Destination XL Group, Inc. (NASDAQ: DXLG), the largest omni-channel

specialty retailer of big and tall men's clothing, today reported

operating results for the first quarter of fiscal 2020 and provided

an update on actions taken in response to the COVID-19 pandemic.

Management’s Response to COVID-19

“We moved early and decisively over the past quarter to preserve

our financial flexibility and to position the Company to withstand

the impact of the COVID-19 pandemic on the consumer,” said Harvey

Kanter, President and Chief Executive Officer. “We have been

communicating consistently and transparently with our employees,

suppliers, landlords and banks and believe this direct and active

communication has meaningfully enhanced the level of partnership

and trust to support the plans we have in place to manage through

the pandemic. All of our stores closed on March 17, 2020 and

we began re-opening gradually at the very end of April, on a

store-by-store basis, as allowed by state and local

authorities. In addition, where permitted, we operated

approximately 30 stores (while closed to the public) to assist with

picking, packing and shipping e-commerce orders.

Kanter continued, “As of June 2, 2020, we now have approximately

201 stores open across the country and we expect all of our stores

will reopen by the end of June. With respect to the stores

that have opened thus far, some stores are performing better than

others, but overall comparable sales initially were down an average

of 70-80% to last year, but performance has improved week-to-week

and today we are seeing comparable sales down approximately 40% to

last year. We are also encouraged by our DXL.com business

where year-to-date demand is trending up 30% over the prior year

and up 70% to-date in the second quarter. Our Global Sourcing and

Design team initially helped us pivot our distribution center’s

tailoring and alterations team to make masks. Our Global

Sourcing teams’ expertise has now been extended even further,

leveraging our growing Wholesale channel to now source and sell

masks to Fortune 100 companies with nearly 2.5 million masks sold

to date in the second quarter and 250,000 masks for sale on

DXL.com. The distribution center has not only supported mask

making, but continues to operate throughout the pandemic,

which has allowed us to service our customers uninterrupted through

our growing digital e-Commerce channels.”

Actions and measures taken in response to the pandemic:

- Drew down $30.0 million of cash against our revolving credit

facility on March 20th to preserve our access to cash.

- Amended our credit facility on April 15th to improve our excess

availability on both the revolver and FILO loan.

- Furloughed entire store operations team and approximately 60%

of corporate office employees. Eliminated 34 corporate

positions permanently.

- Instituted temporary salary reductions ranging from 10% - 20%

for the management team.

- Suspended Non-Employee Directors’ compensation for the second

quarter.

- Cancelled $148 million, at retail, in merchandise receipts for

fiscal 2020.

- Worked with vendors for extended payment terms.

- Currently negotiating with store and corporate office landlords

on rent abatements and deferments for April through July, due to

the impact of shelter-in-place orders and store closures.

- Eliminated capital improvement programs for all discretionary

spend and non-essential expenditures.

Mr. Kanter continued, “At the end of the first quarter of fiscal

2020, we had a cash balance of $26.1 million, total debt of $96.5

million and remaining availability under our credit facility of

$16.8 million. While we cannot estimate with certainty the length

or severity of this pandemic, given our assumptions we have a plan

and we believe we have sufficient liquidity to navigate the working

capital needs to get to the other side and into 2021.”

First Quarter Financial Highlights

- Total sales for the first quarter of $57.2 million, down 49.3%

from $113.0 million in the prior-year first quarter.

- Cash Flow from operations of ($16.8) million as compared to the

prior year of ($16.5) million. Free Cash Flow was ($18.4)

million as compared to ($20.2) million last year.

- Impairment of asset charge of $16.3 million in the first

quarter of fiscal 2020 related to right-of-use lease assets of

$12.5 million and store fixed assets of $3.8 million.

- Net loss for the first quarter was $(41.7) million as compared

to a net loss of $(3.1) million in the prior year’s first

quarter.

- Adjusted EBITDA for the first quarter was $(18.9) million

compared to $4.8 million in the prior-year quarter.

- At May 2, 2020, cash balance of $26.1 million, total debt of

$96.5 million and remaining availability under our credit facility

of $16.8 million.

First Quarter Results

Sales

Total sales for the first quarter of fiscal 2020 decreased 49.3%

to $57.2 million from $113.0 million in the first quarter of fiscal

2019 principally due to the closing of all of our store locations

on March 17, 2020 in response to the COVID-19 pandemic. We have

been highly promotional since our stores closed to encourage our

customers to shop online and to mitigate a buildup of seasonal

inventory.

The growth of our wholesale business continues to be a key

initiative in fiscal 2020 led by our business with Amazon

Essentials, which contributed $2.0 million dollars of sales in the

first quarter. As noted above, we also launched a new

wholesale line of business for the design and sourcing of

protective masks, with sales beginning in the second quarter of

fiscal 2020.

Gross Margin

For the first quarter of fiscal 2020, our gross margin rate,

inclusive of occupancy costs, was 23.1% as compared to a gross

margin rate of 43.7% for the first quarter of fiscal 2019. Our

gross margin rate declined 13.3% from the deleveraging in occupancy

costs and a decrease of 7.3% in merchandise margins. The

decrease in merchandise margins reflects the increased promotional

posture we took in the second half of the first quarter in response

to COVID-19 as well as an increase in inventory reserves of $0.7

million.

Selling, General & Administrative

As a percentage of sales, SG&A (selling, general and

administrative) expenses for the first quarter of fiscal 2019 were

56.1% as compared to 39.5% for the first quarter of fiscal 2019. On

a dollar basis, SG&A decreased by $12.5 million, or 28%, as

compared to the first quarter of fiscal 2019. This decrease

in expenses was primarily driven by furloughs of both our store

associates and certain corporate associates as well as several

measures taken to reduce operating expenses, including marketing,

corporate payroll, and other discretionary spending. As

mentioned above, the majority of our field associates and

approximately 60% of our corporate associates were furloughed

shortly after we closed our stores. Further, our senior

management team each took a temporary reduction in salary of 20%

with other members of our management team taking a reduction of

10-15%. Non-employee directors of our board of directors received

their first quarter compensation, but in March 2020 announced the

suspension of their second quarter of fiscal 2020

compensation.

Management views SG&A expenses through two primary cost

centers: Customer Facing Costs and Corporate Support

Costs. Customer Facing Costs, which include store payroll,

marketing and other store operating costs, represented 25.7% of

sales in the first quarter of fiscal 2020 as compared to 22.6% of

sales in the first quarter of last year. Corporate Support

Costs, which include the distribution center and corporate overhead

costs, represented 30.4% of sales in the first quarter of fiscal

2020 compared to 16.9% of sales in the first quarter of last

year. While these percentages for the first quarter of fiscal

2020 are skewed by the loss of sales, we are continuing to assess

and rationalize our entire SG&A cost structure as we start to

reopen our stores. Given the changes to our business as a result of

this pandemic, we have started to restructure various areas to

ensure that we can operate most efficiently. This included

the elimination of approximately 34 positions in the first quarter

of fiscal 2020 and the elimination of non-essential operating

expenses. Across both our corporate office and stores, we

plan to bring back staff as we reopen and business comes back with

a planned three-phased approach, but will look to optimize store

hours and staffing models based on customer demand, and overall

store payroll costs are expected to trend lower than historical

levels.

Impairment of Assets

As a result of the impact of the COVID-19 pandemic on our

results for first quarter of fiscal 2020 and the uncertainty

surrounding its continuing impact, we completed an impairment

assessment of our long-lived assets as of May 2, 2020. Our

recoverability analysis in the first quarter of 2020 included the

impact of the COVID-19 pandemic on the operations of our stores and

we used projections that were based on multiple

probability-weighted scenarios, assuming that our stores will

gradually open throughout the second quarter of fiscal 2020 but

that consumer retail spending will remain substantially curtailed

for a period of time. As a result, we recorded an impairment

charge of $16.3 million for the first quarter of fiscal 2020.

The impairment charge included approximately $12.5 million for the

write-down of certain right-of-use assets, related to leases where

the carrying value exceeded fair value, and $3.8 million for the

write-down of property and equipment, related to stores where the

carrying value exceeded fair value. There remains uncertainty

regarding the impact of the COVID-19 pandemic on our future results

of our operations, which could result in additional

impairments.

Net Loss

For the first quarter of fiscal 2020, we had a net loss of

$(41.7) million, or $(0.82) per diluted share, compared with a net

loss of $(3.1) million, or $(0.06) per diluted share, for the first

quarter of fiscal 2019.

On a non-GAAP basis, adjusting for the impairment of assets of

$16.3 million in the first quarter of fiscal 2020 and CEO

transition costs of $0.7 million in the first quarter of fiscal

2019, and a normalized tax rate of 26% for both periods, the

adjusted net loss for the first quarter of fiscal 2020 was ($0.37)

per diluted share, as compared to an adjusted net loss of ($0.04)

per diluted share for the first quarter of fiscal 2019.

Adjusted EBITDA

Adjusted earnings before interest, taxes, depreciation and

amortization and excluding CEO transition costs and impairment of

assets, if any, (Adjusted EBITDA), a non-GAAP measure, for the

first quarter of fiscal 2020 were $(18.9) million, compared to $4.8

million for the first quarter of fiscal 2019.

Cash Flow

Cash flow used for operations for the first quarter of fiscal

2020 was $(16.8) million as compared to $(16.5) million for the

first quarter of fiscal 2019 and free cash flow was $(18.4) million

for the first quarter of fiscal 2020 as compared to $(20.2) million

for the first quarter of fiscal 2019.

Preserving liquidity was our primary financial goal this

quarter. In addition to amending our credit facility, we also

entered into several short-term promissory notes with merchandise

vendors and are proactively working with landlords on rent

relief. We have eliminated costs where possible and have

reduced the majority of our capital spending, unless such spending

is necessary to our immediate business needs. Our capital

expenditures for the first three months of fiscal 2020 were $1.6

million as compared to $3.7 million for the same period last

year.

| |

|

For the three months ended |

|

| (in millions) |

|

May 2, 2020 |

|

|

May 4, 2019 |

|

| Cash flow from operating

activities (GAAP basis) |

|

$ |

(16.8 |

) |

|

$ |

(16.5 |

) |

| Capital expenditures,

infrastructure projects |

|

|

(1.2 |

) |

|

|

(2.0 |

) |

| Capital expenditures for DXL

stores |

|

|

(0.4 |

) |

|

|

(1.7 |

) |

| Free Cash Flow

(non-GAAP basis) |

|

$ |

(18.4 |

) |

|

$ |

(20.2 |

) |

Non-GAAP Measures

Adjusted EBITDA, adjusted net loss, adjusted net loss per

diluted share and free cash flow are non-GAAP financial measures.

Please see “Non-GAAP Measures” below and reconciliations of these

non-GAAP measures to the comparable GAAP measures that follow in

the tables below.

Balance Sheet & Liquidity

To provide financial flexibility in the near-term, in March

2020, we drew $30.0 million under our credit facility. Then,

in April 2020, we amended the credit facility, which among other

things: increased our borrowing base by delaying the step-down in

the FILO advance rate until December 2020; lowered the loan cap

from 12.5% to 10.0% and, modified the agreement to allow the

Company the ability to enter into promissory notes with merchandise

vendors, up to an aggregate of $15.0 million. Interest rates

under the revolving facility and the FILO loan were increased by

150 basis points.

At the end of the first quarter of fiscal 2020, we had a cash

balance of $26.1 million, total debt of $96.5 million and remaining

availability under our credit facility of $16.8 million.

As of May 2, 2020, our inventory decreased approximately $4.0

million to $108.3 million, as compared to $112.3 million at May 4,

2019. In early March, we began reacting to the pandemic with

respect to inventory by ultimately cancelling during the quarter

approximately $148 million, at retail, of open orders for fiscal

2020. During the first quarter of fiscal 2020, through our

direct business, we accelerated our promotional activity to sell

through spring merchandise that had been slated for the stores.

With respect to the remainder of fiscal 2020, we expect to be

responsive to business changes but expect that our fall inventory

buys will be below fiscal 2019 levels. Our objective is to maintain

a healthy inventory, which will include narrowing our assortment

while also continuing to manage clearance levels. At May 2, 2020,

our clearance inventory represented 11.5% of our total inventory,

as compared to 10.6% at May 4, 2019.

Retail Store Information

Total retail square footage has remained relatively constant

since the end of fiscal 2017:

| |

Year End 2017 |

|

Year End 2018 |

|

Year End 2019 |

|

At May 2, 2020 |

|

| |

# ofStores |

|

Sq Ft.(000’s) |

|

# ofStores |

|

Sq Ft.(000’s) |

|

# ofStores |

|

Sq Ft.(000’s) |

|

# ofStores |

|

Sq Ft.(000’s) |

|

| DXL retail |

|

212 |

|

|

1,665 |

|

|

216 |

|

|

1,684 |

|

|

228 |

|

|

1,729 |

|

|

228 |

|

|

1,729 |

|

| DXL outlets |

|

14 |

|

|

72 |

|

|

15 |

|

|

78 |

|

|

17 |

|

|

82 |

|

|

17 |

|

|

82 |

|

| CMXL retail |

|

78 |

|

|

268 |

|

|

66 |

|

|

221 |

|

|

50 |

|

|

164 |

|

|

50 |

|

|

164 |

|

| CMXL outlets |

|

33 |

|

|

103 |

|

|

30 |

|

|

91 |

|

|

28 |

|

|

85 |

|

|

26 |

|

|

79 |

|

| Rochester Clothing |

|

5 |

|

|

51 |

|

|

5 |

|

|

51 |

|

|

- |

|

|

- |

|

|

- |

|

- |

|

| Total |

|

342 |

|

|

2,159 |

|

|

332 |

|

|

2,125 |

|

|

323 |

|

|

2,060 |

|

|

321 |

|

|

2,054 |

|

E-Commerce Information

The Company distributes its licensed branded and private label

products directly to consumers through its stores, website and

third-party marketplaces. E-commerce sales, which we also

refer to as direct sales, are defined as sales that originate

online, whether through our website, at the store level or through

a third-party marketplace. With all of our stores closing mid-way

through the first quarter of fiscal 2020 and consumer spending

down, our e-commerce business played a vital role in enabling us to

continue to operate and engage with our customers. For the first

quarter of fiscal 2020, our direct sales increased to 41.4% of

retail segment sales as compared to 21.6% for the first quarter of

fiscal 2019. Although we are planning to open our stores

gradually during the second quarter of fiscal 2020, we expect that

our direct business will continue to be a critical component of how

we navigate through the next several months.

Conference Call

The Company will hold a conference call to review its financial

results today, June 4, 2020 at 9:00 a.m. ET. To listen to the live

webcast, visit the "Investor Relations" section of the Company's

website. The live call also can be accessed by dialing: (877)

930-1064. Please reference conference ID: 5158296.

An archived version of the webcast may be accessed by visiting the

"Events" section of the Company's website for up to one year.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and

trends. The Company’s responses to questions, as well as other

matters discussed during the conference call, may contain or

constitute information that has not been disclosed previously.

Non-GAAP Measures

In addition to financial measures prepared in accordance with

U.S. generally accepted accounting principles (“GAAP”), this press

release contains non-GAAP financial measures, including adjusted

EBITDA, adjusted net loss, adjusted net loss per diluted share and

free cash flow. The presentation of these non-GAAP measures is not

in accordance with GAAP, and should not be considered superior to

or as a substitute for net loss, net loss per diluted share or cash

flows from operating activities or any other measure of performance

derived in accordance with GAAP. In addition, not all companies

calculate non-GAAP financial measures in the same manner and,

accordingly, the non-GAAP measures presented in this release may

not be comparable to similar measures used by other companies. The

Company believes the inclusion of these non-GAAP measures help

investors gain a better understanding of the Company’s performance,

especially when comparing such results to previous periods, and

that they are useful as an additional means for investors to

evaluate the Company's operating results, when reviewed in

conjunction with the Company's GAAP financial statements.

Reconciliations of these non-GAAP measures to their comparable GAAP

measures are provided in the tables below.

The Company believes that adjusted EBITDA (calculated as

earnings before interest, taxes, depreciation and amortization and

excluding CEO transition costs and any asset impairment charges) is

useful to investors in evaluating its performance and is a key

metric to measure profitability and economic

productivity.

The Company has fully reserved against its deferred tax assets

and, therefore, its net loss is not reflective of earnings assuming

a “normal” tax position. In addition, we have added back charges

for costs associated with the CEO transition and asset impairment

charges, if applicable, because it provides comparability of

results without these charges. Adjusted net loss provides

investors with a useful indication of the financial performance of

the business, on a comparative basis, assuming a normalized

effective tax rate of 26%.

Free cash flow is a metric that management uses to monitor

liquidity. Management believes this metric is important to

investors because it demonstrates the Company’s ability to

strengthen liquidity while supporting its capital projects and new

store growth. Free cash flow is calculated as cash flow from

operating activities, less capital expenditures and excludes the

mandatory and discretionary repayment of debt.

About Destination XL Group, Inc.

Destination XL Group, Inc. is the largest retailer of men’s

clothing in sizes XL and up, with operations throughout the United

States as well as in Toronto, Canada. In addition to DXL Big + Tall

retail and outlet stores, subsidiaries of Destination XL Group,

Inc. also operate Casual Male XL retail and outlet stores, and an

e-commerce site, DXL.com. DXL.com offers a multi-channel

solution similar to the DXL store experience with the most

extensive selection of online products available anywhere for Big +

Tall men. The Company is headquartered in Canton, Massachusetts,

and its common stock is listed on the NASDAQ Global Market under

the symbol "DXLG." For more information, please visit the

Company's investor relations website: https://investor.dxl.com.

Forward-Looking Statements Certain statements

and information contained in this press release constitute

forward-looking statements under the federal securities laws,

including statements regarding the Company’s ability to withstand

the impact of the COVID 19 pandemic on the Company’s business and

results in fiscal 2020 and its ability to manage through the

pandemic, including its efforts to restructure and reduce costs,

manage inventory, negotiate rent concessions or rent relief from

its landlords, and maintain sufficient liquidity. The

discussion of forward-looking information requires management of

the Company to make certain estimates and assumptions regarding the

Company's strategic direction and the effect of such plans on the

Company's financial results. The Company's actual results and the

implementation of its plans and operations may differ materially

from forward-looking statements made by the Company. The Company

encourages readers of forward-looking information concerning the

Company to refer to its filings with the Securities and Exchange

Commission, including without limitation, its Annual Report on Form

10-K filed on March 19, 2020, its Quarterly Reports on Form 10-Q

and other filings with the Securities and Exchange Commission that

set forth certain risks and uncertainties that may have an impact

on future results and direction of the Company, including risks

relating to the COVID-19 pandemic and its impact on the Company’s

results of operations, the Company’s execution of its DXL strategy

and ability to grow its market share, predict customer tastes and

fashion trends, forecast sales growth trends and compete

successfully in the United States men’s big and tall apparel

market.

Forward-looking statements contained in this press release speak

only as of the date of this release. Subsequent events or

circumstances occurring after such date may render these statements

incomplete or out of date. The Company undertakes no obligation and

expressly disclaims any duty to update such statements.

|

DESTINATION XL GROUP, INC. |

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

|

(In thousands, except per share data) |

|

|

(unaudited) |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

| |

|

May 2, 2020 |

|

|

May 4, 2019 |

|

| Sales |

|

$ |

57,227 |

|

|

$ |

112,973 |

|

| Cost of goods sold including

occupancy |

|

|

44,013 |

|

|

|

63,560 |

|

| Gross profit |

|

|

13,214 |

|

|

|

49,413 |

|

| |

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

32,112 |

|

|

|

44,611 |

|

|

CEO transition costs |

|

|

— |

|

|

|

702 |

|

|

Impairment of assets |

|

|

16,335 |

|

|

|

— |

|

|

Depreciation and amortization |

|

|

5,732 |

|

|

|

6,338 |

|

| Total expenses |

|

|

54,179 |

|

|

|

51,651 |

|

| |

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(40,965 |

) |

|

|

(2,238 |

) |

| |

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

(741 |

) |

|

|

(864 |

) |

| |

|

|

|

|

|

|

|

|

| Loss before provision

(benefit) for income taxes |

|

|

(41,706 |

) |

|

|

(3,102 |

) |

| Provision (benefit) for income

taxes |

|

|

20 |

|

|

|

(21 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(41,726 |

) |

|

$ |

(3,081 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss per share - basic and

diluted |

|

$ |

(0.82 |

) |

|

$ |

(0.06 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted-average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

50,758 |

|

|

|

49,602 |

|

|

Diluted |

|

|

50,758 |

|

|

|

49,602 |

|

|

DESTINATION XL GROUP, INC. |

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

May 2, 2020, February 1, 2020 and May 4, 2019 |

|

|

(In thousands) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

May 2, |

|

|

February 1, |

|

May 4, |

|

| |

|

2020 |

|

|

2020 |

|

2019 |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

26,147 |

|

|

$ |

4,338 |

|

$ |

6,783 |

|

| Inventories |

|

|

108,325 |

|

|

|

102,420 |

|

|

112,346 |

|

| Other current assets |

|

|

6,901 |

|

|

|

17,102 |

|

|

15,496 |

|

| Property and equipment,

net |

|

|

69,645 |

|

|

|

78,279 |

|

|

89,477 |

|

| Operating lease right-of-use

assets |

|

|

165,528 |

|

|

|

186,413 |

|

|

209,255 |

|

| Intangible assets |

|

|

1,150 |

|

|

|

1,150 |

|

|

1,150 |

|

| Other assets |

|

|

609 |

|

|

|

1,215 |

|

|

3,354 |

|

|

Total assets |

|

$ |

378,305 |

|

|

$ |

390,917 |

|

$ |

437,861 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

31,861 |

|

|

$ |

31,763 |

|

$ |

23,409 |

|

| Accrued expenses and other

liabilities |

|

|

21,024 |

|

|

|

23,390 |

|

|

24,951 |

|

| Operating leases |

|

|

213,555 |

|

|

|

223,227 |

|

|

248,836 |

|

| Long-term debt |

|

|

14,827 |

|

|

|

14,813 |

|

|

14,771 |

|

| Borrowings under credit

facility |

|

|

79,532 |

|

|

|

39,301 |

|

|

64,265 |

|

| Stockholders' equity |

|

|

17,506 |

|

|

|

58,423 |

|

|

61,629 |

|

|

Total liabilities and stockholders' equity |

|

$ |

378,305 |

|

|

$ |

390,917 |

|

$ |

437,861 |

|

|

CERTAIN COLUMNS IN THE FOLLOWING TABLES MAY NOT FOOT DUE TO

ROUNDING |

|

|

|

GAAP TO NON-GAAP RECONCILIATION OF ADJUSTED NET

LOSS |

|

AND ADJUSTED NET LOSS PER DILUTED SHARE |

|

(unaudited) |

| |

| |

|

For the three months ended |

|

| |

|

May 2, 2020 |

|

|

May 4, 2019 |

|

| |

|

$ |

|

|

Per dilutedshare |

|

|

$ |

|

|

Per dilutedshare |

|

| (in thousands, except per

share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss (GAAP basis) |

|

$ |

(41,726 |

) |

|

$ |

(0.82 |

) |

|

$ |

(3,081 |

) |

|

$ |

(0.06 |

) |

| Adjust: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CEO transition costs |

|

|

- |

|

|

|

|

|

|

|

702 |

|

|

|

|

|

| Impairment of assets |

|

|

16,335 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

| Add back actual income tax

provision (benefit) |

|

|

20 |

|

|

|

|

|

|

|

(21 |

) |

|

|

|

|

| Add income tax benefit,

assuming a normal tax rate of 26% |

|

|

6,596 |

|

|

|

|

|

|

|

624 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net loss (non-GAAP

basis) |

|

$ |

(18,775 |

) |

|

$ |

(0.37 |

) |

|

$ |

(1,776 |

) |

|

$ |

(0.04 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| outstanding on a

diluted basis |

|

|

|

|

|

|

50,758 |

|

|

|

|

|

|

|

49,602 |

|

| GAAP TO

NON-GAAP RECONCILIATION OF ADJUSTED EBITDA |

|

(unaudited) |

| |

| |

|

For the three months ended |

|

| |

|

May 2, 2020 |

|

|

May 4, 2019 |

|

| (in millions) |

|

|

|

|

|

|

|

|

| Net loss (GAAP basis) |

|

$ |

(41.7 |

) |

|

$ |

(3.1 |

) |

| Add back: |

|

|

|

|

|

|

|

|

| CEO transition costs |

|

|

- |

|

|

|

0.7 |

|

| Impairment of assets |

|

|

16.3 |

|

|

|

- |

|

| Provision (benefit) for income taxes |

|

|

- |

|

|

|

- |

|

| Interest expense |

|

|

0.7 |

|

|

|

0.9 |

|

| Depreciation and amortization |

|

|

5.7 |

|

|

|

6.3 |

|

| Adjusted EBITDA (non-GAAP basis) |

|

$ |

(18.9 |

) |

|

$ |

4.8 |

|

|

GAAP TO NON-GAAP RECONCILIATION OF FREE CASH

FLOW |

|

(unaudited) |

| |

| |

|

For the three months ended |

|

| (in millions) |

|

May 2, 2020 |

|

|

May 4, 2019 |

|

| Cash flow from operating

activities (GAAP basis) |

|

$ |

(16.8 |

) |

|

$ |

(16.5 |

) |

| Capital expenditures,

infrastructure projects |

|

|

(1.2 |

) |

|

|

(2.0 |

) |

| Capital expenditures for DXL

stores |

|

|

(0.4 |

) |

|

|

(1.7 |

) |

| Free Cash Flow

(non-GAAP basis) |

|

$ |

(18.4 |

) |

|

$ |

(20.2 |

) |

| |

|

|

|

|

|

|

|

|

Investor Contact:

ICR, Inc.

Tom Filandro

646-277-1235

Tom.Filandro@icrinc.com

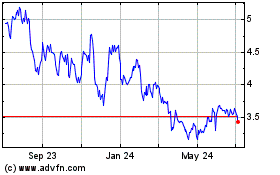

Destination XL (NASDAQ:DXLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

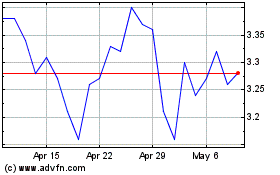

Destination XL (NASDAQ:DXLG)

Historical Stock Chart

From Apr 2023 to Apr 2024