Activist Seeks Slate of Picks For eBay Board -- WSJ

March 12 2020 - 3:02AM

Dow Jones News

By Corrie Driebusch and Cara Lombardo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 12, 2020).

EBay Inc. is facing a renewed challenge from activist investor

Starboard Value LP, which has nominated a slate of directors to the

board of the online marketplace, according to people familiar with

the matter.

Starboard, which last year won the right to help fill one seat

on eBay's board, privately nominated an additional minority slate

of directors recently, the people said. Assuming there isn't some

sort of settlement by then, the nominees would be up for election

at the San Jose, Calif., company's annual meeting in June.

Starboard has publicly expressed frustration that eBay hasn't

moved quickly enough to sell its online-classified-ads business or

make changes to its board. Ebay recently closed the roughly $4

billion sale of its StubHub ticketing business. That leaves the

company with the classified business and its core marketplace,

which connects buyers and sellers of everything from electronics to

collectibles.

It couldn't be learned how many directors Starboard nominated to

eBay's 14-person board. Among the nominees is Starboard's head of

research, Peter Feld, who also sits on the boards of companies

including NortonLifeLock Inc.

The move comes after a tumultuous period for eBay, a darling of

the early Internet economy whose marketplace business has been

eroded by the rise of Amazon.com Inc.

Starboard and eBay have been in discussions on and off in recent

weeks, some of the people said, and in late February eBay said it's

exploring options for the classifieds business, which primarily

operates overseas.

Ebay said it's in discussions with multiple potential buyers of

the unit, which could be worth $10 billion. Private-equity firms

including TPG and Blackstone Group Inc., as well as internet

conglomerate Naspers Ltd., German publishing company Axel Springer

SE and others have expressed interest, people familiar with the

matter have said.

The marketplace business has also drawn takeover interest. New

York Stock Exchange operator Intercontinental Exchange Inc.

approached eBay about a deal before its own shareholders balked,

forcing it to back off the idea.

EBay, which has a market value of roughly $28 billion, has been

without a permanent chief executive since Devin Wenig departed in

September following clashes with the board. The interim CEO is

Scott Schenkel, who previously served as chief financial

officer.

Another activist, Elliott Management Corp., has board

representation in the form of a seat for Jesse Cohn, a senior

official at the hedge-fund firm. Starboard said in February that it

owns more than 1% of eBay's shares, while Elliott has said it owns

a stake of more than 4%

Write to Corrie Driebusch at corrie.driebusch@wsj.com and Cara

Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

March 12, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

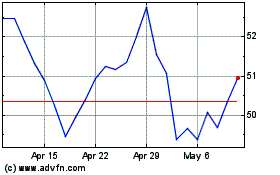

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

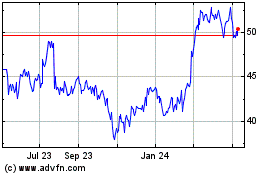

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024