Current Report Filing (8-k)

February 25 2021 - 4:11PM

Edgar (US Regulatory)

Enstar Group LTD0001363829FALSED000013638292021-02-212021-02-210001363829us-gaap:CommonStockMember2021-02-212021-02-210001363829us-gaap:SeriesDPreferredStockMember2021-02-212021-02-210001363829us-gaap:SeriesEPreferredStockMember2021-02-212021-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 21, 2021

Enstar Group Limited

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bermuda

|

|

001-33289

|

|

N/A

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

P.O. Box HM 2267, Windsor Place 3rd Floor

22 Queen Street, Hamilton HM JX Bermuda N/A

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (441) 292-3645

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which Registered

|

|

Ordinary shares, par value $1.00 per share

|

ESGR

|

The NASDAQ Stock Market

|

LLC

|

|

Depositary Shares, Each Representing a 1/1,000th Interest in a 7.00% Fixed-to-Floating Rate

|

ESGRP

|

The NASDAQ Stock Market

|

LLC

|

|

Perpetual Non-Cumulative Preferred Share, Series D, Par Value $1.00 Per Share

|

|

|

|

|

Depositary Shares, Each Representing a 1/1,000th Interest

|

ESGRO

|

The NASDAQ Stock Market

|

LLC

|

|

in a 7.00% Perpetual Non-Cumulative Preferred Share, Series E, Par Value $1.00 Per Share

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On February 21, 2021, Enstar Group Limited ("Enstar") and its wholly owned subsidiary, Cavello Bay Reinsurance Limited ("Cavello Bay"), entered into a Termination and Release Agreement (the "Agreement") with InRe Fund, L.P. (“InRe Fund”), Hillhouse Capital Management, Ltd. and Hillhouse Capital Advisors, Ltd. (collectively, “Hillhouse”), AnglePoint Asset Management, Ltd. (“AnglePoint Cayman”), AnglePoint Asset Management Limited (“AnglePoint HK”), and InRe Fund GP, Ltd. (“InRe GP”) pursuant to which the parties have agreed to terminate certain relationships, primarily with respect to InRe Fund, and to work collaboratively to effectuate the smooth transition of these changes.

Cavello Bay is the principal limited partner in InRe Fund, which is a hedge fund managed by AnglePoint Cayman. AnglePoint Cayman currently receives sub-advisory services with respect to InRe Fund from AnglePoint HK. AnglePoint Cayman and AnglePoint HK are affiliates of Hillhouse. Investment funds managed by Hillhouse collectively own 9.4% of Enstar’s voting ordinary shares. These funds also own non-voting ordinary shares and warrants to purchase additional non-voting ordinary shares, which together with their voting ordinary shares, represent a 16.6% economic interest in Enstar. From February 2017 to February 2021, Jie Liu, a partner of AnglePoint HK, served on Enstar’s Board of Directors.

Pursuant to the Agreement, AnglePoint Cayman will cease to serve as InRe Fund's investment manager on or prior to April 1, 2021 in connection with either Enstar or its designee’s intended purchase of AnglePoint HK from affiliates of Hillhouse. As part of those transactions, AnglePoint Cayman will assign its investment management agreement with InRe Fund to AnglePoint HK. In connection with AnglePoint Cayman ceasing to serve as investment manager, affiliates of Hillhouse agreed to a deduction of $100.0 million from amounts due to them from the InRe Fund and to waive their right to receive any performance fees that could have been earned for 2021. The Agreement also includes mutual releases of certain liabilities and obligations between Enstar and its affiliates on the one hand and Hillhouse and its affiliates on the other hand.

* * *

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements regarding the intent, belief or current expectations of Enstar and its management team. Investors are cautioned that any such forward-looking statements speak only as of the date they are made, are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. In particular, the parties may not be able to complete the series of transactions and assignments related to the purchase of AnglePoint HK from affiliates of Hillhouse. Important risk factors regarding Enstar can be found under the heading "Risk Factors" in Enstar’s Form 10-K for the year ended December 31, 2019 and in Enstar’s Form 10-Q for the three and nine months ended September 30, 2020 and are incorporated herein by reference. Furthermore, Enstar undertakes no obligation to update any written or oral forward-looking statements or publicly announce any updates or revisions to any of the forward-looking statements contained herein, to reflect any change in its expectations with regard thereto or any change in events, conditions, circumstances or assumptions underlying such statements, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENSTAR GROUP LIMITED

|

|

|

|

|

|

|

February 25, 2021

|

|

By:

|

/s/ Paul J. O'Shea

|

|

|

|

|

Paul J. O'Shea

|

|

|

|

|

President

|

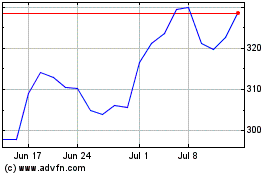

Enstar (NASDAQ:ESGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

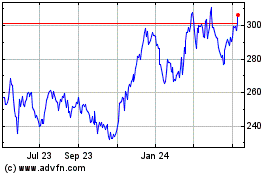

Enstar (NASDAQ:ESGR)

Historical Stock Chart

From Apr 2023 to Apr 2024