SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of

1934

ESSA Pharma Inc.

(Name of Issuer

- as specified in its charter)

Common Shares

(Title

of Class of Securities)

29668H708

(CUSIP

Number)

Peter J. Luiso, Esq.

Chief Compliance Officer and General Counsel

Eventide Asset Management, LLC

One International Place, Suite 4210

Boston, Massachusetts 02110

(877) 771- 3836

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

May 14, 2019

(Date of Event

which Requires Filing of this Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because

of Rule 13d-1(e)(f) or (g), check the following.

þ

*The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of

1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

|

1

|

NAME OF REPORTING PERSON

Eventide Asset Management, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

¨

(a)

¨

(b)

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

1,385,970

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

1,385,970

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,385,970

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.2%

|

|

14

|

TYPE OF REPORTING PERSON

IA

|

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSON

Finny Kuruvilla, M.D. Ph.D.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

¨

(a)

¨

(b)

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

1,385,970

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

1,385,970

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,385,970

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.2%

|

|

14

|

TYPE OF REPORTING PERSON

IN;HC

|

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSON

Eventide Healthcare & Life Sciences Fund

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

¨

(a)

¨

(b)

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Ohio

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

766,996

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

766,996

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

766,996

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

10.6%

|

|

14

|

TYPE OF REPORTING PERSON

IV

|

|

|

|

|

|

1

|

NAME OF REPORTING PERSON

Eventide Gilead Fund

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

¨

(a)

¨

(b)

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Ohio

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

618,974

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

618,974

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

618,974

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.6%

|

|

14

|

TYPE OF REPORTING PERSON

IV

|

|

|

|

|

|

Item 1.

Security and Issuer.

This Statement on

Schedule 13D relates to the Common Shares (the “Shares”) of ESSA Pharma Inc. (the “Issuer”). The address

of the principal executive offices of the Issuer is Suite 720, 999 West Broadway, Vancouver, British Columbia, Canada, V5Z 1K5.

Item 2.

Identity and Background.

This Statement is

being jointly filed by: (i) Eventide Asset Management, LLC, a Delaware limited liability company registered as an investment adviser

with the U.S. Securities and Exchange Commission (“Eventide”); (ii) Finny Kuruvilla, M.D., Ph.D., a United States citizen

who is a Managing Partner and a control person of Eventide (“Kuruvilla”); (iii) Eventide Healthcare & Life Sciences

Fund (the “Healthcare & Life Sciences Fund”), a separate investment series of Mutual Fund Series Trust (the “Trust”),

an investment company registered with the U.S. Securities and Exchange Commission under the Investment Company Act of 1940, as

amended, for which Eventide serves as investment adviser; and (iv) Eventide Gilead Fund (the “Gilead Fund”), a separate

investment series of the Trust for which Eventide also serves as investment adviser. (Eventide, Kuruvilla, the Healthcare &

Life Sciences Fund and the Gilead Fund are sometimes also referred to herein individually as a "Reporting Person" and

collectively as the "Reporting Persons"). Further information regarding the identity and background of certain of the

Reporting Persons is set forth in Exhibit B which is attached hereto.

During the last five years,

none of the Reporting Persons, nor, to the best knowledge of the Reporting Persons, any of their respective executive officers,

their respective managing members or any persons controlling their respective managing members has: (1) been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors) or (2) been party to a civil proceeding of a judicial or administrative

body of competent jurisdiction and, as a result of such proceeding, was or is subject to a judgment, decree or final order enjoining

future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation

with respect to such laws.

Item 3.

Source and Amount

of Funds or Other Consideration.

The Shares herein

reported as being beneficially owned by the Reporting Persons were acquired by Eventide directly acting solely on behalf of its

investment advisory clients. Eventide has purchased a total of 481,970 Shares in negotiated purchases and has acquired 904,000

warrants (the “Warrants”) for an aggregate consideration of $13,158,230 (exclusive of brokerage commissions). To the

best knowledge of the Reporting Persons, the funds used in such purchases were from Eventide’s existing and available investment

capital and none of the consideration for such Shares was represented by borrowed funds.

Item 4.

Purpose of Transaction.

The Reporting Persons have

acquired the Shares for investment purposes and will continue to analyze their investment in the Issuer on an ongoing basis. As

part of this investment analysis process, the Reporting Persons have engaged in discussions with management of the Issuer and the

Reporting Persons reserve the right to engage with third parties that may have an interest in the business affairs of the Issuer

in order to monitor their investment and consider possible strategic alternatives.

Effective as of May 14, 2019,

the Healthcare & Life Sciences Fund and the Gilead Fund each entered into a Waiver and Agreement to Exercise with the Issuer

with respect to the Warrants (the “Exercise Agreement”) pursuant to which the parties agreed to certain matters regarding

the terms of the

exercise of the Warrants in connection with

the Issuer’s proposed transaction with Realm Therapeutics plc (the “Realm Transaction”). The Healthcare &

Life Sciences Fund and the Gilead Fund each agreed to exercise the Warrants subject to the conditions provided for in the Exercise

Agreement, including certain conditions with respect to the timing of the approval of the Realm Transaction. A copy of the Exercise

Agreement is attached hereto as Exhibit C.

Depending upon such discussions

and consideration of strategic alternatives, the Reporting Persons could support one or more of the actions described in subparagraphs

(a) through (j) of Item 4 of Schedule 13D. The Reporting Persons reserve the right to formulate other purposes, plans or proposals

regarding the Issuer to the extent deemed advisable by the Reporting Persons in light of current market conditions generally and

specifically as they relate to the Issuer. The Reporting Persons further reserve the right to add to or reduce their holdings in

the Issuer at any time as circumstances warrant without prior notice.

Item 5. Interest in Securities of

the Issuer.

Based on the most recently

available filing information submitted to the Securities and Exchange Commission by the Issuer, there are 6,311,098 Shares currently

outstanding. For purposes of this filing, the Reporting Persons have calculated their beneficial ownership in accordance with Rule

13d-3(d)(1) based upon: (i) the 6,311,098 Shares outstanding and (ii) the total number of Shares issuable upon the exercise of

the Warrants that are deemed to be beneficially owned by the Reporting Persons. As of May 14, 2019, the Reporting Persons collectively

may be deemed to beneficially own 1,385,970 Shares, which represents 19.2% of the outstanding Shares. The total amount of Shares

deemed to be beneficially owned by the Reporting Persons: (1) includes the 232,996 Shares directly owned by the Healthcare &

Life Sciences Fund and assumes that the 534,000 Warrants held by the Healthcare & Life Sciences Fund have been fully converted

and (2) includes the 248,974 Shares directly owned by the Gilead Fund and assumes that the 370,000 Warrants held by the Gilead

Fund have been fully converted. The number of Shares which may be deemed to be beneficially owned by the Reporting Persons are

as follows:

Shares Deemed to be

Beneficially Owned By:

|

Nature of

Ownership

|

Percentage

of Class

|

|

(A)

Eventide

:

|

|

|

|

1,385,970

|

Sole Voting and Sole Dispositive Power (1)

|

19.2%

|

|

(B)

Kuruvilla:

|

|

|

|

1,385,970

|

Shared Voting and Shared Dispositive Power (2)

|

19.2%

|

|

(C)

Healthcare & Life

Sciences Fund

:

|

|

|

|

766,996

|

Shared Voting and Shared Dispositive Power (3)

|

10.6%

|

|

(D)

Gilead Fund

:

|

|

|

|

618,974

|

Shared Voting and Shared Dispositive Power (4)

|

8.6%

|

____________________

|

|

(1)

|

Such Shares are owned by investment advisory clients of Eventide. By reason of its investment advisory

relationship with such clients, Eventide is deemed to have sole voting and sole dispositive power over such Shares. The economic

interest in such Shares is held by such clients.

|

|

|

(2)

|

Because Kuruvilla is a Managing Partner and control person of Eventide, he could be deemed to share

the power to vote and dispose or direct the disposition of such Shares.

|

|

|

(3)

|

Such Shares are owned by the Healthcare & Life Sciences Fund. Because Eventide serves as investment

adviser to the Fund, the Fund may be deemed to share the power to vote and dispose or direct the disposition of such shares.

|

|

|

(4)

|

Such Shares are owned by the Gilead Fund. Because Eventide serves as investment adviser to the

Fund, the Fund may be deemed to share the power to vote and dispose or direct the disposition of such shares.

|

TRANSACTIONS

The Reporting Persons have

not effected any transactions in the Shares during the last sixty days.

Item 6.

Contracts, Arrangements,

Understandings or Relations With Respect to Securities of the Issuer.

Attached hereto as

Exhibit C is a copy of the Exercise Agreement entered into between the Issuer and the Healthcare & Life Sciences Fund and the

Gilead Fund effective as of May 14, 2019.

Item 7.

Materials Filed

as Exhibits.

The following exhibits

are attached hereto:

Exhibit

A - Joint Filing Agreement of the Reporting Persons

Exhibit

B - Executive Officers and Control Persons of the Reporting Persons

Exhibit

C – Waiver and Agreement to Exercise

In accordance

with Rule 13d-4 of the Securities Exchange Act of 1934, the Reporting Persons expressly disclaim the beneficial ownership of the

securities covered by this statement and the filing of this report shall not be construed as an admission by such persons that

they are the beneficial owners of such securities.

SIGNATURES

The undersigned

certify, after reasonable inquiry and to the best knowledge and belief of the undersigned, that the information set forth in this

Statement is true, complete and correct. The undersigned agree to the filing of this single Statement on Schedule 13D.

|

|

|

Eventide Asset Management, LLC*

|

|

|

|

|

|

Date: May 23, 2019

|

|

By: /s/ Peter J. Luiso

|

|

|

|

Name: Peter J. Luiso

|

|

|

|

Title: Chief Compliance Officer and General Counsel

|

|

|

|

|

|

|

|

|

|

|

|

Finny Kuruvilla, M.D., Ph. D.*

|

|

|

|

|

|

Date: May 23, 2019

|

|

By: /s/ Finny Kuruvilla, M.D., Ph. D.

|

|

|

|

Name: Finny Kuruvilla, M.D., Ph. D.

|

|

|

|

|

|

|

|

Mutual Fund Series Trust, on behalf of Eventide Healthcare & Life Sciences Fund*

|

|

|

|

|

|

Date: May 23, 2019

|

|

By: /s/ Jennifer Bailey

|

|

|

|

Name: Jennifer Bailey

|

|

|

|

Title: Secretary

|

|

|

|

|

|

|

|

Mutual Fund Series Trust, on behalf of Eventide Gilead Fund*

|

|

|

|

|

|

Date: May 23, 2019

|

|

By: /s/ Jennifer Bailey

|

|

|

|

Name: Jennifer Bailey

|

|

|

|

Title: Secretary

|

* The Reporting Persons disclaim beneficial

ownership in the shares represented herein except to the extent of their pecuniary interest therein.

EXHIBIT A

Joint Filing Agreement Among

Eventide Asset Management, LLC, Finny Kuruvilla,

M.D., Ph.D.,

Mutual Fund Series Trust, on behalf of Eventide

Healthcare & Life Sciences Fund and Eventide Gilead Fund

WHEREAS

, in accordance with Rule 13d-1(k)(1)

under the Securities and Exchange Act of 1934 (the "Act"), only one joint Statement and any amendments thereto need to

be filed whenever one or more persons are required to file such a statement or any amendments thereto pursuant to Section 13(d)

of the Act with respect to the same securities, provided that said persons agree in writing that such Statement or amendments thereto

is filed on behalf of each of them:

NOW, THEREFORE

, the parties hereto agree

as follows:

Eventide Asset Management, LLC, Finny Kuruvilla,

M.D., Ph. D., and Mutual Fund Series Trust, on behalf of the Eventide Healthcare & Life Sciences Fund and the Eventide Gilead

Fund, do hereby agree, in accordance with Rule 13d-1(k)(1) under the Act, to file a Statement on Schedule 13D relating to their

ownership of the Common Shares of the Issuer, and do hereby further agree that said Statement on Schedule 13D shall be filed on

behalf of each of them.

|

|

|

Eventide Asset Management, LLC*

|

|

|

|

|

|

Date: May 23, 2019

|

|

By: /s/ Peter J. Luiso

|

|

|

|

Name: Peter J. Luiso

|

|

|

|

Title: Chief Compliance Officer and General Counsel

|

|

|

|

|

|

|

|

|

|

|

|

Finny Kuruvilla, M.D., Ph. D.*

|

|

|

|

|

|

Date: May 23, 2019

|

|

By: /s/ Finny Kuruvilla, M.D., Ph. D.

|

|

|

|

Name: Finny Kuruvilla, M.D., Ph. D.

|

|

|

|

|

|

|

|

Mutual Fund Series Trust, on behalf of Eventide Healthcare & Life Sciences Fund*

|

|

|

|

|

|

Date: May 23, 2019

|

|

By: /s/ Jennifer Bailey

|

|

|

|

Name: Jennifer Bailey

|

|

|

|

Title: Secretary

|

|

|

|

|

|

|

|

Mutual Fund Series Trust, on behalf of Eventide Gilead Fund*

|

|

|

|

|

|

Date: May 23, 2019

|

|

By: /s/ Jennifer Bailey

|

|

|

|

Name: Jennifer Bailey

|

|

|

|

Title: Secretary

|

EXHIBIT B

OFFICERS AND CONTROL PERSONS OF THE REPORTING

PERSONS

Except where otherwise noted, each of the individuals

named below is a citizen of the United States with a principal business address as indicated below.

A. Eventide Asset Management, LLC

Eventide Asset

Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission and organized as a limited

liability company under the laws of the State of Delaware. Its address is:

One International Place, Suite 4210

Boston, Massachusetts 02110

The officers of

Eventide Asset Management, LLC are:

|

Name

|

|

Title

|

|

Robin C. John

|

|

Chief Executive Officer

|

|

Finny Kuruvilla, M.D., Ph. D.*

|

|

Chief Investment Officer

|

|

Peter J. Luiso, Esq.

|

|

Chief Compliance Officer and General Counsel

|

*

Mr.

Kuruvilla is deemed to be a control person of Eventide Asset Management, LLC as a result of his ownership interest in the firm.

B. Mutual Fund Series Trust, on behalf of each of Eventide Healthcare

& Life Sciences Fund and Eventide Gilead Fund

Mutual Fund

Series Trust is an investment company organized as a business trust under the laws of the State of Ohio and it is registered with

the U.S. Securities and Exchange Commission. The Eventide Healthcare & Life Sciences Fund and the Eventide Gilead Fund are

each separate investment series of the Trust and share Officers and Trustees with the Trust. Its address is:

17645 Wright Street, Suite 200

Omaha, Nebraska 68130

Information

regarding the Trustees and Officers of Mutual Fund Series Trust is incorporated herein by reference to the Section titled “Trustees

and Officers” in the Statement of Additional Information included in Post-Effective Amendment No. 398 to the Registration

Statement on Form N-1A of the Trust as filed with the U.S. Securities and Exchange Commission on March 12, 2019.

EXHIBIT C

WAIVER

AND AGREEMENT TO EXERCISE

|

RE:

|

The common share purchase warrant of Essa Pharma Inc. (the “Company”) dated January 9, 2018 and issued In the name of Eventide Gilead Fund (“Eventide Gilead”) and the common share purchase warrant of the Company dated January 9, 2018 and issued in the name of Eventide Healthcare & Life Sciences Fund (together with Eventide Gilead, “Eventide”) (together, the “Warrants”)

|

|

AND RE:

|

The Implementation Agreement (the “Implementation Agreement”) to be entered into between the Company and Realm Therapeutics plc (“Realm”) pursuant to which, among other things, the Company will acquire all of the issued share capital of Realm pursuant to a court-approved scheme of arrangement under the U.K. Companies Act 2008 (the “Scheme”)

|

WHEREAS, section

2(e) of each of the Warrants provides that the Company shall not effect any exercise of the Warrants if Eventide would, in the

aggregate, beneficially own common shares of the Company in excess of the Beneficial Ownership Limitation (as defined in the Warrants);

AND WHEREAS, section

2(e) of each of the Warrants further provides that an increase in the Beneficial Ownership Limitation will not be effective until

the 61st day after notice of such increase is delivered by Eventide to the Company (the “Notice Period”);

AND WHEREAS, in

connection with the Implementation Agreement, Eventide and the Company have been in ongoing discussions regarding Eventide exercising

the Warrants, which exercise would require Eventide to provide notice of the increase in the Beneficial Ownership Limitation in

accordance with the timing requirements of the Notice Period;

AND WHEREAS, under

the terms of the Implementation Agreement, the Scheme will require approval of the shareholders of Realm (the “Shareholder

Approval”) at a meeting of shareholders of Realm currently anticipated to be held during the week of June 24, 2019;

AND WHEREAS, subject

to receipt of the Shareholder Approval, the Company wishes to have Eventide exercise the Warrants one Business Day prior to the

Court Hearing (as such terms are defined below) (the “Exercise Date”), which is currently scheduled to occur as soon

as practicable following receipt of the Shareholder Approval and which is prior to the expiry of the Notice Period;

AND WHEREAS, it

is acknowledged and agreed by the Company and Eventide that discussions regarding the exercise of the Warrants began prior to the

61st day before the Exercise Date;

AND WHEREAS, Eventide

is in the process of submitting a duly completed personal information form to the TSX Venture Exchange (the “TSXV”);

AND WHEREAS, Eventide

has agreed to accede to the Company’s request that it exercise the Warrants on the Exercise Date, subject to certain conditions,

and the Company and Eventide wish to waive the Notice Period to permit that exercise.

NOW THEREFORE, for

good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, Eventide and the Company agree as

follows:

1.

Subject to the TSXV approving (i) the personal

information form submitted by Eventide or the TSXV granting a waiver from such requirement and (ii) Eventide becoming an “Insider”

of the Company within the policies of the TSXV, Eventide and the Company hereby agree to waive section 2(e) of the Warrants in

respect of the Notice Period. For greater certainty, this waiver is given only in respect of section 2(e) as it applies to the

Notice Period and all other terms of the Warrants shall otherwise continue in full force and effect.

2.

Eventide and the Company hereby ratify and confirm

that the Beneficial Ownership Limitation under the Warrants shall not exceed 19.99%.

3.

Subject to the Shareholder Approval of the Scheme

and the Company providing notice to Eventide that the Shareholder Approval has occurred, Eventide hereby agrees that it will exercise

all, but not less than all, of the Warrants effective as of the Exercise Date by delivering to the Company a duly completed and

executed notice of exercise in respect of each of the Warrants in the form attached as Exhibit “A” to the Warrants

(and for greater certainty, if Eventide for any reason fails to do so, then Eventide shall, by its signatures below, be deemed

to have exercised the Warrants as of the Exercise Date).

4.

For the purposes hereof:

(a)

“Business Day” means a day (other

than a Saturday, Sunday, public or bank holiday) on which banks are generally open for business in London, United Kingdom, New

York, United States and Vancouver, British Columbia, Canada;

(b)

“Court” means the High Court of Justice

in England and Wales; and

(c)

“Court Hearing” means the hearing

of the Court at which Realm will seek an order sanctioning the Scheme.

5.

This Waiver and Agreement to Exercise shall be

governed by and construed in accordance with the laws of the Province of British Columbia and the laws of Canada applicable therein.

6.

This Waiver and Agreement to Exercise may be executed

in any number of counterparts and all such counterparts taken together shall be deemed to constitute one and the same instrument.

[Remainder of this page intentionally left blank.]

DATED as of this 14th day of May, 2019.

|

EVENTIDE GILEAD FUND

|

EVENTIDE HEALTHCARE & LIFE

SCIENCES FUND

|

|

Per:

/s/ Finny Kuruvilla

Name: Finny Kuruvilla

Title: Portfolio Manager

|

Per:

/s/ Finny Kuruvilla

Name: Finny Kuruvilla

Title: Portfolio Manager

|

|

|

ESSA PHARMA INC.

|

|

|

Per:

/s/ David Wood

Name: David Wood

Title: Chief Financial Officer

|

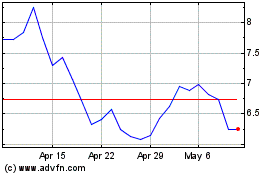

ESSA Pharma (NASDAQ:EPIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

ESSA Pharma (NASDAQ:EPIX)

Historical Stock Chart

From Apr 2023 to Apr 2024