

|

Liane J. Pelletier |

|

29,882 |

|

* |

|

|

|

|

|

|

|

ADDITIONAL NAMED EXECUTIVES OFFICERS |

|

|

|

|

|

Eugene K. Alger (4) |

|

40,859 |

|

* |

|

Daniel R. Wall (5) |

|

58,646 |

|

* |

|

Richard H. Rostan (6) |

|

165,776 |

|

* |

|

Bradley S. Powell (7) |

|

20,830 |

|

* |

|

|

|

|

|

|

|

All Directors & Executive Officers as a Group (15 persons) (8) |

|

1,166,187 |

|

* |

|

(1) |

All shares are held in two trusts for which Mr. Alger and his family maintain voting and dispositive authority. |

|

(2) |

All shares are held in trust for which Ms. Gulyas maintains voting and dispositive authority. |

|

(3) |

Includes 112,513 shares held in trust for which Mr. Musser maintains voting and dispositive authority, 15,000 shares subject to exercisable stock options, 17,444 shares subject to RSU vesting within sixty days |

|

(4) |

Includes 18,657 shares held in trust for which Mr. Alger maintains voting and dispositive authority and 7,050 shares subject to RSU vesting within sixty days. |

|

(5) |

Includes and 7,050 shares subject to RSU vesting within sixty days. |

|

(6) |

Includes 95,000 shares subject to exercisable stock options and 6,240 shares subject to RSU vesting within sixty days. |

|

(7) |

Includes 7,050 shares subject to RSU vesting within sixty days. |

|

(8) |

Includes 111,250 shares subject to stock options exercisable within sixty days and 52,571 shares subject to RSU vesting within sixty days. No Director or Executive Officer has pledged Company stock. |

14 | Expeditors International of Washington, Inc.

NOMINATING & CORPORATE GOVERNANCE COMMITTEE REPORT

The Nominating and Corporate Governance Committee is committed to proven corporate governance policies and procedures designed to continuously improve the effectiveness of the Board and its Committees.

Nominating & Corporate Governance Committee

The committee charter is available at https://investor.expeditors.com

All members are independent under Exchange Act and NASDAQ rules.

Key Responsibilities:

|

|

• |

Determine the criteria for Board membership |

|

|

• |

Lead the search for qualified individuals to become Board members, taking into consideration various criteria including a candidate’s contribution to Board diversity including gender, race and ethnicity |

|

|

• |

Utilize the so-called “Rooney Rule” for CEO and Board candidates recruited from outside the Company so that any initial list of candidates include qualified female and racially/ethnically diverse individuals |

|

|

• |

Recommend the composition of the Board and its Committees |

|

|

• |

Monitor and evaluate changes in Board members’ professional status |

|

|

• |

Conduct evaluations of Board and Committee effectiveness |

|

|

• |

Maintain and advance a set of Corporate Governance Principles |

|

|

• |

Maintain the Company’s Code of Business Conduct and oversee its compliance |

|

|

• |

Assist in evaluating governance-related inquiries, commentary and proposals |

|

|

• |

Analyze current and emerging governance trends for impact on the Company |

|

|

• |

Oversee enterprise risks assigned to Committee by the Board |

|

|

• |

Monitor Directors' compliance with stock ownership guidelines |

|

|

• |

Oversee the Company's commitment to ESG programs |

2020 Committee Highlights

The Nominating and Corporate Governance Committee met four times in 2020.

|

|

• |

Continued to manage Board composition in alignment with the Board’s multi-year succession plan. The current Board slate’s average tenure is seven years and the average age is 63 years. |

|

|

• |

Consistent with the Board’s refreshment strategy, the Board rotated members of its Committees to increase exposure to the detailed matters addressed by each Committee, and to tap into the diverse insights of the Directors who change Committee membership. |

|

|

• |

Oversaw the Company's continuing evolution of its global Code of Business Conduct guidelines. |

|

|

• |

Oversaw the Company’s sustainability efforts and its updated Sustainability Report, disclosed online at www.expeditors.com/sustainability. |

|

|

• |

Reviewed and kept current the Company’s enterprise risk management program. |

|

|

• |

Refined Board operations in response to continuous Board and Committee evaluations. |

|

|

• |

Continued to invest in Board education, including Board sessions on the Company’s cybersecurity program and assuring compliance with SEC-related guidance. |

|

|

• |

Monitored and discussed current and emerging governance issues of interest to our stakeholders. |

Notice of Annual Meeting & Proxy Statement | 15

Corporate Governance Principles

The Committee operates according to the Board’s Governance Principles, available on our website at https://investor.expeditors.com, which includes:

|

|

• |

Commitment to the long term interests of all stakeholders |

|

|

• |

Annual election of all Directors |

|

|

• |

So-called “Rooney Rule” requirement that any initial list of CEO and Board candidates recruited from outside the Company will include qualified female and racially/ethnically diverse individuals |

|

|

• |

In a non-contested election, each Director must be elected by a majority of votes cast |

|

|

• |

Availability of proxy access for qualifying shareholder groups |

|

|

• |

Independent Board Chair |

|

|

• |

The majority of the Board is comprised of independent Directors |

|

|

• |

Each of the three Board Committees is composed of only independent Directors |

|

|

• |

Each Committee operates under a written charter that has been approved by the Board |

|

|

• |

Any Board action must be approved by a majority of the independent Directors |

|

|

• |

Each of the three Committees has the authority to retain independent advisors |

|

|

• |

The Board and each Committee annually evaluates its performance |

|

|

• |

No shareholder rights plan (poison pill) |

|

|

• |

No pledging, hedging or engaging in any derivatives trading of Company shares allowed by employees or Directors |

|

|

• |

No Company spending on political campaigns |

|

|

• |

Annual Director certification of compliance with the Code of Business Conduct, available at https://investor.expeditors.com |

|

|

• |

Director stock ownership requirements |

Considerations for Director Nominations

The Committee follows the board’s policy on director nominations, available on our website https://investor.expeditors.com, which features a number of criteria for nominations such as:

|

|

• |

Experience and accomplishments |

|

|

• |

Contribution to Board diversity in all aspects, including cognitive, gender, race and ethnicity |

16 | Expeditors International of Washington, Inc.

ESG OVERSIGHT: EXPEDITORS’ COMMITMENT TO SUSTAINABILITY

Expeditors has always been committed to the fundamental values of good environmental, social and governance (ESG) corporate citizenship since our Company’s inception. Indeed, this commitment is part of our business model and is reflected in the various long-standing mechanisms that we have put in place to promote the best interests of all Expeditors’ stakeholders – including our shareholders, employees, service providers, customers and communities. We are honored to be recently named as the highest ranked logistics company (and 14th overall) in the 2020 Best ESG Companies Top 50 list published by Investor’s Business Daily and receive a AAA rating (their highest rating) from MSCI, an investment research firm. We are proud of the fact that this achievement is a natural consequence of executing our core business strategy effectively and ethically. Our executive team is firmly committed to good ESG principles and we have well-established ESG employee committees, all undertaken with continuous oversight by our Board of Directors. We also work to provide meaningful disclosures on our various sustainability efforts, mapped against industry metrics relevant to our non-asset, knowledge-based business model.

Additional information about our programs to sustain a healthy environment and to reduce greenhouse gas emissions, as well as our approach to social responsibility and sound governance is set forth below and can also be found in our latest ESG report, which is updated annually: www.expeditors.com/sustainability.

THE ENVIRONMENT

Our Non-Asset Business Model Drives Supply Chain Sustainability

Freight consolidation is at the core of our business. It involves the combining of multiple different shipments in an efficient manner in order to maximize space utilization and, consequently, minimize the consumption of resources. Therefore, freight consolidation saves money for our customers while being measurably better for the environment by reducing unnecessary waste. In performing this important supply chain optimization role, Expeditors operates using a non-asset business model, meaning that we do not own or operate any airplanes, ships or trucks. This model affords several important advantages when it comes to the effective management of Greenhouse Gas (GHG) emissions, not least of which is our ability to accelerate transitions to more modern, fuel-efficient fleets as they become available in the market, thereby further improving overall supply chain sustainability for Expeditors and our customers.

Offering “Green Logistics Solutions” that Drive Efficiency

A key challenge in reducing GHG emissions in supply chains is providing an efficient system for demand to flow to “greener” assets. Our non-asset business model gives us maximum adaptability: as carriers invest in cleaner technologies, and our customers indicate a desire to route cargo via cleaner assets, we can direct our customers’ freight to the most optimal solutions. We are uniquely positioned to do so because we are an intermediary, operating at the orchestration level of the global supply chain. Therefore, we can switch to more efficient assets as soon as they come on line. We can also analyze customer supply chains and provide suggestions on sustainability best practices, including modal shifts, supply chain speed optimization, warehouse space optimization, freight consolidation, and data-based decision making.

Our Green Logistics Solutions service offers our customers multiple levels of insight into the environmental impact of their own supply chains. We can provide Carbon Footprint Summary Reports that illustrate emissions across a customer’s network, by transport mode, geography and business entity. Our Supply Chain Carbon Diagnostic service delivers a more detailed assessment of supply chain flows and carbon emissions, identifying opportunities and recommendations for emissions reductions. This information allows the customer to analyze their supply chain impact on a mode and lane basis, which in turn, can sharpen shipper demand to move cargo in ever more efficient ways.

Leading by Influence with Our Service Providers and Industry Outreach

We also encourage and help our business partners to adopt practices that lead to increased environmental sustainability. We fully support green freight initiatives such as the recent ocean industry adoption of low-sulfur measures for ships, and we work with our shippers to help them leverage the use of new technologies and solutions that promote a lighter carbon footprint. Specifically, we seek out partnerships with service providers that operate fuel-efficient fleets and use equipment supported by strong environmental programs. For example, we have participated in the U.S. Environmental Protection Agency’s SmartWay Transport Partnership program since 2008. Each year we work to increase the percentage of our service providers who are SmartWay members to measure and benchmark fuel use and freight emissions, with the goal of reducing carbon emissions across our customers’ supply chains. In

Notice of Annual Meeting & Proxy Statement | 17

addition, environmental criteria are part of our selection process for service providers, and our service provider contracts require compliance with environmental regulations.

We also work to advance sustainability in global supply chains through industry engagement, providing opportunities for dialog and thought leadership. Expeditors is actively involved in both the Clean Cargo Working Group and the Sustainable Air Freight Alliance, two groups working to bring together carriers, shippers and forwarders in a collaborative manner to reduce freight transportation’s environmental impact. Our Global Environmental Manager currently serves on the Steering Committee of the Clean Cargo Working Group.

Managing What We Control: Our Scope 1 & Scope 2 Emissions

In addition to supporting our customers’ GHG reduction efforts through supply chain efficiency, we are doing our part to reduce GHG emissions from the assets that we control directly. Our Green Teams worldwide track fuel and electricity usage across our office and warehouse facilities. We derive our Scope 1 emissions from fuel used in our operations, and our Scope 2 emissions from the electricity we consume in offices and warehouses. This data allows us to pinpoint locations in need of enhanced energy-saving programs, and the data are disclosed publicly in our annual Sustainability Report and our annual response to CDP (formerly the Carbon Disclosure Project). Our Green Teams continue to take action to reduce our environmental impact by significantly reducing paper usage, increasing the use of electric forklifts, installing more energy-efficient lighting, funding employee commuting via public transportation, and implementing recycling programs, among other initiatives.

Mapping to TCFD and SASB

We continually work to provide meaningful disclosure on our wide range of sustainability efforts taking place throughout our office and warehouse facilities around the world. We published our first public sustainability report in 2017, highlighting our many commitments and progress across the ESG spectrum. We continue to enhance our disclosure on ESG matters while monitoring developments in ESG reporting. Beginning with our 2020 sustainability report, we are mapping our disclosures on a range of ESG topics to selected metrics outlined by the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD) that are directly relevant to our non-asset, knowledge-based business model.

SOCIAL

Human Capital – Employees Are Our Most Important Asset

For more than 40 years, Expeditors has set the standard for excellence in global logistics by making our employees our key focus. Our founders believed that if we took care of our employees, they would take care of our customers.

This founding principle remains at the core of our philosophy on corporate citizenship today and is why the Expeditors’ Vision Statement is not primarily about logistics - it is about our people.

“To create unlimited opportunities for our people through sustainable growth and strategic focus, inspiring our premier customer-focused logistics organization.”

Our founders sought to create a different kind of company where people could do well for themselves – in other words, a place of “unlimited opportunities.” Case in point, our CEO, Jeff Musser, started his career with Expeditors as a part-time messenger while still in high school. After 30 years in a wide range of roles with the Company, he was appointed CEO in 2014. Mr. Musser’s tenure and career path of diverse experience and increasing levels of responsibility is common throughout our organization and embodies one of our corporate mottos: Hire for Attitude, Train for Skill. We believe that our culture, which fosters organic growth and promotion from within, is a competitive advantage that helps us attract and retain high-caliber talent. We are committed to developing our employees’ capabilities so that as they grow in knowledge and experience, their opportunities to service our customers and further their careers grow as well.

Creating and Maintaining a Positive Working Environment for All

We believe in creating and maintaining a positive work environment for all our employees. That commitment is supported by policies designed to promote fairness and equitable treatment. Our supervisors and managers are responsible for setting positive examples and providing mentoring with a focus on creating an inclusive environment where everyone can be successful. We firmly believe that we have an ethical and moral obligation to treat all employees fairly and equally across the globe without harassment, intimidation, or discrimination of any kind based

18 | Expeditors International of Washington, Inc.

on race, sex, sexual orientation, gender identity, gender expression, marital status, age, color, religion, creed, national origin, disability, veteran status, or any other characteristic protected under applicable law. Our Code of Business Conduct outlines our expectations regarding our labor standards and policies, which are designed to promote a fair, open and inclusive environment. We expect our service providers to live up to these same standards too. We also evaluate our ability to engage and retain employees by monitoring turnover rates and the percentage of positions filled internally, and by regularly conducting employee satisfaction surveys to identify opportunities where we can improve. We also post publicly all open positions to ensure that we are including the widest and most diverse pool of talent for consideration. We want to draw employees who are able to see Expeditors as a place of unlimited opportunity for them to achieve their own professional goals.

Workforce Diversity

Diversity and inclusion are part and parcel of our vision of unlimited opportunity for our employees. In 2020, our United States workforce was 45% women and 37% racially/ethnically diverse. Globally, our practice is to hire local employees in our offices so that our operations continue to reflect the diverse and vibrant communities we serve. We leverage regional and local expertise by staffing our districts principally with local managers and personnel who are from the regions in which they operate and who have extensive experience in logistics, coupled with a deep understanding of their local market. This results in a highly talented, inclusive and multi-cultural global workforce that we are extremely proud of. Because our business involves shipments between districts located all over the world and typically touches more than one geographic area, our success requires a high degree of communication and cooperation among our diverse workforce: 17,500 talented people of whom over 11,000 are employed in over 60 countries outside of the United States.

Upward Mobility

Expeditors has a long history of promoting from within and we consider upward mobility to be an important aspect of workforce diversity and inclusion. For instance, ten out of our top 23 global executives are women and/or are of a diverse background (race, ethnicity, or sexual orientation). Moreover, eight out of the last 11 promotions into Expeditors’ senior executive team (consisting of the top Senior Vice President roles or above) have been women and/or a person of a diverse background (race, ethnicity, or sexual orientation). All of these recently promoted individuals are very long tenured, with an average length of service with Expeditors of 24 years (ranging between 17 and 37 years). Our corporate culture enabled these employees to thrive and have long-term success at Expeditors, just as our founders envisioned.

To ensure that this continues, we also take gender, ethnicity, and racial diversity into consideration as part of our succession planning and this specifically forms part of our Board’s review of development and succession plans for our CEO and senior executives:

“The board views board director, CEO and key management selection succession as one of its most important responsibilities. The board shall develop and maintain a succession plan for directors and the CEO. The board will also regularly review CEO developmental plans for succession of key senior executives taking into consideration the diverse experiences, qualifications, and perspectives that each candidate can bring to the Company including gender, race, and ethnicity.” (Governance Principles, page 4).

We also adopted the so-called “Rooney Rule” for our CEO and Board of Director searches. Accordingly, we require any initial list of CEO and Board candidates recruited from outside the Company to include qualified female and racially/ethnically diverse individuals. Any search firms we engage will also be instructed to include the same on their initial lists of potential candidates that are furnished to us. These requirements are set forth in our Policy on Director Nominations and our Governance Principles and are publicly available on our website at https://investor.expeditors.com/corporate-governance/governance-documents.

Workforce Recruitment

Expeditors’ commitment to diversity and inclusion in the workforce is part of our workforce recruitment too. As part of our hiring efforts, we partner with DirectEmployers in the United States to ensure our organization is conducting recruiting outreach to minority and veterans groups. We also recognize that socio-economic disparities pose potential barriers to diversity and inclusion that often have a disproportionate impact on minority communities. To address this, in 2008 we established our Opportunity Knocks Program, which offers paid internships or student work-studies for youth from disadvantaged communities, many of whom have come to work for Expeditors full time once the program

Notice of Annual Meeting & Proxy Statement | 19

ends. Opportunity Knocks started in the United States and has since expanded to our operations in seven countries. Considered a “Best in Class” program, we created a toolkit called “Opportunity Knocks in a Box” so that other companies could replicate the Opportunity Knocks program in their organizations. Further information about Opportunity Knocks is available on our external website: https://web.expeditors.com/opportunity-knocks/ and in our Sustainability Report at www.expeditors.com/sustainability.

Promoting Safety, Security and Professional Development

We are committed to maintaining secure and safe working environments and business operations for our employees globally by following our well-established security, health and safety standards as well as applicable security, health and safety laws and regulations. We have robust mechanisms in place to report accidents, injuries and unsafe working conditions to our dedicated Health and Safety Team.

We also encourage personal growth of our workforce. Expeditors requires all employees to complete a series of compliance training courses annually and we encourage our employees to further take advantage of a host of other training opportunities housed within our Professional Development Center – an online global learning management system that is deployed across our network. Thanks to the efforts of our employees, the average hours of training per employee was 58 hours in 2020. We believe this commitment to the safety and professional development of our employees results in our low level of employee turnover, which substantially reduces our cost to recruit and train new hires. Additionally, long-tenured employees are able to provide strong bench strength as evidenced by the long tenure of our top managers: our CEO has been with the Company for 38 years and the average tenure of our other Named Executive Officers is 30 years.

Employee Protections During the COVID-19 Pandemic

When the COVID-19 pandemic hit the global economy in early 2020, Expeditors promptly announced a “no layoff” policy so that our people would all have certainty that their jobs and livelihoods would be safe. This response was in line with our response during the 2008-09 Global Financial Crisis, a period that witnessed a significant downturn in our industry. We also re-affirmed our commitment to honoring employee healthcare plans, matching 401(k) contributions, and continuing to extend our employee stock purchase plan (ESPP) to all Expeditors employees during the pandemic. These commitments allowed our employees to focus their attention on delivering solutions and excellent service to our customers during this unprecedented crisis.

Business Continuity During the COVID-19 Pandemic

Our Business Continuity Plan (BCP) provides a framework for both protecting the safety of our people and minimizing potential adverse impacts on our operations and our customers' businesses during times of crisis. We relied heavily on our BCP in responding to the ongoing COVID-19 pandemic. What began as a localized outbreak in Wuhan, China in late 2019 rapidly expanded into the single largest business continuity event Expeditors has experienced. In response, we promptly activated our global BCP in the first quarter of 2020 and are continuing to operate under this plan today.

Our plan includes measures to protect and safeguard the health of our employees and service providers, such as sanitization of our facilities, guidelines regarding protective equipment for employees, restricting travel, and requiring office staff to work remotely if they are able to. We continue to monitor the continuously evolving situation and adjust our actions, as needed, based on recommendations from governments and local and national health authorities. Subsequent to the first quarter of 2020, we deployed a global recovery plan regionally following local regulations. Our recovery plan is intended to allow office staff currently working remotely to gradually and safely move back into offices when health risks subside and governments around the world lift restrictions. Accordingly, our districts around the world are at different phases of the recovery plan depending on local conditions.

Giving Back to our Communities Where We Work and Live

Expeditors is also committed to making our communities better places to live and work. Our community support extends to local charities, children's programs, volunteerism, and grassroots projects in our communities around the world. For example, our regional leaders in India created the Avasar Foundation in 2012 to help underprivileged girls gain equal access to unlimited learning opportunities. To date, this program has awarded 141 scholarships to cover tuition, implemented programs for pre-primary school children and equipping more than 40 local schools with state-of-the-art computer labs all of which is funded by Expeditors, employees, friends and families.

20 | Expeditors International of Washington, Inc.

Additionally, even in a pandemic year that was hard on so many, we implemented a new online platform for our Matching Gift Campaign and saw employee involvement at our corporate headquarters increase by 85% over 2019. Total employee contributions were more than 50% higher in 2020 and approximately 200 more organizations were supported in our 2020 Matching Gift Campaign over the prior year. Additionally, Expeditors provides every employee in the United States a paid day off to volunteer at a charity of their choice. No matter where we have a presence, Expeditors encourages each of our employees to commit themselves to helping improve the lives of those in their communities.

GOVERNANCE

Good Governance Means Good Business