Ericsson Agrees to Pay $1 Billion in Bribe Case -- WSJ

December 07 2019 - 3:02AM

Dow Jones News

By Dave Michaels

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 7, 2019).

WASHINGTON -- Telecom-equipment maker Ericsson AB agreed to pay

more than $1 billion to settle U.S. allegations that it conspired

to make illegal payments to win business in five countries.

The settlement includes a $520 million criminal penalty and $540

million in illicit profits that must be disgorged, the U.S. Justice

Department said Friday. A subsidiary of the Swedish company,

Ericsson Egypt Ltd., pleaded guilty in Manhattan federal court to

conspiracy to violate antibribery laws.

Ericsson AB said Thursday that it expected a previously

announced provision of $1.2 billion would cover fines and other

costs related to the probe. An attorney for Ericsson declined to

comment.

Ericsson entered into a deferred-prosecution agreement with

prosecutors requiring it to retain a compliance monitor for three

years and to cooperate in related probes.

The Justice Department said Friday the wrongdoing occurred from

2000 to 2016 in Djibouti, China, Vietnam, Kuwait and Indonesia.

In a separate complaint, the Securities and Exchange Commission

said Ericsson subsidiaries won business worth about $427 million by

using third parties to bribe officials in Saudi Arabia, China and

Djibouti.

In Djibouti, about $2.1 million in bribes were paid to

high-ranking government officials to win a contract with a

state-owned telecommunications firm, prosecutors said. The payments

were facilitated through a sham contract with a consulting company

and the use of fake invoices, U.S. authorities said. Ericsson's

Egypt subsidiary oversaw the Djibouti operations.

In China, Ericsson's subsidiaries were responsible for tens of

millions of dollars paid to agents, consultants and service

providers, "a portion of which" was funneled to an account that

funded gifts, travel and entertainment for overseas officials,

prosecutors said.

"Ericsson's corrupt conduct involved high-level executives and

spanned 17 years and at least five countries, all in a misguided

effort to increase profits," said Assistant Attorney General Brian

Benczkowski.

Steve Peikin, the SEC's co-director of enforcement, said the

case represented an "egregious bribery scheme" that involved "slush

funds and funneling money through sham intermediaries."

The monetary sanctions are among the highest ever imposed by the

U.S. government for violations of the Foreign Corrupt Practices

Act. Last year, the Brazilian oil company Petrobras agreed to pay

more than $1.7 billion to resolve claims levied by the Justice

Department and the SEC, although much of that money went to

Brazilian authorities and investors who filed a class-action

lawsuit.

Write to Dave Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

December 07, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

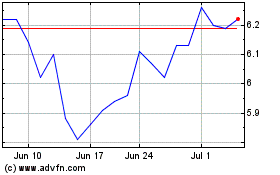

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

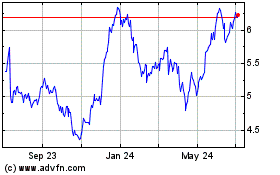

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024