Current Report Filing (8-k)

October 09 2019 - 6:11AM

Edgar (US Regulatory)

0001101239

false

0001101239

2019-10-07

2019-10-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): October 8, 2019

EQUINIX, INC.

(Exact Name of Registrant as Specified

in Charter)

|

Delaware

|

|

000-31293

|

|

77-0487526

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

One Lagoon Drive

|

|

Redwood City, CA 94065

|

|

(Address of Principal Executive Offices, and Zip Code)

|

|

|

|

(650) 598-6000

|

|

Registrant’s Telephone Number, Including Area Code

|

|

|

|

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

|

¨

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001

|

EQIX

|

The NASDAQ Stock Market LLC

|

Item 7.01. Regulation

FD Disclosure

On October 9, 2019, Equinix,

Inc. ("Equinix") issued a press release that includes, among other matters, information related to the Joint Venture,

as defined and described in Item 8.01 below and incorporated into this Item 7.01 by reference. A copy of the press release is furnished

as Exhibit 99.1 and is incorporated into this Item 7.01 by reference.

The information in this

Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the

liabilities of that section and shall not be incorporated by reference into any registration statement or other document pursuant

to the Securities Act of 1933, as amended, except as otherwise stated in such filings.

Item 8.01 Other Events

On October 8, 2019, Equinix

and GIC, Singapore’s sovereign wealth fund (“GIC”), closed their initial

joint venture (the "Joint Venture"). Upon closing, the Joint Venture acquired certain data center facilities in Europe,

with the opportunity to add additional facilities to the Joint Venture in the future.

Pursuant to the terms

of the Joint Venture, the facilities have been acquired and are held by wholly-owned subsidiaries of EMEA Hyperscale 1 C.V., a

Dutch limited partnership of which Equinix owns a 20% interest and GIC owns an 80% interest.

The initial six facilities

which are intended to comprise the Joint Venture will be located in Amsterdam, Frankfurt (two sites), London (two sites) and Paris.

Equinix will provide a number of services to the Joint Venture, and each of the data centers will be managed and operated by Equinix.

The services will include the sales and marketing of the data centers, managing the development of the data centers (and any expansions

to those data centers), facilities management of the data centers, and management and coordination of the Joint Venture.

Concurrent with the closing, the Joint Venture closed on €850

million of secured credit facilities, consisting of a €200 million secured

term loan facility that was drawn at closing and used to fund a portion of the consideration paid to Equinix for the sale to the

Joint Venture of the LD10- of which Equinix is leasing back a portion- and PA8 IBX data centers, a €610

million secured delayed draw term loan facility that will be used to fund a portion of the planned development and construction

costs for the new xScale data centers in Amsterdam, Frankfurt and London, and a €40

million secured revolving credit facility that will be used to fund working capital needs and other general corporate purposes

of the Joint Venture. Deutsche Bank and ING Bank N.V. acted as underwriters, joint-mandated lead arrangers and joint bookrunners

for the facilities.

Cautionary Statement

Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws, including statements regarding

the Joint Venture and the acquisition of certain data centers. The forward-looking statements involve risks and uncertainties.

Actual results may differ materially from expectations discussed in such forward-looking statements. Although Equinix believes

that its forward-looking statements are based on reasonable assumptions, expected results may not be achieved, and actual results

may differ materially from its expectations. Factors that might cause such a material difference include, without limitations,

risks related to whether the data centers which will be contributed to the Joint Venture will be integrated successfully, and whether

such integration may be more difficult, time-consuming or costly than expected; risks that the expected benefits of the Joint Venture

will not occur; the challenges of operating and managing data centers and developing, deploying and delivering Equinix services;

the ability to generate sufficient cash flow or otherwise obtain funds to repay new or outstanding indebtedness; any inability

of the Joint Venture to obtain financing as needed; competition from existing and new competitors; the loss or decline in business

from key hyperscale companies; disruption from the Joint Venture making it more difficult to conduct business as usual or maintain

relationships with customers, employees or suppliers; and other risks described from time to time in Equinix’s filings with

the Securities and Exchange Commission.

Equinix’s forward-looking statements should not be relied

upon except as statements of Equinix’s present intentions and of Equinix’s present expectations, which may or may not

occur. Cautionary statements should be read as being applicable to all forward-looking statements wherever they appear. Except

as required by law, Equinix undertakes no obligation to release publicly the result of any revision to these forward-looking statements

that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Readers are also urged to carefully review and consider the various disclosures Equinix has made in this Current Report on Form

8-K, as well as Equinix’s other filings with the Securities and Exchange Commission. Equinix does not assume any obligation

to update the forward-looking information contained in this Current Report on Form 8-K.

Item 9.01. Financial Statements

and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

DATE: October 9, 2019

|

EQUINIX, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Keith D. Taylor

|

|

|

|

|

Keith D. Taylor

|

|

|

|

|

Chief Financial Officer

|

|

EXHIBIT INDEX

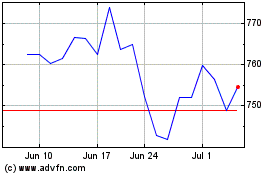

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

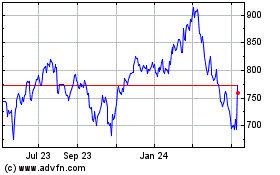

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Apr 2023 to Apr 2024