DESTINATION XL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

04‑2623104

(I.R.S. Employer

Identification No.)

|

|

555 Turnpike Street

Canton, Massachusetts 02021

(781) 828-9300

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

|

___________

Peter H. Stratton, Jr.

Chief Financial Officer

Destination XL Group, Inc.

555 Turnpike Street

Canton, Massachusetts 02021

(781) 828-9300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

___________

Copies to:

Elizabeth W. Fraser, Esq.

Greenberg Traurig, LLP

One International Place

Boston, Massachusetts 02110

Telephone: (617) 310-6237

Facsimile: (617) 279-8427

Approximate date of commencement of proposed sale to public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐Accelerated filer ☒

Non-accelerated filer ☐ Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities to be Registered

|

Amount

to be

Registered (1)(2)

|

Proposed Maximum

Offering Price

Per Unit (2)

|

Proposed

Maximum

Aggregate

Offering Price (2)

|

Amount of

Registration

Fee (3)

|

|

|

|

|

|

|

|

Common Stock, $0.01 par value per share

|

|

|

|

|

|

Preferred Stock, $0.01 par value per share

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

Debt securities

|

|

|

|

|

|

Purchase Contracts

|

|

|

|

|

|

Depositary Shares (4)

|

|

|

|

|

|

Rights

|

|

|

|

|

|

Units (5)

|

|

|

|

|

|

Total

|

$25,000,000

|

|

$25,000,000

|

$3,245

|

|

(1)

|

This registration statement also covers common stock or preferred stock that may be issued by the registrant upon exercise, conversion or exchange of any securities registered hereunder that provide for such issuance. An indeterminate number of the securities is being registered as may at various times be issued at indeterminate prices, with an aggregate offering price not to exceed $25,000,000. In addition, pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the shares being registered hereunder include such indeterminate number of shares of common stock and preferred stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends, or similar transactions.

|

|

(2)

|

Pursuant to General Instruction II.D. of Form S-3, the table lists each of the classes of securities being registered and the aggregate proceeds to be raised, but does not specify by each class information as to the amount to be registered, proposed maximum offering price per unit, and proposed maximum aggregate offering price.

|

|

(3)

|

Calculated pursuant to Rule 457(o) under the Securities Act.

|

|

(4)

|

Each depositary share will represent an interest in a fractional share of preferred stock and will be evidenced by a depositary receipt.

|

|

(5)

|

Each unit will represent an interest in two or more other securities, which may or may not be separable from one another.

|

___________

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), shall determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated June 4, 2020

PROSPECTUS

Destination XL Group, Inc.

$25,000,000

Common Stock

Preferred Stock

Depositary Shares

Warrants

Debt Securities

Purchase Contracts

Rights

Units

___________

We may offer and sell from time to time, in one or more transactions, common stock, preferred stock, depositary shares, warrants, debt securities, purchase contracts, rights and units that include any of these securities, up to a total public offering price of $25,000,000 on terms to be determined at the time of sale. This prospectus describes some of the general terms that may apply to these securities and the general manner in which they may be offered. We will provide specific terms of these securities and the specific manner in which we offer these securities in supplements to this prospectus. You should read this prospectus and any supplement carefully before you invest. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement for those securities.

We may offer and sell these securities directly to investors, to or through one or more underwriters, dealers and agents, or through a combination of these methods, on a continuous or delayed basis. For more information, see “Plan of Distribution” in this prospectus. We may also describe the plan of distribution for any particular offering of these securities in a prospectus supplement. If any underwriters, dealers or agents are involved in the sale of any securities in respect of which this prospectus is delivered, we will disclose their names and the nature of our arrangements with them in a prospectus supplement. The price to the public of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

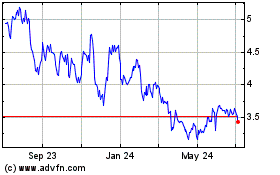

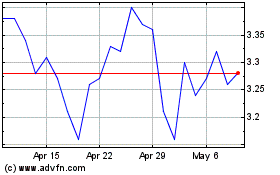

Our common stock is traded on the Nasdaq Global Select Market under the symbol “DXLG.” On June 1, 2020, the closing price of our common stock on the Nasdaq Global Select Market was $0.40 per share.

As of June 1, 2020, the aggregate market value of the voting and non-voting common equity held by non-affiliates, computed by reference to the price at which the common equity was last sold or the average bid and asked price of such common equity on that date, was approximately $12,206,614 based on 51,078,020 shares of outstanding common stock, of which 30,516,535 were held by non-affiliates. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million. We have not offered any securities pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar months prior to and including the date of this prospectus.

___________

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 1 of this prospectus. We may include additional risk factors in an applicable prospectus supplement under the heading “Risk Factors.” You should review that section of the prospectus supplement for a discussion of matters that investors in our securities should consider.

___________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

____________

The date of this prospectus is , 2020.

TABLE OF CONTENTS

Important Notice about the Information Presented in this Prospectus

You should rely only on the information contained or incorporated by reference in this prospectus or any applicable prospectus supplement. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. For further information, see the section of this prospectus entitled “Where You Can Find More Information.” We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should not assume that the information appearing in this prospectus or any applicable prospectus supplement is accurate as of any date other than the date on the front cover of this prospectus or the applicable prospectus supplement, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since such dates.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf process, we may sell any combination of the securities described in this prospectus in one or more offerings up to a total dollar amount of $25,000,000. This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the securities being offered and the terms of that offering. The prospectus supplement may also add to, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement together with the additional information described under the heading “Where You Can Find More Information” carefully before making an investment decision.

Unless the context otherwise requires, the terms “Destination XL Group, Inc.,” “DXLG,” “the Company,” “our company,” “we,” “us,” “our” and similar names refer collectively to Destination XL Group, Inc. and its subsidiaries.

PROSPECTUS SUMMARY

The Company

We are the largest specialty retailer of big and tall men’s clothing and shoes with retail operations in the United States and Toronto, Canada and direct businesses throughout the United States, Canada, and Europe. We operate under the trade names of Destination XL®, DXL®, DXL Men’s Apparel, DXL outlets, Casual Male XL® and Casual Male XL outlets. We currently operate 228 DXL retail stores, 17 DXL outlet stores, 50 Casual Male XL retail stores, 26 Casual Male XL outlet stores and a direct business at www.dxl.com. In fiscal 2018, we launched a wholesale business unit focused on product development and distribution relationships with key retailers offering both private label and co-branded men’s big & tall apparel lines.

We are incorporated in the state of Delaware. Our principal executive offices are located at 555 Turnpike Street, Canton, Massachusetts 02021. Our telephone number is (781) 828-9300. Our Internet address is www.dxl.com. Information contained on our website or that is accessible through our website should not be considered to be part of this prospectus.

RISK FACTORS

Investing in our securities involves significant risks. Please see the risk factors under the heading “Risk Factors” in our most recent Annual Report on Form 10-K, as revised or supplemented by our Quarterly Reports on Form 10-Q filed with the SEC since the filing of our most recent Annual Report on Form 10-K, each of which are on file with the SEC and are incorporated by reference in this prospectus. Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus and any prospectus supplement. The risks and uncertainties we have described are not the only ones facing our company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations.

1

SPECIAL NOTE REGARDING FORWARD‑LOOKING INFORMATION

This prospectus includes and incorporates forward‑looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical facts, included or incorporated in this prospectus regarding our strategy, future operations, financial position, future revenues, projected costs, prospects, plans and objectives of management are forward‑looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terminology such as “may,” “will,” “estimate,” “intend,” “plan,” “continue,” “believe,” “expect” or “anticipate” or the negatives thereof, variations thereon or similar terminology, although not all forward‑looking statements contain these identifying words. These forward-looking statements, which are not exhaustive, generally relate to plans and objectives for future operations and are based upon management’s reasonable estimates of future results or trends and also includes statements regarding the impact of the coronavirus outbreak on the Company’s business and results in fiscal 2020 and actions being taken by the Company to mitigate the impact, including to reduce operating expenses and capital expenditures, cancel inventory receipts, and to preserve liquidity. We cannot guarantee that we actually will achieve the plans, intentions or expectations disclosed in our forward‑looking statements and you should not place undue reliance on our forward‑looking statements. These forward-looking statements are subject to a number of known and unknown risks, uncertainties and assumptions, including risks described in the section titled “Risk Factors” and elsewhere in this prospectus, and in the documents we incorporate by reference in this prospectus. You should read these factors and other cautionary statements made in this prospectus and any accompanying prospectus supplement, and in the documents we incorporate by reference as being applicable to all related forward-looking statements wherever they appear in the prospectus and any accompanying prospectus supplement, and in the documents incorporated by reference. These factors include, among other things:

|

|

•

|

Our ability to operate due to the business interruption caused by the Coronavirus pandemic that resulted in temporary store closings;

|

|

|

•

|

Our ability to execute our strategy and grow our market share;

|

|

|

•

|

Our ability to develop and execute marketing programs to drive traffic and convert that traffic into a loyal customer base;

|

|

|

•

|

Our ability to grow our direct business and develop our e-commerce and internet infrastructure;

|

|

|

•

|

Our ability to grow our wholesale segment;

|

|

|

•

|

Our ability to develop and implement our omni-channel initiatives;

|

|

|

•

|

Our ability to maintain our central distribution center;

|

|

|

•

|

Our ability to identify suitable store locations with acceptable lease terms;

|

|

|

•

|

Our ability to be successful in a highly competitive market;

|

|

|

•

|

Our ability to engage third parties to manufacture our merchandise;

|

|

|

•

|

Our ability to operate with economic, health and political issues abroad and in the U.S;

|

|

|

•

|

Our ability to operate and expand our business and to respond to changing business and economic conditions will depend on the availability of adequate capital;

|

|

|

•

|

Our ability to protect the proprietary information of our customers and our security systems;

|

|

|

•

|

Our ability to predict fashion trends and customer preferences successfully;

|

|

|

•

|

Our ability to maintain our key trademarks and licenses;

|

|

|

•

|

Our ability to attract and maintain key personnel;

|

|

|

•

|

Our ability to manage the price, availability and quality of raw materials and finished goods;

|

|

|

•

|

Our ability to comply with laws, rules and regulations;

|

|

|

•

|

The ability of our stock price to withstand volatility due to many factors;

|

|

|

•

|

Our ability to maintain listing of our common stock on the Nasdaq Global Select Market; and

|

|

|

•

|

Our ability to maintain as a going concern.

|

New risk factors emerge from time to time and it is not possible for us to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. These forward-looking statements speak only as of the date of the document in which they are made. We disclaim any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances in which the forward-looking statement is based.

2

USE OF PROCEEDS

We currently intend to use the estimated net proceeds from the sale of these securities for working capital and other general corporate purposes. Working capital and other general corporate purposes may include repaying debt, making capital expenditures, funding general and administrative expenses and any other purpose that we may specify in any prospectus supplement. We have not yet determined the amount of net proceeds to be used specifically for any of the foregoing purposes. Accordingly, our management will have significant discretion and flexibility in applying the net proceeds from the sale of these securities. Pending any use, as described above, we intend to invest the net proceeds in high-quality, short-term, interest-bearing securities. Our plans to use the estimated net proceeds from the sale of these securities may change, and if they do, we will update this information in a prospectus supplement.

THE SECURITIES WE MAY OFFER

The descriptions of the securities contained in this prospectus, together with the applicable prospectus supplements, summarize the material terms and provisions of the various types of securities that we may offer. We will describe in the applicable prospectus supplement relating to any securities the particular terms of the securities offered by that prospectus supplement. If we so indicate in the applicable prospectus supplement, the terms of the securities may differ from the terms we have summarized below. We will also include in the prospectus supplement information, where applicable, about material United States federal income tax considerations relating to the securities, and the securities exchange, if any, on which the securities will be listed.

We may sell from time to time, in one or more offerings:

|

|

•

|

warrants to purchase common stock, preferred stock, depositary shares or units;

|

|

|

•

|

rights to purchase common stock, preferred stock, depositary shares or warrants; or

|

|

|

•

|

units comprised of common stock, preferred stock, depositary shares, debt securities, warrants and purchase contracts in any combination.

|

In this prospectus, we refer to the common stock, preferred stock, depositary shares, warrants, debt securities, purchase contracts, rights and units collectively as “securities.” The total dollar amount of all securities that we may issue will not exceed $25,000,000.

This prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

3

DESCRIPTION OF COMMON STOCK

For a description of our common stock, please see the Description of Securities of the Company filed as Exhibit 4.1 to our Annual Report on Form 10-K for the fiscal year ended February 1, 2020 filed with the SEC on March 19, 2020, and any future description of capital stock filed thereafter for the purpose of updating such description.

4

DESCRIPTION OF PREFERRED STOCK

Under our certificate of incorporation, we have authority to issue 1,000,000 shares of preferred stock, par value $.01 per share. Of these shares, 50,000 shares have been designated as “Series A Junior Participating Preferred Stock,” none of which are outstanding, and 200,000 shares have been designated as “Series B Convertible Preferred Stock,” none of which are outstanding.

Shares of preferred stock may be issued from time to time, in one or more series, as authorized by our board of directors. Prior to the issuance of shares of each series, the board of directors is required by the Delaware General Corporation Law and our certificate of incorporation to fix, for each series, the designations, powers and preferences and the relative, participating, optional or other special rights of the shares of each series and any qualifications, limitations and restrictions thereof, as are permitted by Delaware law. Our board of directors could authorize the issuance of shares of preferred stock with terms and conditions that could have the effect of discouraging a takeover or other transactions that holders of common stock might believe to be in their best interests or in which holders of some, or a majority, of the shares of common stock might receive a premium for their shares over the then market price of such shares of common stock. When issued, the preferred stock will be fully paid and nonassessable and will have no preemptive rights.

If we decide to issue any preferred stock pursuant to this prospectus, we will describe in a prospectus supplement the terms of the preferred stock, including, if applicable, the following:

|

|

•

|

the title of the series and stated value;

|

|

|

•

|

the number of shares of the series of preferred stock offered, the liquidation preference per share, if applicable, and the offering price;

|

|

|

•

|

the applicable dividend rate(s) or amount(s), period(s) and payment date(s) or method(s) of calculation thereof;

|

|

|

•

|

the date from which dividends on the preferred stock will accumulate, if applicable;

|

|

|

•

|

any procedures for auction and remarketing;

|

|

|

•

|

any provisions for a sinking fund;

|

|

|

•

|

any applicable provision for redemption and the price or prices, terms and conditions on which preferred stock may be redeemed;

|

|

|

•

|

any securities exchange listing;

|

|

|

•

|

any voting rights and powers;

|

|

|

•

|

whether interests in the preferred stock will be represented by depositary shares;

|

|

|

•

|

the terms and conditions, if applicable, of conversion into shares of our common stock, including the conversion price or rate or manner of calculation thereof;

|

|

|

•

|

a discussion of any material U.S. federal income tax considerations;

|

|

|

•

|

the relative ranking and preference as to dividend rights and rights upon our liquidation, dissolution or the winding up of our affairs;

|

|

|

•

|

any limitations on issuance of any series of preferred stock ranking senior to or on a parity with such series of preferred stock as to dividend rights and rights upon our liquidation, dissolution or the winding up of our affairs; and

|

|

|

•

|

any other specific terms, preferences, rights, limitations or restrictions of such series of preferred stock.

|

5

DESCRIPTION OF DEPOSITARY SHARES

We may issue receipts for depositary shares representing fractional shares of preferred stock. The fractional share of the applicable series of preferred stock represented by each depositary share will be set forth in the applicable prospectus supplement.

The shares of any series of preferred stock underlying any depositary shares that we may sell under this prospectus will be deposited under a deposit agreement between us and a depositary selected by us. Subject to the terms of the deposit agreement, each holder of a depositary share will be entitled, in proportion to the applicable fraction of a share of the preferred stock underlying the depositary share, to all of the rights, preferences, and privileges, and will be subject to the qualifications and restrictions, of the preferred stock underlying that depositary share.

The depositary shares will be evidenced by depositary receipts issued under the deposit agreement. Depositary receipts will be distributed to the holders of the depositary shares that are sold in the applicable offering. We will incorporate by reference into the registration statement of which this prospectus is a part the form of any deposit agreement, including a form of depositary receipt, that describes the terms of any depositary shares we are offering before the issuance of the related depositary shares. The following summaries of material provisions of the deposit agreement, the depositary shares, and the depositary receipts are subject to, and qualified in their entirety by reference to, all of the provisions of the deposit agreement applicable to a particular offering of depositary shares. We urge you to read the prospectus supplements relating to any depositary shares that are sold under this prospectus, as well as the complete deposit agreement and depositary receipt.

Form

Pending the preparation of definitive depositary receipts, the depositary may, upon our written order, issue temporary depositary receipts substantially identical to the definitive depositary receipts but not in definitive form. These temporary depositary receipts will entitle their holders to all of the rights of definitive depositary receipts. Temporary depositary receipts will then be exchangeable for definitive depositary receipts at our expense.

Dividends and Other Distributions

The depositary will distribute all cash dividends or other cash distributions received with respect to the underlying preferred stock to the record holders of depositary shares in proportion to the number of depositary shares owned by those holders.

If there is a distribution other than in cash, the depositary will distribute property received by it to the record holders of depositary shares in proportion to the number of depositary shares owned by those holders, unless the depositary determines that it is not feasible to do so. If this occurs, the depositary may, with our approval, sell the property and distribute the net proceeds from the sale to those holders in proportion to the number of depositary shares owned by them.

The amount distributed to holders of depositary shares will be reduced by any amounts required to be withheld by us or the depositary on account of taxes or other governmental charges.

Liquidation Preference

If a series of preferred stock underlying the depositary shares has a liquidation preference, in the event of our voluntary or involuntary liquidation, dissolution, or winding up, holders of depositary shares will be entitled to receive the fraction of the liquidation preference accorded each share of the applicable series of preferred stock, as set forth in the applicable prospectus supplement.

Withdrawal of Underlying Preferred Stock

Except as otherwise provided in a prospectus supplement, holders may surrender depositary receipts at the principal office of the depositary and, upon payment of any unpaid amount due to the depositary, be entitled to receive the number of whole shares of underlying preferred stock and all money and other property represented by the related depositary shares. We will not issue any partial shares of preferred stock. If the holder delivers depositary receipts evidencing a number of depositary shares that represent more than a whole number of shares of preferred stock, the depositary will issue a new depositary receipt evidencing the excess number of depositary shares to the holder.

Redemption of Depositary Shares

If the preferred stock underlying any depositary shares we may sell under this prospectus is subject to redemption, the depositary shares will be redeemed from the proceeds received by the depositary resulting from any such redemption, in whole or in

6

part, of that underlying preferred stock. The redemption price per depositary share will be equal to the applicable fraction of the redemption price per share payable with respect to the underlying preferred stock. Whenever we redeem shares of underlying preferred stock that are held by the depositary, the depositary will redeem, as of the same redemption date, the number of depositary shares representing the shares of underlying preferred stock so redeemed. If fewer than all of the depositary shares are to be redeemed, the depositary shares to be redeemed will be selected by lot or proportionately, as may be determined by the depositary.

After the date fixed for redemption, the depositary shares called for redemption will no longer be deemed to be outstanding, and all rights of the holders of the depositary shares will cease, except the right to receive the monies payable and any other property to which the holders were entitled upon the redemption upon surrender to the depositary of the depositary receipts evidencing the depositary shares. Any funds deposited by us with the depositary for any depositary shares that the holders fail to redeem will be returned to us after a period of two years from the date the funds are deposited.

Voting

Upon receipt of notice of any meeting at which holders of the preferred stock underlying any depositary shares that we may sell under this prospectus are entitled to vote, the depositary will mail the information contained in the notice to the record holders of the depositary shares. Each record holder of the depositary shares on the record date, which will be the same date as the record date for the underlying preferred stock, will be entitled to instruct the depositary as to the exercise of the voting rights pertaining to the amount of the underlying preferred stock represented by the holder’s depositary shares. The depositary will then try, as far as practicable, to vote the number of shares of preferred stock underlying those depositary shares in accordance with those instructions, and we will agree to take all reasonable actions which may be deemed necessary by the depositary to enable the depositary to do so. The depositary will not vote the underlying preferred stock to the extent it does not receive specific instructions with respect to the depositary shares representing such preferred stock.

Conversion of Preferred Stock

If the prospectus supplement relating to any depositary shares that we may sell under this prospectus states that the underlying preferred stock is convertible into our common stock or other securities, the following will apply. The depositary shares, as such, will not be convertible into any of our securities. Rather, any holder of the depositary shares may surrender the related depositary receipts to the depositary with written instructions that direct us to cause conversion of the preferred stock represented by the depositary shares into or for whole shares of our common stock or other securities, as applicable. Upon receipt of those instructions and any amounts payable by the holder in connection with the conversion, we will cause the conversion using the same procedures as those provided for conversion of the underlying preferred stock. If only some of a holder’s depositary shares are converted, a new depositary receipt or receipts will be issued to the holder for any depositary shares not converted.

Amendment and Termination of the Deposit Agreement

The form of depositary receipt evidencing the depositary shares and any provision of the deposit agreement may at any time be amended by agreement between us and the depositary. However, any amendment which materially and adversely alters the rights of the holders of depositary shares will not be effective until 90 days after notice of that amendment has been given to the holders. Each holder of depositary shares at the time any amendment becomes effective shall be deemed to consent and agree to that amendment and to be bound by the deposit agreement as so amended. The deposit agreement may be terminated by us or by the depositary only if all outstanding depositary shares have been redeemed or converted into any other securities into which the underlying preferred stock is convertible or there has been a final distribution, including to holders of depositary receipts, of the underlying preferred stock in connection with our liquidation, dissolution, or winding up.

Charges of Depositary

We will pay all transfer and other taxes and governmental charges arising solely from the existence of the depositary arrangement. We will also pay charges of the depositary in connection with the initial deposit of the preferred stock, the initial issuance of the depositary shares, any redemption of the preferred stock, and all withdrawals of preferred stock by owners of depositary shares. Holders of depositary receipts will pay transfer, income, and other taxes and governmental charges and other specified charges as provided in the deposit arrangement for their accounts. If these charges have not been paid, the depositary may refuse to transfer depositary shares, withhold dividends and distributions, and sell the depositary shares evidenced by the depositary receipt.

Limitation on Liability

Neither we nor the depositary will be liable if either of us is prevented or delayed by law or any circumstance beyond our control in performing our respective obligations under the deposit agreement. Our obligations and those of the depositary will be

7

limited to performance of our respective duties under the deposit agreement without, in our case, negligence or bad faith or, in the case of the depositary, negligence or willful misconduct. We and the depositary may rely upon advice of counsel or accountants, or upon information provided by persons presenting the underlying preferred stock for deposit, holders of depositary receipts, or other persons believed by us in good faith to be competent and on documents believed to be genuine.

Corporate Trust Office of Depositary

The depositary’s corporate trust office will be set forth in the applicable prospectus supplement relating to a series of depositary shares. The depositary will act as transfer agent and registrar for depositary receipts, and, if shares of a series of preferred stock are redeemable, the depositary will act as redemption agent for the corresponding depositary receipts.

Resignation and Removal of Depositary

The depositary may resign at any time by delivering to us notice of its intent to do so, and we may at any time remove the depositary, any such resignation or removal to take effect upon the appointment of a successor depositary meeting the requirements specified in the deposit agreement and its acceptance of such appointment.

Reports to Holders

We will deliver all required reports and communications to holders of the preferred stock to the depositary, and it will forward those reports and communications to the holders of depositary shares. Upon request, the depositary will provide for inspection to the holders of depositary shares the transfer books of the depositary and the list of holders of receipts; provided that any requesting holder certifies to the depositary that such inspection is for a proper purpose reasonably related to such person’s interest as an owner of depositary shares evidenced by the receipts.

8

DESCRIPTION OF WARRANTS

We may issue the warrants in one or more series under one or more warrant agreements, each to be entered into between us and a bank, trust company, or other financial institution as warrant agent. We may add, replace, or terminate warrant agents from time to time. We may also choose to act as our own warrant agent, or may choose one of our subsidiaries to do so.

The warrant agent under a warrant agreement will act solely as our agent in connection with the warrants issued under that agreement. The warrant agent will not assume any obligation or relationship of agency or trust for or with any holders of those warrants. Any holder of warrants may, without the consent of any other person, enforce by appropriate legal action, on its own behalf, its right to exercise those warrants in accordance with their terms. Until the warrant is properly exercised, no holder of any warrant will be entitled to any rights of a holder of the warrant property purchasable upon exercise of the warrant.

Terms

The applicable prospectus supplement will describe the terms of any warrants in respect of which this prospectus is being delivered, including:

• the title of such warrants;

• the aggregate number of such warrants;

• the price or prices at which such warrants will be issued;

• the currency or currencies, in which the price of such warrants will be payable;

• the securities purchasable upon exercise of such warrants;

• the price at which and the currency or currencies in which the securities or other rights purchasable upon exercise of such warrants may be purchased;

• the date on which the right to exercise such warrants shall commence and the date on which such right shall expire;

• if applicable, the minimum or maximum amount of such warrants which may be exercised at any one time;

• if applicable, the designation and terms of the securities with which such warrants are issued and the number of such warrants issued with each such security;

• if applicable, the date on and after which such warrants and the related securities will be separately transferable;

• information with respect to book-entry procedures, if any;

• if applicable, a discussion of any material United States federal income tax considerations; and

• any other terms of such warrants, including terms, procedures and limitations relating to the exchange and exercise of such warrants.

Form, Exchange, and Transfer

We may issue the warrants in registered form or bearer form. Warrants issued in registered form, i.e., book-entry form, will be represented by a global security registered in the name of a depository, which will be the holder of all the warrants represented by the global security. Those investors who own beneficial interests in a global warrant will do so through participants in the depository’s system, and the rights of these indirect owners will be governed solely by the applicable procedures of the depository and its participants. In addition, we may issue warrants in non-global form, i.e., bearer form. If any warrants are issued in non-global form, warrant certificates may be exchanged for new warrant certificates of different denominations, and holders may exchange, transfer, or exercise their warrants at the warrant agent’s office or any other office indicated in the applicable prospectus supplement, information incorporate by reference or free writing prospectus.

Prior to the exercise of their warrants, holders of warrants exercisable for debt securities will not have any of the rights of holders of the debt securities purchasable upon such exercise and will not be entitled to payments of principal (or premium, if any) or interest, if any, on the debt securities purchasable upon such exercise. Prior to the exercise of their warrants, holders of warrants exercisable for shares of preferred stock or common stock will not have any rights of holders of the preferred stock or common stock purchasable upon such exercise and will not be entitled to dividend payments, if any, or voting rights of the preferred stock or common stock purchasable upon such exercise.

Exercise of Warrants

A warrant will entitle the holder to purchase an amount of securities at an exercise price that will be stated in, or that will be

9

determinable as described in, the applicable prospectus supplement or information incorporated by reference therein. Holders of warrants may exercise the warrants at any time up to the specified time on the expiration date set forth in the applicable prospectus supplement or information incorporated by reference therein. After the close of business on the expiration date, unexercised warrants will become void. Warrants may be redeemed as set forth in the applicable prospectus supplement or information incorporated by reference therein.

Warrants may be exercised as set forth in the applicable prospectus supplement or information incorporated by reference therein. Upon receipt of payment and the warrant certificate properly completed and duly executed at the corporate trust office of the warrant agent or any other office indicated in the prospectus supplement or information incorporated by reference therein, we will forward, as soon as practicable, the securities purchasable upon such exercise. If less than all of the warrants represented by such warrant certificate are exercised, a new warrant certificate will be issued for the remaining warrants.

10

DESCRIPTION OF DEBT SECURITES

Our debt securities may be issued from time to time in one or more series and may include senior debt securities, subordinated debt securities, convertible debt securities and exchangeable debt securities. The particular terms of any series of debt securities and the extent to which the general provisions may apply to a particular series of debt securities will be described in the prospectus supplement relating to that series. When describing any debt securities, references to “we,” “us” and “our” refer to the issuer of those debt securities and not to any of its subsidiaries.

The debt securities we offer will be issued under an indenture between us and the trustee named in the indenture. You should also read the indenture under which the debt securities are to be issued. We have filed a form of indenture governing different types of debt securities with the SEC as an exhibit to the registration statement of which this prospectus is a part. The following summary of the indenture does not purport to be complete and is subject to, and qualified in its entirety by reference to, all of the provisions of the indenture, including definitions therein of certain terms. A form of each debt security, reflecting the specific terms and provisions of that series of debt securities, will be filed with the SEC in connection with each offering and will be incorporated by reference in the registration statement of which this prospectus forms a part. You may obtain a copy of the indenture and any form of debt security that has been filed in the manner described under “Where You Can Find More Information.”

For a comprehensive description of any series of debt securities being offered to you pursuant to this prospectus, you should read this prospectus and the applicable prospectus supplement, indenture (including any amendments or supplements we may enter into from time to time that are permitted under the debt securities or indenture) and form of debt security.

General Terms of the Indenture

The indenture does not limit the amount of debt securities that we may issue. The indenture does provide that we may issue debt securities up to the principal amount that we may authorize, which may be in any currency or currency unit that we may designate. Except for the limitations on consolidation, merger and sale of all or substantially all of our assets contained in the indenture, the terms of the indenture do not contain any covenants or other provisions designed to give holders of any debt securities protection against changes in our operations, financial condition or transactions involving us. For each series of debt securities, any restrictive covenants for those debt securities will be described in the applicable prospectus supplement for those debt securities.

We may issue the debt securities issued under the indenture as “discount securities,” which means they may be sold at a discount below their stated principal amount. These debt securities, as well as other debt securities that are not issued at a discount, may, for United States federal income tax purposes, be treated as if they were issued with “original issue discount,” or OID, because of interest payment and other characteristics. Special United States federal income tax considerations applicable to debt securities issued with original issue discount will be described in more detail in any applicable prospectus supplement.

The prospectus supplement relating to a particular series of debt securities will describe the terms of the debt securities offered by that prospectus supplement and by this prospectus, including the following:

|

|

•

|

the title and authorized denominations of the debt securities;

|

|

|

•

|

any limit on the aggregate principal amount of that series of debt securities;

|

|

|

•

|

the date or dates on which principal and premium, if any, of the debt securities of that series is payable;

|

|

|

•

|

interest rates, and the dates from which interest, if any, on the debt securities of that series will accrue, and the dates when interest is payable and the maturity;

|

|

|

•

|

the right, if any, to extend the interest payment periods and the duration of the extensions;

|

|

|

•

|

the guarantors, if any, of our obligations under the debt securities;

|

|

|

•

|

if the amount of payments of principal or interest is to be determined by reference to an index or formula, or based on a coin or currency other than that in which the debt securities are stated to be payable, the manner in which these amounts are determined and the calculation agent, if any, with respect thereto;

|

|

|

•

|

the place or places where and the manner in which principal of, premium, if any, and interest, if any, on the debt securities of that series will be payable and the place or places where those debt securities may be presented for transfer and, if applicable, conversion or exchange;

|

|

|

•

|

the period or periods within which, the price or prices at which, the currency or currencies in which, and other terms and conditions upon which those debt securities may be redeemed, in whole or in part, at our option or the option of a holder of those securities, if we or a holder is to have that option;

|

|

|

•

|

our obligation or right, if any, to redeem, repay or purchase those debt securities pursuant to any sinking fund or analogous provision or at the option of a holder of those securities, and the terms and conditions upon which the debt securities will be redeemed, repaid or purchased, in whole or in part, pursuant to that

|

11

|

|

•

|

the terms, if any, on which the debt securities of that series and any guarantees thereof will be subordinate in right and priority of payment to our other debt;

|

|

|

•

|

the denominations in which those debt securities will be issuable;

|

|

|

•

|

if other than the entire principal amount of the debt securities when issued, the portion of the principal amount payable upon acceleration of maturity as a result of a default on our obligations;

|

|

|

•

|

whether those debt securities will be issued in fully registered form without coupons or in a form registered as to principal only with coupons or in bearer form with coupons;

|

|

|

•

|

whether any securities of that series are to be issued in whole or in part in the form of one or more global securities and the depositary for those global securities;

|

|

|

•

|

if other than United States dollars, the currency or currencies in which payment of principal of or any premium or interest on those debt securities will be payable;

|

|

|

•

|

if the principal of or any premium or interest on the debt securities of that series is to be payable, or is to be payable at our election or the election of a holder of those securities, in securities or other property, the type and amount of those securities or other property, or the manner of determining that amount, and the period or periods within which, and the terms and conditions upon which, any such election may be made;

|

|

|

•

|

the covenants relating to the debt securities that are in addition to, modify or delete those described in this prospectus, including the merger, consolidation and sale covenant;

|

|

|

•

|

the events of default relating to the debt securities that are in addition to, modify or delete those described in this prospectus;

|

|

|

•

|

conversion or exchange provisions, if any, including conversion or exchange prices or rates and adjustments thereto;

|

|

|

•

|

whether and upon what terms the debt securities may be defeased, if different from the provisions set forth in the indenture;

|

|

|

•

|

the nature and terms of any security for any secured debt securities;

|

|

|

•

|

the terms applicable to any debt securities issued at a discount from their stated principal amount; and

|

|

|

•

|

any other specific terms of any debt securities.

|

The applicable prospectus supplement will present material United States federal income tax considerations for holders of any debt securities and the securities exchange or quotation system on which any debt securities are to be listed or quoted.

Registration and Transfer

Unless otherwise indicated in the applicable prospectus supplement, each series of debt securities will be issued in registered form only, without coupons, and such registered securities will be issued in denominations of $1,000 or any integral multiple thereof.

Unless otherwise indicated in the applicable prospectus supplement, we will pay interest on the debt securities to the persons who are their registered holders at the close of business on a certain date preceding the respective interest payment date. We will not be required to register the transfer or exchange of debt securities of any series during a period beginning 15 days before the mailing of a notice of redemption of or an offer to repurchase debt securities of that series or 15 days before an interest payment date.

Conversion or Exchange Rights

Debt securities may be convertible into or exchangeable for shares of our common stock or other securities. The terms and conditions of conversion or exchange will be stated in the applicable prospectus supplement. The terms will include, among others, the following:

|

|

•

|

the conversion or exchange price;

|

|

|

•

|

the conversion or exchange period;

|

|

|

•

|

provisions regarding our ability or the ability of any holder to convert or exchange the debt securities;

|

|

|

•

|

events requiring adjustment to the conversion or exchange price; and

|

|

|

•

|

provisions affecting conversion or exchange in the event of our redemption of the debt securities.

|

Consolidation, Merger or Sale

The indenture generally permits a consolidation or merger between us and another entity, and another corporation, if the

12

surviving corporation meets certain limitations and conditions. Subject to these conditions, the indenture also permits the sale or transfer by us of all or substantially all of our property and assets. If this happens, the remaining or acquiring corporation shall assume all of our responsibilities and liabilities under the indenture including the payment of all amounts due on the debt securities and performance of the covenants in the indenture.

We are only permitted to consolidate or merge with or into any other corporation or sell all or substantially all of our assets according to the terms and conditions of the indenture, as indicated in the applicable prospectus supplement. The remaining or acquiring corporation will be substituted for us in the indenture with the same effect as if it had been an original party to the indenture. Thereafter, the successor corporation may exercise our rights and powers under any indenture, in our name or in its own name.

Redemption and Repurchase

The debt securities may be redeemable at our option, may be subject to mandatory redemption pursuant to a sinking fund or otherwise, or may be subject to repurchase by us at the option of the holders, in each case upon the terms, at the times and at the prices set forth in the applicable prospectus supplement.

Events of Default

The indenture provides that the following will be “events of default” with respect to any series of debt securities:

|

|

•

|

failure to pay interest for 90 days after the date payment is due and payable;

|

|

|

•

|

failure to pay principal or premium, if any, on any debt security when due, either at maturity, upon any redemption, by declaration or otherwise;

|

|

|

•

|

failure to make sinking fund payments when due and continuance of such default for a period of 30 days;

|

|

|

•

|

failure to perform other covenants for 90 days after notice of such default or breach and request for it to be remedied;

|

|

|

•

|

events in bankruptcy, insolvency or reorganization relating to us; or

|

|

|

•

|

any other event of default provided in the applicable officer’s certificate, resolution of our board of directors or the supplemental indenture under which we issue a series of debt securities.

|

An event of default for a particular series of debt securities does not necessarily constitute an event of default for any other series of debt securities issued under the indenture. For each series of debt securities, any modifications to the above events of default will be described in the applicable prospectus supplement for those debt securities.

The indenture provides that if an event of default specified in the first, second, third, fourth or sixth bullets above occurs and is continuing, either the trustee or the holders of at least 25% in aggregate principal amount of the outstanding debt securities of that series may declare the principal amount of all those debt securities (or, in the case of discount securities or indexed securities, that portion of the principal amount as may be specified in the terms of that series) to be due and payable immediately. If an event of default specified in the fifth bullet above occurs and is continuing, then the principal amount of all those debt securities (or, in the case of discount securities or indexed securities, that portion of the principal amount as may be specified in the terms of that series) will be due and payable immediately, without any declaration or other act on the part of the trustee or any holder. In certain cases, the holders of a majority in principal amount of the outstanding debt securities of any series may, on behalf of holders of all those debt securities, waive any past default and consequences of such default.

The indenture imposes limitations on suits brought by holders of debt securities against us. Except for actions for payment of overdue principal or interest, no holder of debt securities of any series may institute any action against us under the indenture unless:

|

|

•

|

the holder has previously given to the trustee written notice of a continuing default;

|

|

|

•

|

the holders of at least 25% in principal amount of the outstanding debt securities of the affected series have requested that the trustee institute the action;

|

|

|

•

|

the requesting holders have offered the trustee indemnity for the costs, expenses and liabilities that may be incurred by bringing the action;

|

13

|

|

•

|

the trustee has not instituted the action within 90 days of the request and offer of indemnity; and

|

|

|

•

|

the trustee has not received inconsistent direction by the holders of a majority in principal amount of the outstanding debt securities of the affected series.

|

We will be required to file annually with the trustee a certificate, signed by one of our officers, stating whether or not the officer knows of any default by us in the performance, observance or fulfillment of any condition or covenant of the indenture.

Discharge, Defeasance and Covenant Defeasance

We can discharge or decrease our obligations under the indenture as stated below.

We may discharge obligations to holders of any series of debt securities that have not already been delivered to the trustee for cancellation and that have either become due and payable or are by their terms to become due and payable, or are scheduled for redemption, within one year. We may effect a discharge by irrevocably depositing with the trustee cash or government obligations denominated in the currency of the debt securities, as trust funds, in an amount certified to be enough to pay when due, whether at maturity, upon redemption or otherwise, the principal of, and any premium and interest on, the debt securities and any mandatory sinking fund payments.

Unless otherwise provided in the applicable prospectus supplement, we may also discharge certain of our obligations to holders of any series of debt securities at any time, which we refer to as defeasance. We may also be released from the obligations imposed by certain covenants of outstanding series of debt securities and provisions of the indenture, and we may omit to comply with those covenants without creating an event of default under the indenture, which we refer to as covenant defeasance. We may effect defeasance and covenant defeasance only if, among other things, we irrevocably deposit with the trustee cash or government obligations denominated in the currency of the debt securities, as trust funds, in an amount certified by a nationally recognized firm of independent certified accountants to be enough to pay at maturity, or upon redemption, the principal (including any mandatory sinking fund payments) of, and any premium and interest on, all outstanding debt securities of the series.

Although we may discharge or decrease our obligations under the indenture as described in the preceding paragraphs, we may not discharge certain enumerated obligations, including but not limited to, our duty to register the transfer or exchange of any series of debt securities, to replace any temporary, mutilated, destroyed, lost or stolen series of debt securities or to maintain an office or agency in respect of any series of debt securities.

Modification of the Indenture and Waivers

The indenture provides that we and the trustee may enter into supplemental indentures without the consent of the holders of debt securities to, among other things:

|

|

•

|

cure any ambiguity, defect, or inconsistency in the indenture or in the debt securities of any series;

|

|

|

•

|

evidence the assumption by a successor entity of our obligations;

|

|

|

•

|

provide for uncertificated debt securities in addition to or in place of certificated securities;

|

|

|

•

|

add to the covenants, restrictions, conditions or provisions relating to us for the benefit of the holders of all or any series of debt securities (and if such covenants, restrictions, conditions or provisions are to be for the benefit of less than all series of debt securities, stating that such covenants, restrictions, conditions or provisions are expressly being included solely for the benefit of such series), to make the occurrence, or the occurrence and the continuance, of a default in any such additional covenants, restrictions, conditions or provisions an event of default, or to surrender any right or power in the indenture conferred upon us;

|

|

|

•

|

add to, delete from, or revise the conditions, limitations, and restrictions on the authorized amount, terms, or purposes of issue, authentication, and delivery of debt securities, as set forth in the indenture;

|

|

|

•

|

make any change that does not adversely affect the rights of any holder of any debt securities in any material respect;

|

|

|

•

|

provide for the issuance of and establish the form and terms and conditions of the debt securities of any series as provided in the indenture, to establish the form of any certifications required to be furnished pursuant to the terms of the indenture or any series of debt securities, or to add to the rights of the holders of any series of debt securities;

|

|

|

•

|

evidence and provide for the acceptance of appointment under the indenture by a successor trustee; and

|

comply with any requirements of the SEC in connection with the qualification of the indenture under the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”).

14

Any provision of the indenture shall automatically be deemed to have been modified, eliminated or added to the extent required to be made as a result of an amendment to the Trust Indenture Act.

The indenture also provides that we and the trustee may, with the consent of the holders of not less than a majority in aggregate principal amount of debt securities of each series of debt securities affected by such supplemental indenture then outstanding, add any provisions to, or change in any manner, eliminate or modify in any way the provisions of, the indenture or any supplemental indenture or modify in any manner the rights of the holders of the debt securities. We and the trustee may not, however, without the consent of the holder of each outstanding debt security affected thereby:

|

|

•

|

extend the fixed maturity of any debt security;

|

|

|

•

|

reduce the principal amount of any debt security;

|

|

|

•

|

reduce the rate or extend the time of payment of interest on any debt security;

|

|

|

•

|

reduce any premium payable upon redemption of any debt security; or

|

|

|

•

|

reduce the percentage of holders of debt securities of any series whose consent is required for any modification of the indenture or for waivers of compliance with or defaults under the indenture with respect to debt securities of that series.

|

The indenture provides that the holders of not less than a majority in aggregate principal amount of the then outstanding debt securities of any series, by notice to the trustee, may on behalf of the holders of the debt securities of that series waive any default and its consequences under the indenture except:

|

|

•

|

a default in the payment of the principal of or premium or interest on any such debt security; or

|

|

|

•

|

a default in respect of a covenant or provision of the indenture that cannot be modified or amended without the consent of the holder of each outstanding debt security of each series affected.

|

Global Securities

The debt securities of a series may be issued in whole or in part in the form of one or more global securities that will be deposited with, or on behalf of, a depositary or nominee for a depositary identified in the applicable prospectus supplement. Global debt securities may be issued in either registered or bearer form and in either temporary or permanent form. Unless and until it is exchanged in whole or in part for individual certificates evidencing debt securities, a global debt security may not be transferred except as a whole:

|

|

•

|

by the depository to a nominee of such depository;

|

|

|

•

|

by a nominee of such depository to such depository or another nominee of such depository; or

|

|

|

•

|

by such depository, or any such nominee to a successor of such depository, or a nominee of such successor.

|

The specific terms of the depository arrangement with respect to a series of global debt securities and certain limitations and restrictions relating to a series of global bearer securities will be described in the applicable prospectus supplement.

Concerning the Trustee

The indenture provides that in the event that the trustee resigns or is removed with respect to less than all series of debt securities outstanding under the indenture, there may be more than one trustee under the indenture. If there are different trustees for different series of debt securities under the indenture, each such trustee will be a trustee of a trust under the indenture separate and apart from the trust administered by any other trustee under the indenture. Except as otherwise indicated in this prospectus or any prospectus supplement, any action permitted to be taken by a trustee may be taken by such trustee only on the one or more series of debt securities for which it is the trustee under the indenture. Any trustee under the indenture may resign or be removed from one or more series of debt securities.

The indenture provides that, except during the continuance of an event of default, the trustee will perform only such duties as are specifically set forth in the indenture. During the existence of an event of default, the trustee will exercise those rights and powers

15

vested in it under the indenture and use the same degree of care and skill in its exercise as a prudent person would exercise under the circumstances in the conduct of such person’s own affairs.

The trustee may engage in other transactions with us. If the trustee acquires any conflicting interest relating to any duties concerning the debt securities, however, the trustee must eliminate the conflict or resign as trustee.

No Individual Liability of Incorporators, Stockholders, Officers or Directors

The indenture provides that no past, present or future director, officer, stockholder or employee of ours, any of our affiliates, or any successor corporation, in their capacity as such, shall have any individual liability for any of our obligations, covenants or agreements under the debt securities or the indenture.

Governing Law

The indenture is, and any debt securities will be, governed by, and construed in accordance with, the laws of the State of New York.

16

DESCRIPTION OF PURCHASE CONTRACTS

We may issue purchase contracts, including contracts obligating holders to purchase from us, and for us to sell to holders, a specific or varying number of shares of common stock or preferred stock, depositary shares, warrants, or any combination of the above, at a future date or dates. Alternatively, the purchase contracts may obligate us to purchase from holders, and obligate holders to sell to us, a specific or varying number of shares of common stock or preferred stock, depositary shares, warrants, or any combination of the above. The price of the securities subject to the purchase contracts may be fixed at the time the purchase contracts are issued or may be determined by reference to a specific formula described in the purchase contracts. We may issue purchase contracts separately or as a part of units, each consisting of a purchase contract and one or more of the other securities described in this prospectus or securities of third parties, including U.S. Treasury securities, securing the holder’s obligations under the purchase contract. If we issue a purchase contract as part of a unit, the applicable prospectus supplement will state whether the purchase contract will be separable from the other securities in the unit before the purchase contract settlement date. The purchase contracts may require us to make periodic payments to holders or vice versa and the payments may be unsecured or pre-funded on some basis. The purchase contracts may require holders to secure the holder’s obligations in a manner specified in the applicable prospectus supplement, and in certain circumstances, we may deliver newly issued prepaid purchase contracts, often known as prepaid securities, upon release to a holder of any collateral securing such holder’s obligations under the original purchase contract.

The applicable prospectus supplement will describe the terms of any purchase contracts in respect of which this prospectus is being delivered, including, to the extent applicable, the following:

|

|

•

|

whether the purchase contracts obligate the holder or us to purchase or sell, or both purchase and sell, the securities subject to purchase under the purchase contract, and the nature and amount of each of those securities, or the method of determining those amounts;

|

|

|

•

|

whether the purchase contracts are to be prepaid or not;

|

|

|

•

|

whether the purchase contracts will be issued as part of a unit and, if so, the other securities comprising the unit;

|

|

|

•

|

whether the purchase contracts are to be settled by delivery, or by reference or linkage to the value, performance, or level of the securities subject to purchase under the purchase contract;

|

|

|

•

|

any acceleration, cancellation, termination, or other provisions relating to the settlement of the purchase contracts; and

|

|

|

•

|

whether the purchase contracts will be issued in fully registered or global form.

|

Material U.S. federal income tax consideration applicable to the purchase contracts will also be discussed in the applicable prospectus supplement.

17

DESCRIPTION OF RIGHTS

We may issue rights to purchase common stock, preferred stock, depositary shares, debt securities or warrants that we may offer to our security holders. The rights may or may not be transferable by the persons purchasing or receiving the rights. In connection with any rights offering, we may enter into a standby underwriting or other arrangement with one or more underwriters or other persons pursuant to which such underwriters or other persons would purchase any offered securities remaining unsubscribed for after such rights offering. Each series of rights will be issued under a separate rights agent agreement to be entered into between us and a bank or trust company, as rights agent, that we will name in the applicable prospectus supplement. The rights agent will act solely as our agent in connection with the rights and will not assume any obligation or relationship of agency or trust for or with any holders of rights certificates or beneficial owners of rights.

The prospectus supplement relating to any rights that we offer will include specific terms relating to the offering, including, among other matters:

|

|

•

|

the date of determining the security holders entitled to the rights distribution;

|

|

|

•

|

the aggregate number of rights issued and the aggregate number of shares of common stock, preferred stock, depositary shares, debt securities or warrants purchasable upon exercise of the rights;

|

|

|

•

|

the conditions to completion of the rights offering;

|

|

|

•

|

the date on which the right to exercise the rights will commence and the date on which the rights will expire; and

|

|

|

•

|

any applicable federal income tax considerations.

|

Each right would entitle the holder of the rights to purchase for cash the amount of shares of common stock, preferred stock, depositary shares or warrants at the exercise price set forth in the applicable prospectus supplement. Rights may be exercised at any time up to the close of business on the expiration date for the rights provided in the applicable prospectus supplement. After the close of business on the expiration date, all unexercised rights will become void.

If less than all of the rights issued in any rights offering are exercised, we may offer any unsubscribed securities directly to persons other than our security holders, to or through agents, underwriters or dealers or through a combination of such methods, including pursuant to standby arrangements, as described in the applicable prospectus supplement.

18

DESCRIPTION OF UNITS

The following description, together with the additional information we include in any applicable prospectus supplement, summarizes the material terms and provisions of the units that we may offer under this prospectus. Units may be offered independently or together with common stock, preferred stock, depositary shares, debt securities, purchase contracts, and/or warrants offered by any prospectus supplement, and may be attached to or separate from those securities.

While the terms we have summarized below will generally apply to any future units that we may offer under this prospectus, we will describe the particular terms of any series of units that we may offer in more detail in the applicable prospectus supplement. The terms of any units offered under a prospectus supplement may differ from the terms described below.