Current Report Filing (8-k)

June 12 2020 - 4:54PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 10, 2020

DESTINATION XL GROUP, INC.

(Exact name of Registrant as Specified in Its Charter)

|

Delaware

|

01-34219

|

04-2623104

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

555 Turnpike Street,

Canton, Massachusetts

|

|

02021

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (781) 828-9300

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act.

|

|

|

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

DXLG

|

NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Compensatory Arrangements of Certain Officers

On June 11, 2020, the Compensation Committee (“Committee”) of the Board of Directors of Destination XL Group, Inc. (the “Company”) approved the Destination XL Group, Inc. Third Amended and Restated Long-Term Incentive Plan (the “LTIP”), in which the Company’s executives (including its Named Executive Officers) and certain other members of management are eligible to participate. The LTIP was amended as follows:

|

|

•

|

Section 6(a) relating to the time-based portion of the LTIP was amended to modify how the number of stock options is determined if a stock option award is granted. As amended, the number of stock options to be granted pursuant to an award will be determined by taking the lesser of (i) the dollar value of the stock option award divided by the closing price of the Company’s common stock on grant date, multiplied by a factor of 1.1 to 1.8 as determined by the Committee or (ii) the dollar value of the stock option award divided by the Black-Scholes value on the grant date; and

|

|

|

•

|

Section 6(b) relating to the performance-based portion of the LTIP was amended to remove the ability to grant stock options for the performance-vesting benefit amount.

|

The LTIP is filed herewith as Exhibit 10.1 and incorporated herein by this reference.

Grant of Stock Option to Chief Executive Officer

On June 10, 2020, the Committee granted to Harvey S. Kanter, the Company’s President and CEO, a stock option to purchase up to 450,000 shares of the Company’s common stock, at an exercise price of $0.64 per share, which will vest in three equal installments with the first tranche vesting on June 10, 2021, the second tranche on April 1, 2022 and remaining tranche on April 1, 2023. In approving the award, the Committee determined that it was important to preserve continuity of leadership through the COVID-19 pandemic and the uncertain recovery period, and accordingly to provide Mr. Kanter with a long-term, equity incentive that aligns his interests with those of the Company’s stockholders.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

DESTINATION XL GROUP, INC.

|

|

Date:

|

June 12, 2020

|

By:

|

/s/ Robert S. Molloy

|

|

|

|

|

Robert S. Molloy

|

|

|

|

|

Chief Administrative Officer, General Counsel and Secretary

|

3

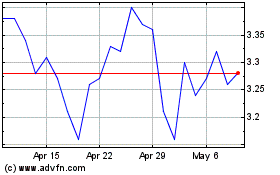

Destination XL (NASDAQ:DXLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

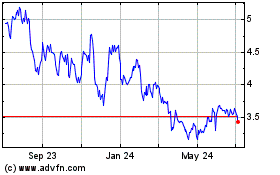

Destination XL (NASDAQ:DXLG)

Historical Stock Chart

From Apr 2023 to Apr 2024