Current Report Filing (8-k)

February 14 2020 - 5:48PM

Edgar (US Regulatory)

0001050441

false

0001050441

2020-02-09

2020-02-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): February 10, 2020

Eagle Bancorp, Inc.

(Exact name of registrant as specified in

its charter)

|

Maryland

|

0-25923

|

52-2061461

|

|

(State or other jurisdiction

|

(Commission file number)

|

(IRS Employer

|

|

of incorporation)

|

|

Number)

|

7830 Old Georgetown Road, Bethesda, Maryland 20814

(Address of Principal Executive Offices)

(Zip Code)

Registrant's telephone number, including

area code: 301.986.1800

Check the appropriate

box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (See General Instruction A.2. below):

|

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities Registered under Section 12(b)

of the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.01 par value

|

|

EGBN

|

|

The Nasdaq Stock Market, LLC

|

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors, Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(e) Named

Executive Officer Compensation Decisions. On February 10, 2020, the Compensation Committee of the Board of Directors of Eagle

Bancorp, Inc. (the “Company”) approved base salaries for calendar year 2020 (retroactive to January 1, 2020), cash

bonus awards under the Company’s Senior Executive Incentive Plan (the “SEIP”) for 2019 performance, retention

bonus awards for certain named executive officers, the award of shares of time-vested restricted stock and performance based restricted

stock units (“PRSUs”) under the Company’s 2020 Long Term Incentive Plan and 2016 Stock Plan, to the persons expected

to be designated as the Company’s named executive officers for 2020, as set forth below.

|

Name

|

|

Title

|

|

2020 Annual

Salary

|

|

|

SEIP Bonus

for 2019

Performance

|

|

|

Retention

Bonuses

|

|

|

Shares of

Time-Vested

Restricted

Stock

Awarded

|

|

|

PRSUs

Awarded (at

Target )

|

|

|

Susan G. Riel

|

|

President and CEO – Company and EagleBank

|

|

$

|

800,000

|

|

|

$

|

1,387,510

|

|

|

$

|

-

|

|

|

|

20,319

|

|

|

|

20,319

|

|

|

Charles D. Levingston

|

|

EVP and CFO – Company and EagleBank

|

|

$

|

417,514

|

|

|

$

|

237,482

|

|

|

$

|

-

|

|

|

|

4,723

|

|

|

|

4,723

|

|

|

Antonio F. Marquez

|

|

EVP & CLO – Commercial Real Estate - EagleBank

|

|

$

|

509,834

|

|

|

$

|

343,876

|

|

|

$

|

-

|

|

|

|

7,534

|

|

|

|

7,534

|

|

|

Lindsey S. Rheaume

|

|

EVP & CLO – C&I- EagleBank

|

|

$

|

421,656

|

|

|

$

|

244,026

|

|

|

$

|

-

|

|

|

|

4,589

|

|

|

|

4,589

|

|

|

Janice L. Williams

|

|

EVP & Chief Credit Officer – EagleBank

|

|

$

|

510,144

|

|

|

$

|

299,390

|

|

|

$

|

200,000

|

|

|

|

7,576

|

|

|

|

7,576

|

|

All awards of time-vested

restricted stock vest in three substantially equal installments commencing on the first anniversary of the date of grant, subject

to the terms of the 2016 Stock Plan and the form of award certificate. PRSUs are awards of the right to receive shares of common

stock based upon the Company’s achievement in respect of specified performance measures over a three year performance period,

2020-2022, based upon the Company’s return on average assets and total shareholder return as compared to the companies comprising

the KBW Regional Bank Index (the “Index”). PRSUs are awarded at target, meaning the number of shares which would vest

if the Company met the target level of performance for each performance metric. The actual number of PRSUs vested will be determined

by interpolating the Company’s performance in respect of each metric on a straight-line basis between threshold, target and

stretch/maximum award levels. The table below establishes the performance goals and payment ranges for the 2020-2022 performance

period. A copy of the Company’s 2020-2022 Long Term Incentive Plan, as amended to reflect a change in one of the metrics

for vesting of PRSUs from tangible book value total shareholder return, is included as Exhibit 10.1 to this report. The retention

bonus for Ms. Williams vests in two equal annual installments commencing on the date of award.

|

Measures

|

|

Weight

|

|

Threshold

|

|

Target

|

|

Stretch/Maximum

|

|

|

Return on Average Assets compared to Index

|

|

50%

|

|

Median

|

|

62.5% Percentile

|

|

75% Percentile

|

|

|

Total Shareholder Return compared to

Index

|

|

50%

|

|

Median

|

|

62.5% Percentile

|

|

75% Percentile

|

|

|

Payout Range (% of Target)

|

|

100%

|

|

50%

|

|

100%

|

|

150%

|

|

Director Awards.

On February 10, 2020, the Compensation Committee of the Board of Directors of the Company approved awards of shares of restricted

stock under the 2016 Stock Plan to non-employee members of the Board of Directors of the Company for service on the Boards of Directors

of the Company and the Bank, as follows:

|

Name

|

|

Number of shares of Restricted Stock

|

|

Matthew Brockwell

|

|

560

|

|

Theresa LaPlaca

|

|

3,363

|

|

Leslie Ludwig

|

|

6,726

|

|

Norman Pozez

|

|

43,441

|

|

Kathy Raffa

|

|

6,726

|

|

James Soltesz

|

|

6,726

|

|

Benjamin Soto

|

|

3,363

|

|

Leland Weinstein

|

|

6,726

|

All such awards of

time-vested restricted stock vest in three substantially equal installments commencing on the first anniversary of the date of

grant, subject to the terms of the 2016 Stock Plan and the form of award certificate.

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits.

Signatures

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

EAGLE BANCORP, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Susan G. Riel

|

|

|

|

Susan G. Riel, President, Chief Executive Officer

|

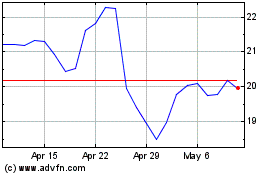

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

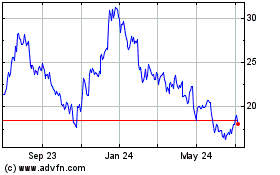

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Apr 2023 to Apr 2024