By Eric Uhlfelder

With most Treasurys yielding under 2% and savings accounts

yielding even less, individual investors are hard-pressed to figure

out what to do with money they don't want exposed to material

market risk.

One viable alternative is bonds that trade on stock exchanges,

known as exchange-traded bonds.

About $19 billion of these securities trade mostly on the New

York Stock Exchange, with many investment-grade offerings generally

yielding between 5% and 6%.

While tiny compared with the traditional $9.3 trillion

corporate-bond market, exchange-traded bonds generally offer more

transparency than traditional debt offerings. That's because

investors who buy them have the same ease of access to bid and ask

information, current yield and limit orders they enjoy when buying

and selling stocks, says Kevin Conery, fixed-income trading desk

analyst at Piper Jaffrey.

Exchange-traded bonds also have other features that individual

investors might find attractive.

These securities are issued in $25 bonds, compared with $1,000

for traditional corporate bonds. They pay interest on a quarterly

basis versus corporate issues that pay semiannually. And because

issuers can typically call exchange-traded bonds five years after

their initial offering at par and any point thereafter, the yields

are often higher than traditional corporate bonds issued by the

same company.

Companies are willing to offer higher yields on exchange-traded

bonds because the five-year call features gives them more

flexibility to refinance debt if rates fall or eliminate it

altogether if the money is no longer needed -- something that

$1,000 corporates can only do closer to maturity, if at all.

That five-year call feature also can reduce the overall

volatility of these bonds (as long as they aren't suffering from

credit issues), especially after the call date has passed. The

reason: Prices tend to trade close to par within a year or two of

the call and anytime thereafter.

Consider the long-term senior bond of internet-auction giant

eBay Inc., which is listed on the NYSE under the symbol EBAYL. This

investment-grade offering currently yields 5.59% and is trading at

$27.

By comparison, a traditional 4% coupon bond from eBay that

matures in 2042 trades at 99.54 (or $995.40 per bond) and yields

4.14%. And while individuals can make any size purchase of

exchange-traded bonds, there is a minimum online bid of 10

corporate bonds, or $9,954.

With many online major brokerages having eliminated trading

fees, exchange-traded bonds can be bought and sold without cost.

However, because these bonds are thinly traded, investors need to

use limit orders to ensure efficient pricing.

Some caveats

Barry McAlinden, a fixed-income strategist at UBS Global Wealth

Management, cautions investors not to mistake the ease of buying

exchange-traded bonds with reduced need for due diligence.

"While their returns and ostensible safety can be enticing,"

says Mr. McAlinden, "there are many variables that need to be

considered before investing and special caveats that may come into

play during difficult times."

Among the things investors need to consider:

Bond interest is taxed as ordinary income. For higher-income

households, this is going to be a much higher rate than the

up-to-20% rate at which qualified dividends from common and

preferred stock dividends are taxed. As such, tax-deferred

retirement accounts might be an ideal place to hold these

bonds.

Some of these securities are junior subordinated debt, meaning

they have a lower-priority claim against assets if a company goes

into bankruptcy. While senior bonds can't miss payments without

triggering a default, junior subordinated debt can typically defer

interest payments for up to 10 years without doing so. That said,

such deferrals are rare. As UBS's Mr. McAlinden explains, "Such a

deferral would wreck any firms' plans to access capital markets

going forward."

If investors are hoping to benefit from the bond rally -- due to

additional interest-rate cuts -- they shouldn't count on it. Piper

Jaffrey's Mr. Conery explains such a price rise is only likely if

there is at least 3.5 years before the bond is callable. "Prices of

bonds with shorter call dates will likely trade closer to their

call price," says Mr. Conery, regardless of minor changes in

interest rates.

Maturity rates

Still, the hunt for yield is leading some investors to take on

principal risk.

The municipal-bond insurer Assured Guaranty Municipal Holdings

(AGO-B) A-rated 6.875% ultralong-term exchange-traded bond is

trading at $27.50 and can be called anytime with 20 days' notice.

While the current yield of 6.36% looks enticing, a call at this

price would result in a 10% capital loss. To break even, new

investors would need the bond to remain outstanding for at least a

year and a half.

Because the aforementioned eBay bond trades well above par, its

effective annualized yield would be reduced to 1.81% if the company

calls the security a year from now -- its initial call date. (See

table.) Effective yield will rise the longer the bond remains

outstanding as investors receive more quarterly payments.

Maturity dates also are important, especially if that date

stretches into the next century. The longer the maturity date, the

more volatile pricing can be, especially when interest rates move.

Pricing is based on yield and credit spreads over equivalently

termed Treasurys.

Not all exchange-traded bonds are rated. That could mean the

company is confident that its issue will be well subscribed to

without a rating, but it also could indicate a company that doesn't

want to pay for a mediocre grade.

Quantumonline.com maintains a free database to help investors

get started understanding the exchange-traded bond market.

Mr. Uhlfelder writes about global capital markets from New York.

He can be reached at reports@wsj.com.

(END) Dow Jones Newswires

January 05, 2020 22:17 ET (03:17 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

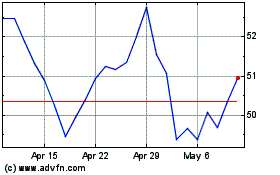

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

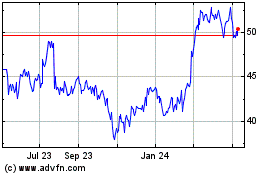

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024