Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 09 2020 - 6:02AM

Edgar (US Regulatory)

Issuer Free Writing Prospectus dated June 8, 2020

(Relating to Preliminary Prospectus Supplement dated June 8, 2020)

Filed Pursuant to Rule 433

Registration Statement No. 333-221380

Equinix, Inc.

This Final Term Sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement. The information in this Final Term Sheet supplements

the Preliminary Prospectus Supplement and supersedes the information in the Preliminary Prospectus Supplement to the extent inconsistent with the information in the Preliminary Prospectus Supplement. Capitalized terms used herein without definition

shall have the meanings ascribed thereto in the Preliminary Prospectus Supplement.

1.250% Senior Notes due 2025

|

|

|

|

|

Issuer:

|

|

Equinix, Inc. (“Equinix” or the “Issuer”)

|

|

|

|

|

Securities:

|

|

1.250% Senior Notes due 2025 (the “2025 notes”)

|

|

|

|

|

Principal Amount:

|

|

$500,000,000

|

|

|

|

|

Coupon (Interest Rate):

|

|

1.250% per annum

|

|

|

|

|

Yield to Maturity:

|

|

1.297%

|

|

|

|

|

Benchmark Treasury:

|

|

UST 0.250% due May 31, 2025

|

|

|

|

|

Benchmark Treasury Price and Yield:

|

|

99-01; 0.447%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+85 bps

|

|

|

|

|

Scheduled Maturity Date:

|

|

July 15, 2025

|

|

|

|

|

Public Offering Price:

|

|

99.770% plus accrued interest, if any, from June 22, 2020.

|

|

|

|

|

Net Proceeds to Issuer before Estimated Expenses:

|

|

$495,850,000

|

|

|

|

|

Interest Payment Dates:

|

|

January 15 and July 15 of each year, commencing on January 15, 2021.

|

|

|

|

|

Interest Record Dates:

|

|

January 1 and July 1 of each year.

|

|

|

|

|

|

|

|

|

Optional Redemption:

|

|

The Issuer may redeem at its election, at any time or from time to time, some or all of the 2025 notes before they mature. The redemption

price will equal the sum of (1) an amount equal to one hundred percent (100%) of the principal amount of the 2025 notes being redeemed plus accrued and unpaid interest up to, but not including, the redemption date (subject to the rights of Holders

of record on the relevant record date to receive interest due on the relevant interest payment date) and (2) a make-whole premium. Notwithstanding the foregoing, if the 2025 notes are redeemed on or after June 15, 2025 (one month prior to the

maturity date of the 2025 notes) (such date, the “2025 First Par Call Date”), the redemption price will not include a make-whole premium.

The Issuer will calculate the make-whole premium with respect to any 2025 notes redeemed before the 2025 First Par Call Date, as the excess, if any, of:

1. the aggregate present value as of the date of such redemption of each dollar of

principal being redeemed or paid and the amount of interest (exclusive of interest accrued to the date of redemption) that would have been payable in respect of such dollar if such redemption had been made on the 2025 First Par Call Date, in each

case determined by discounting, on a semiannual basis, such principal and interest at the 2025 Reinvestment Rate (determined on the third business day preceding the date such notice of redemption is given) from the respective dates on which such

principal and interest would have been payable if such redemption had been made on the 2025 First Par Call Date; over

2. the principal amount of such 2025 note.

|

|

|

|

|

|

|

“2025 Reinvestment Rate” means 15 basis points, plus the arithmetic mean (rounded to the nearest 1/100th of a percentage

point) of the yields for the immediately preceding full week published in the most recent Federal Reserve Statistical Release H.15 that has become publicly available prior to the date of determining the make-whole premium (or if such statistical

release is no longer published, any such other reasonably comparable index which shall be designated by the Issuer) most nearly equal to the 2025 First Par Call Date. If no maturity exactly corresponds to the 2025 First Par Call Date, the 2025

Reinvestment Rate will be obtained by linear interpolation (calculated to the nearest one-twelfth of a year) from the yields for the two published maturities most closely corresponding to such date (for the avoidance of doubt, with such

two published maturities being the published maturity occurring most closely before such date and the published maturity occurring most closely after such date).

Neither the Trustee nor any paying agent shall have any obligation to calculate or verify the calculation of the make-whole premium.

|

|

|

|

|

CUSIP:

|

|

29444U BF2

|

|

|

|

|

ISIN:

|

|

US29444UBF21

|

-2-

|

|

|

|

|

|

|

1.800% Senior Notes due 2027

|

|

|

|

|

Issuer:

|

|

Equinix, Inc. (“Equinix” or the “Issuer”)

|

|

|

|

|

Securities:

|

|

1.800% Senior Notes due 2027 (the “2027 notes”)

|

|

|

|

|

Principal Amount:

|

|

$500,000,000

|

|

|

|

|

Coupon (Interest Rate):

|

|

1.800% per annum

|

|

|

|

|

Yield to Maturity:

|

|

1.838%

|

|

|

|

|

Benchmark Treasury:

|

|

UST 0.500% due May 31, 2027

|

|

|

|

|

Benchmark Treasury Price and Yield:

|

|

98-23; 0.688%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+115 bps

|

|

|

|

|

Scheduled Maturity Date:

|

|

July 15, 2027

|

|

|

|

|

Public Offering Price:

|

|

99.749% plus accrued interest, if any, from June 22, 2020.

|

|

|

|

|

Net Proceeds to Issuer before Estimated Expenses:

|

|

$495,620,000

|

|

|

|

|

Interest Payment Dates:

|

|

January 15 and July 15 of each year, commencing on January 15, 2021.

|

|

|

|

|

Interest Record Dates:

|

|

January 1 and July 1 of each year.

|

|

|

|

|

Optional Redemption:

|

|

The Issuer may redeem at its election, at any time or from time to time, some or all of the 2027 notes before they mature. The redemption

price will equal the sum of (1) an amount equal to one hundred percent (100%) of the principal amount of the 2027 notes being redeemed plus accrued and unpaid interest up to, but not including, the redemption date (subject to the rights of Holders

of record on the relevant record date to receive interest due on the relevant interest payment date) and (2) a make-whole premium. Notwithstanding the foregoing, if the 2027 notes are redeemed on or after May 15, 2027 (two months prior to the

maturity date of the 2027 notes) (such date, the “2027 First Par Call Date”), the redemption price will not include a make-whole premium.

The Issuer will calculate the make-whole premium with respect to any 2027 notes redeemed before the 2027 First Par Call Date, as the excess, if any, of:

1. the aggregate present value as of the date of such redemption of each dollar of

principal being redeemed or paid and the amount of interest (exclusive of interest accrued to the date of redemption) that would have been payable in respect of such dollar if such redemption had been made on the 2027 First Par Call Date, in each

case determined by discounting, on a

|

-3-

|

|

|

|

|

|

|

|

|

|

semiannual basis, such principal and interest at the 2027 Reinvestment Rate (determined on the third business day preceding the date such

notice of redemption is given) from the respective dates on which such principal and interest would have been payable if such redemption had been made on the 2027 First Par Call Date; over

2. the principal amount of such 2027 note.

|

|

|

|

|

|

|

“2027 Reinvestment Rate” means 20 basis points, plus the arithmetic mean (rounded to the nearest 1/100th of a percentage

point) of the yields for the immediately preceding full week published in the most recent Federal Reserve Statistical Release H.15 that has become publicly available prior to the date of determining the make-whole premium (or if such statistical

release is no longer published, any such other reasonably comparable index which shall be designated by the Issuer) most nearly equal to the 2027 First Par Call Date. If no maturity exactly corresponds to the 2027 First Par Call Date, the 2027

Reinvestment Rate will be obtained by linear interpolation (calculated to the nearest one-twelfth of a year) from the yields for the two published maturities most closely corresponding to such date (for the avoidance of doubt, with such

two published maturities being the published maturity occurring most closely before such date and the published maturity occurring most closely after such date).

Neither the Trustee nor any paying agent shall have any obligation to calculate or verify the calculation of the make-whole premium.

|

|

|

|

|

CUSIP:

|

|

29444U BG0

|

|

|

|

|

ISIN:

|

|

US29444UBG04

|

|

|

|

2.150% Senior Notes due 2030

|

|

|

|

|

Issuer:

|

|

Equinix

|

|

|

|

|

Securities:

|

|

2.150% Senior Notes due 2030 (the “2030 notes”)

|

|

|

|

|

Principal Amount:

|

|

$1,100,000,000

|

|

|

|

|

Coupon (Interest Rate):

|

|

2.150% per annum

|

|

|

|

|

Yield to Maturity:

|

|

2.182%

|

|

|

|

|

Benchmark Treasury:

|

|

UST 0.625% due May 15, 2030

|

|

|

|

|

Benchmark Treasury Price and Yield:

|

|

97-18; 0.882%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+130 bps

|

-4-

|

|

|

|

|

|

|

|

Scheduled Maturity Date:

|

|

July 15, 2030

|

|

|

|

|

Public Offering Price:

|

|

99.711% plus accrued interest, if any, from June 22, 2020.

|

|

|

|

|

Net Proceeds to Issuer before Estimated Expenses:

|

|

$1,089,671,000

|

|

|

|

|

Interest Payment Dates:

|

|

January 15 and July 15 of each year, commencing on January 15, 2021.

|

|

|

|

|

Interest Record Dates:

|

|

January 1 and July 1 of each year.

|

|

|

|

|

Optional Redemption:

|

|

The Issuer may redeem at its election, at any time or from time to time, some or all of the 2030 notes before they mature. The redemption

price will equal the sum of (1) an amount equal to one hundred percent (100%) of the principal amount of the 2030 notes being redeemed plus accrued and unpaid interest up to, but not including, the redemption date (subject to the rights of Holders

of record on the relevant record date to receive interest due on the relevant interest payment date) and (2) a make-whole premium. Notwithstanding the foregoing, if the 2030 notes are redeemed on or after April 15, 2030 (three months prior to the

maturity date of the 2030 notes) (such date, the “2030 First Par Call Date”), the redemption price will not include a make-whole premium.

The Issuer will calculate the make-whole premium with respect to any 2030 notes redeemed before the 2030 First Par Call Date, as the excess, if any, of:

1. the aggregate present value as of the date of such redemption of each dollar of

principal being redeemed or paid and the amount of interest (exclusive of interest accrued to the date of redemption) that would have been payable in respect of such dollar if such redemption had been made on the 2030 First Par Call Date, in each

case determined by discounting, on a semiannual basis, such principal and interest at the 2030 Reinvestment Rate (determined on the third business day preceding the date such notice of redemption is given) from the respective dates on which such

principal and interest would have been payable if such redemption had been made on the 2030 First Par Call Date; over

2. the principal amount of such 2030 note.

|

|

|

|

|

|

|

“2030 Reinvestment Rate” means 20 basis points, plus the arithmetic mean (rounded to the nearest 1/100th of a percentage point) of the yields for the immediately preceding full week published in the most recent

Federal Reserve Statistical Release H.15 that has become publicly available prior to the date of determining the make-whole premium (or if such statistical release is no longer published, any such other reasonably comparable index which shall be

designated by the Issuer) most nearly equal to the 2030 First Par Call Date. If no maturity exactly corresponds to the 2030 First Par Call Date, the 2030 Reinvestment Rate will be obtained by linear interpolation (calculated to the

nearest one-twelfth of a year) from the yields for the two published maturities most closely corresponding to such date (for the avoidance of doubt, with such two published maturities being the published maturity occurring most closely

before such date and the published maturity occurring most closely after such date).

|

-5-

|

|

|

|

|

|

|

|

|

|

Neither the Trustee nor any paying agent shall have any obligation to calculate or verify the calculation of the make-whole premium.

|

|

|

|

|

CUSIP:

|

|

29444U BH8

|

|

|

|

|

ISIN:

|

|

US29444UBH86

|

|

|

|

3.000% Senior Notes due 2050

|

|

|

|

|

Issuer:

|

|

Equinix

|

|

|

|

|

Securities:

|

|

3.000% Senior Notes due 2050 (the “2050 notes” and, together with the 2025 notes, the 2027 notes and the 2030 notes, the “notes”)

|

|

|

|

|

Principal Amount:

|

|

$500,000,000

|

|

|

|

|

Coupon (Interest Rate):

|

|

3.000% per annum

|

|

|

|

|

Yield to Maturity:

|

|

3.089%

|

|

|

|

|

Benchmark Treasury:

|

|

UST 2.000% due February 15, 2050

|

|

|

|

|

Benchmark Treasury Price and Yield:

|

|

108-15; 1.639%

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

+145 bps

|

|

|

|

|

Scheduled Maturity Date:

|

|

July 15, 2050

|

|

|

|

|

Public Offering Price:

|

|

98.264% plus accrued interest, if any, from June 22, 2020.

|

|

|

|

|

Net Proceeds to Issuer before Estimated Expenses:

|

|

$486,945,000

|

|

|

|

|

Interest Payment Dates:

|

|

January 15 and July 15 of each year, commencing on January 15, 2021.

|

|

|

|

|

Interest Record Dates:

|

|

January 1 and July 1 of each year.

|

|

|

|

|

Optional Redemption:

|

|

The Issuer may redeem at its election, at any time or from time to time, some or all of the 2050 notes before they mature. The redemption price will equal the sum of (1) an amount equal to one hundred percent (100%) of the principal

amount of the 2050 notes being redeemed plus accrued and unpaid interest up to, but not including, the redemption date (subject to the rights of Holders of record on the relevant record date to receive interest due on the relevant interest payment

date) and (2) a make-whole premium. Notwithstanding the foregoing, if the 2050 notes are redeemed on or after January 15, 2050 (six months prior to the maturity date of the 2050 notes) (such date, the “2050 First Par Call

Date”), the redemption price will not include a make-whole premium.

|

-6-

|

|

|

|

|

|

|

|

|

|

The Issuer will calculate the make-whole premium with respect to any 2050 notes redeemed before the 2050 First Par Call Date, as the excess,

if any, of:

1. the aggregate present value as of the date of such redemption of each

dollar of principal being redeemed or paid and the amount of interest (exclusive of interest accrued to the date of redemption) that would have been payable in respect of such dollar if such redemption had been made on the 2050 First Par Call Date,

in each case determined by discounting, on a semiannual basis, such principal and interest at the 2050 Reinvestment Rate (determined on the third business day preceding the date such notice of redemption is given) from the respective dates on which

such principal and interest would have been payable if such redemption had been made on the 2050 First Par Call Date; over

2. the principal amount of such 2050 note.

|

|

|

|

|

|

|

“2050 Reinvestment Rate” means 25 basis points, plus the arithmetic mean (rounded to the nearest 1/100th of a percentage

point) of the yields for the immediately preceding full week published in the most recent Federal Reserve Statistical Release H.15 that has become publicly available prior to the date of determining the make-whole premium (or if such statistical

release is no longer published, any such other reasonably comparable index which shall be designated by the Issuer) most nearly equal to the 2050 First Par Call Date. If no maturity exactly corresponds to the 2050 First Par Call Date, the 2050

Reinvestment Rate will be obtained by linear interpolation (calculated to the nearest one-twelfth of a year) from the yields for the two published maturities most closely corresponding to such date (for the avoidance of doubt, with such

two published maturities being the published maturity occurring most closely before such date and the published maturity occurring most closely after such date).

Neither the Trustee nor any paying agent shall have any obligation to calculate or verify the calculation of the make-whole premium.

|

|

|

|

|

CUSIP:

|

|

29444U BJ4

|

|

|

|

|

ISIN:

|

|

US29444UBJ43

|

|

|

|

|

All Notes

|

|

|

|

|

|

|

Distribution:

|

|

SEC Registered (Registration No. 333-221380)

|

|

|

|

|

Listing:

|

|

None

|

|

|

|

|

Trade Date:

|

|

June 8, 2020

|

-7-

|

|

|

|

|

|

|

|

Settlement Date:

|

|

It is expected that delivery of the notes will be made against payment therefor on or about June 22, 2020, which is the tenth business day following the date of pricing of the notes (such settlement cycle being referred to as

“T+10”). Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days unless the parties to any such trade expressly agree otherwise.

Accordingly, purchasers who wish to trade the notes on the date of pricing or the next succeeding seven business days will be required, by virtue of the fact that the notes initially will settle in T+10, to specify an alternative settlement cycle at

the time of any such trade to prevent failed settlement and should consult their own advisors.

|

|

|

|

|

Use of Proceeds:

|

|

As set forth in the Preliminary Prospectus Supplement.

|

|

|

|

|

Joint Book-Running Managers:

|

|

BofA Securities, Inc.

Goldman Sachs & Co. LLC

J.P. Morgan Securities

LLC

|

|

|

|

|

Bookrunners:

|

|

Citigroup Global Markets Inc.

RBC Capital

Markets, LLC

MUFG Securities Americas Inc.

SMBC Nikko

Securities America, Inc.

TD Securities (USA) LLC

HSBC

Securities (USA) Inc.

ING Financial Markets LLC

Mizuho

Securities USA LLC

Morgan Stanley & Co. LLC

Barclays

Capital Inc.

BNP Paribas Securities Corp.

Wells Fargo

Securities, LLC

|

|

|

|

|

Co-Managers:

|

|

Deutsche Bank Securities Inc.

PNC Capital

Markets LLC

Scotia Capital (USA) Inc.

U.S. Bancorp

Investments, Inc.

|

The Issuer has filed a registration statement (including a prospectus) and a preliminary prospectus supplement with the SEC

for the offering to which this communication relates. Before you invest, you should read the preliminary prospectus supplement and the accompanying prospectus and other documents the Issuer has filed with the SEC for more complete information about

the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, copies of the preliminary prospectus supplement and accompanying prospectus and, when available, the final

prospectus supplement relating to this offering may be obtained from BofA Securities, Inc. at (800) 294-1322 (toll-free) or dg.prospectus_requests@bofa.com, Goldman Sachs & Co. LLC at (866) 471-2526 (toll free) or J.P. Morgan

Securities LLC at (212) 834-4533 (collect).

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION

AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

-8-

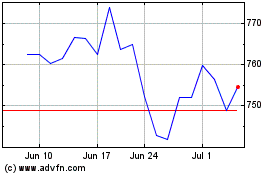

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

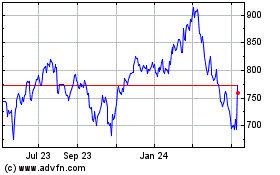

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Apr 2023 to Apr 2024